Iowa Subscription Agreement

Description

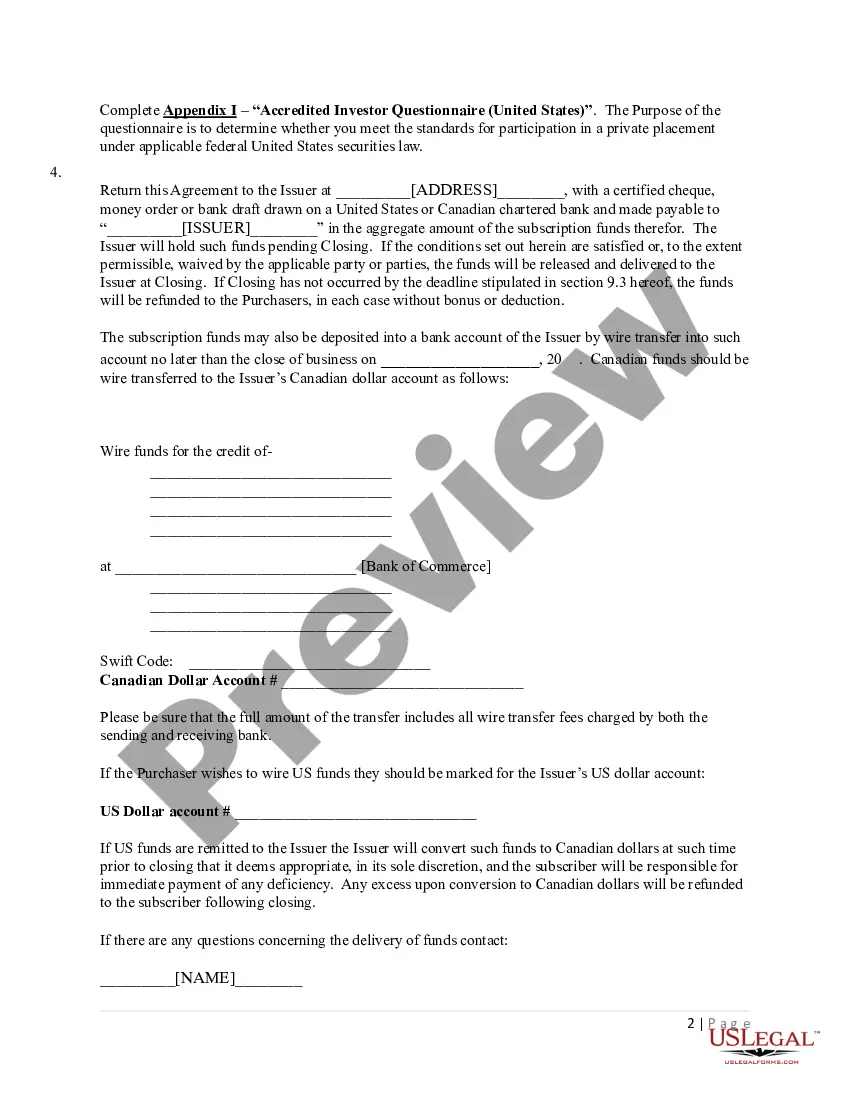

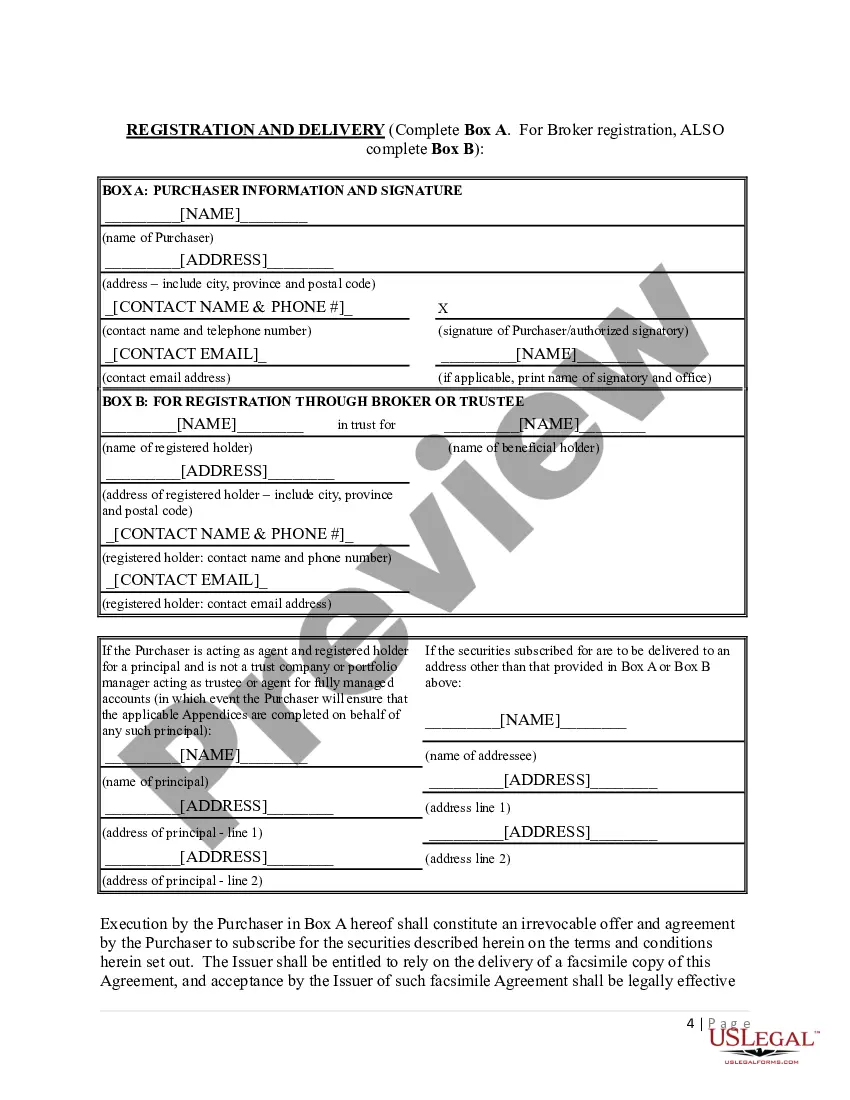

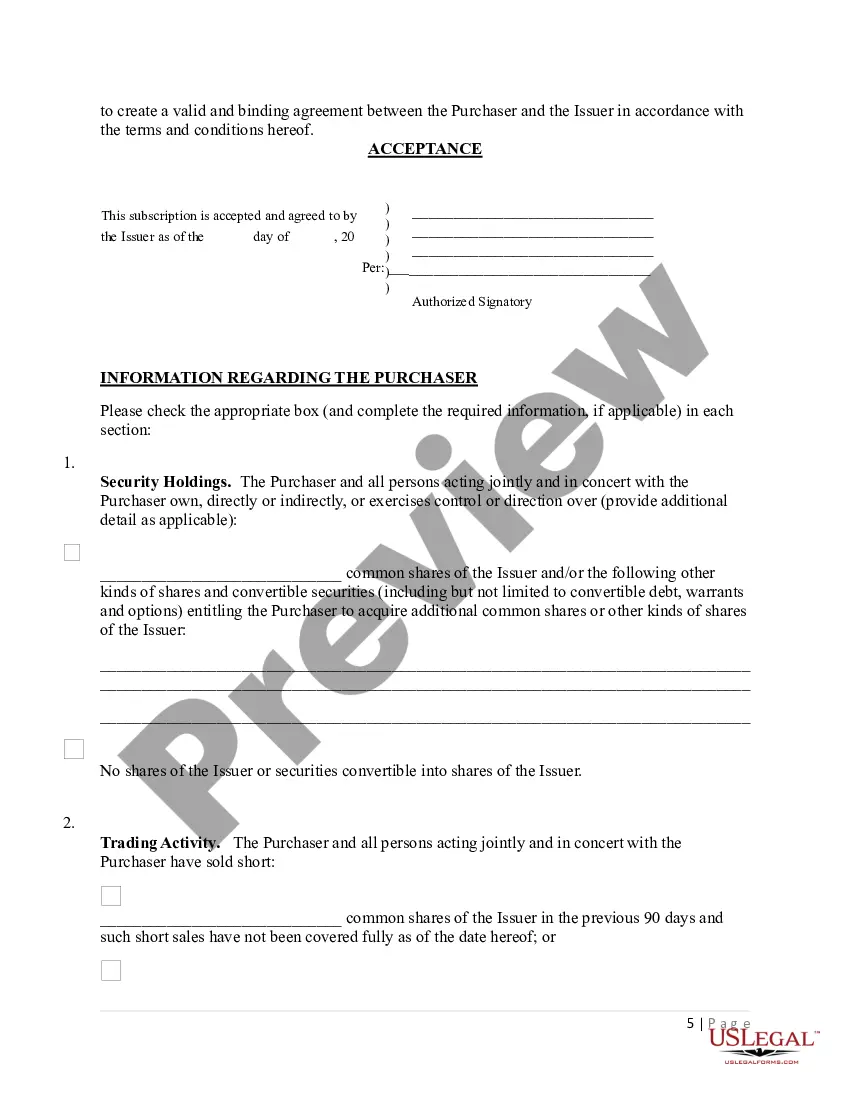

How to fill out Subscription Agreement?

Are you presently in the placement where you require papers for both enterprise or individual reasons almost every time? There are a variety of lawful record themes available online, but locating ones you can rely isn`t simple. US Legal Forms gives thousands of type themes, like the Iowa Subscription Agreement, that are written to fulfill state and federal requirements.

In case you are presently knowledgeable about US Legal Forms website and get a merchant account, basically log in. Next, you are able to obtain the Iowa Subscription Agreement design.

Unless you come with an accounts and wish to start using US Legal Forms, follow these steps:

- Obtain the type you want and make sure it is for the appropriate metropolis/county.

- Utilize the Review switch to analyze the shape.

- Browse the description to ensure that you have chosen the right type.

- When the type isn`t what you are searching for, take advantage of the Lookup industry to find the type that suits you and requirements.

- If you obtain the appropriate type, click on Purchase now.

- Opt for the pricing program you desire, complete the necessary info to create your money, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient document structure and obtain your backup.

Find every one of the record themes you possess purchased in the My Forms food list. You may get a further backup of Iowa Subscription Agreement at any time, if needed. Just click on the required type to obtain or printing the record design.

Use US Legal Forms, the most considerable collection of lawful types, to save time and steer clear of errors. The support gives skillfully produced lawful record themes that you can use for a selection of reasons. Create a merchant account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

What is an LLC Subscription Agreement? An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

Hear this out loud PauseSummary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

By including these five key elements in your Share Subscription Agreement ? subscription price, payment terms, representations and warranties, closing conditions, and indemnification ? you can help safeguard against any potential issues or disputes that may arise down the road.

A subscription contract can be defined as regular or continuous use of a certain service or product by paying a certain amount. In this type of contract, the buyer has the right to demand a product or service from the other party for a certain period or continuously by paying a certain amount.

Hear this out loud PauseThere are advantages as well as disadvantages of each agreement. A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.

Hear this out loud Pause1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

Hear this out loud PauseSubscription agreements are legal contracts that allow an investor to buy shares, bonds, or units of a company as a subscriber and shareholder with limited partnerships (LP) or private placement rights. Share subscription agreements are a type of subscription agreement that involves purchasing shares specifically.