Iowa Clauses Relating to Preferred Returns

Description

How to fill out Clauses Relating To Preferred Returns?

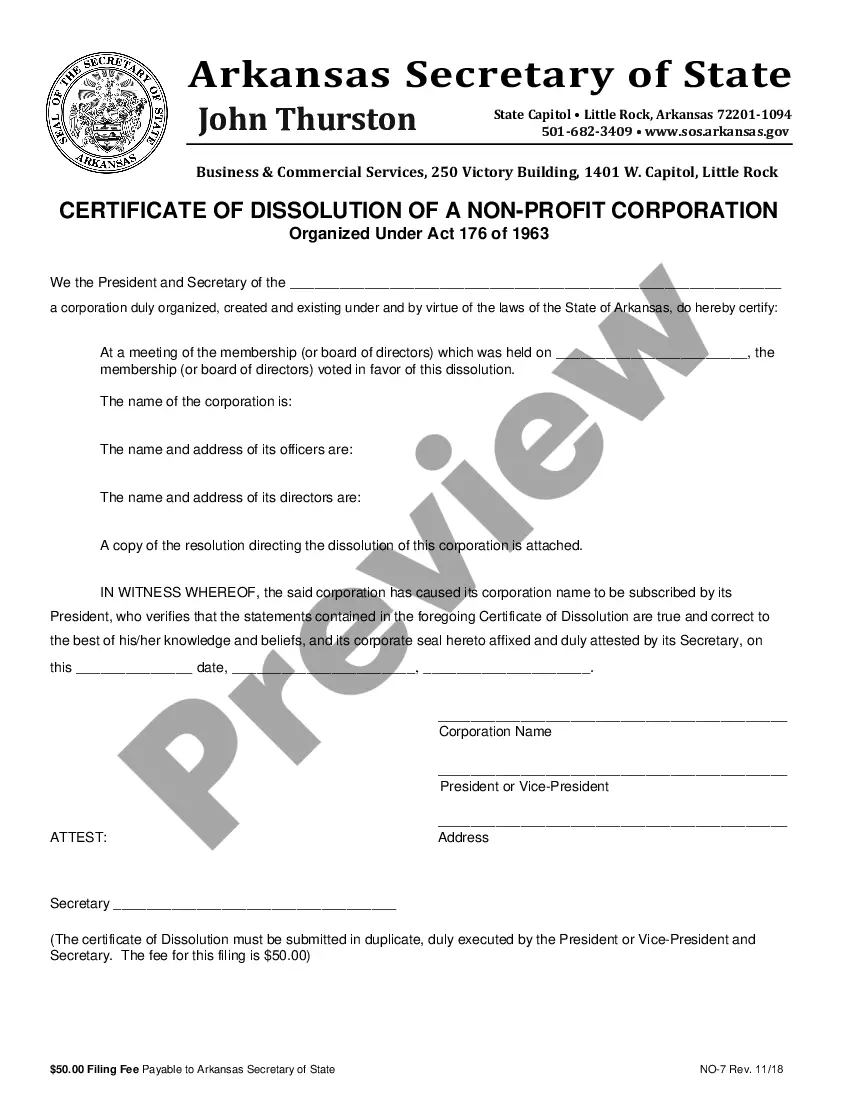

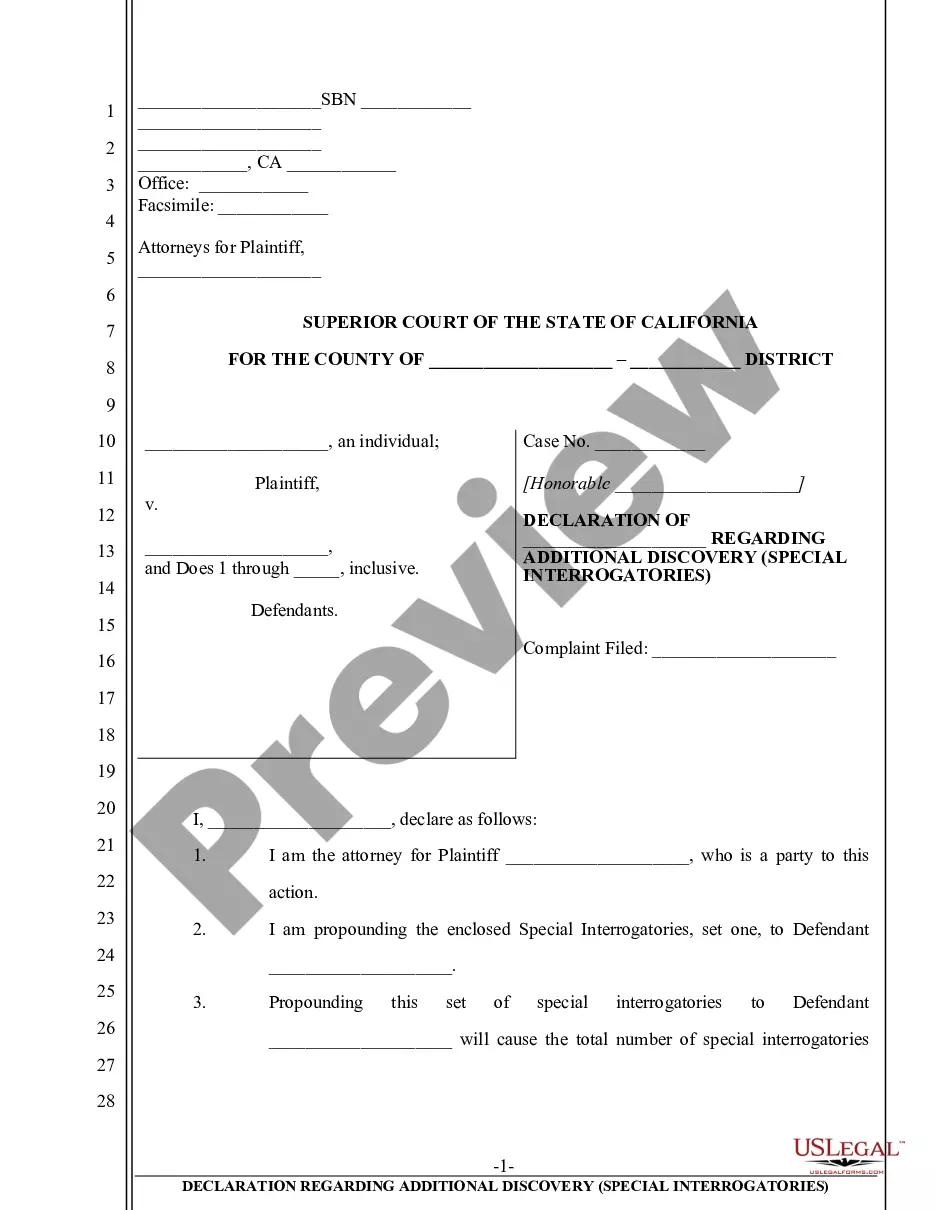

Discovering the right lawful document web template could be a have difficulties. Naturally, there are a variety of layouts accessible on the Internet, but how can you find the lawful form you require? Utilize the US Legal Forms web site. The support gives thousands of layouts, such as the Iowa Clauses Relating to Preferred Returns, that you can use for business and private demands. Each of the kinds are checked out by specialists and meet federal and state needs.

Should you be previously registered, log in for your accounts and then click the Down load option to find the Iowa Clauses Relating to Preferred Returns. Make use of accounts to search from the lawful kinds you have ordered in the past. Visit the My Forms tab of your respective accounts and obtain an additional duplicate of your document you require.

Should you be a whole new end user of US Legal Forms, allow me to share straightforward directions for you to follow:

- Initially, make sure you have selected the correct form to your city/area. You can look through the shape utilizing the Preview option and study the shape explanation to make certain it will be the best for you.

- In case the form does not meet your preferences, make use of the Seach discipline to obtain the correct form.

- Once you are certain that the shape would work, go through the Purchase now option to find the form.

- Choose the prices prepare you need and type in the necessary details. Make your accounts and pay money for an order using your PayPal accounts or credit card.

- Select the data file file format and acquire the lawful document web template for your product.

- Full, modify and print out and signal the obtained Iowa Clauses Relating to Preferred Returns.

US Legal Forms is the greatest library of lawful kinds where you can find a variety of document layouts. Utilize the service to acquire skillfully-made files that follow state needs.

Form popularity

FAQ

Access the digital replica of USA TODAY and more than 200 local newspapers with your subscription. Here's how the rates will change: 2023: The top rate will lower to 6%, giving a tax cut to Iowans making $75,000 or more. 2024: The top rate will lower to 5.7%, giving a tax cut to Iowans making $30,000 or more.

Who is Required to File? Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers. Part-year residents (for the part of the year they resided in Iowa)

By: Robin Opsahl - March 15, 2023 pm. The Senate Ways and Means committee advanced legislation Wednesday to reduce and eventually eliminate Iowa's income tax. Changes to Iowa's income tax rates are already underway through laws signed in 2018 and 2022, moving to a single rate of 3.9% by 2026.

Standard deduction increase: For tax year 2023, the standard deduction increased to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: Income tax brackets went up in 2023 to account for inflation.

Looking to the new year, the 2023 IRS standard deduction for seniors is $13,850 for those filing single or married filing separately, $27,700 for qualifying widows or married filing jointly, and $20,800 for a head of household.

Year-End Gift and Estate Tax Planning: Gift/Estate Tax Exemption: Starting in 2023, each U.S. citizen can take advantage of a lifetime exemption of $12.92 million to protect transfers from estate and gift tax. The tax rate for these transfers is 40%. For married couples, the exemption is doubled to $25.84 million.

511.8 Investment of funds. A company organized under chapter 508 shall, at all times, have invested in the securities provided in this section, funds equivalent to its legal reserve. Legal reserve is the net present value of all outstanding policies and contracts involving life contingencies.

2023: The top rate will lower to 6%, giving a tax cut to Iowans making $75,000 or more. 2024: The top rate will lower to 5.7%, giving a tax cut to Iowans making $30,000 or more. 2025: The top rate will lower to 4.82%, giving a tax cut to those making $6,000 or more.