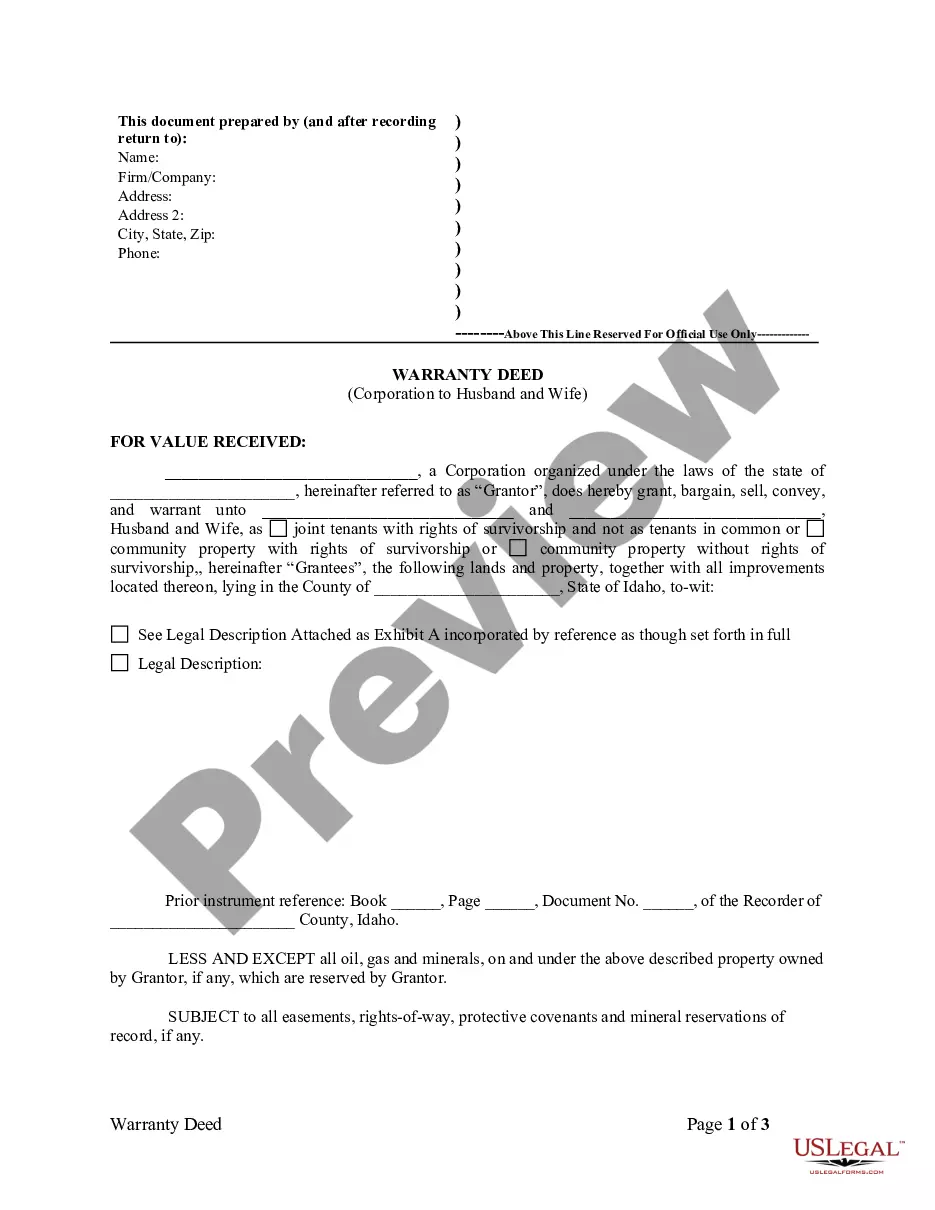

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Idaho Warranty Deed from Corporation to Husband and Wife

Description

How to fill out Idaho Warranty Deed From Corporation To Husband And Wife?

Get access to the most comprehensive catalogue of authorized forms. US Legal Forms is actually a solution where you can find any state-specific form in couple of clicks, such as Idaho Warranty Deed from Corporation to Husband and Wife examples. No reason to spend hrs of the time looking for a court-admissible example. Our certified specialists ensure you get updated documents every time.

To benefit from the documents library, choose a subscription, and sign-up your account. If you did it, just log in and then click Download. The Idaho Warranty Deed from Corporation to Husband and Wife template will instantly get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new profile, look at simple guidelines listed below:

- If you're proceeding to use a state-specific documents, make sure you indicate the right state.

- If it’s possible, review the description to know all the ins and outs of the form.

- Utilize the Preview option if it’s available to look for the document's content.

- If everything’s proper, click on Buy Now button.

- After picking a pricing plan, register your account.

- Pay by card or PayPal.

- Downoad the sample to your computer by clicking Download.

That's all! You ought to fill out the Idaho Warranty Deed from Corporation to Husband and Wife template and double-check it. To ensure that all things are precise, contact your local legal counsel for support. Register and simply browse more than 85,000 useful forms.

Form popularity

FAQ

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

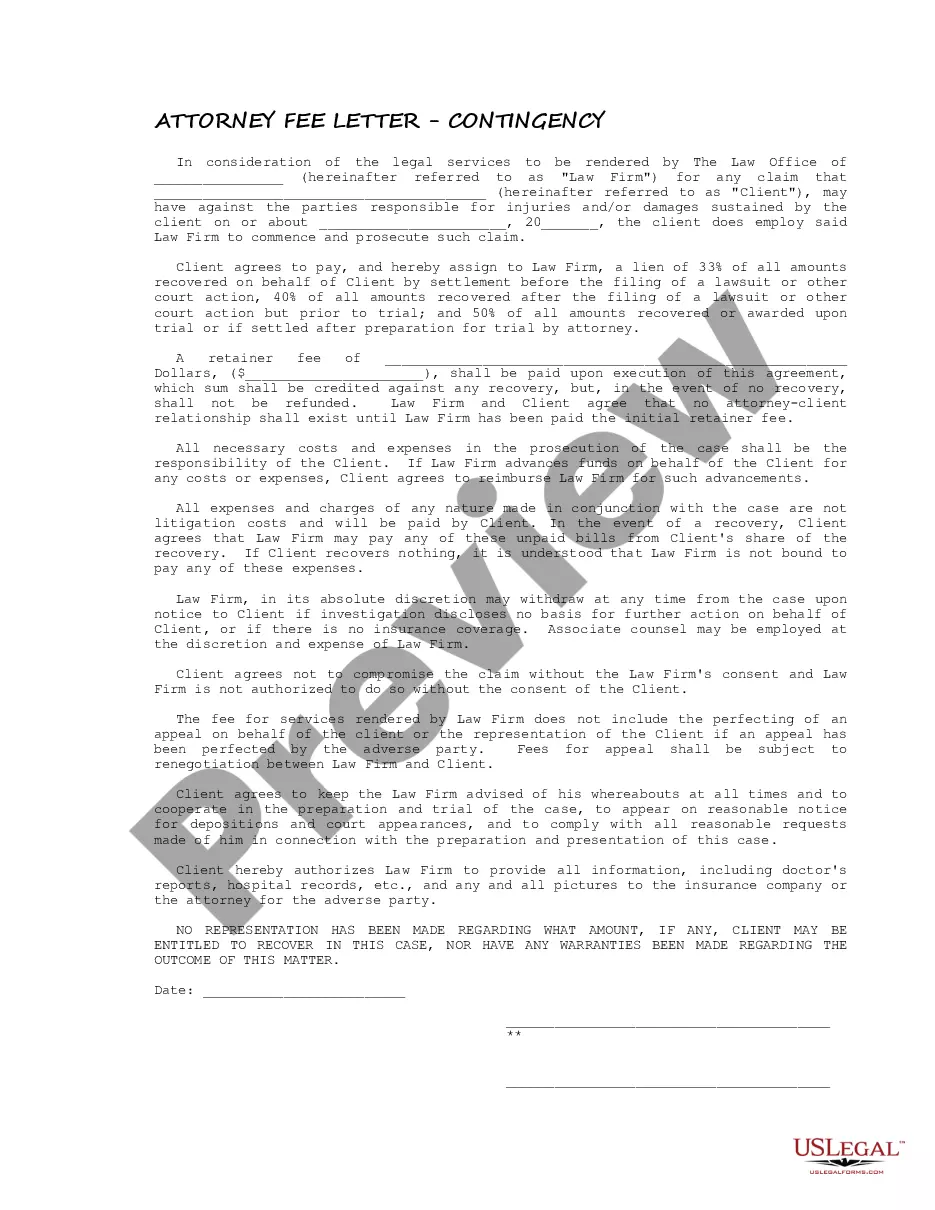

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.