Iowa Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner

Description

How to fill out Bonus Receipt, Lease Ratification, And Rental Division Order By Mineral Owner?

Have you been in a position that you require paperwork for possibly company or person functions virtually every time? There are a lot of authorized file themes available online, but discovering types you can depend on is not effortless. US Legal Forms delivers thousands of type themes, like the Iowa Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner, which are composed to satisfy federal and state demands.

If you are presently informed about US Legal Forms web site and have a merchant account, just log in. Afterward, it is possible to down load the Iowa Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner design.

Unless you have an bank account and would like to begin using US Legal Forms, abide by these steps:

- Get the type you require and ensure it is to the appropriate city/region.

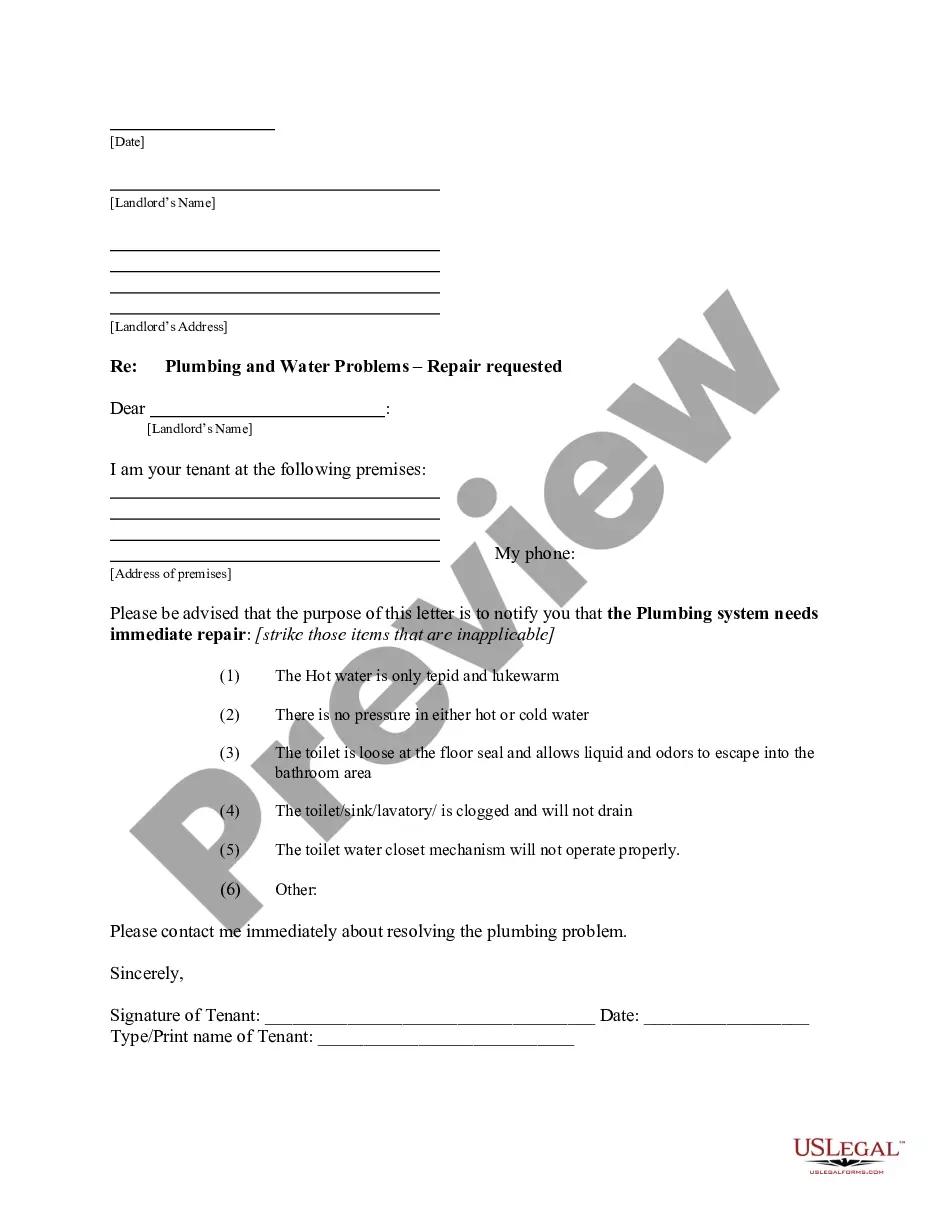

- Use the Preview key to analyze the form.

- Browse the information to actually have selected the appropriate type.

- When the type is not what you`re seeking, make use of the Research field to discover the type that meets your requirements and demands.

- If you obtain the appropriate type, click on Purchase now.

- Opt for the prices prepare you desire, complete the required information to generate your account, and pay for the order using your PayPal or charge card.

- Decide on a handy file formatting and down load your backup.

Find every one of the file themes you possess bought in the My Forms food selection. You may get a extra backup of Iowa Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner whenever, if required. Just click the essential type to down load or print out the file design.

Use US Legal Forms, one of the most considerable collection of authorized kinds, to save lots of efforts and prevent faults. The assistance delivers professionally made authorized file themes that you can use for an array of functions. Produce a merchant account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

A ratification of an existing Texas oil and gas lease usually executed by a non-participating royalty interest owner or a non-executive mineral interest owner. It can be used for transactions involving business entities or private individuals.

A mineral lease is a contract between a mineral owner (the lessor) and a company or working interest owner (the lessee) in which the lessor grants the lessee the right to explore, drill, and produce oil, gas, and other minerals for a specified period of time.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

: a deed by which a landowner authorizes exploration for and production of oil and gas on his land usually in consideration of a royalty.