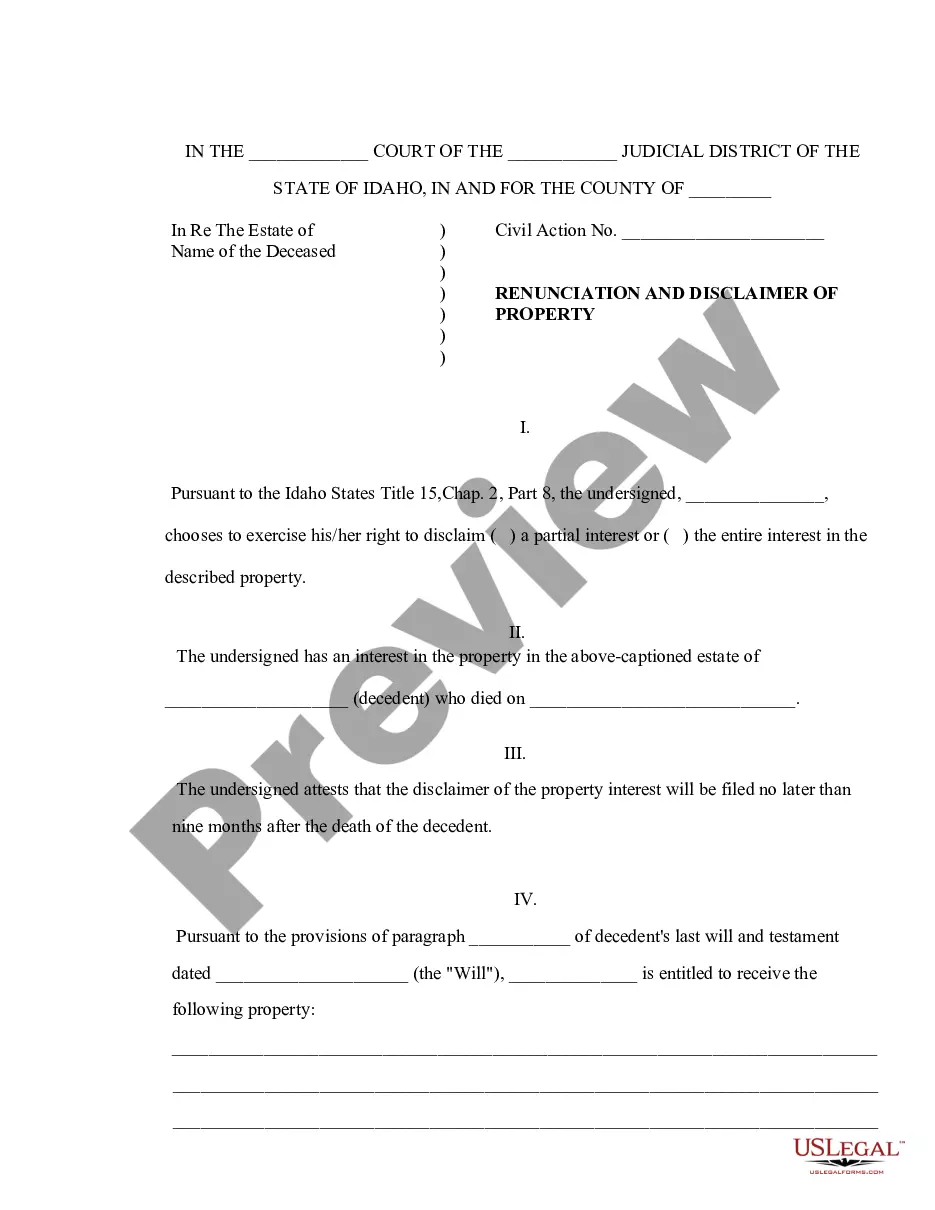

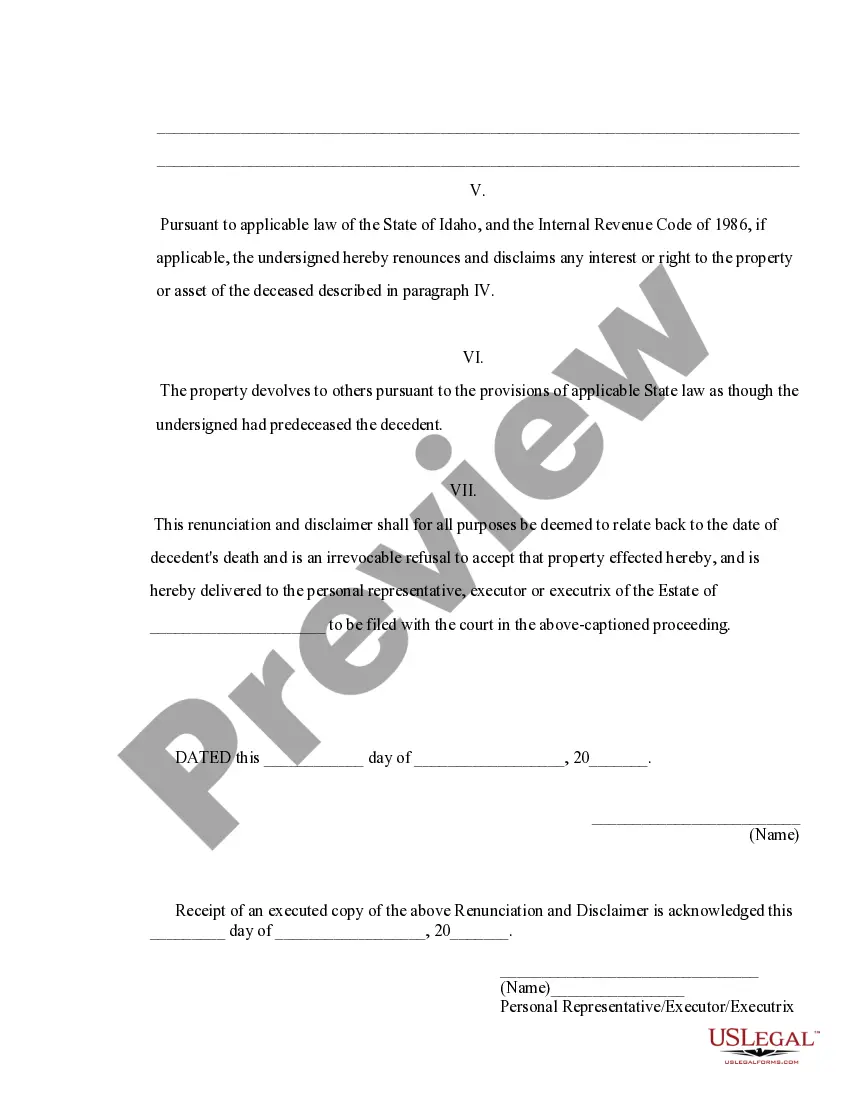

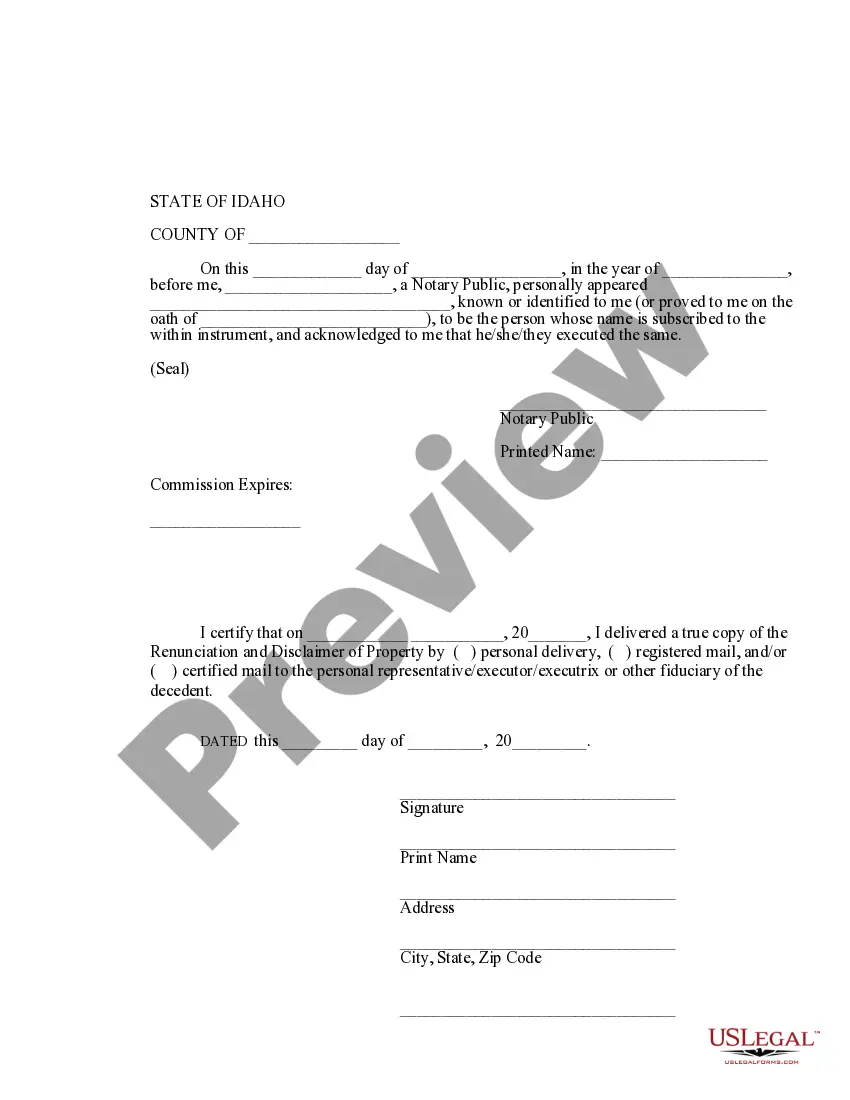

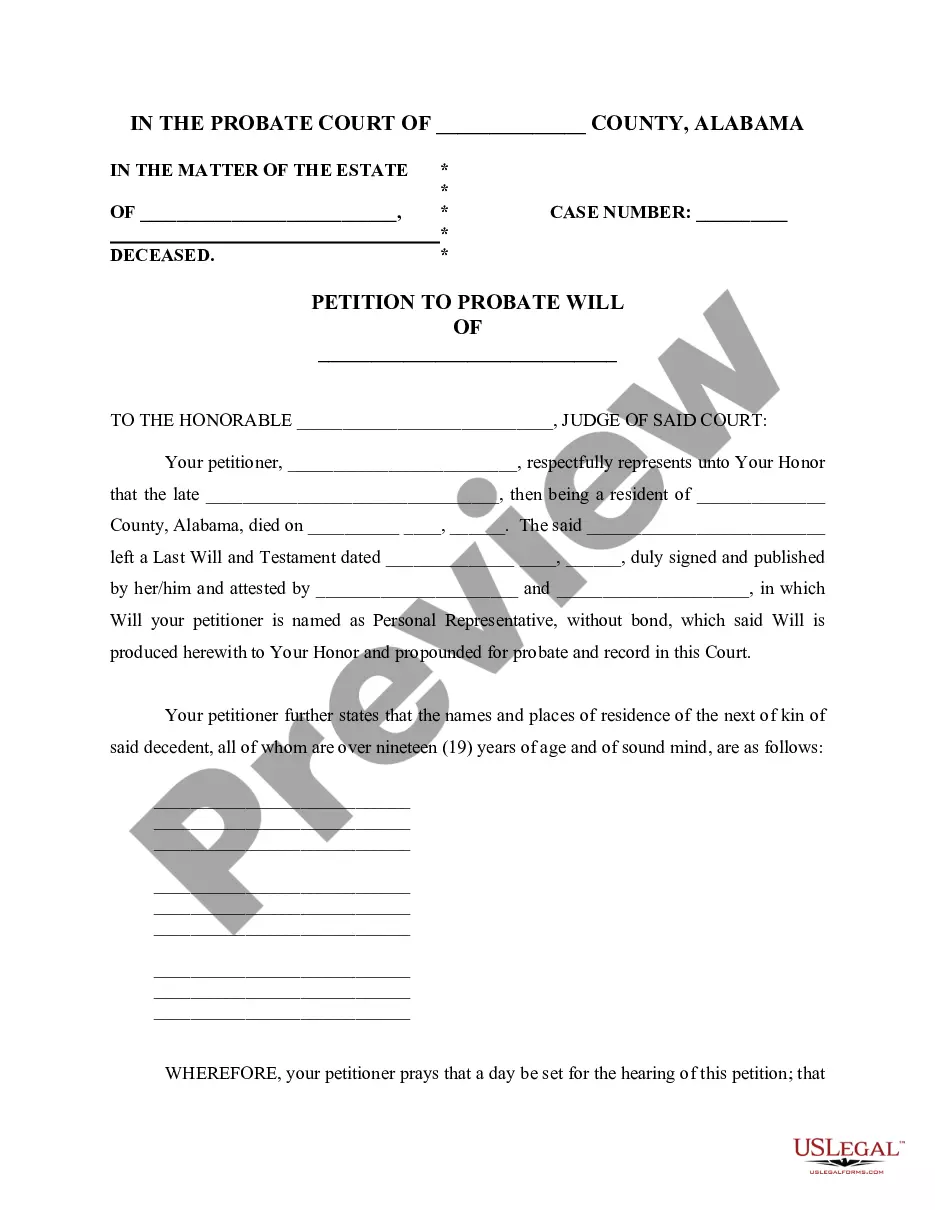

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. The beneficiary has gained an interest in the described property of the decedent. However, pursuant to the Idaho Statutes Title 15, Chap. 2, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Idaho Renunciation and Disclaimer of Property from Will by Testate

Description Disclaimer Will Online

How to fill out Idaho Disclaimer?

Get one of the most extensive library of authorized forms. US Legal Forms is really a solution where you can find any state-specific document in clicks, such as Idaho Renunciation and Disclaimer of Property from Will by Testate samples. No reason to spend time of your time trying to find a court-admissible sample. Our accredited specialists ensure you receive up to date documents every time.

To make use of the documents library, choose a subscription, and sign-up your account. If you created it, just log in and click on Download button. The Idaho Renunciation and Disclaimer of Property from Will by Testate sample will automatically get kept in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new profile, follow the brief instructions listed below:

- If you're proceeding to use a state-specific documents, make sure you indicate the proper state.

- If it’s possible, go over the description to know all of the ins and outs of the document.

- Utilize the Preview option if it’s available to check the document's content.

- If everything’s correct, click Buy Now.

- After selecting a pricing plan, create your account.

- Pay by credit card or PayPal.

- Downoad the sample to your device by clicking Download.

That's all! You should submit the Idaho Renunciation and Disclaimer of Property from Will by Testate form and check out it. To make sure that all things are exact, contact your local legal counsel for assist. Register and easily look through above 85,000 beneficial forms.

Property Will Paper Form popularity

Property Will Printable Other Form Names

Disclaimer Form FAQ

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The beneficiary can disclaim only a portion of an inherited IRA or asset, allowing some to flow to the contingent beneficiary(s). Partial disclaiming is either a specific dollar or percentage amount as of the date of death.The balance will go to the next beneficiary(s).

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

You can head off an inheritance by renouncing or disclaiming it. This involves notifying the executor or personal representative of the estate the individual charged with guiding it through the probate process and settling it that you don't want the gift. You must do so in writing, and it's an irrevocable decision.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).