Iowa Clauses Relating to Venture IPO: A Comprehensive Overview In the state of Iowa, various clauses are in place in regard to venture initial public offerings (IPOs). These clauses serve as legal frameworks that govern the processes, rights, and obligations involved in taking a privately held venture public. Understanding these Iowa clauses is crucial for entrepreneurs, investors, and legal professionals involved in venture financing. Let's delve into the various types of Iowa Clauses Relating to Venture IPO: 1. Disclosure Clauses: — Iowa Blue Sky Laws: These laws require companies to disclose essential information about the venture IPO, such as financial statements, management background, and potential risks, to ensure investors have access to all relevant details. — Prospectus Requirements: The Iowa clauses mandate the preparation and distribution of a prospectus, a comprehensive document outlining the IPO details, including the purpose of the offering, financial data, business strategy, and risk factors. 2. Registration Clauses: — Securities Act Registration: Iowa follows federal securities laws, requiring companies to register their IPOs with the U.S. Securities and Exchange Commission (SEC) and comply with relevant regulations to safeguard investor interests. — Blue Sky Registration: In addition to federal registration, Iowa requires companies to fulfill state-level registration requirements, known as "blue sky" registration, ensuring compliance with state regulations. 3. Anti-Fraud Clauses: — Anti-fraud provisions: Iowa law imposes strict anti-fraud clauses to prevent misleading or deceptive practices by companies during the venture IPO process. These provisions aim to protect investors from false or exaggerated statements and ensure transparency in all dealings. 4. Shareholder Clauses: — Shareholder Voting Rights: Iowa clauses outline the rights of shareholders in a venture IPO, such as voting rights on crucial matters, including the initial public offering itself, election of directors, and other major corporate decisions. — Shareholder Approval: Certain Iowa clauses may require shareholder approval for specific actions, such as the issuance of new shares, acquisitions, or any other material transactions that may impact existing shareholders' ownership or rights. 5. Lock-up Clauses: — Lock-up Agreements: These clauses govern the restriction on the sale or transfer of shares by company insiders, founders, and early investors for a specific period after the IPO. Lock-up periods aim to prevent sudden sell-offs that could destabilize the market. 6. Due Diligence Clauses: — Iowa Securities Law Due Diligence Requirements: These clauses require companies conducting a venture IPO to perform thorough due diligence to assess potential risks, internal controls, and compliance with applicable laws. Understanding these Iowa Clauses Relating to Venture IPO is vital for companies navigating the complex process of going public. It is essential to consult legal professionals with expertise in Iowa securities and corporate laws to ensure compliance and mitigate potential legal risks.

Iowa Clauses Relating to Venture IPO

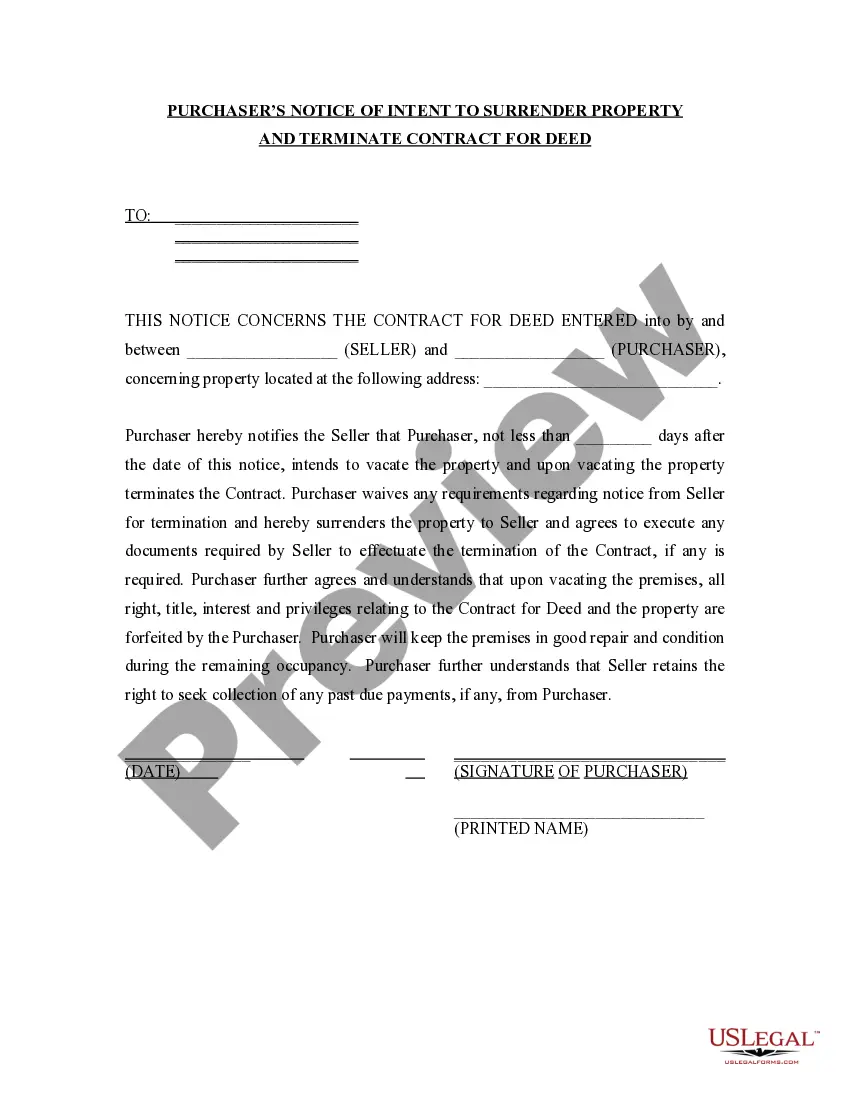

Description

How to fill out Iowa Clauses Relating To Venture IPO?

Are you presently within a situation where you need to have paperwork for sometimes company or individual reasons just about every working day? There are a variety of legitimate document web templates available on the Internet, but getting versions you can rely isn`t straightforward. US Legal Forms offers thousands of type web templates, much like the Iowa Clauses Relating to Venture IPO, which are composed to fulfill federal and state needs.

When you are presently familiar with US Legal Forms internet site and get your account, merely log in. Next, you may download the Iowa Clauses Relating to Venture IPO format.

If you do not provide an account and wish to begin using US Legal Forms, follow these steps:

- Find the type you need and ensure it is for the appropriate city/state.

- Use the Preview switch to analyze the form.

- See the explanation to ensure that you have chosen the right type.

- If the type isn`t what you`re trying to find, make use of the Research industry to obtain the type that meets your requirements and needs.

- Once you find the appropriate type, click Acquire now.

- Choose the pricing plan you desire, fill out the required details to produce your money, and pay money for the order making use of your PayPal or credit card.

- Decide on a hassle-free data file file format and download your version.

Locate every one of the document web templates you might have purchased in the My Forms menus. You can obtain a further version of Iowa Clauses Relating to Venture IPO at any time, if necessary. Just click the needed type to download or produce the document format.

Use US Legal Forms, the most substantial collection of legitimate types, in order to save time and avoid errors. The services offers appropriately created legitimate document web templates which can be used for an array of reasons. Create your account on US Legal Forms and begin generating your daily life a little easier.