Iowa Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Iowa Underwriter Agreement - Self-Employed Independent Contractor?

Have you been in the position that you need to have documents for sometimes organization or individual reasons virtually every day time? There are tons of authorized document templates available on the net, but discovering types you can rely on is not effortless. US Legal Forms offers a large number of type templates, like the Iowa Underwriter Agreement - Self-Employed Independent Contractor, that happen to be written to meet federal and state demands.

In case you are previously knowledgeable about US Legal Forms website and get your account, just log in. Afterward, it is possible to obtain the Iowa Underwriter Agreement - Self-Employed Independent Contractor design.

Should you not provide an account and need to begin using US Legal Forms, abide by these steps:

- Obtain the type you need and make sure it is for your proper city/region.

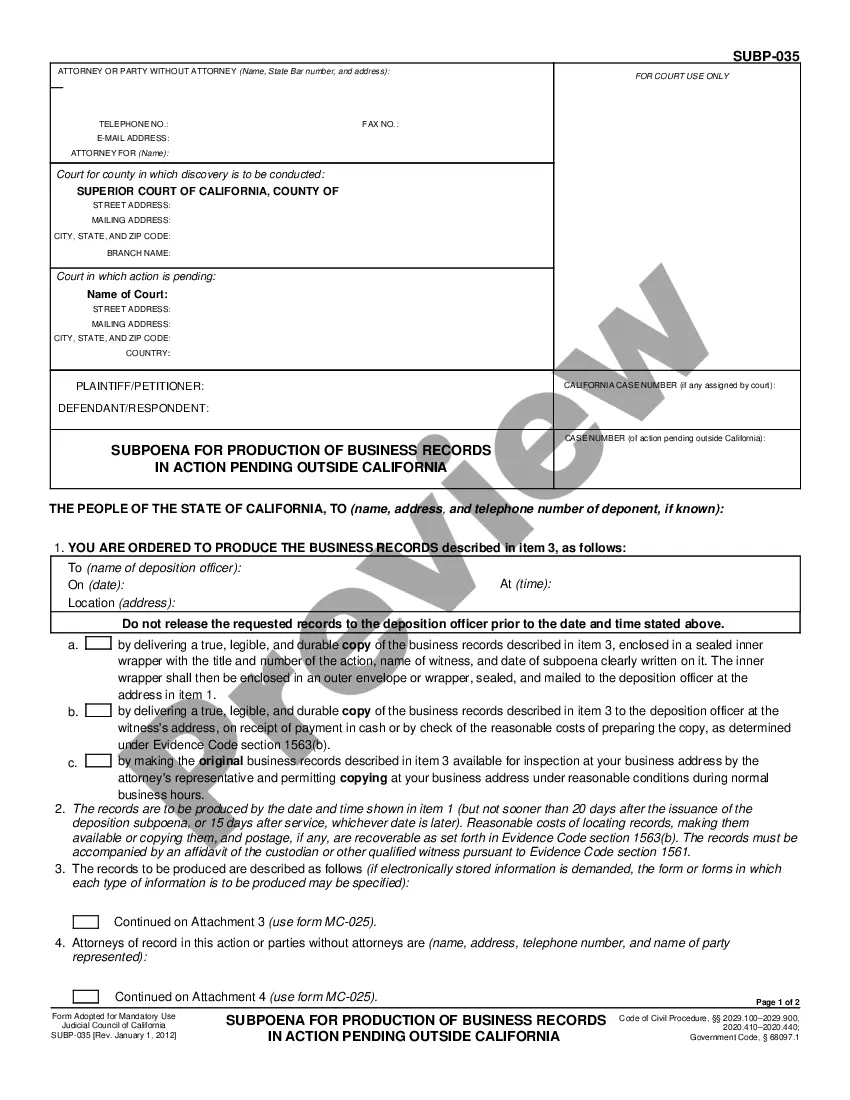

- Make use of the Review button to analyze the shape.

- See the explanation to ensure that you have selected the right type.

- In case the type is not what you`re looking for, utilize the Research field to obtain the type that meets your requirements and demands.

- If you obtain the proper type, click Get now.

- Opt for the pricing prepare you would like, submit the specified info to make your account, and purchase the transaction with your PayPal or bank card.

- Pick a convenient paper file format and obtain your duplicate.

Find every one of the document templates you have purchased in the My Forms menu. You can get a additional duplicate of Iowa Underwriter Agreement - Self-Employed Independent Contractor anytime, if possible. Just select the needed type to obtain or produce the document design.

Use US Legal Forms, one of the most considerable variety of authorized varieties, to save efforts and steer clear of mistakes. The support offers professionally made authorized document templates which you can use for an array of reasons. Create your account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.