An Iowa General Power of Attorney with No Durability Provision — Short Form is a legal document that grants someone, known as the agent or attorney-in-fact, the authority to make financial and legal decisions on behalf of another person, known as the principal. This type of power of attorney does not remain effective if the principal becomes incapacitated or mentally incompetent. The Iowa General Power of Attorney with No Durability Provision — Short Form is a simplified version of a power of attorney, specifically designed for individuals who are seeking a quick and straightforward way to grant limited powers to their chosen agent. This document allows the agent to perform certain tasks and make specific decisions on behalf of the principal, such as managing bank accounts, paying bills, or entering into legal contracts. However, it is important to note that there may be various versions or variations of Iowa General Power of Attorney with No Durability Provision — Short Form, each with its own distinctive features. Some possible variations could include: 1. Limited Power of Attorney: This version restricts the agent's authority to specific tasks or decisions defined within the document. For example, the principal may limit the power to only handle real estate transactions or manage investments. 2. Springing Power of Attorney: This type of power of attorney becomes effective only when a specified event or condition occurs, usually the incapacity of the principal. Until that triggering event takes place, the agent has no authority to act on behalf of the principal. 3. Statutory Power of Attorney: Iowa state law provides specific forms for power of attorney, including short forms with no durability provision. These forms are designed to comply with legal requirements and offer clear instructions for granting powers to an agent. When creating an Iowa General Power of Attorney with No Durability Provision — Short Form, it is recommended to consult with a qualified attorney to ensure the document aligns with individual circumstances and accurately reflects the principal's wishes. Additionally, it's crucial to select a trustworthy and reliable agent, as they will have the authority to act on the principal's behalf and make important financial and legal decisions.

Iowa General Power of Attorney with No Durability Provision - Short Form

Description

How to fill out Iowa General Power Of Attorney With No Durability Provision - Short Form?

Are you in the situation the place you need to have documents for sometimes enterprise or individual purposes almost every working day? There are a lot of authorized papers layouts available on the net, but discovering types you can rely on isn`t simple. US Legal Forms delivers a huge number of kind layouts, such as the Iowa General Power of Attorney with No Durability Provision - Short Form, which are created to meet federal and state requirements.

When you are already acquainted with US Legal Forms internet site and also have your account, just log in. Afterward, you can down load the Iowa General Power of Attorney with No Durability Provision - Short Form template.

If you do not come with an profile and want to start using US Legal Forms, adopt these measures:

- Find the kind you will need and ensure it is for that appropriate town/region.

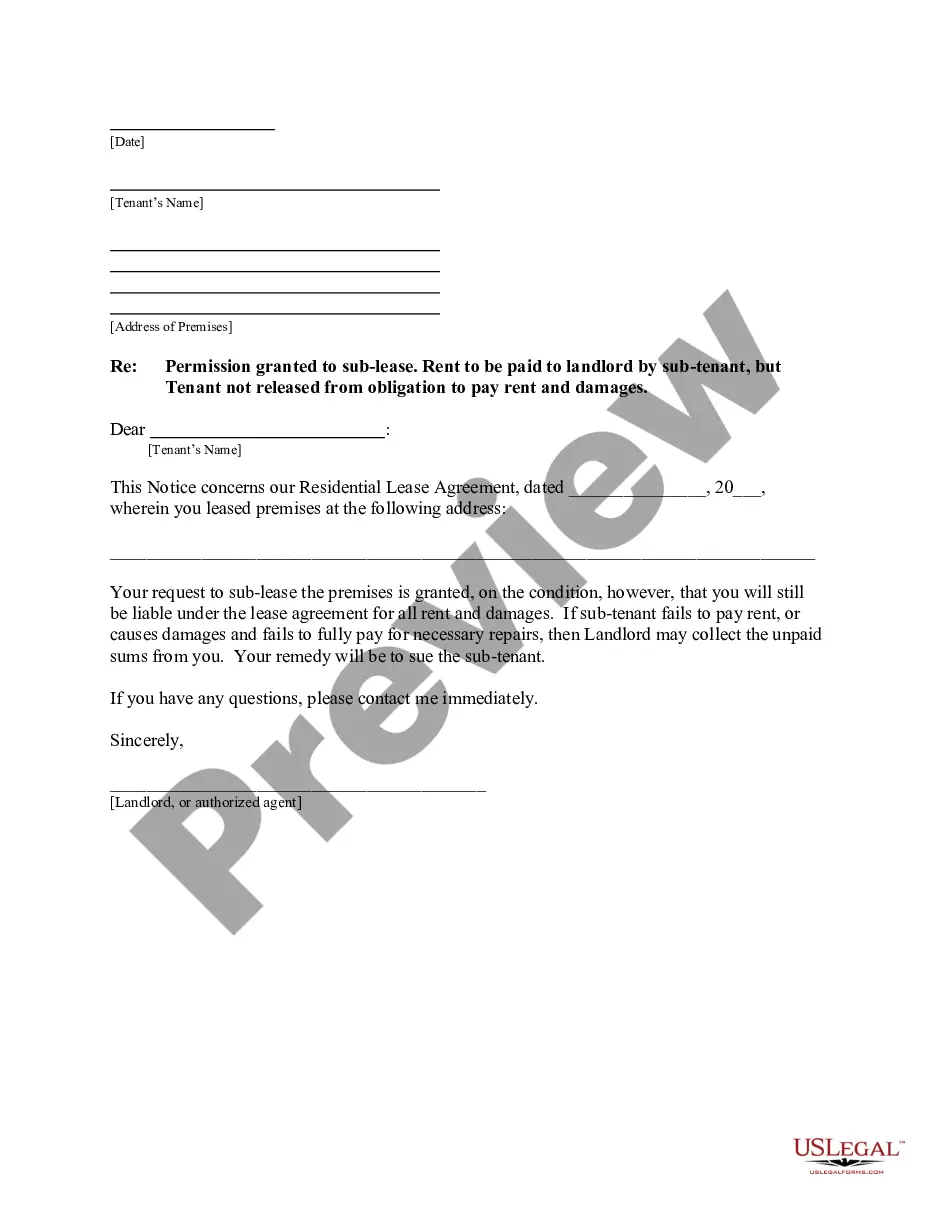

- Make use of the Review button to check the shape.

- Look at the explanation to ensure that you have chosen the correct kind.

- In case the kind isn`t what you are trying to find, make use of the Look for area to discover the kind that meets your requirements and requirements.

- Whenever you get the appropriate kind, click on Acquire now.

- Opt for the pricing strategy you want, complete the specified information and facts to produce your money, and pay for the transaction utilizing your PayPal or charge card.

- Pick a convenient paper format and down load your duplicate.

Discover each of the papers layouts you have bought in the My Forms food selection. You can obtain a more duplicate of Iowa General Power of Attorney with No Durability Provision - Short Form any time, if required. Just select the essential kind to down load or print the papers template.

Use US Legal Forms, by far the most comprehensive assortment of authorized varieties, to conserve time as well as prevent blunders. The assistance delivers expertly produced authorized papers layouts which can be used for a selection of purposes. Create your account on US Legal Forms and begin generating your way of life easier.