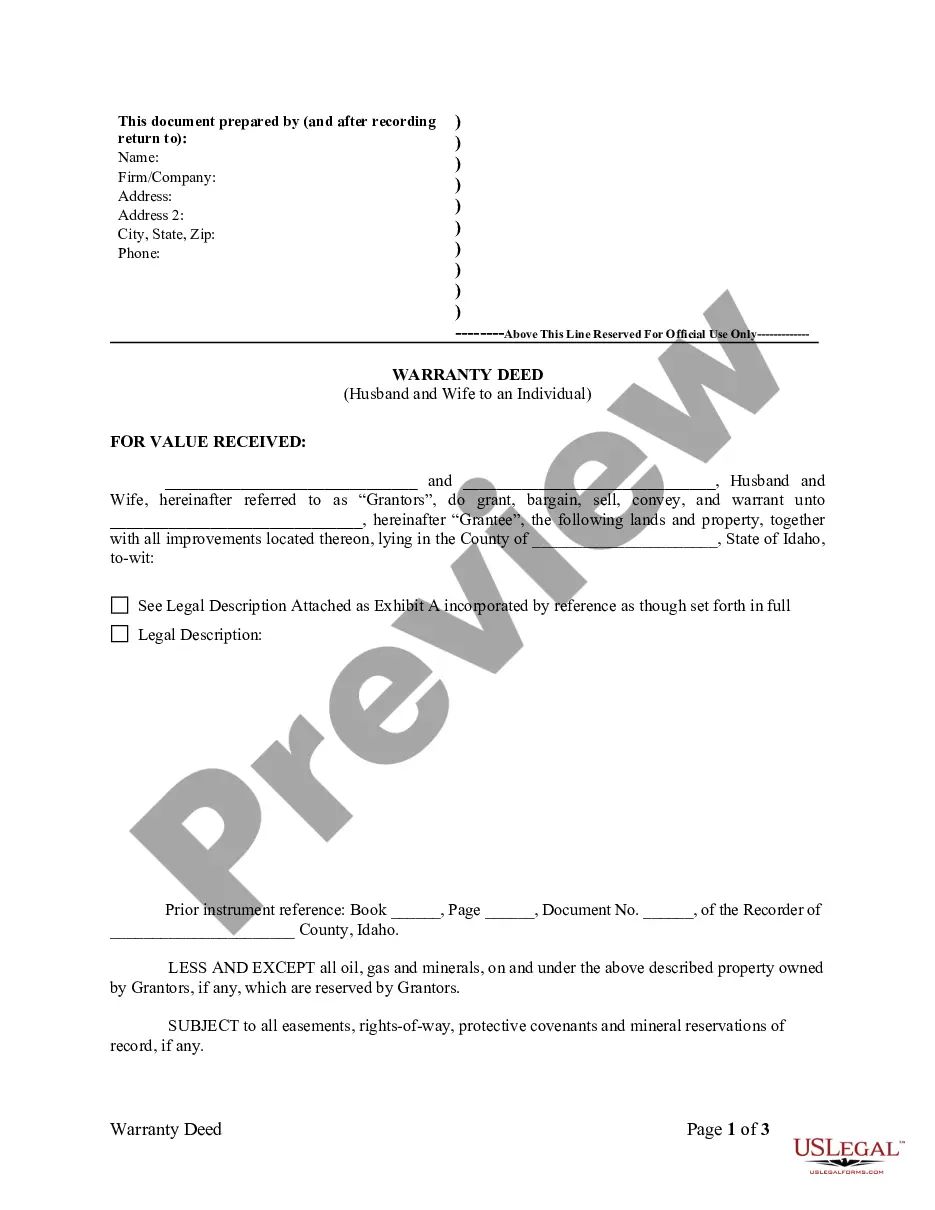

This form is a Warranty Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and warrant the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Idaho Warranty Deed from Husband and Wife to an Individual

Description

How to fill out Idaho Warranty Deed From Husband And Wife To An Individual?

Get one of the most extensive library of authorized forms. US Legal Forms is actually a solution to find any state-specific file in clicks, including Idaho Warranty Deed from Husband and Wife to an Individual samples. No reason to waste time of the time searching for a court-admissible sample. Our certified professionals ensure that you receive up to date samples all the time.

To take advantage of the documents library, pick a subscription, and create your account. If you already did it, just log in and click Download. The Idaho Warranty Deed from Husband and Wife to an Individual sample will automatically get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new account, follow the short instructions listed below:

- If you're going to utilize a state-specific documents, be sure you indicate the appropriate state.

- If it’s possible, review the description to know all the ins and outs of the document.

- Make use of the Preview function if it’s offered to check the document's information.

- If everything’s right, click Buy Now.

- Right after choosing a pricing plan, make your account.

- Pay by credit card or PayPal.

- Save the sample to your device by clicking Download.

That's all! You need to submit the Idaho Warranty Deed from Husband and Wife to an Individual template and check out it. To ensure that things are exact, speak to your local legal counsel for assist. Join and easily find above 85,000 helpful samples.

Form popularity

FAQ

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

Joint Tenancy Two or more people, including spouses, may hold title to their jointly owned real estate as joint tenants. There is a so-called right of survivorship, which means that when one dies, the property automatically transfers to the survivor without the necessity of probating the estate.

The names on the mortgage show who's responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In estate law, joint tenancy is a special form of ownership by two or more persons of the same property. The individuals, who are called joint tenants, share equal ownership of the property and have the equal, undivided right to keep or dispose of the property. Joint tenancy creates a Right of Survivorship.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.