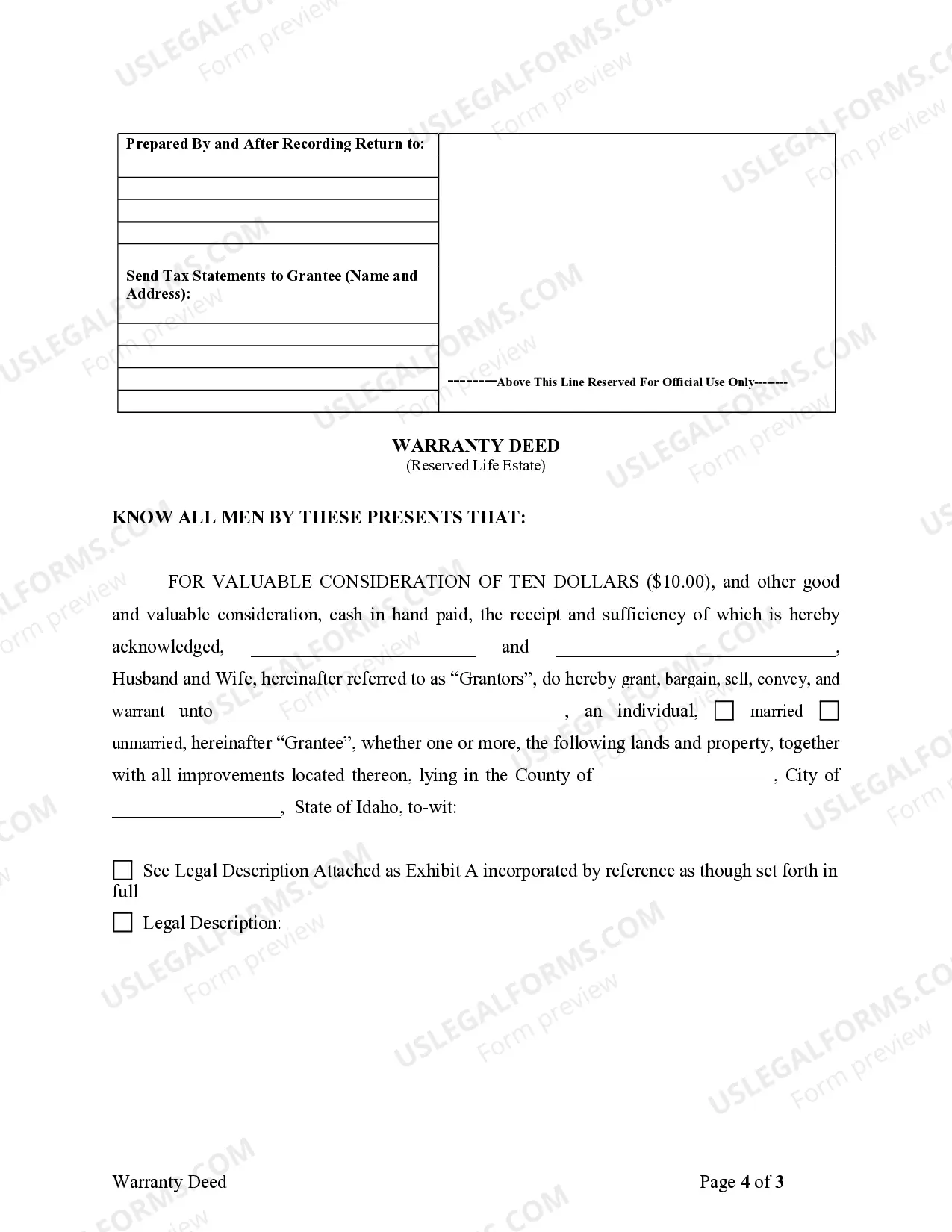

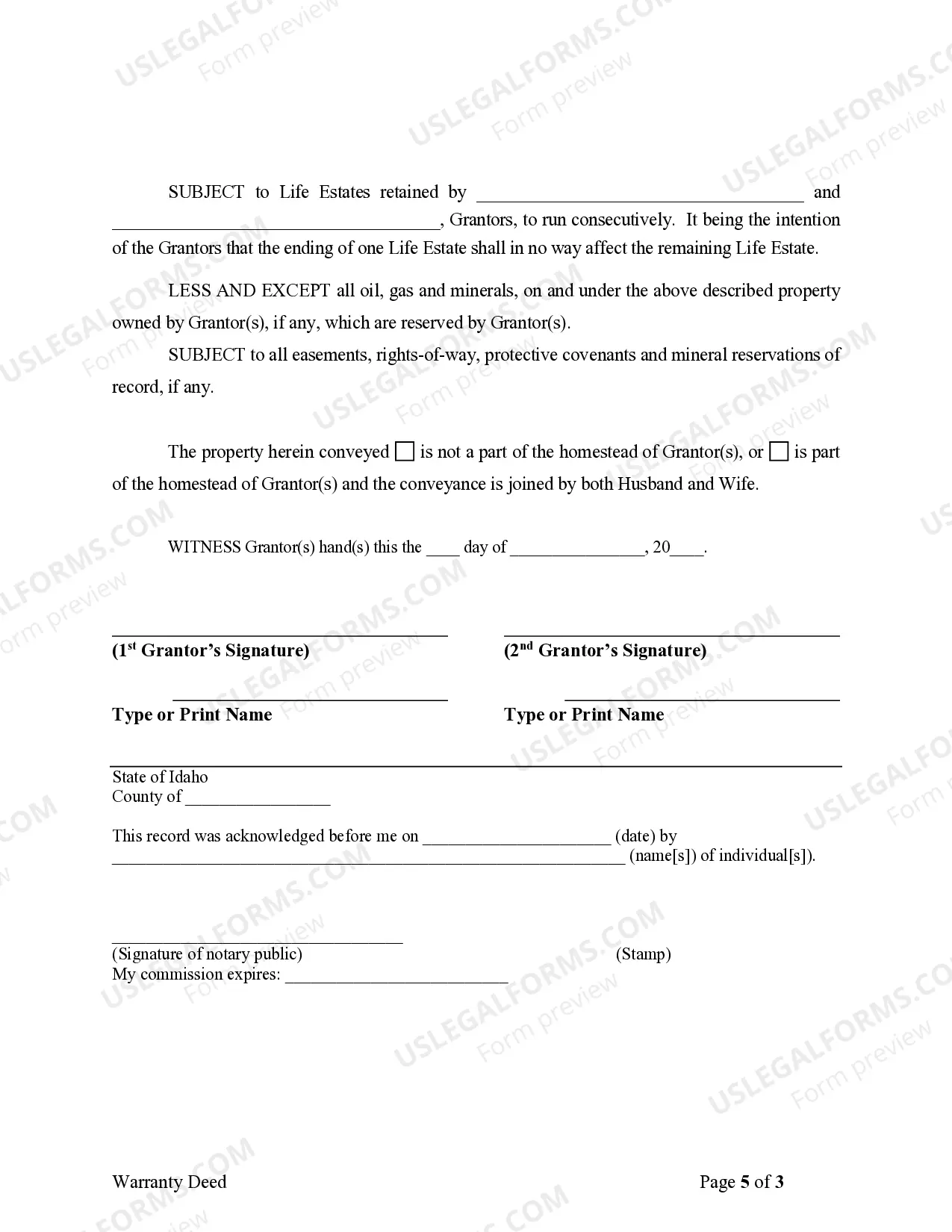

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Idaho Warranty Deed to Child Reserving a Life Estate in the Parents

Description Deed

How to fill out Warranty Estate Form?

Get access to one of the most holistic catalogue of authorized forms. US Legal Forms is actually a platform to find any state-specific form in clicks, such as Idaho Warranty Deed to Child Reserving a Life Estate in the Parents examples. No reason to waste hrs of your time looking for a court-admissible example. Our qualified experts make sure that you receive up-to-date samples every time.

To make use of the forms library, select a subscription, and sign up your account. If you already registered it, just log in and then click Download. The Idaho Warranty Deed to Child Reserving a Life Estate in the Parents file will quickly get kept in the My Forms tab (a tab for every form you save on US Legal Forms).

To create a new profile, follow the brief guidelines below:

- If you're going to use a state-specific sample, make sure you indicate the proper state.

- If it’s possible, review the description to understand all the nuances of the document.

- Utilize the Preview option if it’s accessible to take a look at the document's information.

- If everything’s correct, click Buy Now.

- Right after picking a pricing plan, register an account.

- Pay by credit card or PayPal.

- Save the sample to your computer by clicking on Download button.

That's all! You ought to fill out the Idaho Warranty Deed to Child Reserving a Life Estate in the Parents template and check out it. To be sure that all things are accurate, speak to your local legal counsel for support. Register and simply find around 85,000 valuable samples.

Id Life Estate Form popularity

Warranty Estate Application Other Form Names

Deed Contract FAQ

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner. Life estates can be used to avoid probate and to give a house to children without giving up the ability to live in it.

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

People typically consider a life estate deed because they like the idea of avoiding probate and/or they believe there is a chance that they might need to apply for Medicaid-covered long-term care in the future.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

A Life Estate may be created in real property or in personal property. It is a term used to describe ownership of an asset for the duration of the person's life. The owner of a Life Estate is called a 'life tenant'. The life tenant has the right to possession and enjoyment of the asset and its income until their death.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.