Iowa Gutter Services Contract - Self-Employed

Description

How to fill out Iowa Gutter Services Contract - Self-Employed?

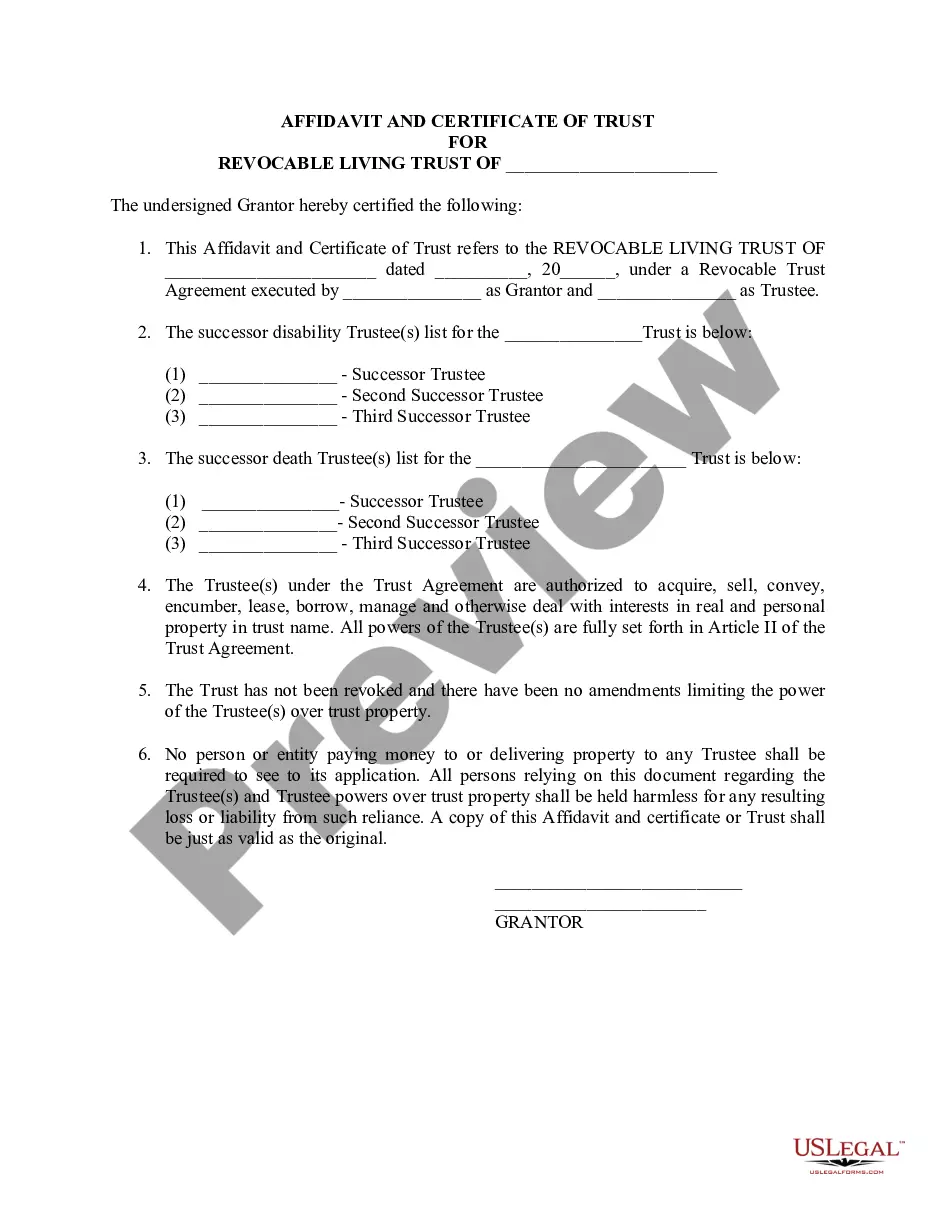

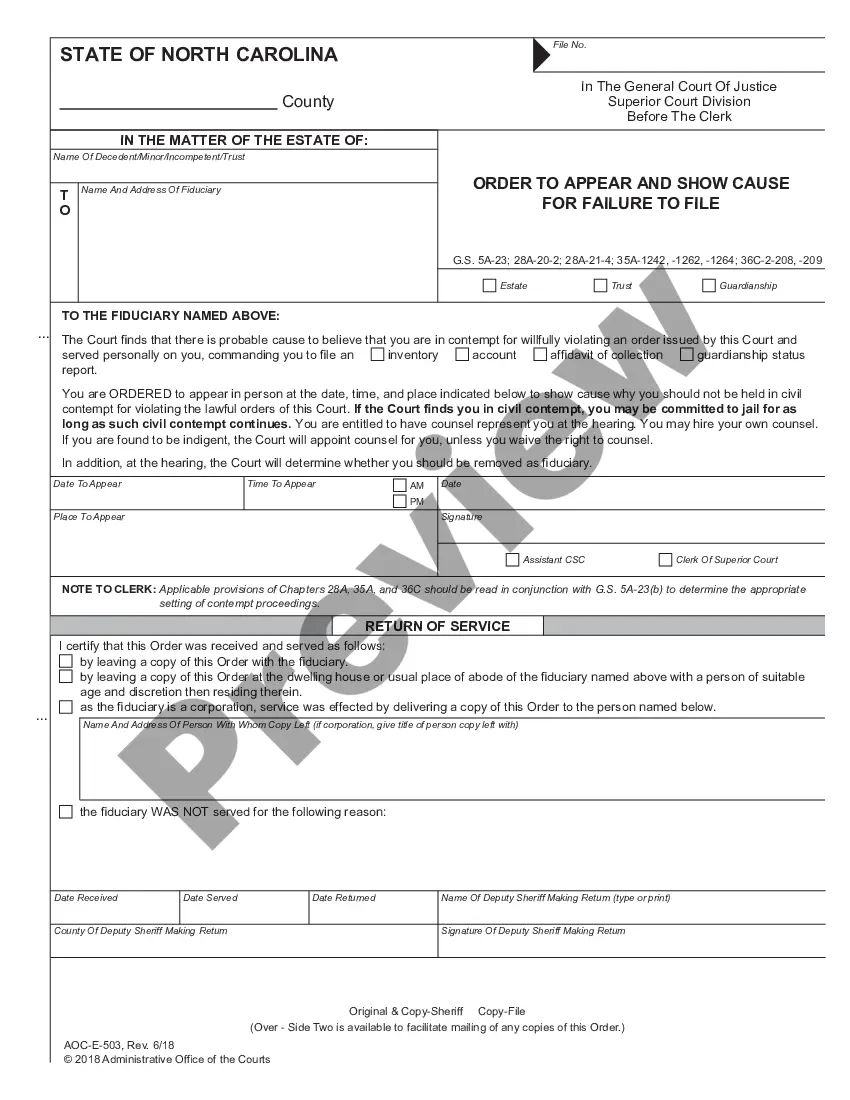

US Legal Forms - one of several greatest libraries of lawful kinds in the States - delivers a variety of lawful document web templates it is possible to acquire or print. Utilizing the website, you can find a huge number of kinds for business and personal purposes, sorted by classes, suggests, or search phrases.You can find the latest versions of kinds such as the Iowa Gutter Services Contract - Self-Employed in seconds.

If you already possess a monthly subscription, log in and acquire Iowa Gutter Services Contract - Self-Employed from your US Legal Forms collection. The Obtain key will show up on every single develop you view. You gain access to all previously downloaded kinds in the My Forms tab of your account.

If you want to use US Legal Forms for the first time, allow me to share basic instructions to get you started off:

- Be sure to have chosen the right develop for the city/state. Select the Preview key to analyze the form`s content. Look at the develop outline to actually have selected the proper develop.

- In case the develop doesn`t satisfy your needs, make use of the Search field on top of the monitor to discover the one which does.

- Should you be happy with the shape, validate your option by visiting the Buy now key. Then, choose the prices strategy you want and supply your accreditations to sign up for the account.

- Method the transaction. Make use of bank card or PayPal account to complete the transaction.

- Pick the file format and acquire the shape on your gadget.

- Make changes. Load, change and print and signal the downloaded Iowa Gutter Services Contract - Self-Employed.

Each template you included with your account lacks an expiry day and is your own property permanently. So, if you wish to acquire or print an additional copy, just proceed to the My Forms area and click on on the develop you need.

Obtain access to the Iowa Gutter Services Contract - Self-Employed with US Legal Forms, by far the most extensive collection of lawful document web templates. Use a huge number of specialist and status-distinct web templates that meet up with your company or personal needs and needs.

Form popularity

FAQ

Repair labor is not taxable.

After that the employee pays tax of 20 per cent up until the basic rate limit along with a further 12 per cent employee NICs. The combined marginal tax rate is 32 per cent. Contractors are paying 19 per cent then a typical further 7.5 per cent on what's left as a dividend, making a marginal tax rate of 25.1 per cent.

It does not apply to tangible personal property. The contractor is responsible for paying tax to the supplier on materials.; The contractor does not charge tax to the customer on the labor or materials.

Sales of parts purchased for use in performing service under optional maintenance contracts are exempt from the sales tax in Iowa.

There are three key documents you need from an independent contractor: a W-9 form, a written contract, and documentation of payment information. In case of an IRS audit, it's important to keep thorough documentation on your independent contractors. Learn more about each form you need, below.

Construction. When services are performed on or connected with new construction, reconstruction, alteration, expansion, or remodeling of a building or structure, they are exempt from sales and use tax. Repair services remain taxable.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Labor is exempt from sales tax for real property and structures only. Not tangible personal property. You pay tax to the supplier for materials. You do not charge tax to the customer for labor or materials.