Iowa Exhibit C Accounting Procedure Joint Operations refers to a set of guidelines and protocols followed in the accounting and financial management of joint operations in the state of Iowa. These procedures are specifically designed to ensure accurate recording, reporting, and transparency of financial transactions related to joint ventures in various industries. By adhering to these accounting procedures, companies engaged in joint operations can maintain a comprehensive and organized record-keeping system, minimize financial discrepancies, and enhance decision-making processes. Keywords: Iowa, Exhibit C, accounting procedure, joint operations, financial management, guidelines, protocols, accurate recording, reporting, transparency, financial transactions, joint ventures, industries, comprehensive, organized record-keeping system, minimize financial discrepancies, decision-making processes. Different types of Iowa Exhibit C Accounting Procedure Joint Operations: 1. Oil and Gas Joint Operations: These accounting procedures are specifically tailored to the oil and gas industry, where multiple parties collaborate and share costs and revenues associated with exploration, extraction, and production operations. The procedures outline the methods to track expenditure, maintain production records, and calculate revenue distributions among the joint venture partners. 2. Real Estate Joint Operations: The accounting procedures related to real estate joint operations aim to manage the financial aspects of partnerships between developers, builders, and investors involved in construction projects or property development. These procedures include tracking construction costs, monitoring project milestones, and allocating profits or losses appropriately among the joint venture participants. 3. Manufacturing Joint Operations: For companies engaged in manufacturing collaborations, the accounting procedures detail the financial management techniques to account for shared manufacturing expenses, cost allocations for shared resources, and tracking inventory related to joint operations. These procedures ensure accurate cost determination and facilitate proper profit-sharing among the participating entities. 4. Technology Joint Operations: Accounting procedures specific to technology joint operations outline the methodologies for tracking research and development costs, licensing fees, intellectual property rights, and revenue sharing arrangements. These procedures help in reducing financial complexities and ensuring fair distribution of profits or losses among the joint venture partners in the technology sector. 5. Agricultural Joint Operations: Designed for partnerships in the agricultural sector, these accounting procedures encompass budgeting, tracking farm inputs, monitoring crop yields, and managing revenue distributions among the joint venture participants. They provide clarity on cost-sharing arrangements, production expenses, and returns on investment in joint farming activities. Overall, Iowa Exhibit C Accounting Procedure Joint Operations provide a structured framework for companies engaged in joint ventures across various sectors, ensuring transparency, accuracy, and effective financial management.

Iowa Exhibit C Accounting Procedure Joint Operations

Description

How to fill out Iowa Exhibit C Accounting Procedure Joint Operations?

Finding the right legal document design could be a have a problem. Naturally, there are tons of themes accessible on the Internet, but how will you discover the legal develop you need? Make use of the US Legal Forms website. The assistance provides 1000s of themes, such as the Iowa Exhibit C Accounting Procedure Joint Operations, that you can use for enterprise and personal requirements. All of the types are checked out by pros and meet state and federal requirements.

When you are currently listed, log in in your profile and click the Down load switch to have the Iowa Exhibit C Accounting Procedure Joint Operations. Make use of profile to appear with the legal types you might have bought formerly. Check out the My Forms tab of your profile and obtain yet another version of your document you need.

When you are a whole new user of US Legal Forms, listed below are easy guidelines that you can adhere to:

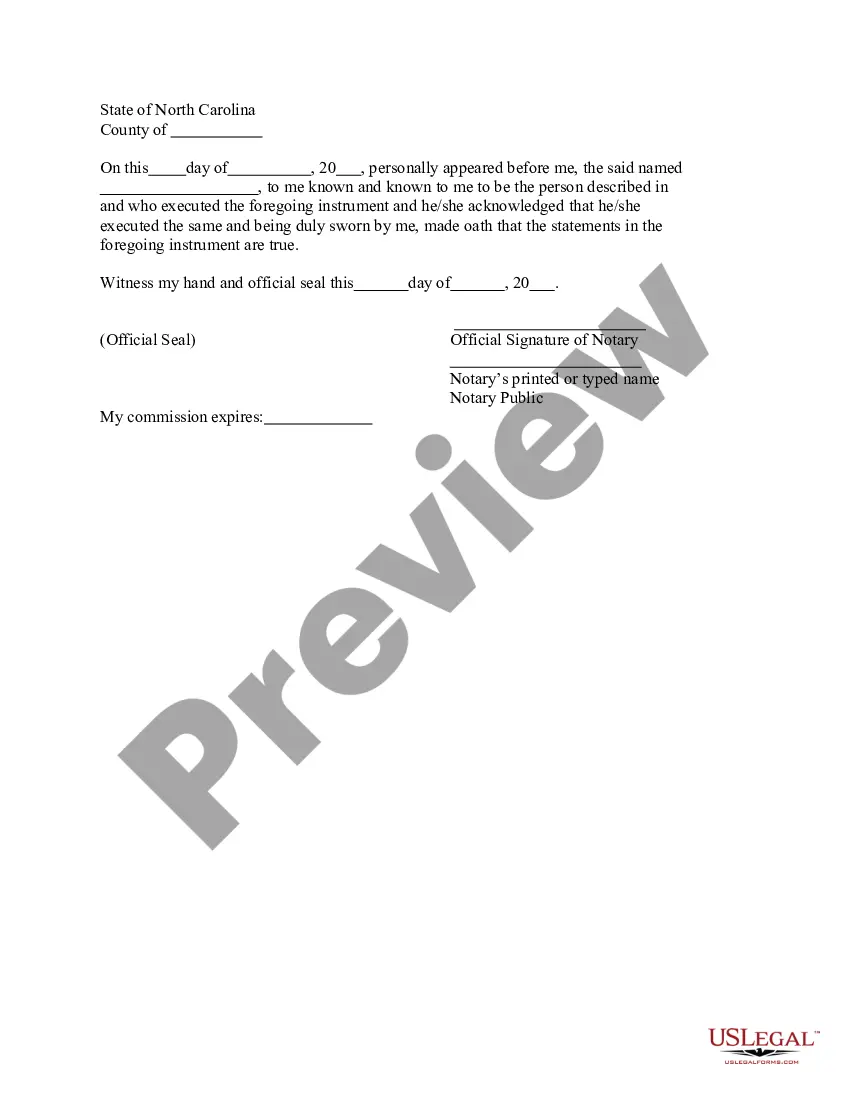

- Initially, ensure you have chosen the proper develop for your city/state. You are able to examine the form while using Review switch and study the form description to make certain this is basically the best for you.

- When the develop fails to meet your requirements, take advantage of the Seach industry to find the correct develop.

- Once you are certain that the form is acceptable, click the Buy now switch to have the develop.

- Opt for the rates strategy you need and enter the required information. Build your profile and pay money for the transaction using your PayPal profile or charge card.

- Select the document formatting and acquire the legal document design in your system.

- Full, edit and produce and indicator the obtained Iowa Exhibit C Accounting Procedure Joint Operations.

US Legal Forms is definitely the most significant collection of legal types that you can discover numerous document themes. Make use of the service to acquire professionally-created documents that adhere to state requirements.

Form popularity

FAQ

CAP is the predecessor of the Accounting Principles Board, itself a predecessor to the Financial Accounting Standards Board. Its formation and activities were early efforts to rationalize and legitimize the reporting of business performance. However, it is widely regarded as having failed. Committee on Accounting Procedure - Wikipedia Wikipedia ? wiki ? Committee_on_Acco... Wikipedia ? wiki ? Committee_on_Acco...

Individual assets, liabilities, revenue and expenses are to be included in the joint operator's financial statements as its assets, liabilities, revenue and expenses. In some cases, this will follow the legal form and in other cases, it will reflect other facts and circumstances.

The pronouncements that were issued by the Committee on Accounting Procedures were related to the issues faced in accounting and reporting by the organizations. This committee was established to set the standards related to accounting in the U.S.

The correct answer is option B) APB Opinions. The pronouncement issued by the Accounting Principles Board is called the APB Opinions. Which of the following pronouncements were issued by ... study.com ? explanation ? which-of-th... study.com ? explanation ? which-of-th...

Established in 1973, the Financial Accounting Standards Board (FASB) is the independent, private- sector, not-for-profit organization based in Norwalk, Connecticut, that establishes financial accounting and reporting standards for public and private companies and not-for-profit organizations that follow Generally ... About the FASB fasb.org ? facts fasb.org ? facts

In response to the SEC's Accounting Series Release No. 4, the American Institute of Accountants () reorganized its Committee on Accounting Procedure (CAP) in 1939 and increased it from 8 to 22 members, all accounting practitioners except for three academicians. The Richard C. Adkerson Gallery on the SEC Role in Accounting ... sechistorical.org ? museum ? galleries ? rca sechistorical.org ? museum ? galleries ? rca