Iowa Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

If you want to total, acquire, or printing legitimate papers layouts, use US Legal Forms, the largest collection of legitimate varieties, which can be found on-line. Utilize the site`s easy and hassle-free research to obtain the papers you need. Various layouts for business and specific uses are sorted by groups and says, or key phrases. Use US Legal Forms to obtain the Iowa Direction For Payment of Royalty to Trustee by Royalty Owners in just a few mouse clicks.

In case you are previously a US Legal Forms client, log in to your account and click the Obtain button to get the Iowa Direction For Payment of Royalty to Trustee by Royalty Owners. Also you can access varieties you formerly downloaded in the My Forms tab of the account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for your correct metropolis/land.

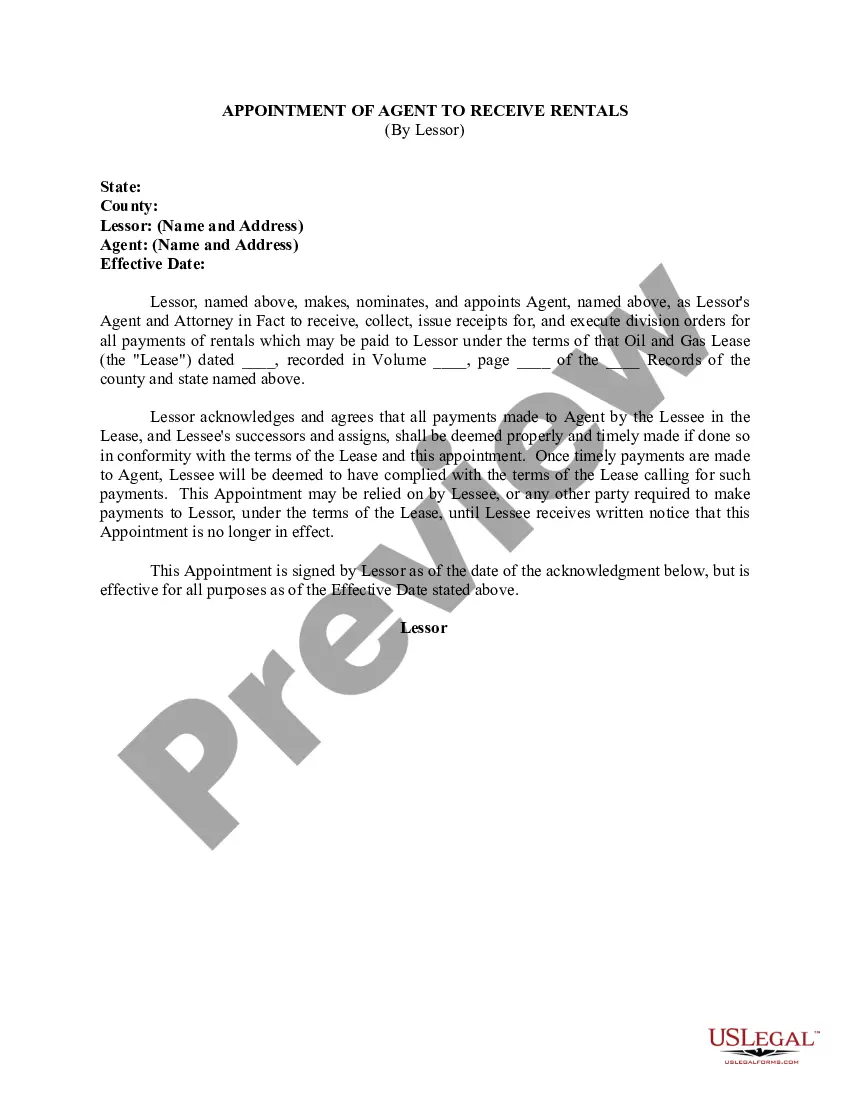

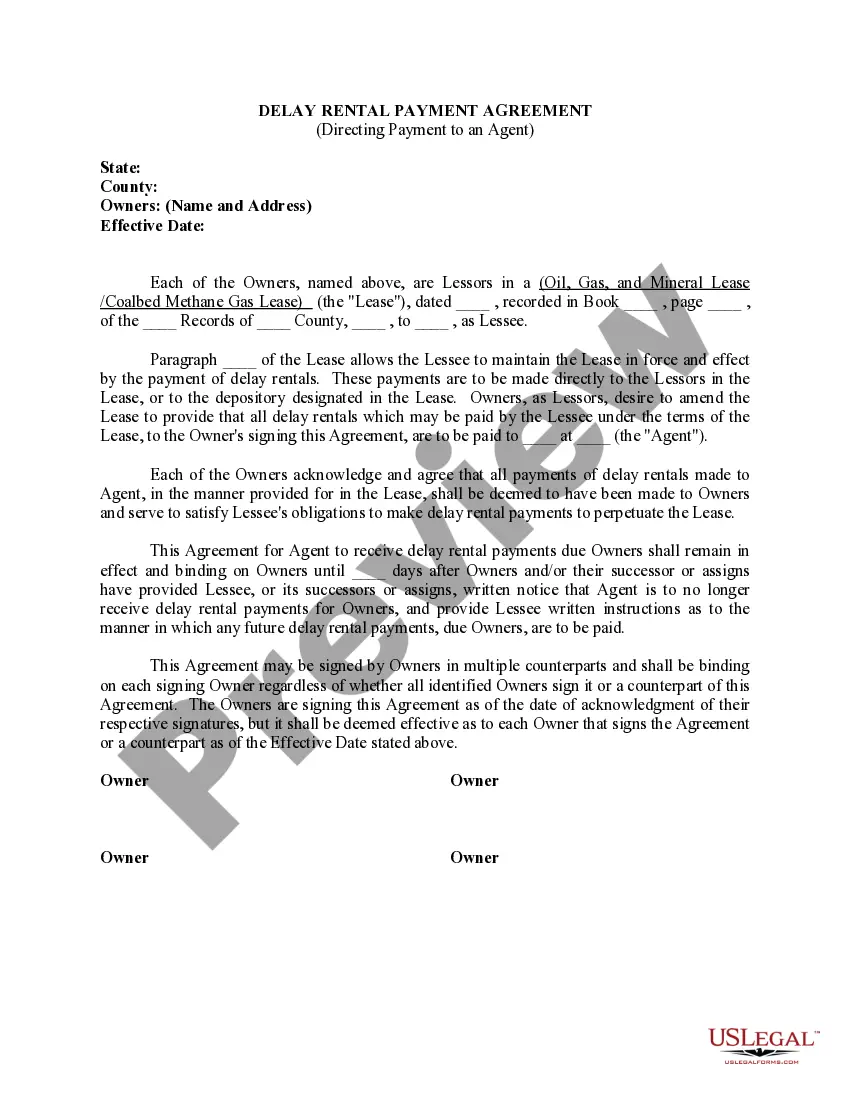

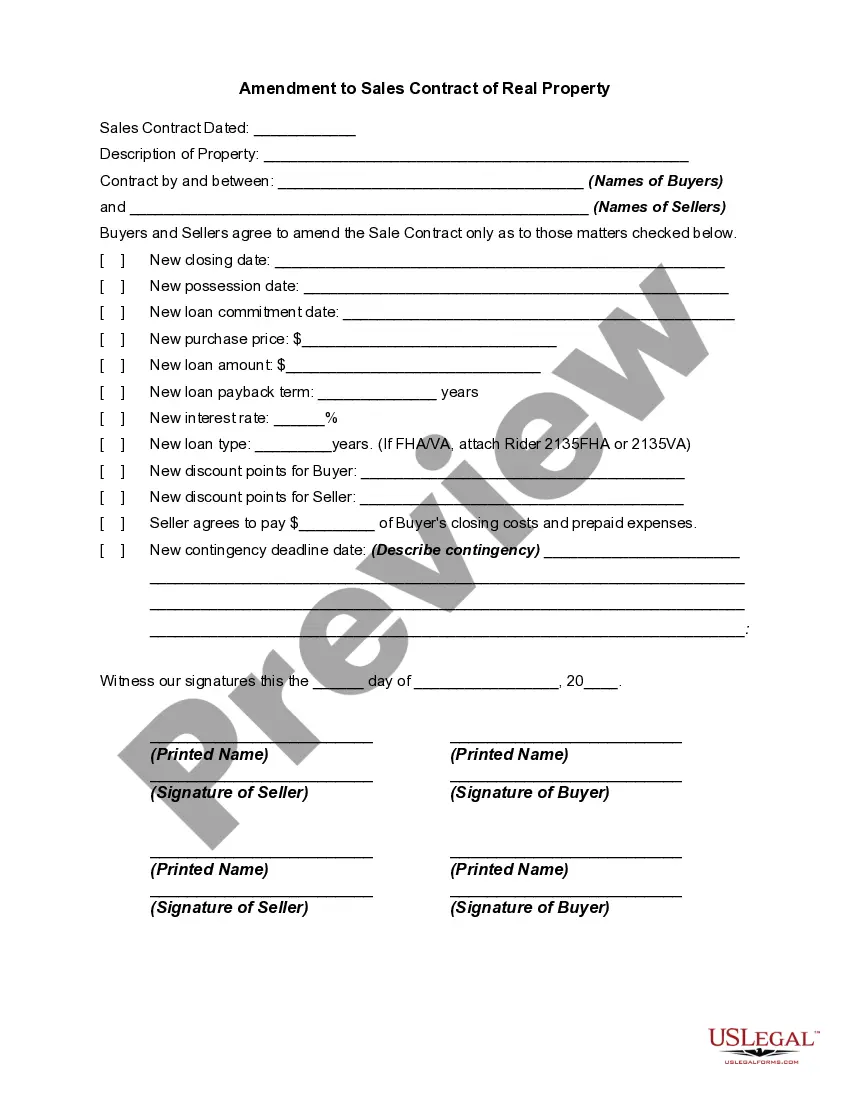

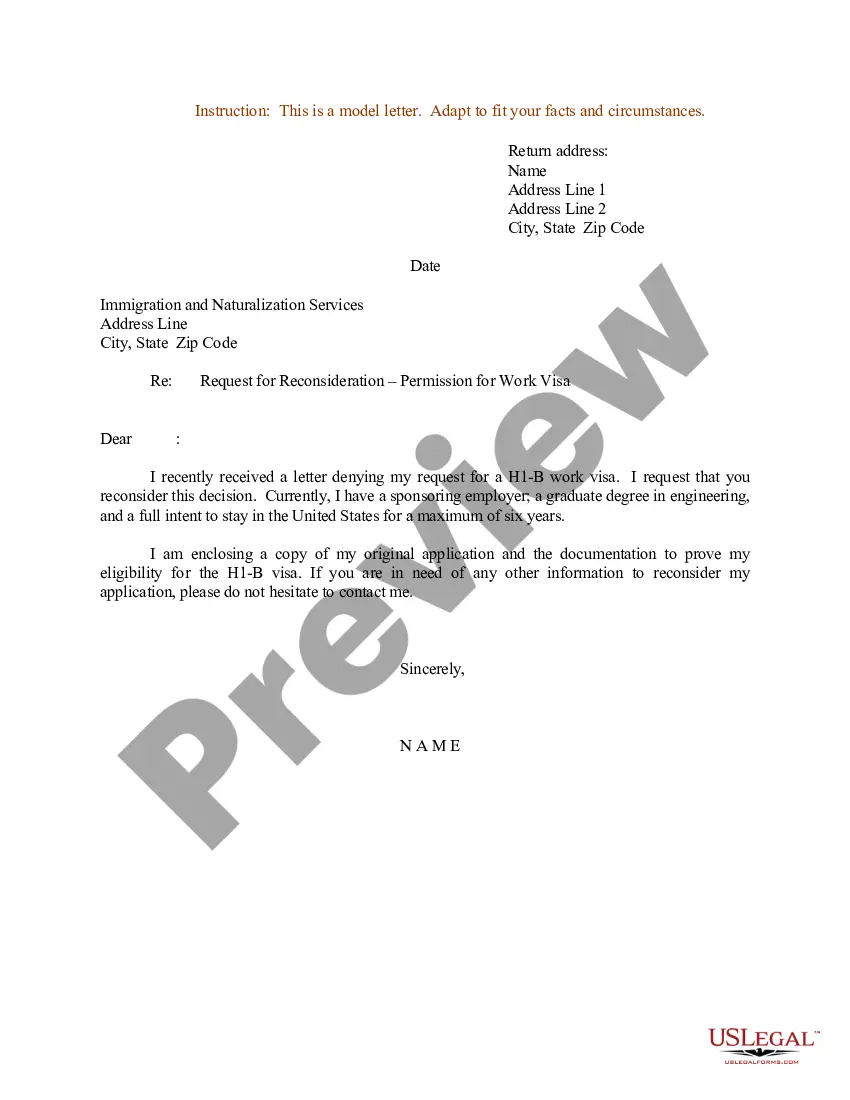

- Step 2. Utilize the Preview option to check out the form`s content. Never forget to read through the outline.

- Step 3. In case you are not satisfied with the kind, utilize the Search discipline near the top of the screen to find other versions from the legitimate kind template.

- Step 4. Upon having found the form you need, go through the Acquire now button. Pick the prices prepare you like and add your references to register for the account.

- Step 5. Approach the purchase. You can utilize your bank card or PayPal account to complete the purchase.

- Step 6. Select the structure from the legitimate kind and acquire it on your own system.

- Step 7. Comprehensive, change and printing or indicator the Iowa Direction For Payment of Royalty to Trustee by Royalty Owners.

Every single legitimate papers template you purchase is yours forever. You have acces to every single kind you downloaded inside your acccount. Go through the My Forms segment and choose a kind to printing or acquire yet again.

Contend and acquire, and printing the Iowa Direction For Payment of Royalty to Trustee by Royalty Owners with US Legal Forms. There are thousands of specialist and status-certain varieties you can use to your business or specific needs.

Form popularity

FAQ

Factors to consider in determining the governing law include the place of the trust's creation, the location of the trust property, and the domicile of the settlor, the trustee, and the beneficiaries.

Beneficiaries are responsible for paying income tax if assets are distributed before earning income. Not all trusts and estates have to file Form 1041 ? only if they have income-producing assets or nonresident alien beneficiaries.

Location of the Trust Administration Some states use the location of the management or administration of the trust to determine its residency. This factor may also be combined with others, such as the residency of the grantor and the residency of the trustee.

While a trust drawn up in one state is valid in any other state, state laws vary considerably in other aspects. Some of these may indicate that a change to the trust provisions is in order if the trust's original intent is to be protected.

Income required to be distributed currently is income that is required under the terms of the governing instrument and applicable local law to be distributed in the year it is received.

Tax Forms. The two tax forms for trusts are Form 1041 and K-1. Form 1041 is similar to Form 1040. On this form, the trust deducts from its taxable income any interest it distributes to beneficiaries.

For example, some states will look to the residency of the grantor or settlor at the time that the trust was created to determine whether the trust is a resident trust. Other states will look to the location of the fiduciary and administration of the trust to determine residency.

Jurisdiction focuses on which state and which court have the power to make decisions about a particular person's rights and responsibilities. When it comes to a litigated trust matter, the superior court in the state where the ?principal place of administration? is located would have jurisdiction.