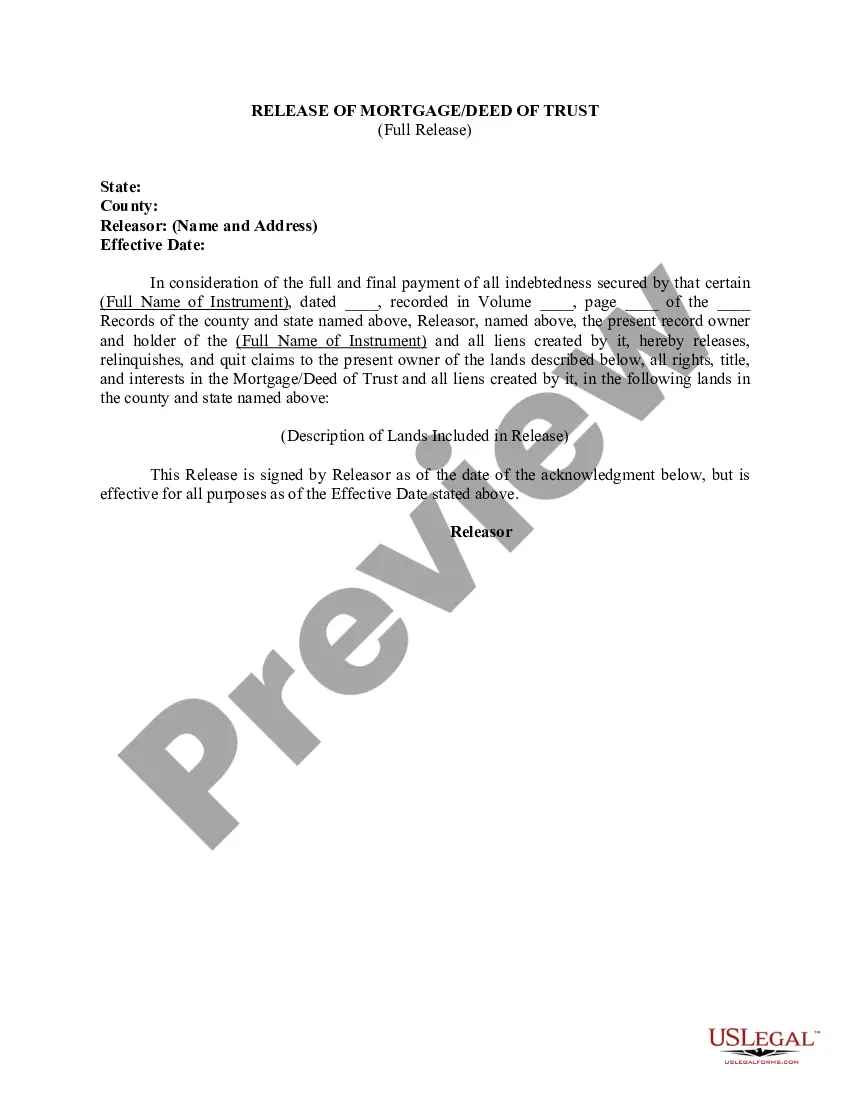

A Detailed Description of Iowa Release of Mortgage / Deed of Trust — Full Release In Iowa, the Release of Mortgage, also known as the Deed of Trust — Full Release, is a legal document that signifies the completion of a mortgage or deed of trust obligation. This document is crucial as it officially releases the lender's claim on the property, allowing the homeowner to have clear ownership rights. The Iowa Release of Mortgage / Deed of Trust — Full Release must be prepared carefully to ensure compliance with state laws, and it is recommended to consult with a real estate attorney or title company to guarantee accuracy and completeness. The document should include specific keywords that pertain to the transaction and protect both the lender and borrower's interests. Keywords commonly associated with the Iowa Release of Mortgage / Deed of Trust — Full Release include: 1. Release of Mortgage: This keyword emphasizes that the document releases the mortgage lien on the property, indicating that the borrower has fulfilled their financial obligations. 2. Deed of Trust — Full Release: This phrase signifies that the entire deed of trust, including any attached collateral or security, is being released and discharged. 3. Lender: Refers to the party who initially provided the loan or mortgage in exchange for a security interest in the property. The lender is releasing their claim on the property. 4. Borrower: Refers to the individual or entity who obtained the loan or mortgage and is obligated to repay the debt. The borrower is now being released from their financial burden. 5. Property Description: Details about the property, such as legal description, address, and any other necessary information, should be included to clearly identify the property being released. 6. Notary Public: This keyword highlights the importance of the document being notarized, indicating that it has been properly witnessed and the parties involved have provided valid identification. Different types of Iowa Release of Mortgage / Deed of Trust — Full Release might be categorized based on specific circumstances or document variations. For example: 1. Voluntary Release: This type of release occurs when the loan or mortgage has been fully paid off by the borrower, and the lender willingly releases their claim on the property. 2. Foreclosure Release: In cases where a foreclosure process has been initiated, this type of release reflects the lender's acknowledgment that the debt has been fully satisfied, either through payment or the sale of the property. 3. Partial Release: In situations where multiple properties are collateral for a loan or mortgage, a partial release is granted when one or more properties are released from the lien while others remain encumbered. 4. Release of Junior Lien: When there are multiple liens on a property, a release of junior lien occurs when a subordinate lien holder is willing to relinquish their claim on the property, often in exchange for partial or full payment. Remember, the usage of specific keywords may vary based on the circumstances and content requirements of the Iowa Release of Mortgage / Deed of Trust — Full Release document. It is essential to consult with legal professionals to ensure accuracy and compliance with Iowa laws.

Iowa Release of Mortgage / Deed of Trust - Full Release

Description

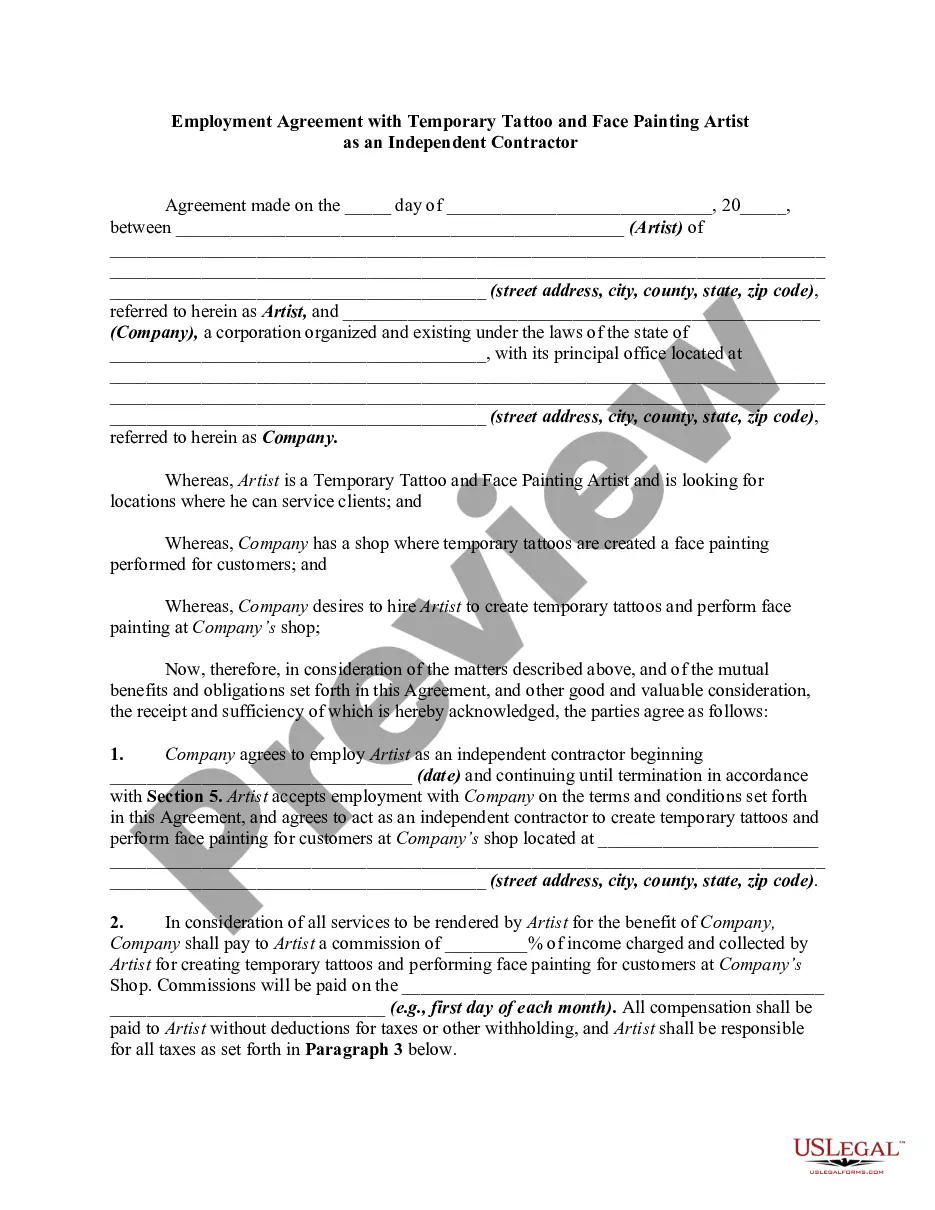

How to fill out Iowa Release Of Mortgage / Deed Of Trust - Full Release?

Finding the right legitimate record format can be quite a battle. Of course, there are tons of templates available on the net, but how would you find the legitimate kind you require? Take advantage of the US Legal Forms website. The services gives 1000s of templates, including the Iowa Release of Mortgage / Deed of Trust - Full Release, that you can use for enterprise and private needs. Every one of the kinds are examined by experts and satisfy federal and state demands.

If you are previously listed, log in for your profile and then click the Obtain button to obtain the Iowa Release of Mortgage / Deed of Trust - Full Release. Make use of profile to appear with the legitimate kinds you might have ordered formerly. Check out the My Forms tab of your respective profile and have yet another version of your record you require.

If you are a whole new customer of US Legal Forms, listed here are easy guidelines that you should adhere to:

- Very first, ensure you have chosen the proper kind for your personal town/area. It is possible to check out the form using the Review button and study the form description to make certain this is the best for you.

- In case the kind fails to satisfy your needs, take advantage of the Seach industry to obtain the correct kind.

- Once you are sure that the form is proper, go through the Acquire now button to obtain the kind.

- Choose the costs strategy you need and type in the necessary info. Design your profile and pay for the order making use of your PayPal profile or charge card.

- Select the document formatting and down load the legitimate record format for your gadget.

- Full, edit and print out and indicator the attained Iowa Release of Mortgage / Deed of Trust - Full Release.

US Legal Forms is definitely the most significant collection of legitimate kinds in which you will find various record templates. Take advantage of the company to down load professionally-made paperwork that adhere to status demands.

Form popularity

FAQ

A release of mortgage, commonly known as a discharge of mortgage, is a legal document issued by the lender acknowledging that the mortgage debt is settled. It effectively releases the property from the lien, allowing homeowners clear ownership.

589.31 City and county deeds. The deeds and conveyances are legalized and valid as if the record showed that the law had been complied with, and that the conveyances and deeding had been duly authorized by the governing body of the city or county.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

6. Any person who commits a trespass as defined in section 716.7, subsection 2, paragraph ?a?, subparagraph (6), commits a class ?D? felony. 7. Any person who commits a trespass as defined in section 716.7, subsection 2, paragraph ?a?, subparagraph (7), commits a serious misdemeanor.

Iowa Code 318.3 prohibits physical changes to right-of-way without a permit. Unauthorized spraying is an example of a physical change. For more information, contact our office at 319-892-6400.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.