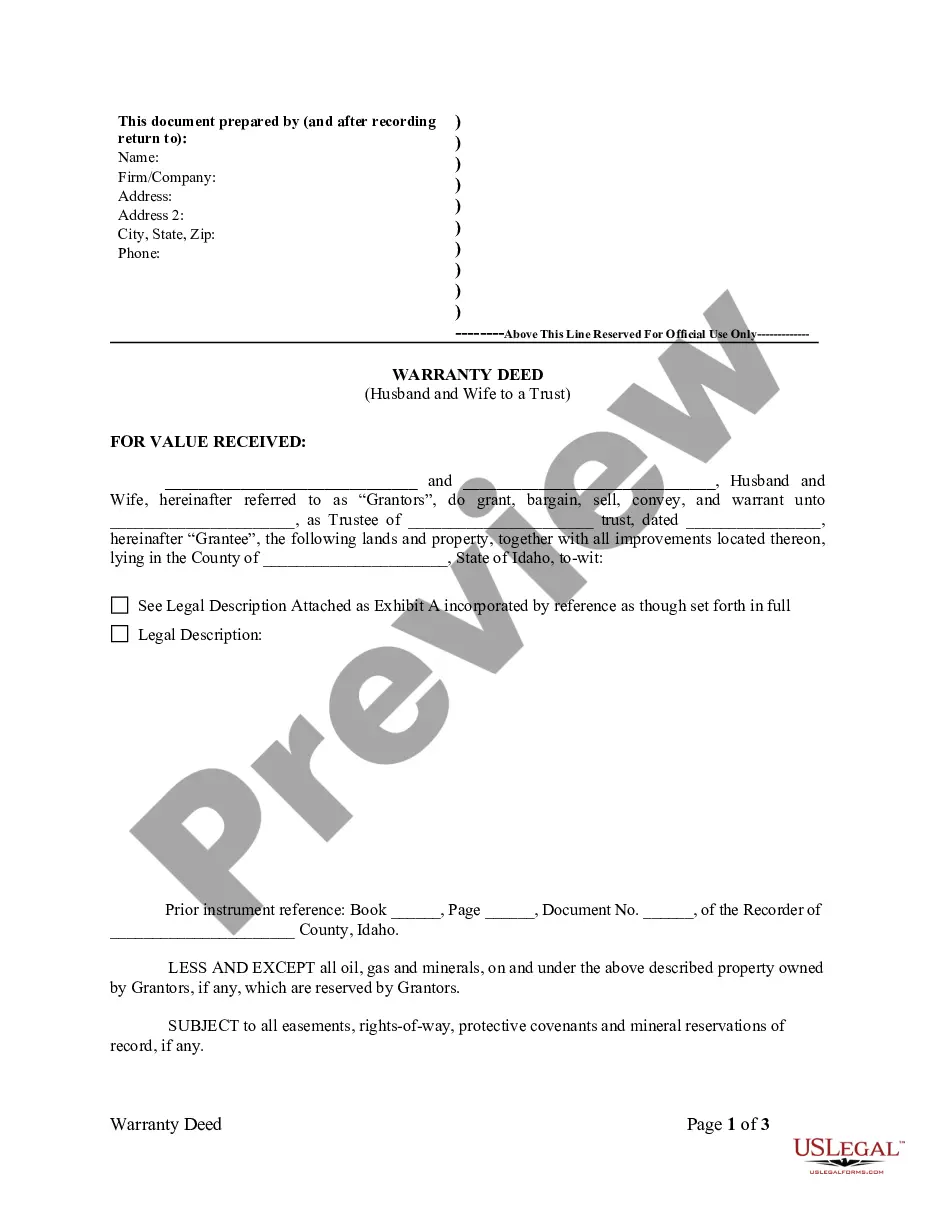

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Idaho Warranty Deed from Husband and Wife to a Trust

Description

How to fill out Idaho Warranty Deed From Husband And Wife To A Trust?

Gain access to the most comprehensive collection of sanctioned forms.

US Legal Forms serves as a tool to discover any state-specific document with just a few clicks, like Idaho Warranty Deed from Husband and Wife to a Trust templates.

No need to squander your time searching for a court-accepted sample.

- To take advantage of the forms library, select a subscription and set up your account.

- If you have already registered, simply Log In and hit the Download button.

- The Idaho Warranty Deed from Husband and Wife to a Trust template will be immediately saved in the My documents tab (the section for all forms you download from US Legal Forms).

- To create a new profile, refer to the straightforward instructions below.

- If you are planning to use a state-specific sample, ensure you select the correct state.

- If possible, review the description to understand all the details of the document.

Form popularity

FAQ

A trustee deed offers no such warranties about the title.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.