This office lease is subject and subordinate to all ground or underlying leases and to all mortgages which may affect the lease or the real property of which demised premises are a part and to all renewals, modifications, consolidations, replacements and extensions of any such underlying leases and mortgages. This clause shall be self-operative.

Iowa Subordination Provision

Description

How to fill out Subordination Provision?

If you need to full, down load, or printing legitimate papers templates, use US Legal Forms, the largest variety of legitimate types, that can be found on the Internet. Take advantage of the site`s basic and practical search to obtain the files you require. A variety of templates for company and individual reasons are sorted by classes and suggests, or keywords. Use US Legal Forms to obtain the Iowa Subordination Provision in just a couple of clicks.

If you are already a US Legal Forms client, log in to the account and then click the Obtain switch to obtain the Iowa Subordination Provision. You can also accessibility types you in the past saved from the My Forms tab of your account.

If you work with US Legal Forms the first time, refer to the instructions listed below:

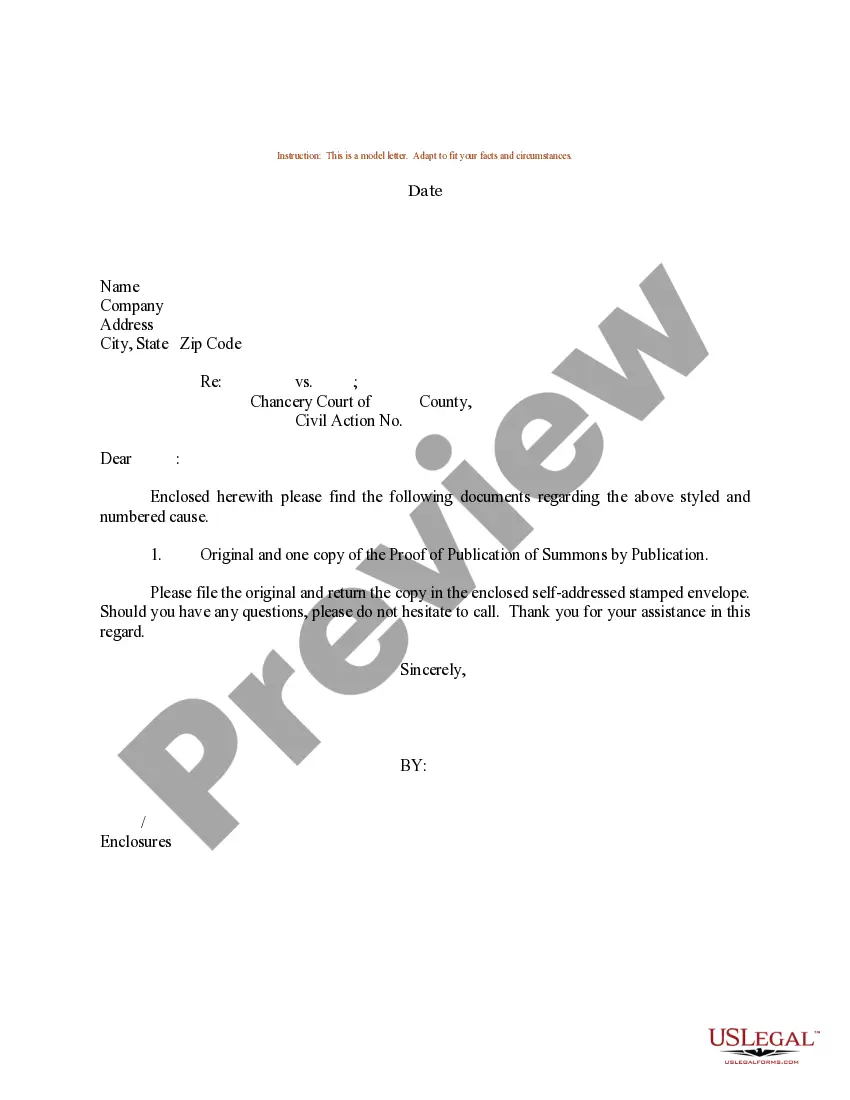

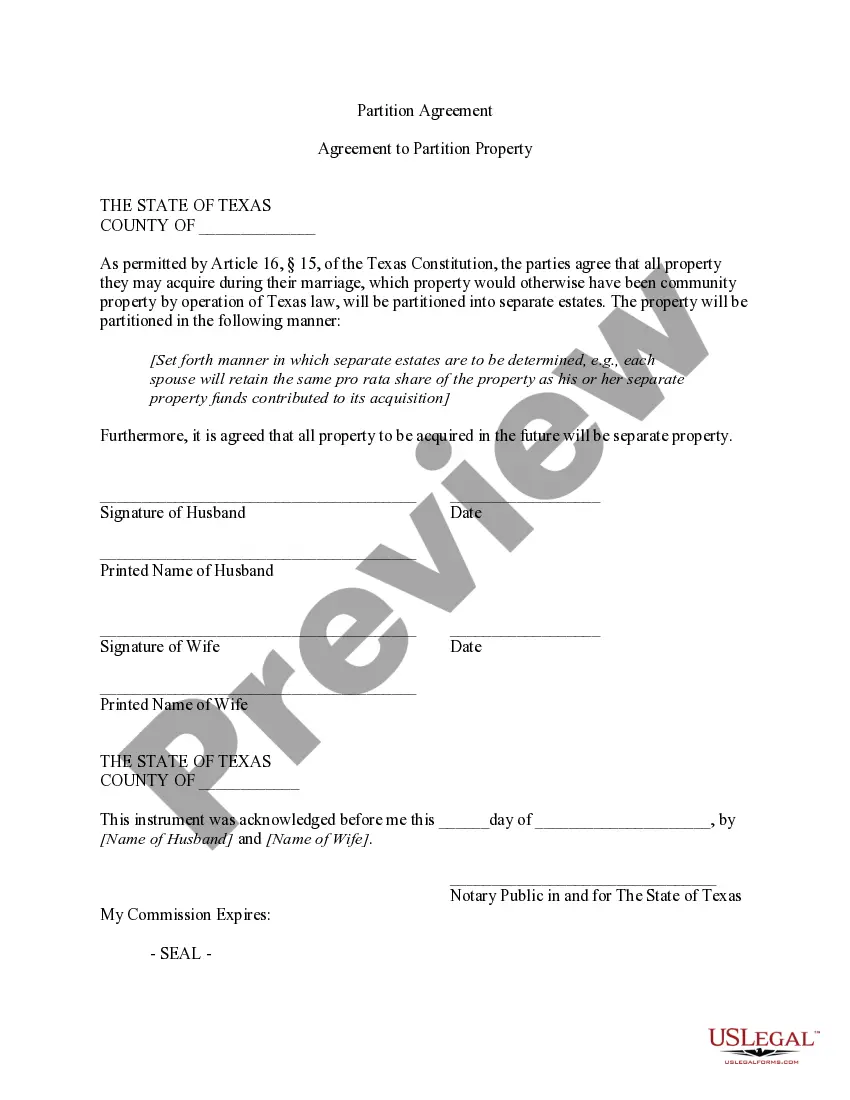

- Step 1. Make sure you have selected the form for the proper city/nation.

- Step 2. Utilize the Preview solution to look over the form`s information. Don`t neglect to see the information.

- Step 3. If you are unsatisfied with all the develop, utilize the Look for discipline near the top of the monitor to discover other versions from the legitimate develop format.

- Step 4. Upon having located the form you require, go through the Purchase now switch. Select the pricing strategy you favor and put your accreditations to register for the account.

- Step 5. Approach the transaction. You should use your credit card or PayPal account to complete the transaction.

- Step 6. Pick the structure from the legitimate develop and down load it in your product.

- Step 7. Complete, edit and printing or sign the Iowa Subordination Provision.

Each legitimate papers format you buy is yours for a long time. You might have acces to each develop you saved within your acccount. Select the My Forms portion and pick a develop to printing or down load again.

Remain competitive and down load, and printing the Iowa Subordination Provision with US Legal Forms. There are millions of skilled and condition-distinct types you may use for your company or individual needs.

Form popularity

FAQ

558.70 Contract disclosure statement required for certain residential real estate installment sales.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

558.31 Proof of execution and delivery in lieu of acknowledgment.

1. The provision of rule of evidence 5.412 involving a victim of sexual abuse shall apply to discovery conducted in a criminal case or in a postconviction relief proceeding under chapter 822 including but not limited to depositions.

Failure to record a conveyance or lease of agricultural land required to be recorded by this section by the grantee or lessee within the specified time limit is punishable by a fine not to exceed one hundred dollars per day for each day of violation.