Iowa Clauses Relating to Venture Interests

Description

How to fill out Clauses Relating To Venture Interests?

Choosing the right lawful document design can be a have a problem. Naturally, there are a lot of themes accessible on the Internet, but how would you obtain the lawful develop you want? Make use of the US Legal Forms website. The services provides thousands of themes, such as the Iowa Clauses Relating to Venture Interests, which can be used for business and private demands. Each of the kinds are inspected by specialists and fulfill federal and state requirements.

Should you be currently registered, log in to your account and click the Acquire button to find the Iowa Clauses Relating to Venture Interests. Make use of your account to search throughout the lawful kinds you may have purchased in the past. Check out the My Forms tab of the account and acquire an additional duplicate of your document you want.

Should you be a fresh end user of US Legal Forms, listed below are basic recommendations that you can comply with:

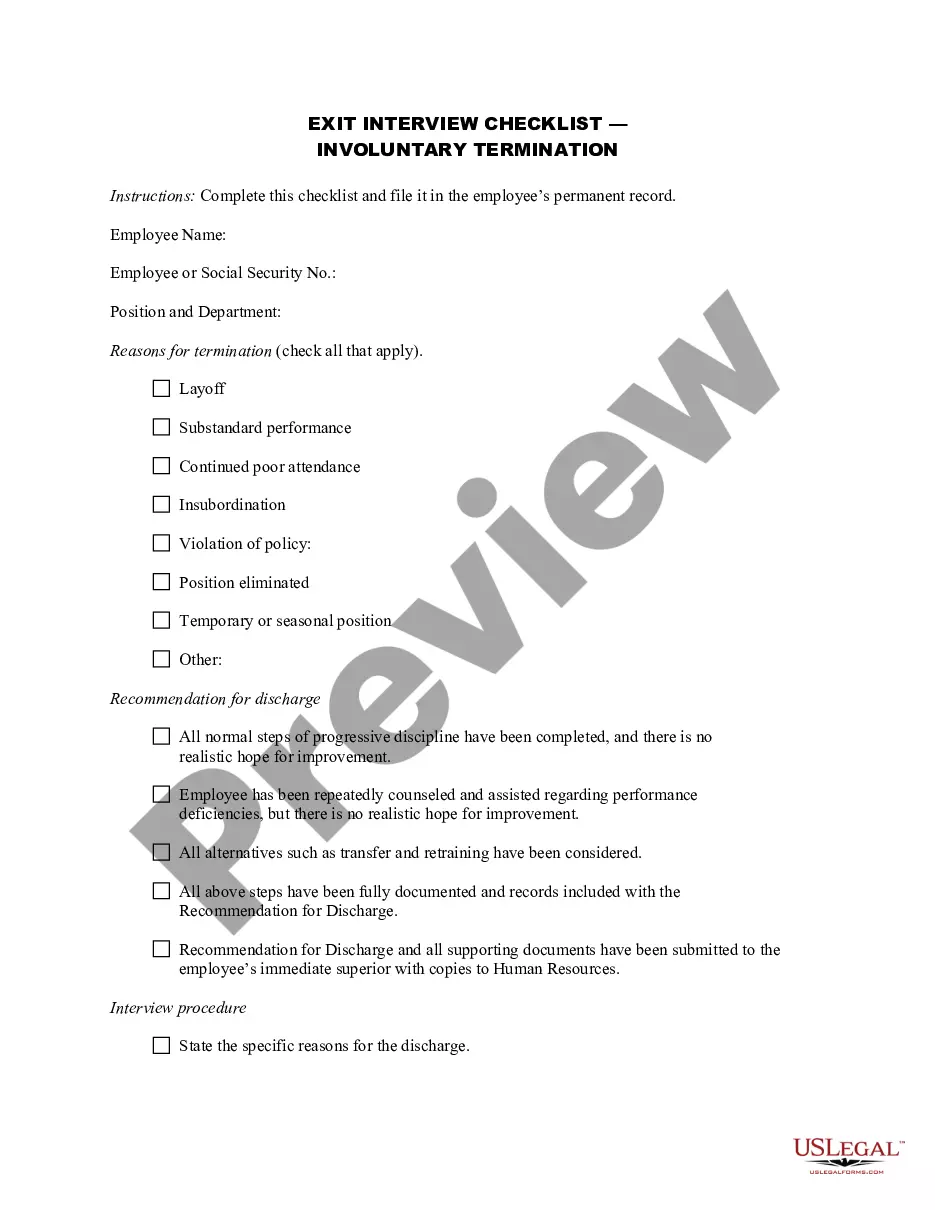

- Very first, ensure you have chosen the proper develop for the area/area. It is possible to examine the form utilizing the Preview button and browse the form explanation to guarantee it will be the right one for you.

- In case the develop will not fulfill your needs, take advantage of the Seach field to discover the appropriate develop.

- When you are positive that the form is acceptable, go through the Acquire now button to find the develop.

- Select the pricing prepare you would like and enter the necessary information and facts. Create your account and buy your order with your PayPal account or credit card.

- Opt for the document file format and download the lawful document design to your product.

- Total, edit and produce and sign the attained Iowa Clauses Relating to Venture Interests.

US Legal Forms may be the largest local library of lawful kinds that you can discover various document themes. Make use of the company to download professionally-made papers that comply with state requirements.

Form popularity

FAQ

An insurer may acquire collateral loans or other debt securities secured by collateral consisting of any assets or investments permitted under this section, provided that the amount of the loan is not in excess of ninety percent of the value of the collateral.