Iowa Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

You may devote several hours online looking for the legitimate record design that meets the federal and state demands you need. US Legal Forms gives a huge number of legitimate forms that are reviewed by pros. You can easily obtain or printing the Iowa Complaint regarding Insurer's Failure to Pay Claim from your assistance.

If you already possess a US Legal Forms account, it is possible to log in and click the Down load option. Next, it is possible to full, modify, printing, or indication the Iowa Complaint regarding Insurer's Failure to Pay Claim. Each legitimate record design you acquire is yours for a long time. To obtain an additional duplicate of the obtained form, visit the My Forms tab and click the related option.

If you are using the US Legal Forms web site the very first time, stick to the basic directions listed below:

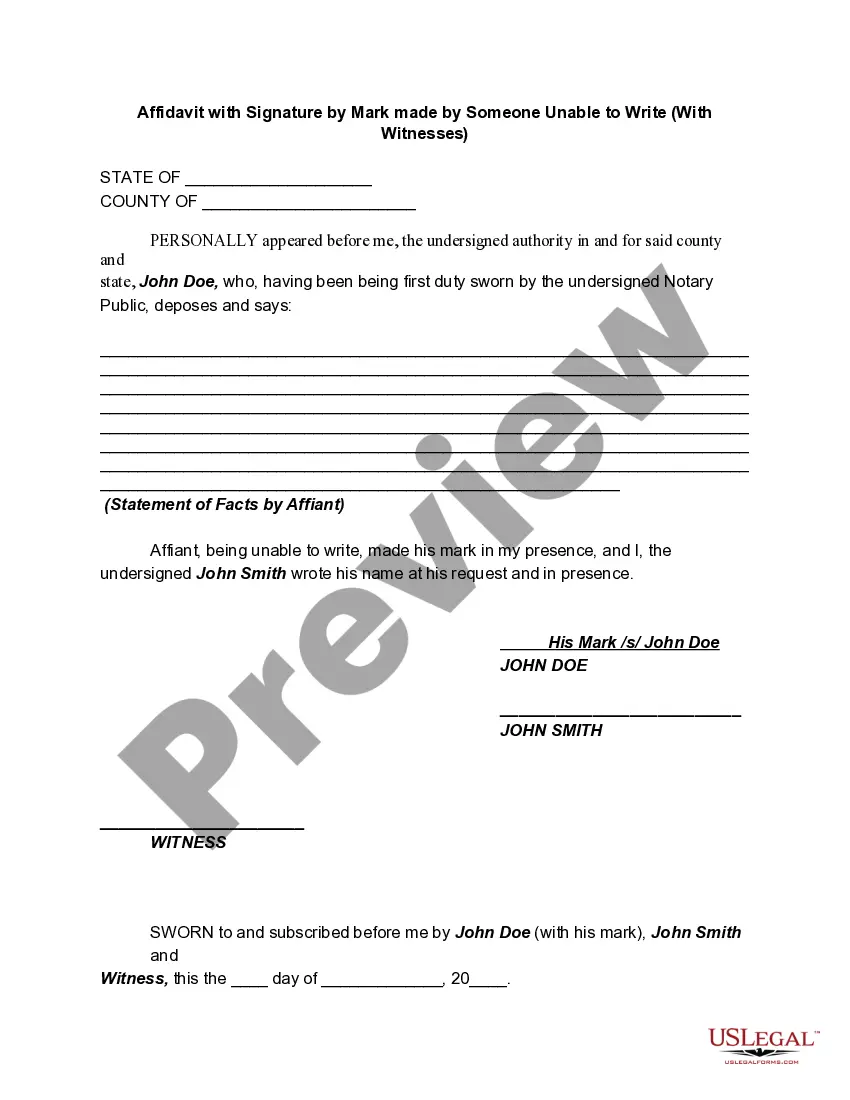

- Initially, ensure that you have chosen the correct record design for that area/area of your choice. See the form information to make sure you have picked out the appropriate form. If available, utilize the Review option to search through the record design at the same time.

- If you wish to locate an additional model from the form, utilize the Research area to get the design that suits you and demands.

- After you have found the design you want, click on Buy now to move forward.

- Select the rates program you want, type in your references, and register for a free account on US Legal Forms.

- Total the financial transaction. You may use your bank card or PayPal account to pay for the legitimate form.

- Select the structure from the record and obtain it to the product.

- Make modifications to the record if necessary. You may full, modify and indication and printing Iowa Complaint regarding Insurer's Failure to Pay Claim.

Down load and printing a huge number of record layouts using the US Legal Forms site, that offers the most important collection of legitimate forms. Use expert and condition-particular layouts to tackle your company or individual demands.

Form popularity

FAQ

Internal appeal: If your claim is denied or your health insurance coverage canceled, you have the right to an internal appeal. You may ask your insurance company to conduct a full and fair review of its decision. If the case is urgent, your insurance company must speed up this process.

If your claim has been refused because of a condition or exclusion, you might be able to argue: the insurer was wrong in applying the condition or exclusion. the condition or exclusion did not cause the loss (or only part of it) or the insurer wasn't disadvantaged by it (section 54, Insurance Contracts Act)

If there is any indication that their policyholder isn't responsible the insurer will deny your claim. Claims may also be denied if there's evidence to show that the policyholder isn't entirely to blame for an accident. In California, anyone who contributes to an accident can be held responsible for resulting injuries.

191?15.44(507B) Standards for determining replacement cost and actual cost values. damage incurred in making such repair or replacement not otherwise excluded by the policy shall be included in the loss. The insured shall not have to pay for betterment or any other cost except for the applicable deductible. b.

Insurance companies in Iowa have 75 days to settle a claim after it is filed. Iowa insurance companies also have specific time frames in which they must acknowledge the claim and then decide whether to accept it, before paying out the final settlement.

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

191?15.1(507B) Purpose. This chapter is intended to establish certain minimum standards and guidelines of conduct by identifying unfair methods of competition and unfair or deceptive acts or practices in the business of insurance, as prohibited by Iowa Code chapter 507B.

Third-party bad faith cases typically fall under three categories: Failure to defend. Your insurance company has a duty to provide an adequate defense on your behalf in lawsuit. ... Failure to settle. Your provider has a duty to pay for any damages of which you are found liable in lawsuits. ... Negligent handling of the case.