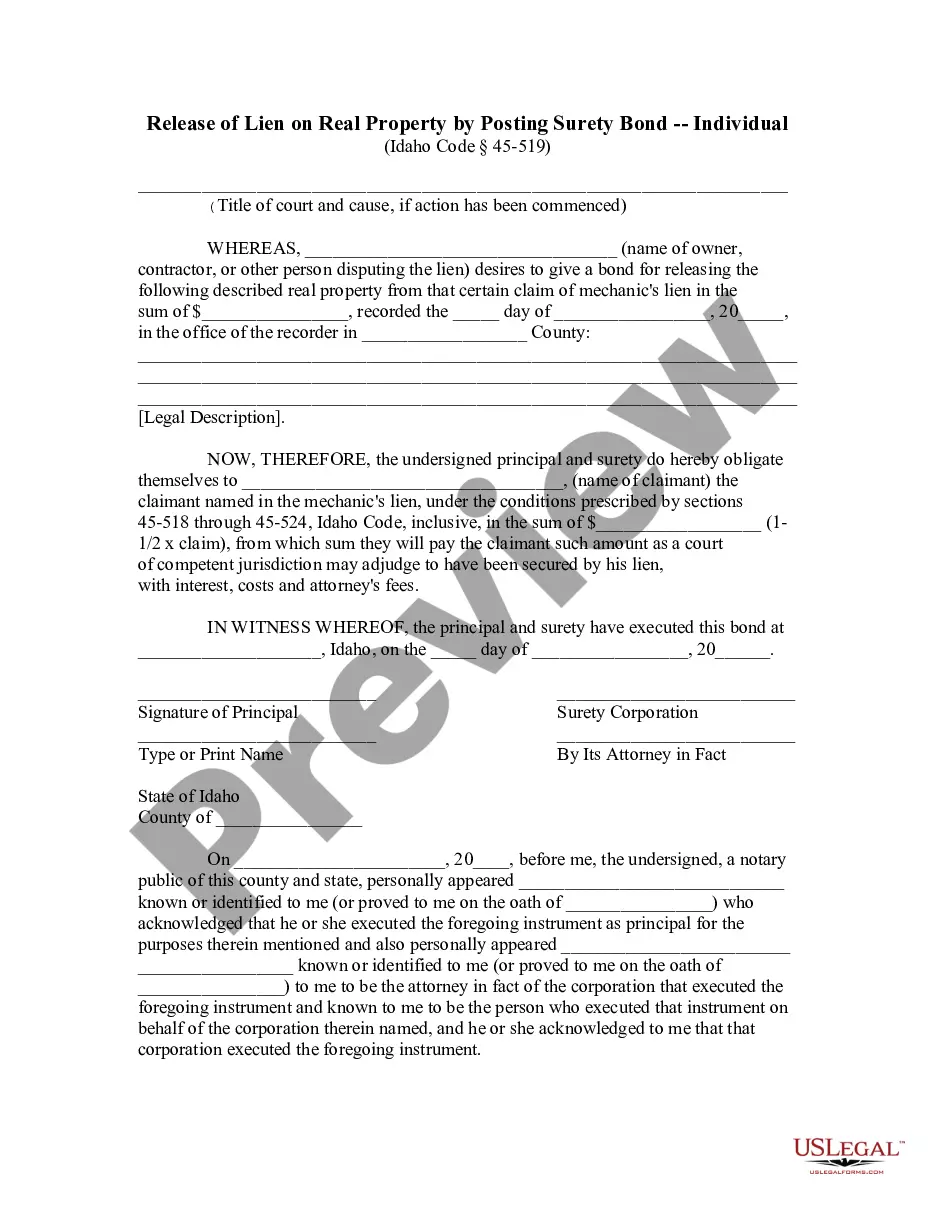

Idaho law contains several lengthy provisions regarding the process by which a party may commence a legal action to have a lien released by posting a surety bond. Filing an action under most of these statutes requires the services of an attorney. However, Idaho statutes also provide a standard form which may be filed to show that a party with an interest in the property has obtained a surety bond. Idaho Code §45-519.

Idaho Release of Lien by Posting of Surety Bond - Individual

Description Release Bond Template

How to fill out Bond Release Of Lien State Of Idaho?

Access one of the most extensive library of authorized forms. US Legal Forms is really a solution where you can find any state-specific file in clicks, such as Idaho Release of Lien by Posting of Surety Bond - Individual samples. No need to spend several hours of your time looking for a court-admissible form. Our licensed professionals ensure you receive up-to-date samples all the time.

To take advantage of the documents library, pick a subscription, and register your account. If you registered it, just log in and then click Download. The Idaho Release of Lien by Posting of Surety Bond - Individual file will quickly get kept in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new account, follow the short guidelines listed below:

- If you're going to utilize a state-specific example, be sure you indicate the appropriate state.

- If it’s possible, look at the description to understand all the nuances of the document.

- Make use of the Preview function if it’s available to take a look at the document's content.

- If everything’s proper, click Buy Now.

- After selecting a pricing plan, register an account.

- Pay by credit card or PayPal.

- Save the sample to your computer by clicking on Download button.

That's all! You should fill out the Idaho Release of Lien by Posting of Surety Bond - Individual template and double-check it. To be sure that everything is exact, call your local legal counsel for assist. Register and simply browse more than 85,000 helpful samples.

Surety Bond Idaho Form popularity

Idaho Bond Contract Other Form Names

Individual Surety FAQ

A bond for a $100,000 contract will typically cost $500 to $2,000. Get a free Performance Bond quote.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

The state of California requires every Notary to purchase a $15,000 Surety Bond in order to protect the public financially from the possibility of a negligent mistake or intentional misconduct.

At its simplest, a surety bond requires the surety to pay a set amount of money to the obligee if a principal fails to perform a contractual obligation. It also helps principals, typically small contractors, compete for contracts by reassuring customers that they will receive the product or service promised.

When it comes to surety bonds, you will not need to pay month-to-month. In fact, when you get a quote for a surety bond, the quote is a one-time payment quote. This means you will only need to pay it one time (not every month).Most bonds are quoted at a 1-year term, but some are quoted at a 2-year or 3-year term.

Nevada law requires all Notaries to purchase and maintain a $10,000 Notary surety bond for the duration of their 4-year commission. The Notary bond protects the general public of Nevada against any financial loss due to improper conduct by a Nevada Notary. The bond is NOT insurance protection for Nevada Notaries.

This is one way a surety bond differs from an insurance policy. While an insurance company does not expect to be paid back for a claim, a surety company does.You are also responsible for paying back the surety company every penny they pay out on a claim, including all costs associated with the claim.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).