Iowa Technical Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Iowa Technical Writer Agreement - Self-Employed Independent Contractor?

Are you currently in a situation that you will need paperwork for possibly business or person uses nearly every day time? There are plenty of lawful papers layouts available online, but locating kinds you can depend on is not simple. US Legal Forms offers 1000s of type layouts, such as the Iowa Technical Writer Agreement - Self-Employed Independent Contractor, that are composed to satisfy state and federal demands.

If you are already acquainted with US Legal Forms site and also have a merchant account, just log in. Following that, you can down load the Iowa Technical Writer Agreement - Self-Employed Independent Contractor web template.

If you do not come with an bank account and wish to start using US Legal Forms, adopt these measures:

- Discover the type you want and make sure it is for your appropriate metropolis/county.

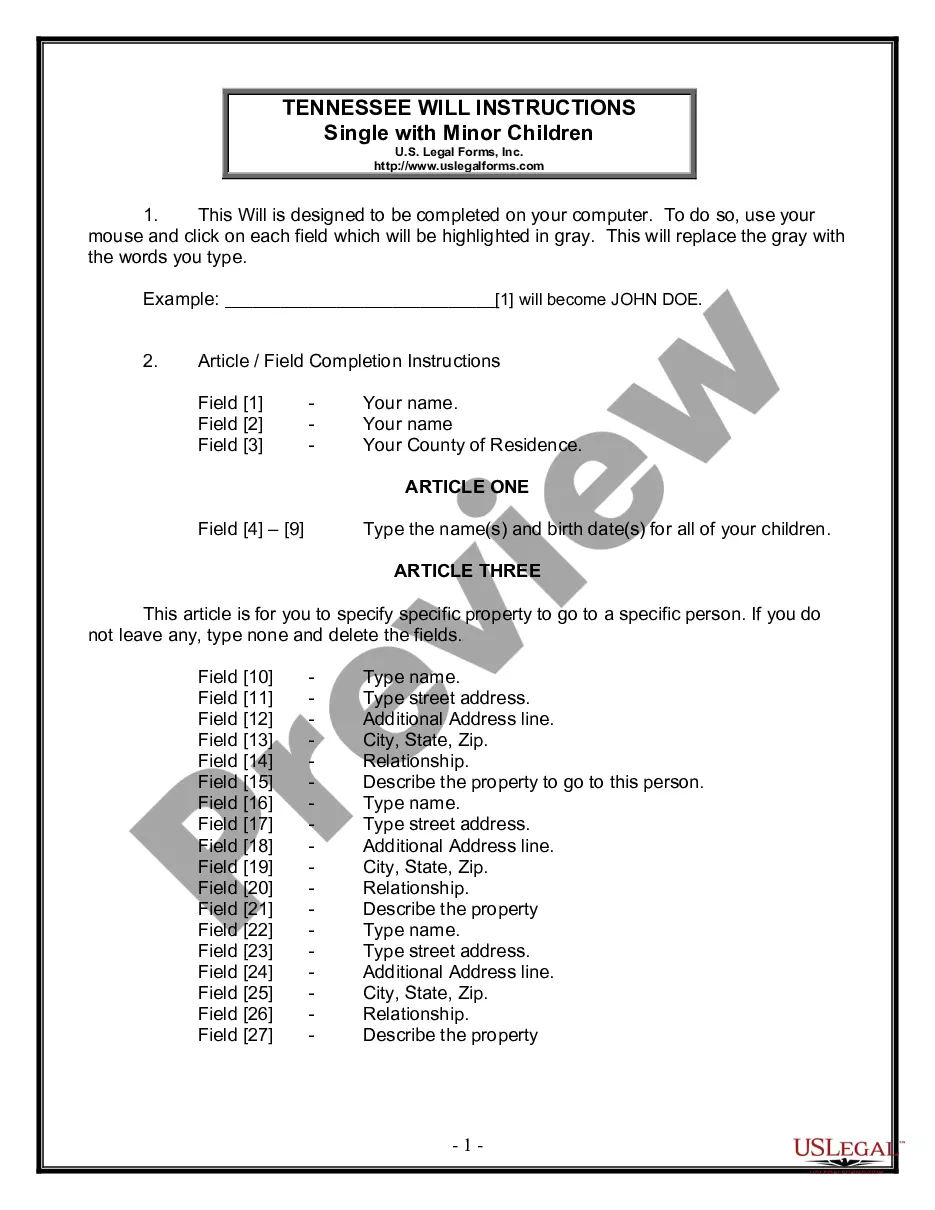

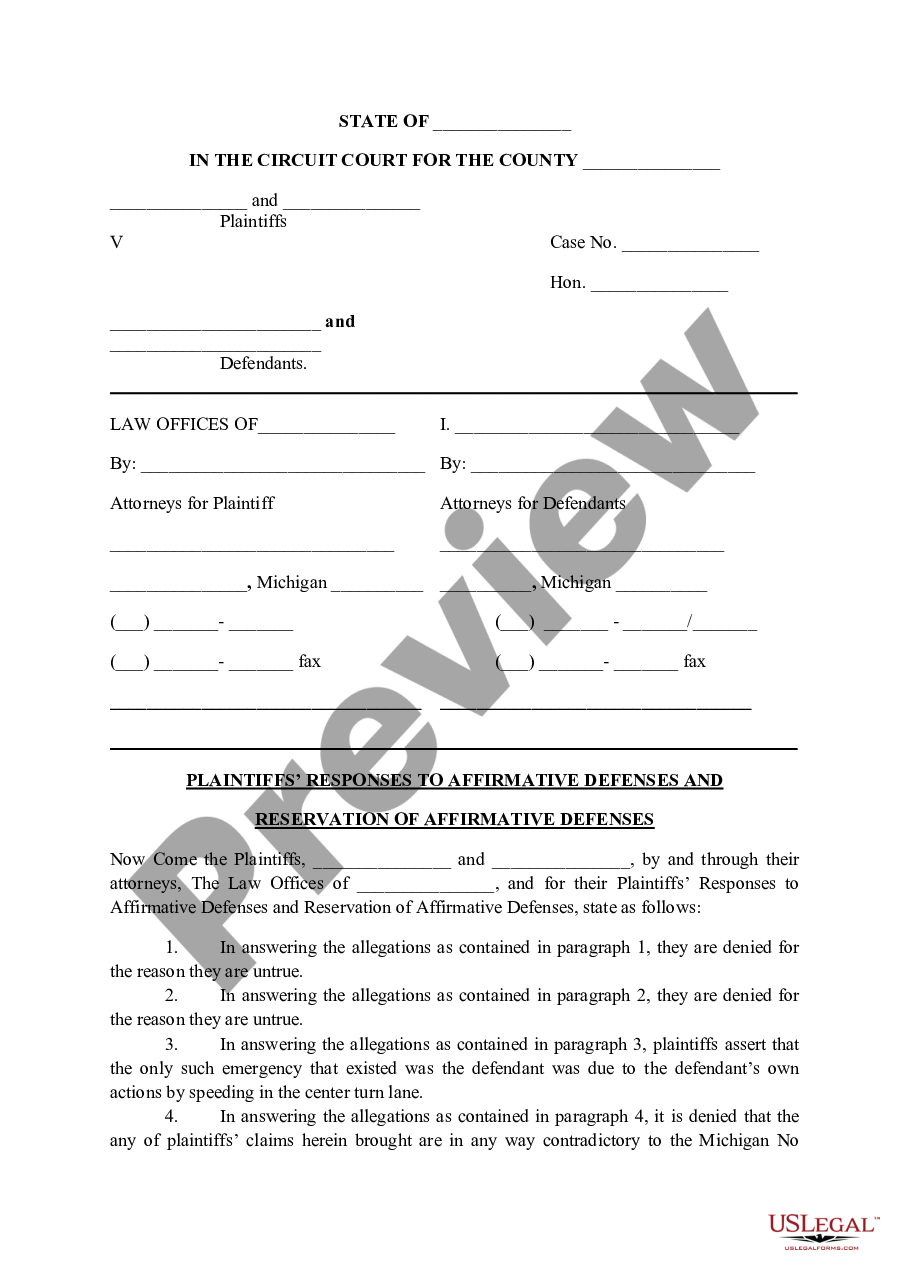

- Make use of the Review button to analyze the shape.

- Browse the information to actually have selected the correct type.

- In the event the type is not what you are trying to find, take advantage of the Lookup discipline to discover the type that meets your requirements and demands.

- Whenever you discover the appropriate type, just click Purchase now.

- Select the pricing plan you want, fill out the required information to create your bank account, and purchase your order making use of your PayPal or bank card.

- Choose a convenient file structure and down load your copy.

Get all of the papers layouts you may have bought in the My Forms food list. You may get a extra copy of Iowa Technical Writer Agreement - Self-Employed Independent Contractor whenever, if needed. Just click on the essential type to down load or printing the papers web template.

Use US Legal Forms, one of the most considerable selection of lawful types, in order to save time and avoid blunders. The assistance offers appropriately produced lawful papers layouts that can be used for an array of uses. Make a merchant account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.