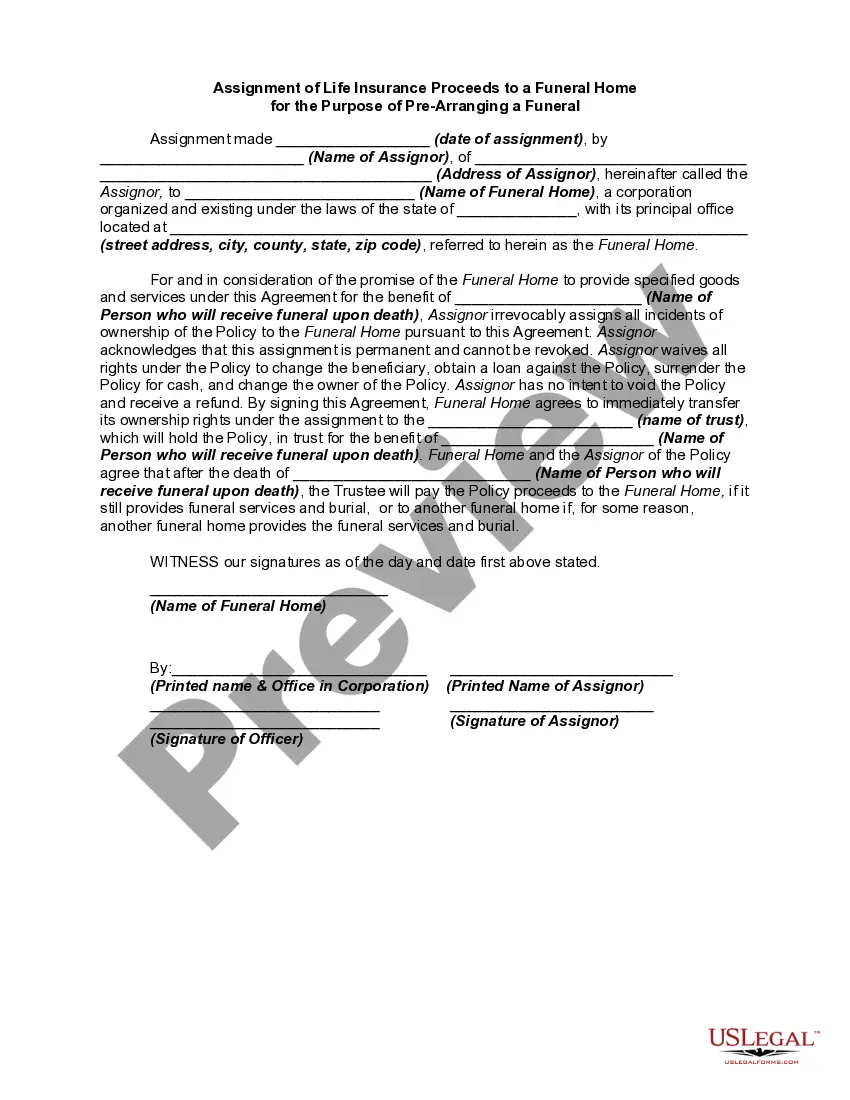

Iowa Assignment of Life Insurance as Collateral

Description

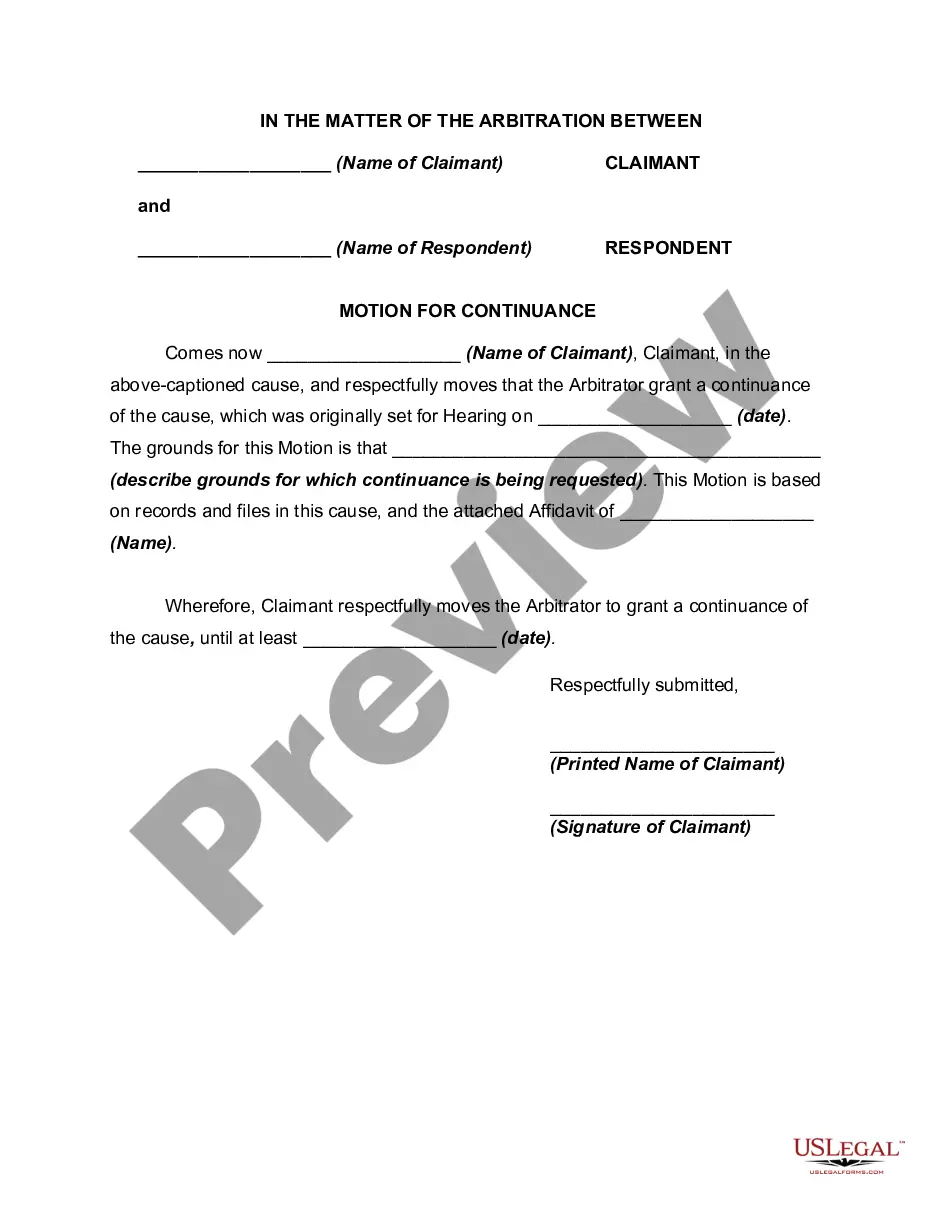

How to fill out Assignment Of Life Insurance As Collateral?

US Legal Forms - one of many largest libraries of legal types in the USA - provides a variety of legal record layouts you may download or produce. Utilizing the website, you may get a large number of types for organization and individual functions, sorted by types, states, or search phrases.You can get the newest models of types just like the Iowa Assignment of Life Insurance as Collateral within minutes.

If you have a registration, log in and download Iowa Assignment of Life Insurance as Collateral through the US Legal Forms collection. The Down load option will appear on each develop you see. You have access to all previously delivered electronically types in the My Forms tab of the account.

In order to use US Legal Forms initially, allow me to share easy directions to help you started out:

- Be sure you have picked the correct develop for your personal metropolis/area. Click the Review option to analyze the form`s information. See the develop information to actually have selected the right develop.

- If the develop doesn`t suit your demands, make use of the Research industry near the top of the screen to discover the one that does.

- In case you are satisfied with the form, affirm your option by simply clicking the Buy now option. Then, choose the costs strategy you favor and give your qualifications to sign up for the account.

- Procedure the transaction. Utilize your charge card or PayPal account to perform the transaction.

- Select the format and download the form in your gadget.

- Make alterations. Complete, revise and produce and indication the delivered electronically Iowa Assignment of Life Insurance as Collateral.

Each design you put into your account lacks an expiration day and it is the one you have permanently. So, if you want to download or produce another duplicate, just go to the My Forms section and then click around the develop you want.

Obtain access to the Iowa Assignment of Life Insurance as Collateral with US Legal Forms, by far the most substantial collection of legal record layouts. Use a large number of specialist and state-certain layouts that meet up with your small business or individual demands and demands.

Form popularity

FAQ

You can use either term or whole life insurance policy as collateral, but the death benefit must meet the lender's terms. Alternately, the policy owner's access to the cash value is restricted to protect the collateral.

Any type of life insurance policy is acceptable for collateral assignment, provided the insurance company allows assignment for the policy. Some banks may require an escrow account for the life insurance premiums, others may require proof of premiums paid or prepaid.

Only permanent policies can build cash value. Term life insurance is typically less expensive, but it does not build cash.

Which of these actions is taken when a policyowner uses a Life Insurance policy as collateral for a bank loan? Collateral assignment" A policyowner using the Life Insurance policy as collateral for a bank loan normally would make a collateral assignment.

If you have a term policy, you will not be able to borrow against it. However, you may want to consider converting your policy to whole life insurance to take advantage of this option in the future. Look up the current cash value: Find out how much your policy is currently worth.

The collateral assignment is irrevocable as established by a written agreement preventing the holder of the life insurance policy from affecting or using the cash surrender value after the irrevocable assignment.

Term life insurance can be extremely valuable to your family and to your own peace of mind, but since it doesn't create cash value, it doesn't count as an asset.

Can you cash out term life insurance? Since a term life insurance policy doesn't come with a cash value component, it's not possible to cash it out. This policy solely includes a death benefit that your beneficiaries may receive if you die before the end of the policy's term.