Iowa Woodworking Services Contract - Self-Employed

Description

How to fill out Iowa Woodworking Services Contract - Self-Employed?

If you need to total, download, or print out legitimate record themes, use US Legal Forms, the greatest assortment of legitimate kinds, that can be found on the web. Use the site`s easy and handy look for to discover the files you need. Various themes for organization and individual purposes are categorized by categories and suggests, or key phrases. Use US Legal Forms to discover the Iowa Woodworking Services Contract - Self-Employed in a few clicks.

If you are currently a US Legal Forms customer, log in in your bank account and click on the Download switch to find the Iowa Woodworking Services Contract - Self-Employed. You may also gain access to kinds you in the past delivered electronically from the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for your right metropolis/land.

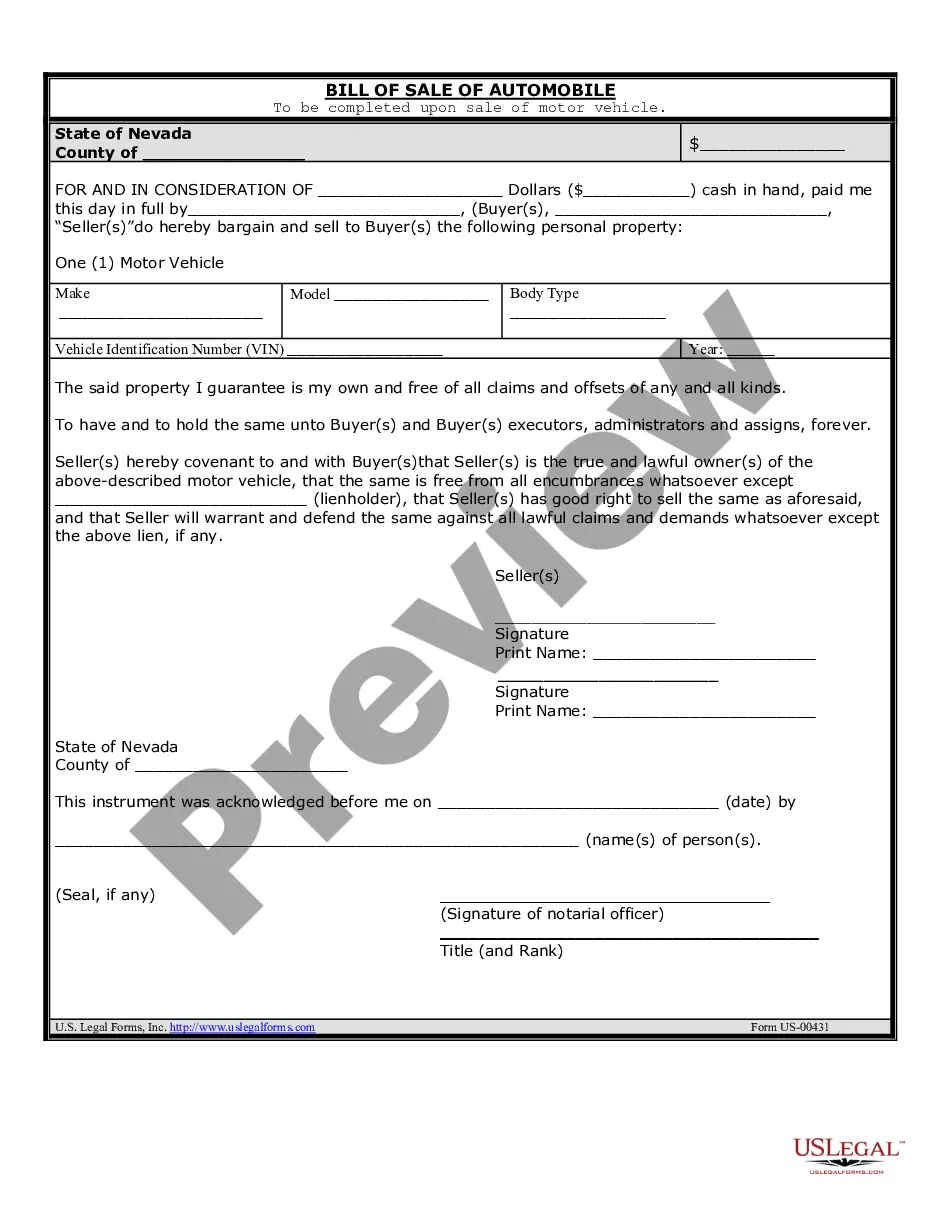

- Step 2. Utilize the Preview choice to examine the form`s content material. Don`t overlook to read the outline.

- Step 3. If you are not satisfied with the form, utilize the Research area towards the top of the display screen to get other models from the legitimate form design.

- Step 4. After you have discovered the form you need, click on the Acquire now switch. Choose the pricing strategy you favor and add your credentials to sign up for the bank account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Select the file format from the legitimate form and download it on your product.

- Step 7. Total, modify and print out or indicator the Iowa Woodworking Services Contract - Self-Employed.

Every legitimate record design you purchase is the one you have permanently. You might have acces to every single form you delivered electronically inside your acccount. Select the My Forms section and decide on a form to print out or download yet again.

Remain competitive and download, and print out the Iowa Woodworking Services Contract - Self-Employed with US Legal Forms. There are many expert and status-specific kinds you can use to your organization or individual requirements.

Form popularity

FAQ

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.