Iowa Assignment of Promissory Note & Liens: A Comprehensive Overview In Iowa, an Assignment of Promissory Note & Liens refers to a legal document that transfers the rights and interest in a promissory note or a lien from one party to another. This assignment plays a crucial role in facilitating the transfer of debt obligations or ownership of a property secured by a lien. In this article, we will delve into the details of Iowa Assignment of Promissory Note & Liens, exploring its types and importance. Types of Iowa Assignment of Promissory Note & Liens: 1. Assignment of Promissory Note: This type of assignment involves the transfer of the rights, title, and interest in a promissory note from the original lender (assignor) to a new lender or investor (assignee). By executing this assignment, the lender assigns all its rights to collect the debt, including principal and interest payments, to the assignee. 2. Assignment of Lien: When a lien is assigned, it means that the claim or over a property as security for the repayment of a debt is transferred from the original lien holder to a new party. This assignment ensures that the new party will have the authority to enforce the lien, foreclose on the property, or take other legal actions if the debtor fails to fulfill their obligations. Importance of Iowa Assignment of Promissory Note & Liens: 1. Debt Transfer: Assigning a promissory note allows the assignor to transfer the debt to a new lender or investor. This is often seen in cases where the original lender wants to sell or transfer the debt to another party, thereby obtaining immediate cash or reducing their risk exposure. 2. Secured Debt Transfer: With an assignment of lien, a creditor can transfer their claim on a property's value as collateral to another party. This facilitates the sale or transfer of ownership of the property while ensuring that the new party acquires the rights to the lien and can enforce it if necessary. 3. Loan Modification: An assignment of promissory note & liens can also be used to modify the terms of a loan. By assigning the note to a new lender, parties involved can negotiate new terms, such as interest rate adjustments, repayment schedules, or loan extensions. This can be beneficial for both the borrower and lender, allowing for more favorable loan conditions. 4. Legal Protection: Assignments of promissory note & liens have legal significance as they document the transfer of rights and obligations. By executing a proper assignment, parties involved can protect their interests and ensure that the transfer is legally recognized, reducing the potential for disputes or challenges in the future. In conclusion, the Iowa Assignment of Promissory Note & Liens involves the transfer of rights and interest in a promissory note or a lien from one party to another. This assignment holds various types, including assignment of promissory note and assignment of lien. Whether it is for debt transfer, securing collateral, loan modifications, or legal protection, the Iowa Assignment of Promissory Note & Liens plays a vital role in facilitating the smooth transfer of debt obligations and ownership rights in Iowa's legal landscape.

Iowa Assignment of Promissory Note & Liens

Description

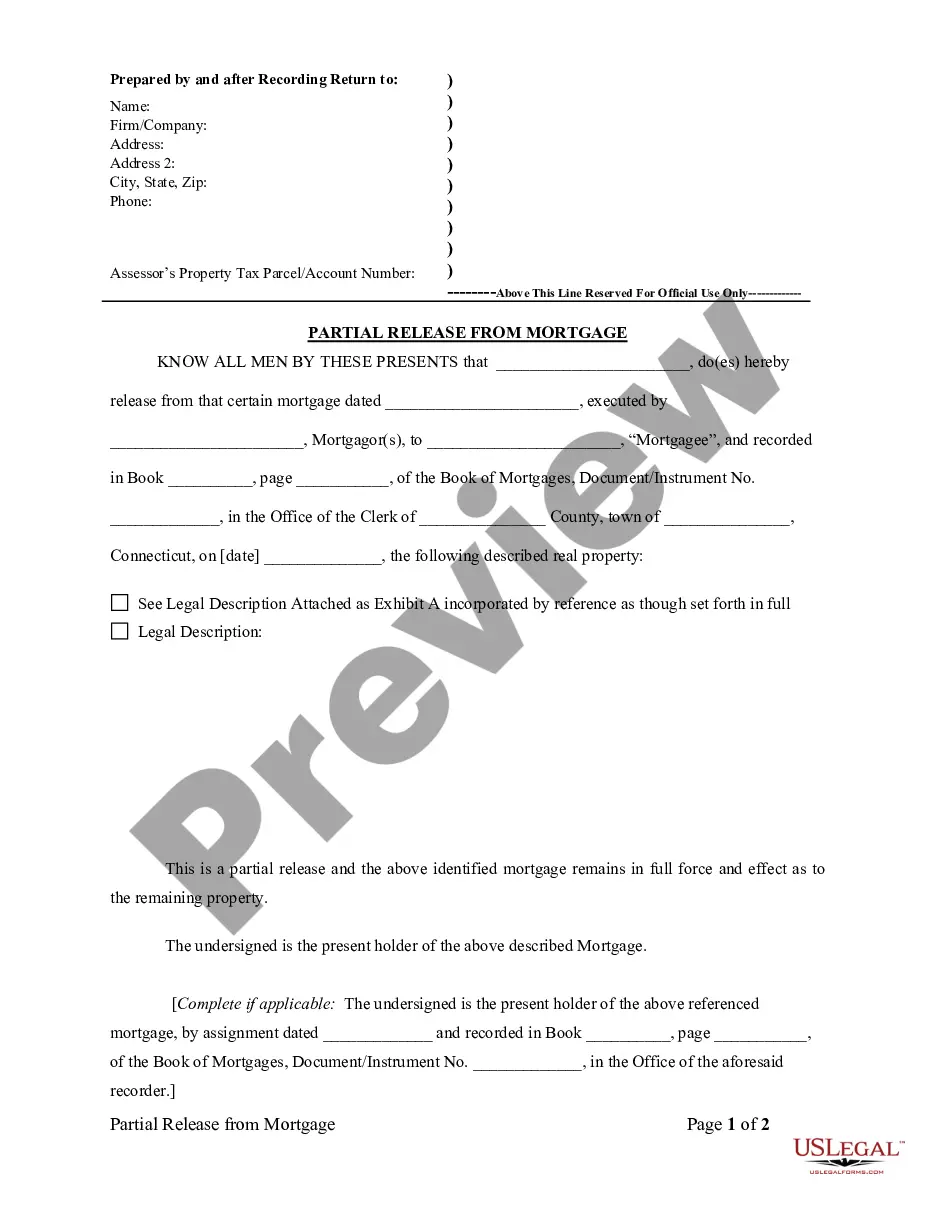

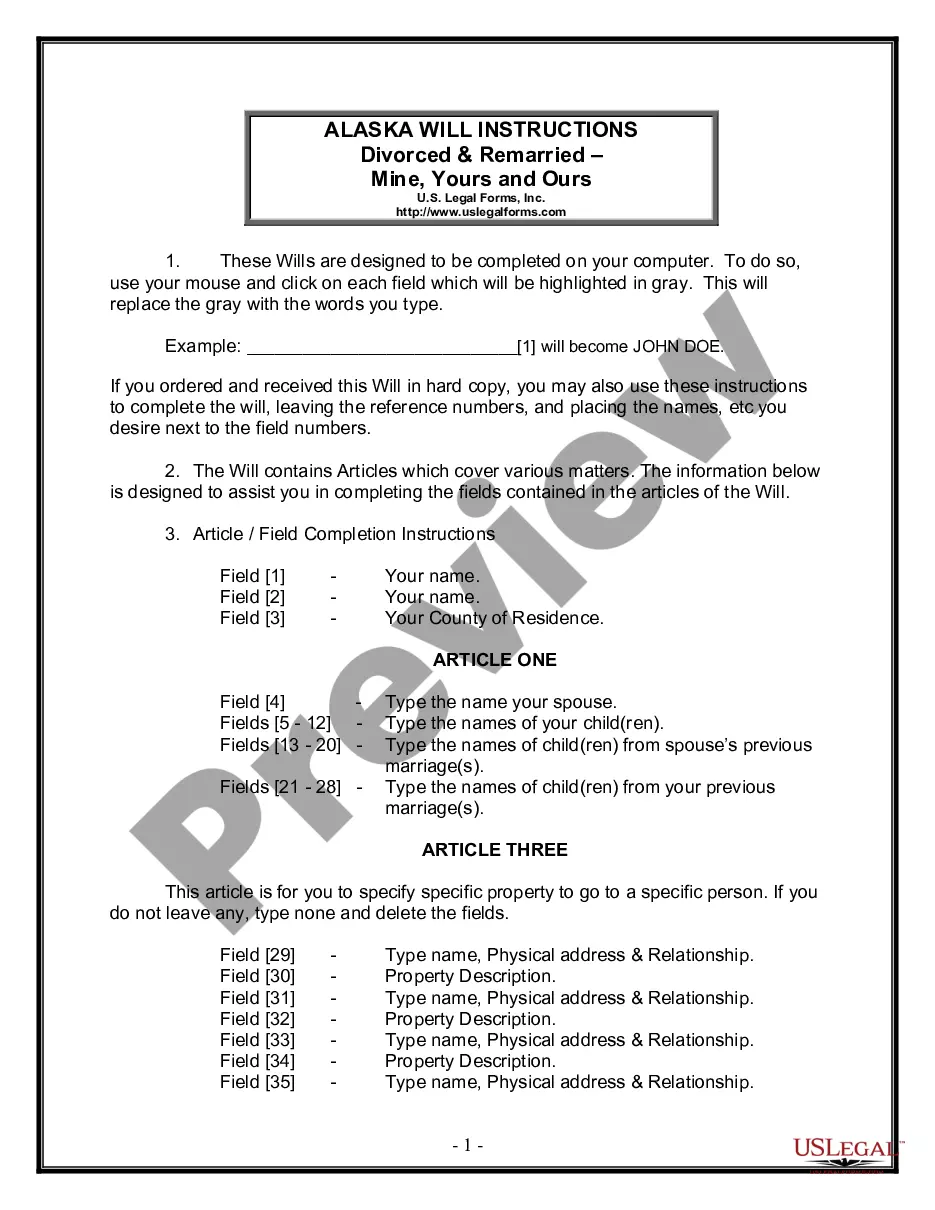

How to fill out Iowa Assignment Of Promissory Note & Liens?

You may devote time online looking for the authorized document design that suits the state and federal requirements you will need. US Legal Forms gives thousands of authorized types which are analyzed by professionals. It is possible to obtain or print out the Iowa Assignment of Promissory Note & Liens from our assistance.

If you already possess a US Legal Forms account, you may log in and click the Acquire option. Following that, you may total, edit, print out, or indication the Iowa Assignment of Promissory Note & Liens. Every authorized document design you acquire is yours eternally. To get one more duplicate of any purchased develop, proceed to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms web site for the first time, adhere to the straightforward guidelines beneath:

- Very first, be sure that you have selected the correct document design for that county/area that you pick. Read the develop description to ensure you have selected the proper develop. If readily available, make use of the Review option to look from the document design at the same time.

- In order to get one more variation of the develop, make use of the Search industry to obtain the design that meets your needs and requirements.

- Once you have located the design you desire, click on Acquire now to carry on.

- Pick the costs prepare you desire, key in your references, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the authorized develop.

- Pick the formatting of the document and obtain it to the system.

- Make adjustments to the document if needed. You may total, edit and indication and print out Iowa Assignment of Promissory Note & Liens.

Acquire and print out thousands of document templates utilizing the US Legal Forms site, which offers the most important variety of authorized types. Use expert and express-specific templates to take on your small business or person demands.

Form popularity

FAQ

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

In ance with the common law ?best evidence rule,? a party seeking to prove the disputed contents of the promissory note, such as the amount owed on said note, must produce the original document because it is the ?best evidence? of the terms of the note itself.

Promissory notes are legally binding contracts that can hold up in court if the terms of borrowing and repayment are signed and follow applicable laws.

Losing the original note or a copy The original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Written contracts (personal loans, mortgages, car loans): 10 years. Oral agreements: 5 years. Promissory notes: 5 years. Open accounts (credit card debt, department store accounts, or any revolving credit): 5 years.