Iowa Government Contractor Agreement - Self-Employed

Description

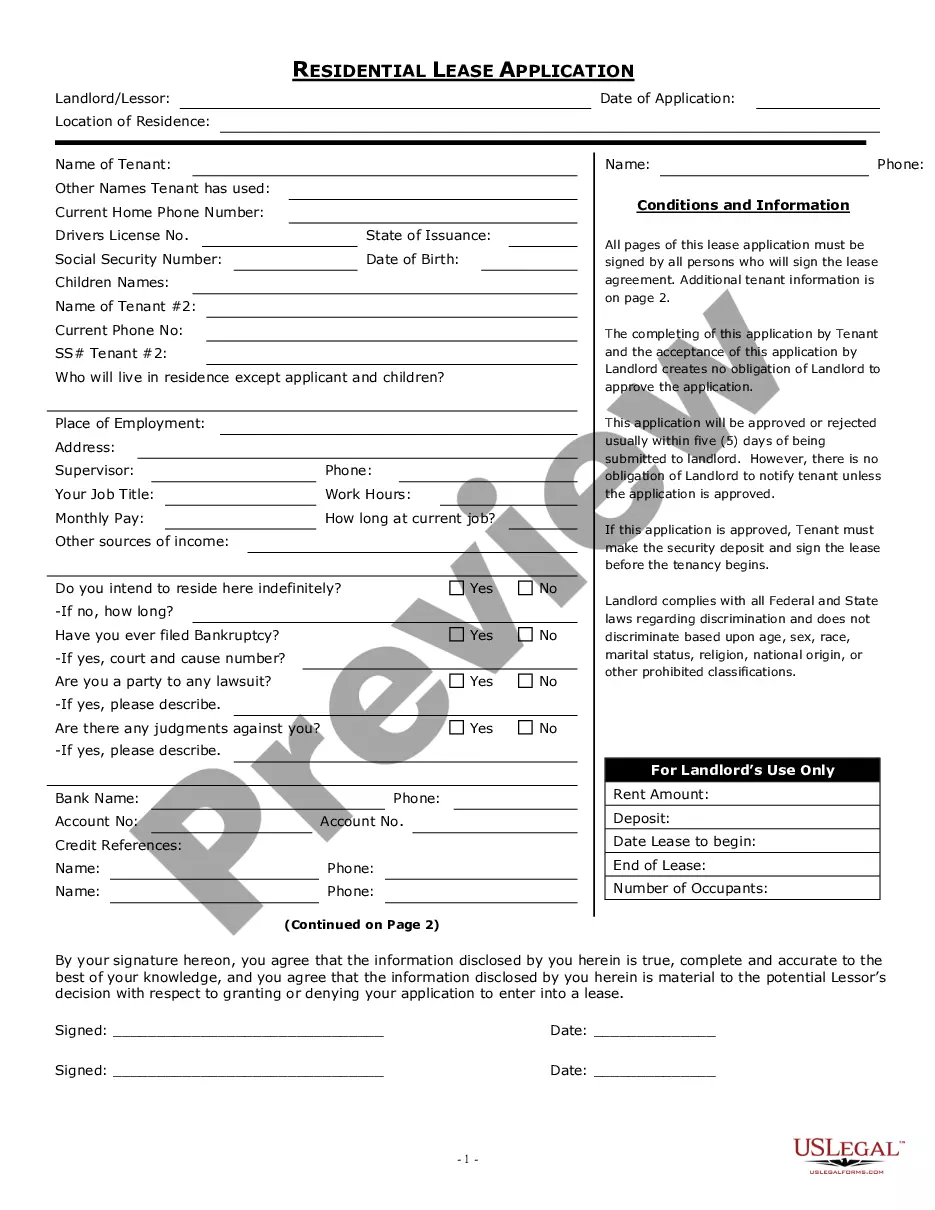

How to fill out Government Contractor Agreement - Self-Employed?

You can dedicate hours online searching for the legal document template that meets the federal and state requirements you need. US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily download or create the Iowa Government Contractor Agreement - Self-Employed from my service. If you already have a US Legal Forms account, you can Log In and click on the Obtain button. Then, you can fill out, edit, print, or sign the Iowa Government Contractor Agreement - Self-Employed. Every legal document template you receive is yours permanently.

To get another copy of any downloaded form, go to the My documents section and click on the corresponding button. If you are using the US Legal Forms website for the first time, follow the simple steps below: First, ensure that you have selected the correct document format for the state/city of your choice. Review the form description to confirm you have chosen the right one. If available, use the Review button to look through the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that suits your needs and specifications.

- Once you have found the template you desire, click Acquire now to continue.

- Select the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your device.

- Make modifications to the document if possible. You can fill out, edit, and sign and print the Iowa Government Contractor Agreement - Self-Employed.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

To set up as a self-employed contractor under the Iowa Government Contractor Agreement - Self-Employed, you must first register your business with the state. This process involves selecting a suitable business structure and obtaining any necessary licenses or permits. Next, you should establish a separate bank account for your business finances to ensure proper management of income. Using platforms like US Legal Forms can simplify the documentation process and guide you through the legal requirements associated with this agreement.

Creating an independent contractor agreement involves several key steps. Start by outlining the scope of work, payment structure, and timelines. Next, include important clauses that protect both parties, such as confidentiality and termination terms. To ensure compliance with state laws, consider using uslegalforms to access a reliable Iowa Government Contractor Agreement - Self-Employed template that meets legal standards.

Typically, the hiring party drafts the independent contractor agreement. This ensures that the document aligns with their specific needs and expectations. However, it is advisable for both parties to review the Iowa Government Contractor Agreement - Self-Employed to ensure clarity and mutual understanding. Utilizing platforms like uslegalforms can simplify this process by providing templates tailored for Iowa's legal requirements.

To write an independent contractor agreement, start by drafting a clear outline that includes the parties involved, services provided, and payment conditions. Next, be sure to add terms about how either party can terminate the agreement and dispute resolution methods. If you're working on an Iowa Government Contractor Agreement - Self-Employed, consider using resources from USLegalForms to ensure that you incorporate all necessary legal elements.

employed contract should include the names and addresses of both parties, a description of the services, and payment terms. Additionally, incorporate clauses about project completion timelines and any confidential information agreements. For those navigating an Iowa Government Contractor Agreement SelfEmployed, covering all legal bases is crucial, and platforms like USLegalForms provide valuable templates to assist you.

Filling out an independent contractor agreement involves outlining the expectations between you and the client. Start by specifying the project's scope, timeline, and payment structure. Make sure to incorporate terms related to confidentiality and non-compete clauses, especially for an Iowa Government Contractor Agreement - Self-Employed. Consider using tools available on USLegalForms to ensure compliance and assistance.

To fill out an independent contractor form, start by gathering all necessary information, such as your name, address, and Social Security number. Include details about the services you will provide, payment terms, and the specific project scope. For an Iowa Government Contractor Agreement - Self-Employed, ensure you confirm any additional state requirements. Utilizing platforms like USLegalForms can simplify this process.

Breaking an independent contractor agreement can lead to various consequences, including financial penalties and legal action. Terms within the agreement usually specify the repercussions of a breach. Understanding the implications of the Iowa Government Contractor Agreement - Self-Employed is essential for avoiding conflicts. When disputes arise, consulting resources like US Legal Forms can guide you through the resolution process.

The independent contractor agreement in Iowa is a legal document that outlines the relationship between a contractor and a client. It details the services to be provided, payment terms, and any other relevant conditions of the working relationship. Using an Iowa Government Contractor Agreement - Self-Employed helps ensure compliance with state regulations. This agreement protects both parties and clarifies their rights.

The primary difference lies in the level of control and independence. Employees work under the direction of an employer, while independent contractors operate independently and set their own schedules. In the context of the Iowa Government Contractor Agreement - Self-Employed, it's crucial to understand these distinctions for tax and legal purposes. Recognizing your status can significantly impact your rights and obligations.