Iowa Assignment of After Payout Interest is a legal document used in Iowa to transfer or assign the interest earned from a loan or investment after the payment has been made. This agreement is crucial in ensuring the rightful ownership and transfer of financial gains to the assigned party. In Iowa, there are two main types of Assignment of After Payout Interest: 1. Absolute Assignment of After Payout Interest: This type of assignment involves a complete transfer of the after-payout interest to the assignee. The assignee becomes the new owner of the interest and has full rights to receive and control the funds generated from the original investment or loan. This type of assignment is often used in situations where the assignor wants to permanently transfer their interest and relinquish any rights associated with it. 2. Security Assignment of After Payout Interest: In this type of assignment, the assignee is granted a security interest in the after-payout interest, rather than full ownership. The assignor retains the ownership of the interest but pledges it as collateral to secure a loan or debt. If the assignor defaults on the loan, the assignee has the right to collect the after-payout interest to repay the debt owed to them. This type of assignment is commonly utilized in lending and financing agreements. The Iowa Assignment of After Payout Interest document typically includes the following key provisions: 1. Identification of the parties involved: The assignor (current owner of the after-payout interest) and the assignee (the party to whom the interest is being transferred) are clearly identified in the document. 2. Description of the assignment: The document specifies whether it is an absolute assignment or a security assignment, outlining the nature and extent of the transfer of interest. 3. Terms and conditions: The agreement includes the terms under which the assignment is made, such as the effective date, duration, and any restrictions or conditions attached to the assignment. 4. Representations and warranties: Both parties may provide certain assurances regarding their authority, ownership, and the absence of any third-party claims or liens on the after-payout interest. 5. Governing law and jurisdiction: The document states that the assignment is governed by the laws of Iowa and specifies the appropriate jurisdiction for resolving any disputes or claims arising from the agreement. The Iowa Assignment of After Payout Interest is a crucial legal document that safeguards the rights and interests of both parties involved in the transfer of after-payout interest. Whether it's an absolute assignment or a security assignment, this agreement ensures transparency and legal validity in the assignment process, providing a clear framework for the transfer of financial gains.

Iowa Assignment of After Payout Interest

Description

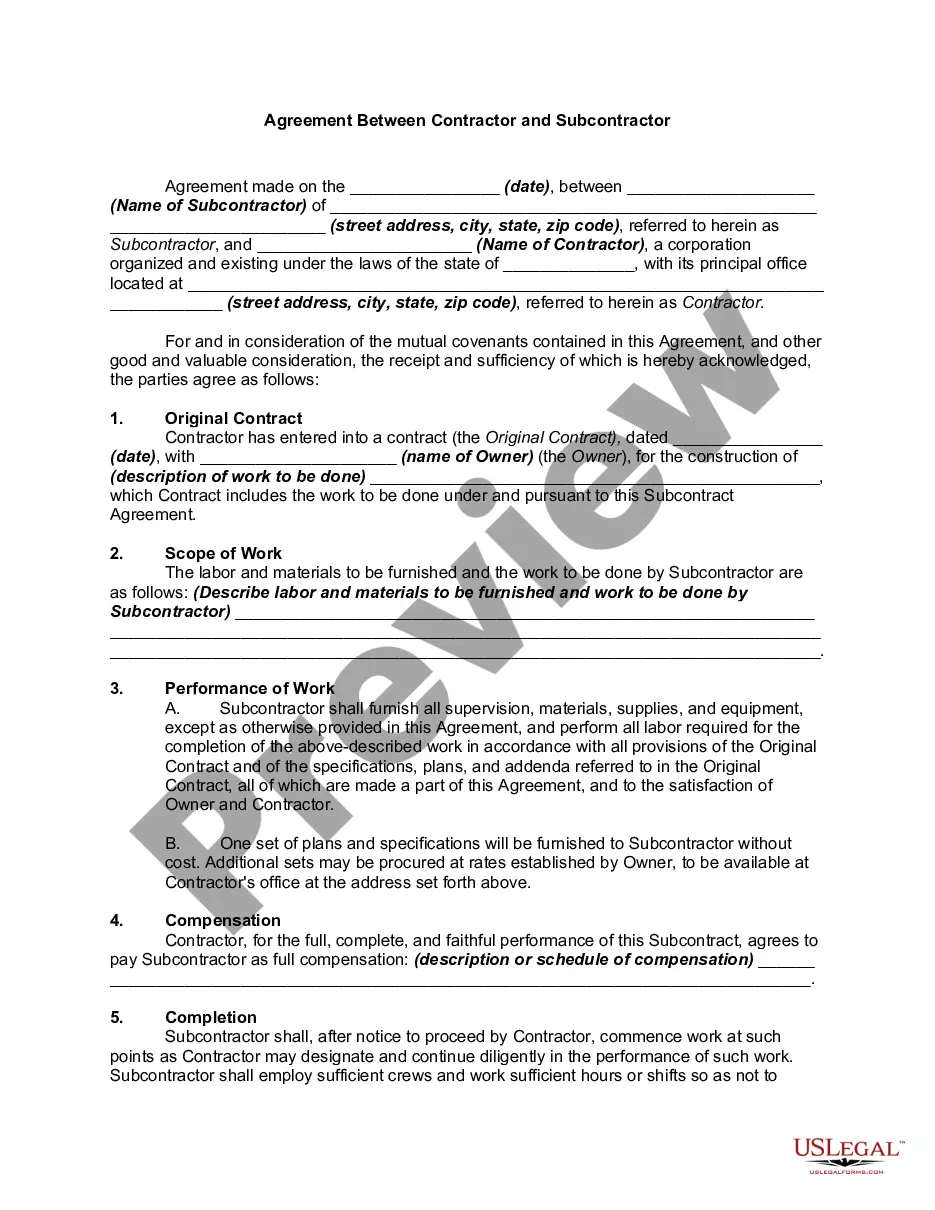

How to fill out Iowa Assignment Of After Payout Interest?

It is possible to invest hours online attempting to find the legal record design which fits the federal and state requirements you will need. US Legal Forms supplies thousands of legal kinds that happen to be analyzed by experts. You can actually down load or produce the Iowa Assignment of After Payout Interest from your services.

If you currently have a US Legal Forms account, you are able to log in and click the Download option. Next, you are able to comprehensive, modify, produce, or signal the Iowa Assignment of After Payout Interest. Every legal record design you get is your own property forever. To get yet another backup of the bought form, check out the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website the first time, follow the basic directions under:

- Very first, make certain you have selected the best record design to the region/city of your choice. Browse the form outline to ensure you have selected the proper form. If available, use the Review option to search with the record design as well.

- If you want to discover yet another variation in the form, use the Search discipline to find the design that fits your needs and requirements.

- Upon having found the design you want, just click Get now to move forward.

- Choose the prices program you want, key in your credentials, and register for your account on US Legal Forms.

- Complete the deal. You may use your Visa or Mastercard or PayPal account to purchase the legal form.

- Choose the formatting in the record and down load it to your device.

- Make modifications to your record if needed. It is possible to comprehensive, modify and signal and produce Iowa Assignment of After Payout Interest.

Download and produce thousands of record layouts using the US Legal Forms website, that offers the largest assortment of legal kinds. Use skilled and status-certain layouts to take on your company or individual demands.