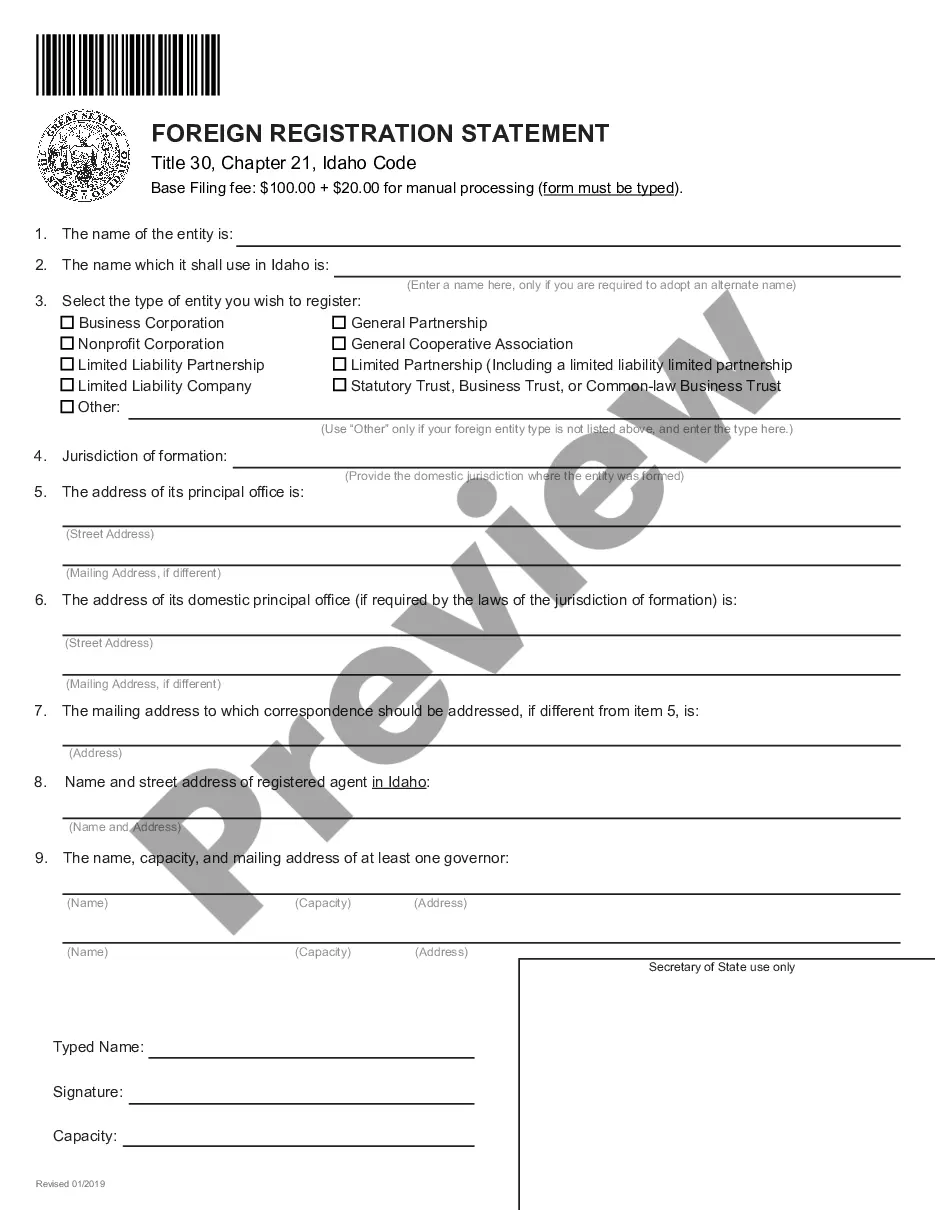

Idaho Registration of Foreign Corporation

Description Idaho Foreign Llc

How to fill out Idaho Registration Of Foreign Corporation?

Access one of the most comprehensive library of authorized forms. US Legal Forms is actually a system to find any state-specific file in a few clicks, even Idaho Registration of Foreign Corporation examples. No reason to spend several hours of your time searching for a court-admissible form. Our accredited pros make sure that you get up-to-date samples all the time.

To benefit from the forms library, pick a subscription, and create your account. If you already registered it, just log in and click Download. The Idaho Registration of Foreign Corporation sample will automatically get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, follow the short guidelines below:

- If you're having to utilize a state-specific documents, be sure you indicate the correct state.

- If it’s possible, go over the description to know all the ins and outs of the form.

- Make use of the Preview option if it’s offered to look for the document's content.

- If everything’s correct, click Buy Now.

- Right after choosing a pricing plan, create an account.

- Pay out by card or PayPal.

- Save the example to your device by clicking on Download button.

That's all! You should submit the Idaho Registration of Foreign Corporation template and double-check it. To make certain that things are exact, call your local legal counsel for help. Sign up and simply browse more than 85,000 valuable forms.

Form popularity

FAQ

How much does it cost to form an LLC in Idaho? The Idaho Secretary of State charges $100 to file the Certificate of Organization online and $120 to file by mail. You can reserve your LLC name with the Idaho Secretary of State for $20.

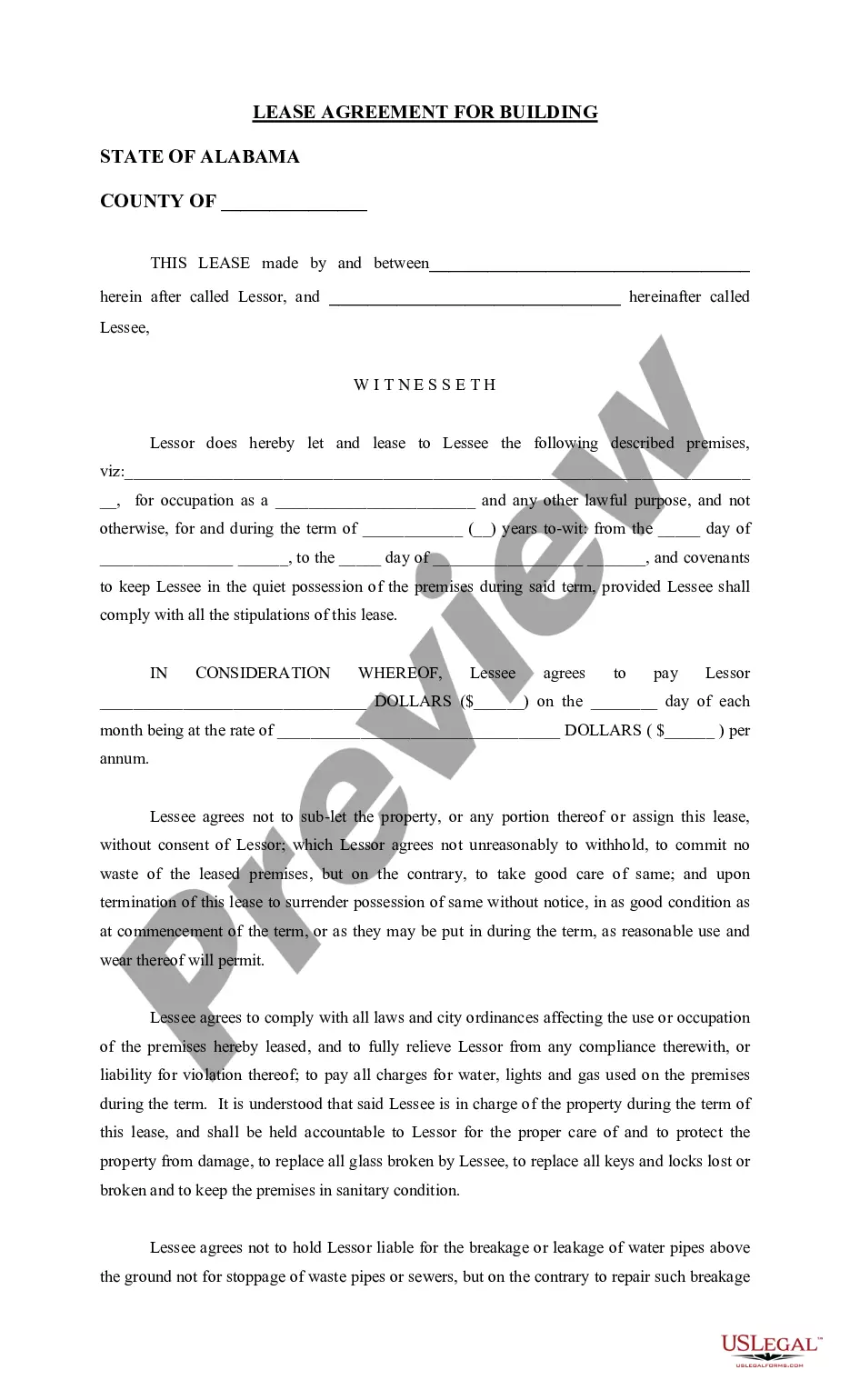

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

LLC Processing Time It normally takes 1-2 weeks for the LLC paperwork to be approved in Idaho. Expedited processing is also available for an additional fee.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Foreigner registration is a mandatory requirement by the Government of India under which all foreign nationals (excluding overseas citizens of India) visiting India on a long term visa (more than 180 days) are required to register themselves with a Registration Officer within 14 days of arriving in India.

Generally, there are no restrictions on foreign ownership of a company formed in the United States. The procedure for a foreign citizen to form a company in the US is the same as for a US resident. It is not necessary to be a US citizen or to have a green card to own a corporation or LLC.

Step 1: Name Your Idaho Corporation. Choosing a business name is the first step in starting a corporation. Step 2: Choose an Idaho Registered Agent. Step 3: Hold an Organizational Meeting. Step 4: File the Idaho Articles of Incorporation. Step 5: Get an EIN for Your Idaho Corporation.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).