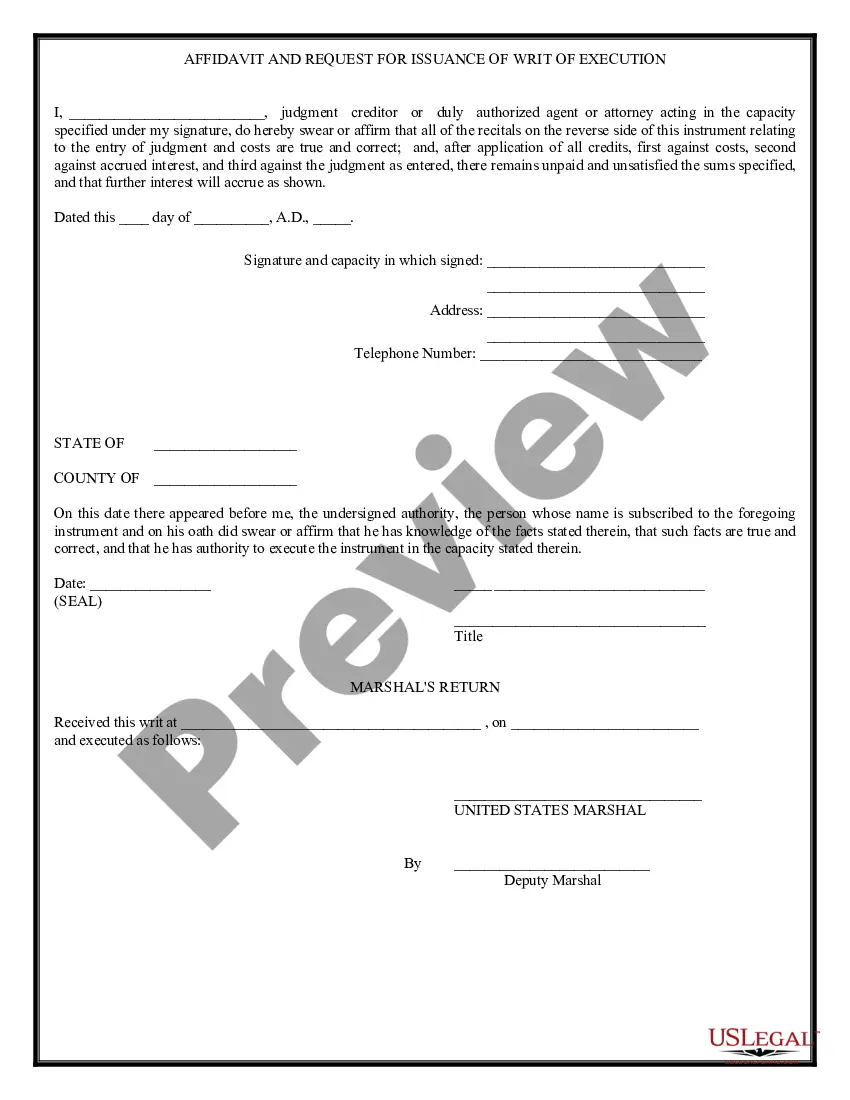

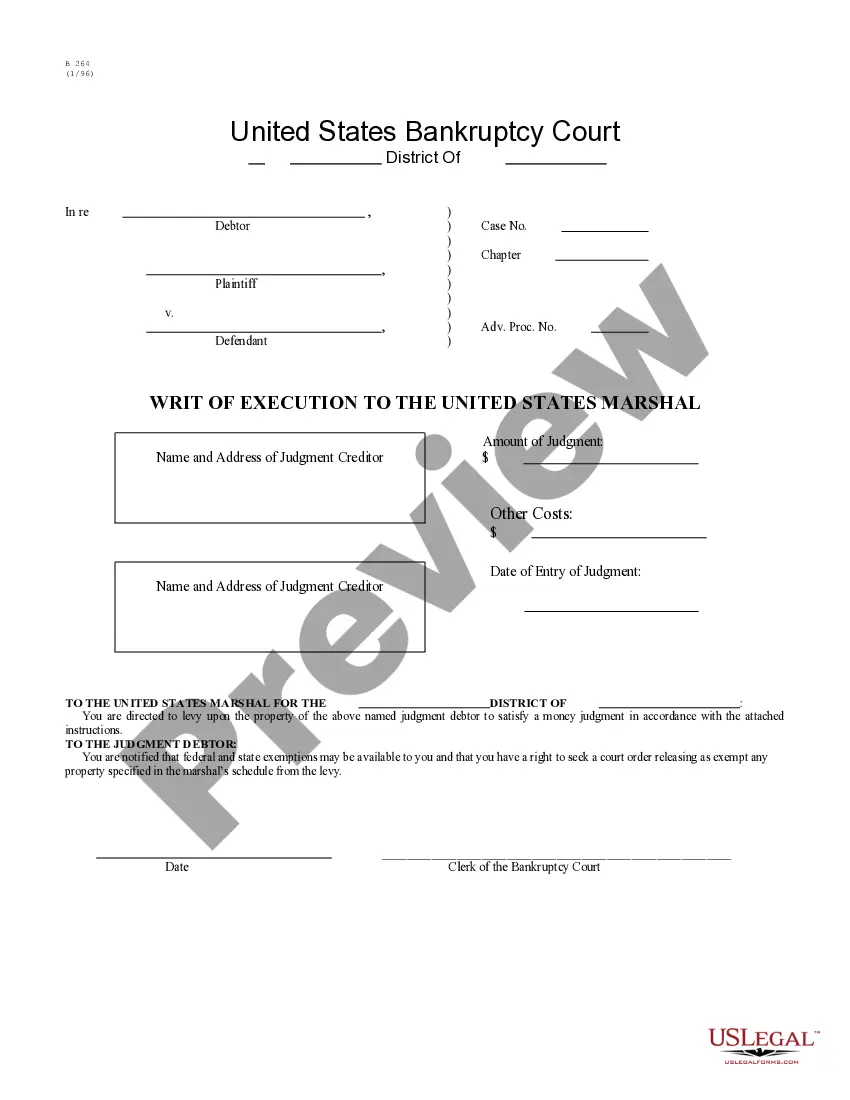

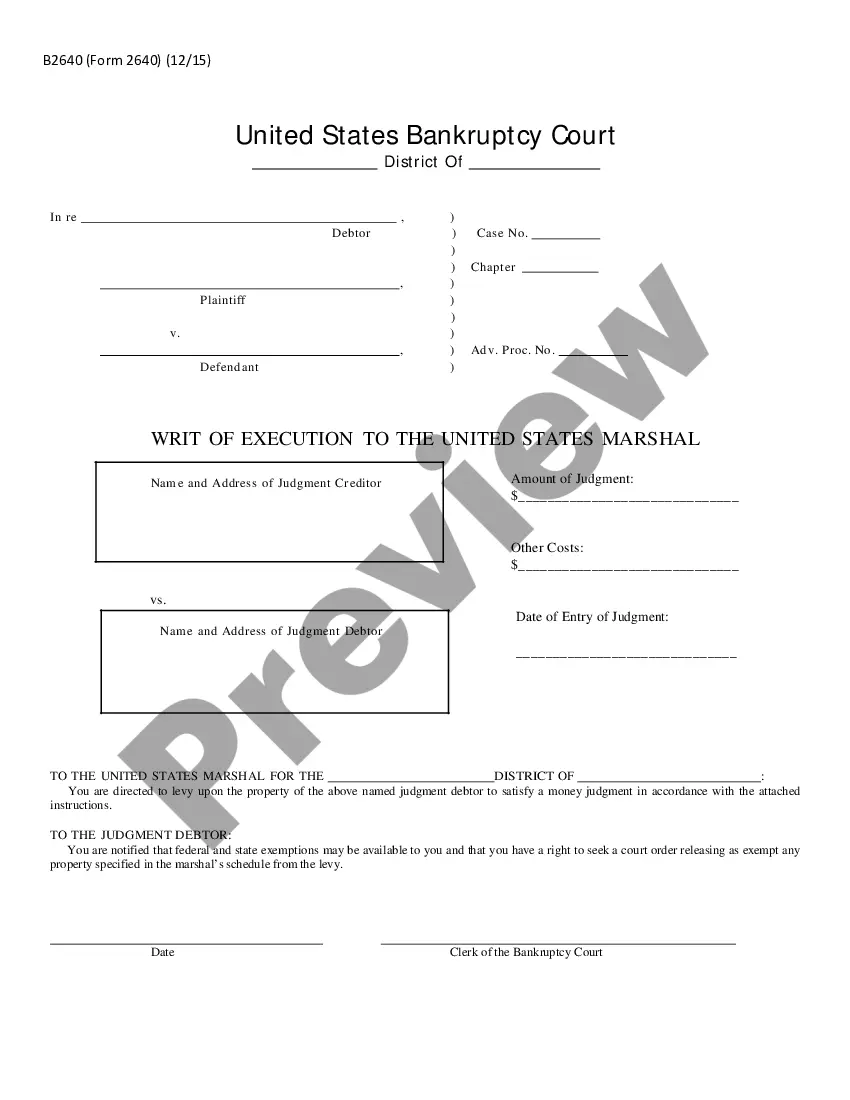

Iowa Writ of Execution

Description

How to fill out Writ Of Execution?

Are you currently in a situation in which you require documents for possibly business or specific reasons just about every day time? There are plenty of legal file templates available online, but finding ones you can depend on is not straightforward. US Legal Forms gives a large number of kind templates, much like the Iowa Writ of Execution, that are written to satisfy federal and state needs.

In case you are already familiar with US Legal Forms website and have a merchant account, simply log in. Afterward, you can acquire the Iowa Writ of Execution template.

Should you not offer an accounts and need to begin to use US Legal Forms, follow these steps:

- Get the kind you require and make sure it is for that correct area/state.

- Make use of the Preview option to review the shape.

- See the description to ensure that you have chosen the appropriate kind.

- If the kind is not what you`re seeking, take advantage of the Lookup industry to discover the kind that meets your requirements and needs.

- When you discover the correct kind, click Buy now.

- Pick the pricing strategy you want, complete the required info to produce your account, and pay for your order using your PayPal or bank card.

- Pick a handy paper format and acquire your copy.

Discover all the file templates you possess bought in the My Forms menus. You can obtain a more copy of Iowa Writ of Execution any time, if possible. Just click on the necessary kind to acquire or print the file template.

Use US Legal Forms, by far the most considerable variety of legal kinds, in order to save time as well as stay away from blunders. The support gives professionally manufactured legal file templates which you can use for an array of reasons. Produce a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

If you are an individual and want to file a lawsuit for $10,000 or less, you have the option of filing a small claims case or a limited civil case. If you are a business, you can file in small claims court for $5,000 or less.

Replevin is a legal action to regain rightful possession of goods or personal property. It is not an action for damages, but the court ?shall also award damages? for cost incurred due to the wrongful possession of the property. Iowa Code § 643.17.

Judgments are valid for a period of twenty years. Iowa Code § 614.1. Judgments are liens upon the real estate owned by the defendant for a period of ten years from the date of the judgment.

In Iowa, you have to file an action against the other party to seek enforcement of the existing court decree order. The enforcement action is formally known as an Application for Rule to Show Cause, commonly referred to as a contempt filing. This filing brings the opposing party's bad acts to the court's attention.

People frequently appear in small claims court without a lawyer. If you do not fully understand your case or the court process, consider reaching out to an attorney. You may be able to get free legal help from an organization like Iowa Legal Aid or you can hire your own lawyer.

What are the steps in a Contempt of Court action? We file an application for a contempt citation, including the facts supporting the application, with the Clerk of Court, and serve it on the person ordered to pay support. The court holds a hearing to decide whether the violation of the support order is willful.

A small claims case is a civil action for a money judgment in which the amount of damages is $6,500 or less. An action for forcible entry and detainer arising out of a landlord tenant dispute can be brought in small claims court. In small claims court, cases are tried before a judge, not a jury.

A Praecipe is a legal document that tells the clerk of court to begin the legal process of collecting (executing on) a judgment that the defendant is not paying. The praceipe directs the clerk of court to issue an execution directed to the sheriff of the county where the asset or property is located.