Iowa Cease and Desist for Debt Collectors

Description

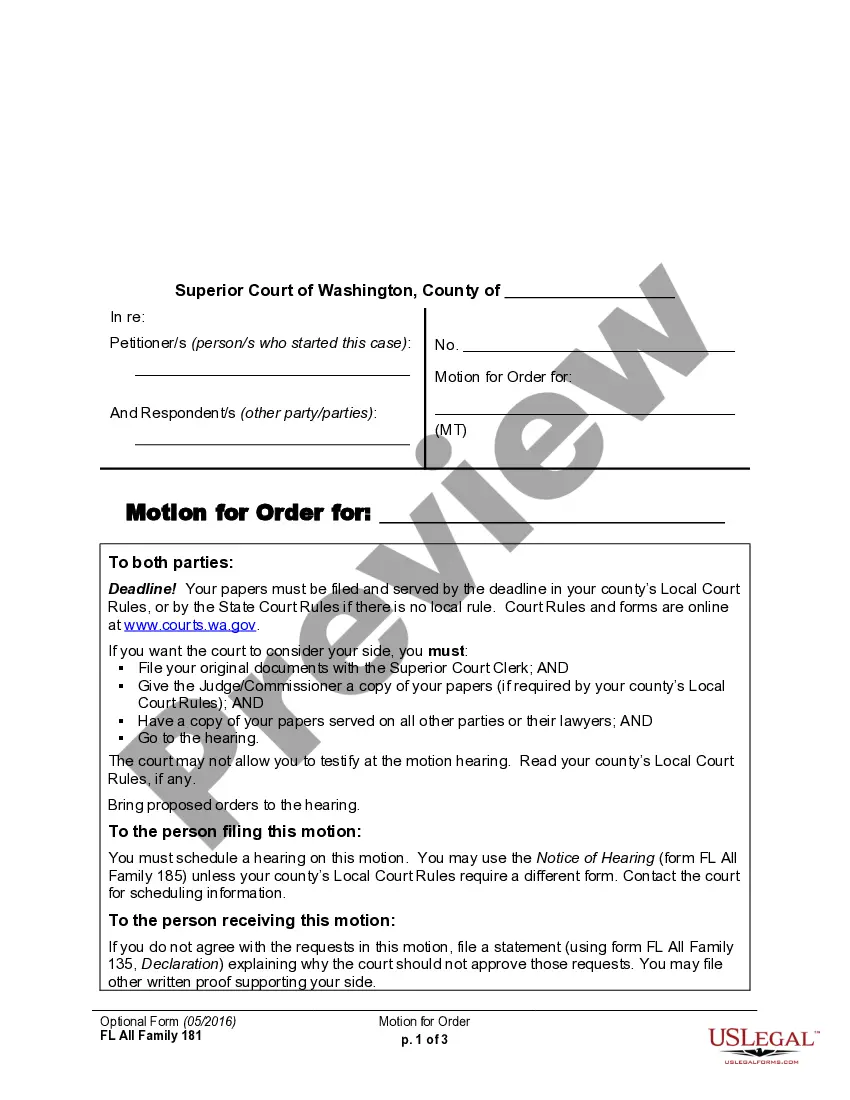

How to fill out Iowa Cease And Desist For Debt Collectors?

If you have to complete, obtain, or printing lawful papers web templates, use US Legal Forms, the biggest collection of lawful forms, that can be found online. Use the site`s easy and practical search to obtain the papers you want. Different web templates for organization and person uses are sorted by classes and suggests, or keywords. Use US Legal Forms to obtain the Iowa Cease and Desist for Debt Collectors in a few click throughs.

If you are currently a US Legal Forms consumer, log in to your account and click on the Download option to have the Iowa Cease and Desist for Debt Collectors. You may also gain access to forms you previously acquired within the My Forms tab of your own account.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your appropriate town/region.

- Step 2. Use the Review method to check out the form`s content material. Never neglect to read the outline.

- Step 3. If you are not satisfied with the kind, take advantage of the Search discipline near the top of the monitor to locate other types of the lawful kind design.

- Step 4. When you have discovered the form you want, go through the Get now option. Select the rates prepare you choose and include your accreditations to sign up to have an account.

- Step 5. Procedure the transaction. You should use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the lawful kind and obtain it on your system.

- Step 7. Total, modify and printing or indication the Iowa Cease and Desist for Debt Collectors.

Every single lawful papers design you purchase is the one you have forever. You possess acces to each and every kind you acquired inside your acccount. Select the My Forms segment and pick a kind to printing or obtain once more.

Compete and obtain, and printing the Iowa Cease and Desist for Debt Collectors with US Legal Forms. There are millions of expert and condition-certain forms you can use for your personal organization or person requirements.

Form popularity

FAQ

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

This letter should be addressed and directed at one creditor only. You'll have to write one for each of the creditors that you want to stop calling you. Sending a cease and desist letter isn't a solution to your problem; it's merely a solution to receiving annoying phone calls.

Dear debt collector: Pursuant to my rights under the state and federal fair debt collection laws, I hereby request that you immediately cease all calls to your phone number in relation to the account of wrong person's full name. This is the wrong number to contact that person.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

In California, the statute of limitations on most debts is four years. With some limited exceptions, creditors and debt buyers can't sue to collect debt that is more than four years old. When the debt is based on a verbal agreement, that time is reduced to two years.

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

If you're being contacted by a lawyer on behalf of a creditor, the lawyer must stop contacting you too, provided he or she handles more than two debts in a year. The point of a cease and desist letter is to stop receiving harassing communications. Your creditors are still able to try to collect the debt owed, though.

Include your contact information and send this letter via certified mail with a return receipt requested so that you know if and when the creditor receives your letter. Once the debt collector receives a cease and desist letter, it must stop all further contact unless the law permits otherwise.

Under Iowa state law, creditors have 10 years to sue for any unpaid debt that stems from a written contract. For debts based on oral agreements, the statute of limitations is five years.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.