Iowa Breeder Agreement - Self-Employed Independent Contractor

Description

How to fill out Iowa Breeder Agreement - Self-Employed Independent Contractor?

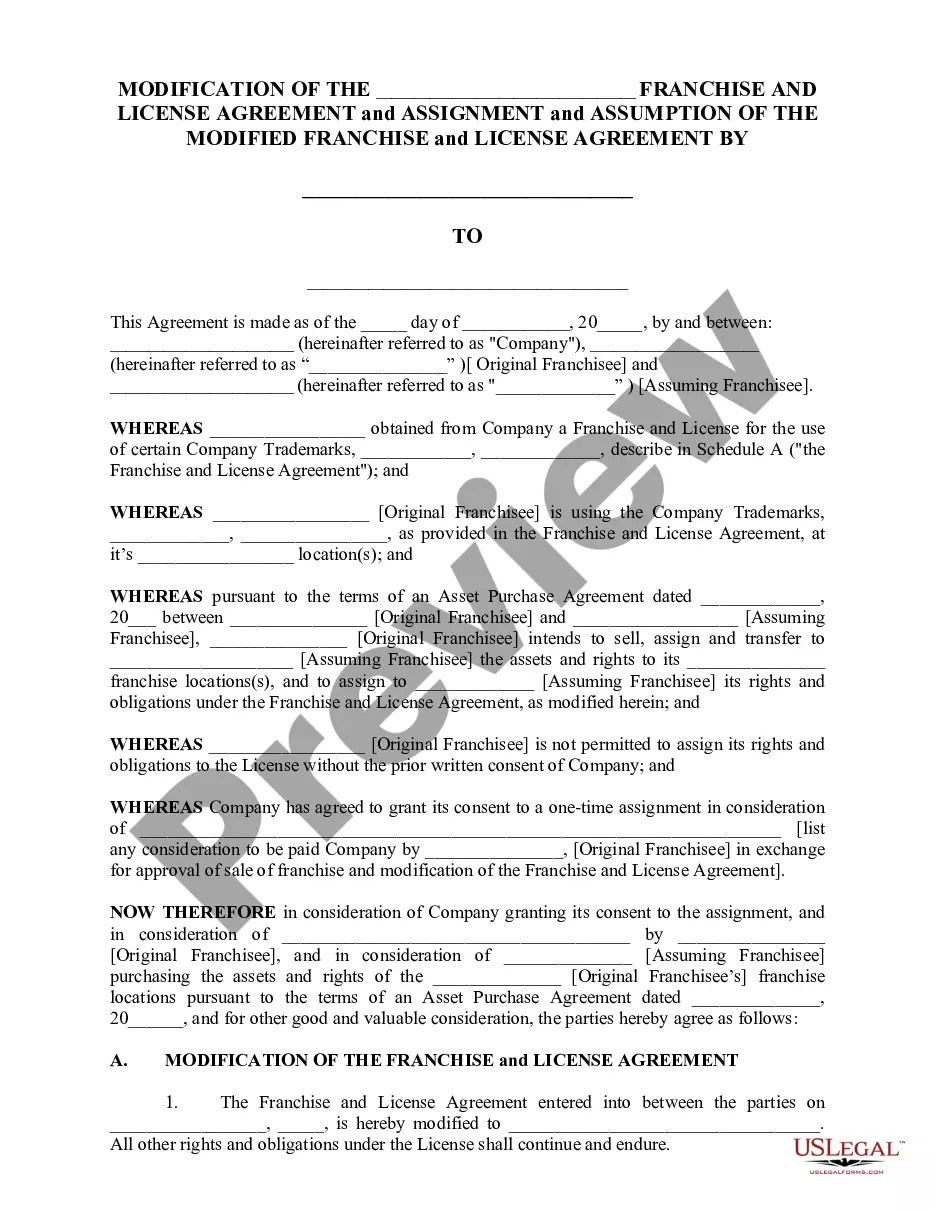

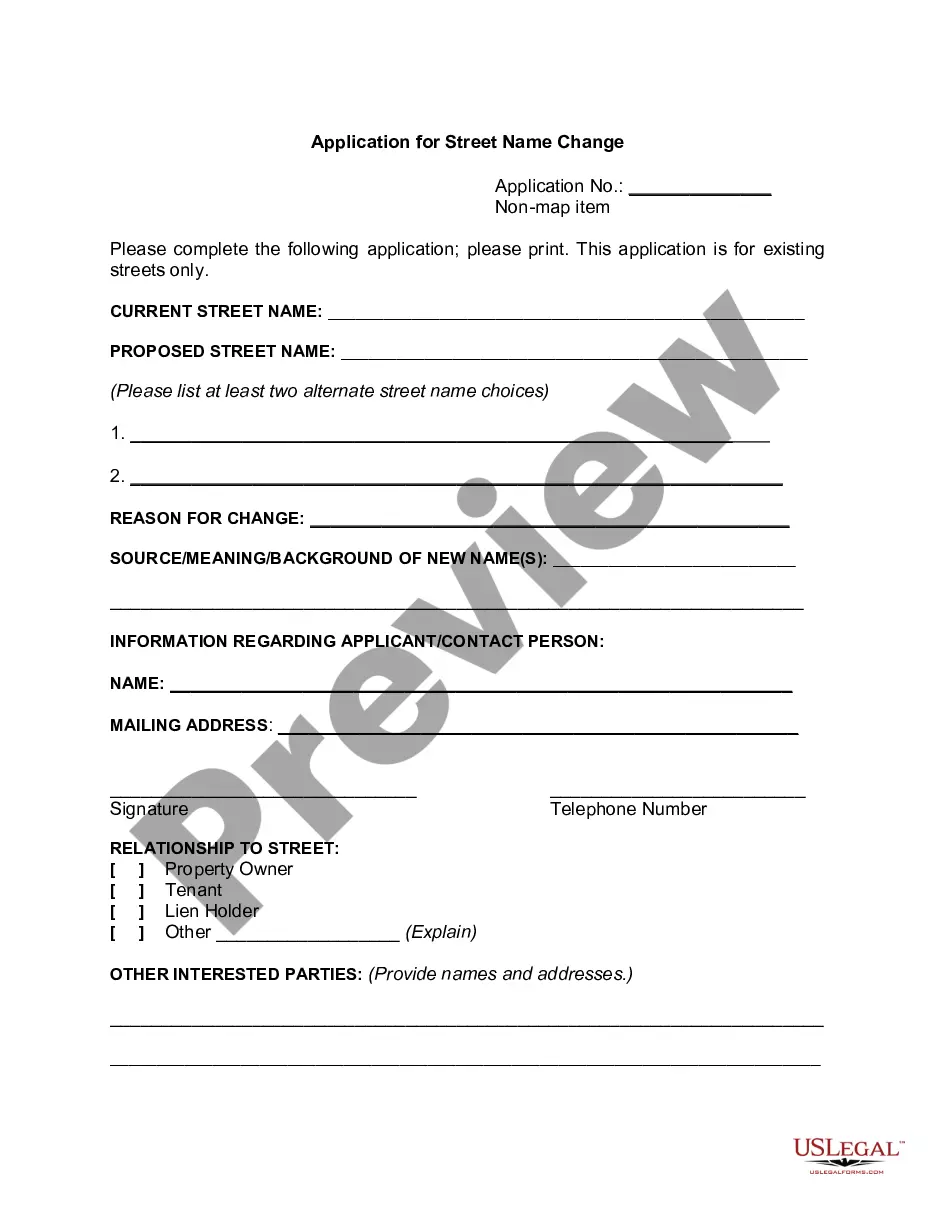

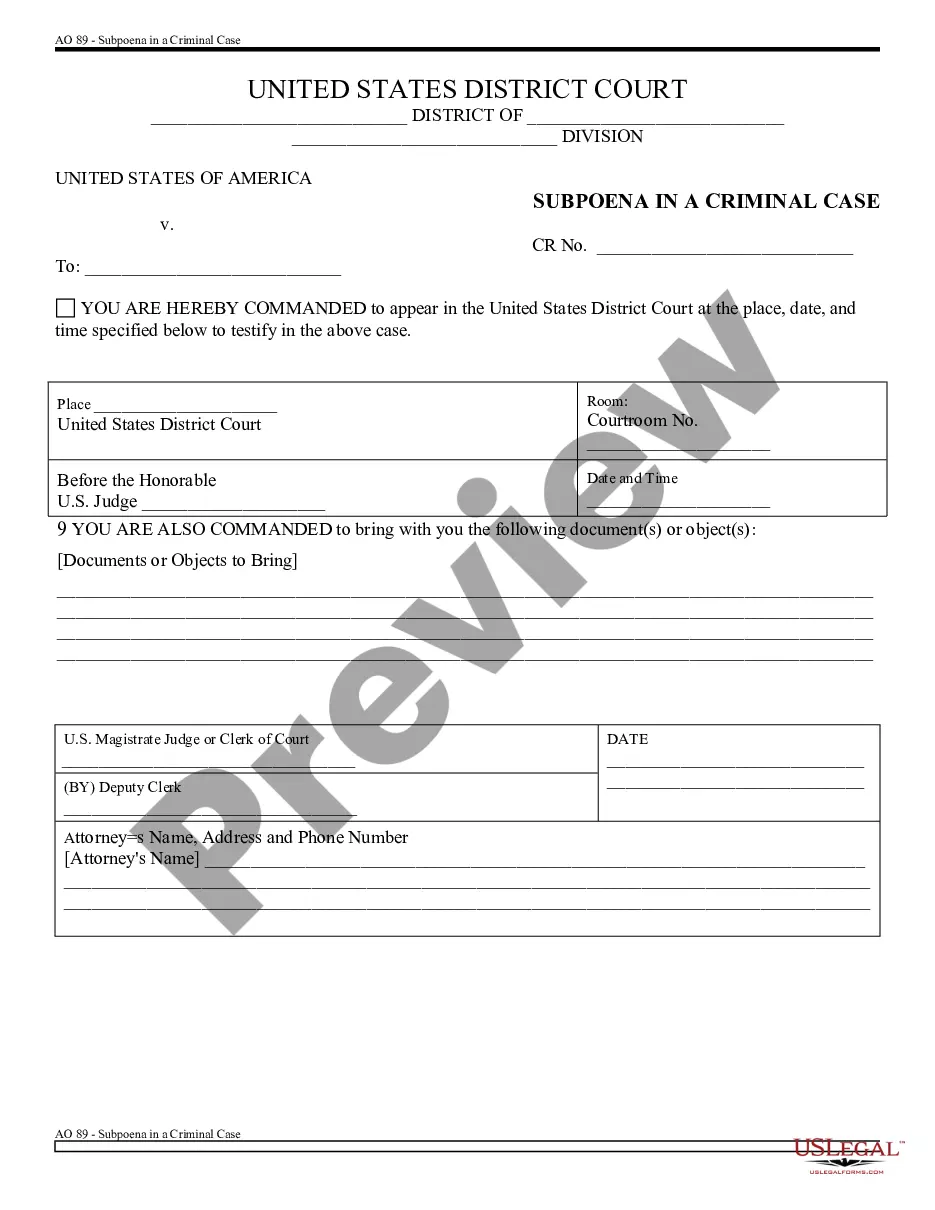

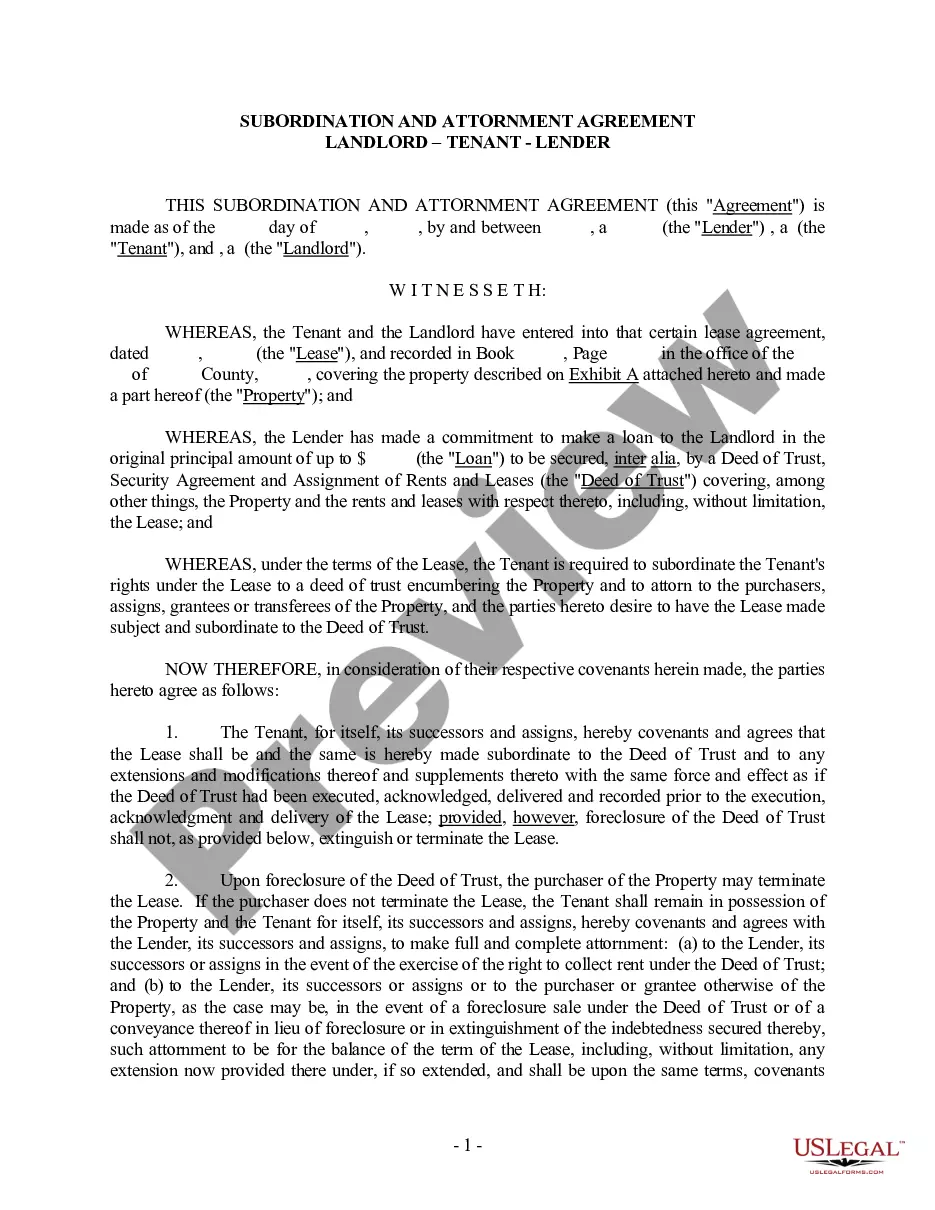

US Legal Forms - one of the biggest libraries of authorized forms in the United States - offers a variety of authorized papers layouts you can download or print. Making use of the web site, you may get a huge number of forms for organization and person purposes, categorized by groups, claims, or keywords.You will find the most recent types of forms such as the Iowa Breeder Agreement - Self-Employed Independent Contractor within minutes.

If you currently have a registration, log in and download Iowa Breeder Agreement - Self-Employed Independent Contractor in the US Legal Forms catalogue. The Obtain key will show up on each and every form you see. You gain access to all formerly downloaded forms in the My Forms tab of your own profile.

If you want to use US Legal Forms initially, allow me to share simple directions to help you get began:

- Be sure to have chosen the correct form for the town/region. Select the Preview key to check the form`s content. See the form description to ensure that you have chosen the right form.

- In case the form doesn`t satisfy your requirements, make use of the Search field on top of the display to obtain the one which does.

- Should you be satisfied with the shape, verify your selection by visiting the Get now key. Then, opt for the pricing strategy you favor and supply your references to sign up for an profile.

- Method the deal. Make use of charge card or PayPal profile to perform the deal.

- Find the structure and download the shape on your own device.

- Make changes. Load, change and print and sign the downloaded Iowa Breeder Agreement - Self-Employed Independent Contractor.

Every single design you added to your account lacks an expiration time which is yours eternally. So, if you wish to download or print yet another copy, just visit the My Forms portion and click on around the form you need.

Obtain access to the Iowa Breeder Agreement - Self-Employed Independent Contractor with US Legal Forms, by far the most considerable catalogue of authorized papers layouts. Use a huge number of specialist and condition-certain layouts that fulfill your organization or person needs and requirements.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.