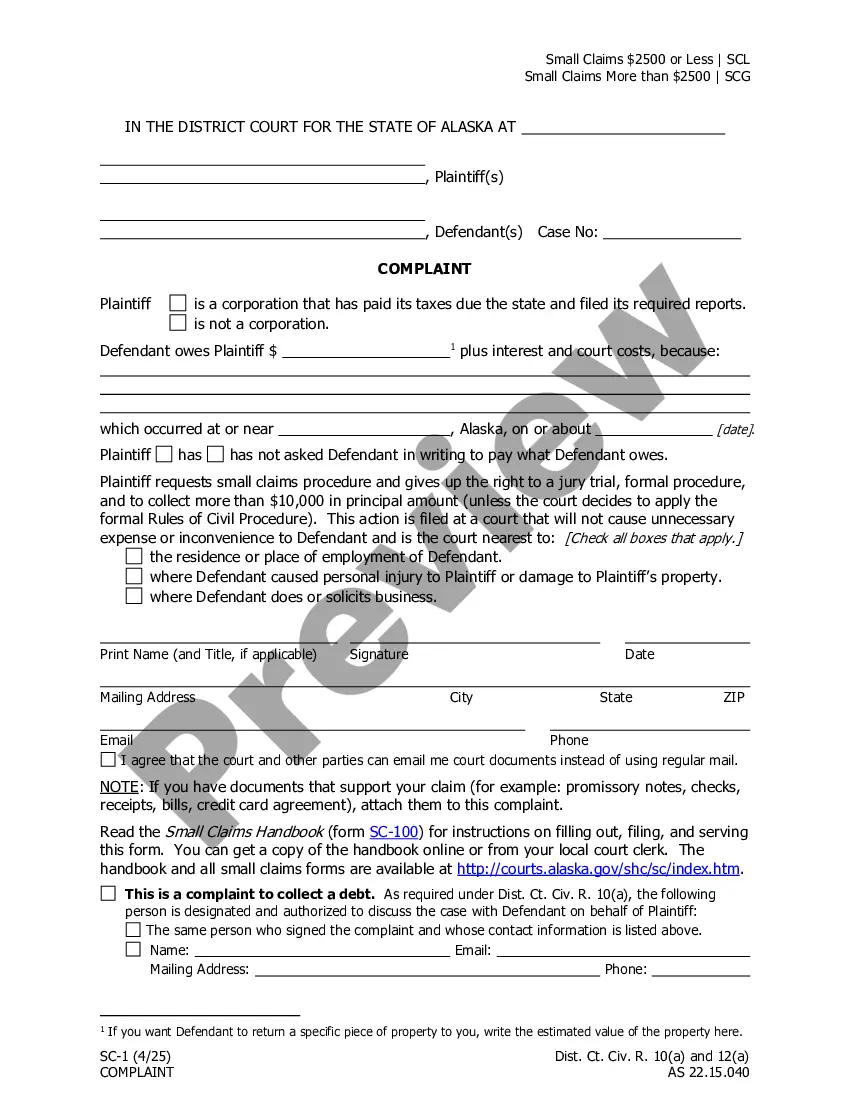

UCC1 - Financing Statement - Iowa - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Iowa UCC1 Financing Statement

Description

How to fill out Iowa UCC1 Financing Statement?

Get access to the most expansive library of legal forms. US Legal Forms is really a system to find any state-specific document in clicks, including Iowa UCC1 Financing Statement examples. No need to waste time of the time seeking a court-admissible sample. Our qualified pros ensure you receive updated examples every time.

To take advantage of the forms library, select a subscription, and sign-up an account. If you created it, just log in and click on Download button. The Iowa UCC1 Financing Statement sample will automatically get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at quick recommendations below:

- If you're proceeding to utilize a state-specific documents, make sure you indicate the proper state.

- If it’s possible, review the description to understand all the ins and outs of the document.

- Take advantage of the Preview function if it’s available to check the document's content.

- If everything’s correct, click on Buy Now button.

- Right after choosing a pricing plan, create an account.

- Pay by card or PayPal.

- Save the sample to your computer by clicking Download.

That's all! You ought to submit the Iowa UCC1 Financing Statement template and double-check it. To be sure that things are exact, call your local legal counsel for assist. Sign up and simply look through over 85,000 beneficial forms.

Form popularity

FAQ

In Texas you can search for UCC-1 filings made against your company through a website provided by the Texas Secretary of State's office. There is a very small fee for conducting this search. Normally a UCC-1 Financing Statement expires five years from the date and time of filing as indicated on the UCC-1 form.

A UCC filing, also known as a UCC lien or a UCC-1, is a financing statement which lenders can file against your business with your secretary of state.This might be a piece of equipment, a vehicle, property, or even a blanket lien naming all your assets.

A UCC-Uniform Commercial Code-1 statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans.These forms must be filed with agencies located in the state where the borrower's business is incorporated.

Searching Secretary of State Records Online. Locate the correct secretary of state's website. UCC financing statement forms must be filed in the state where the borrower is located. Most states have online directories of UCC filings available on the secretary of state's website.

UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.

You can always check the status of UCC filings against your business through your business credit report or searching UCC lien public records.

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.