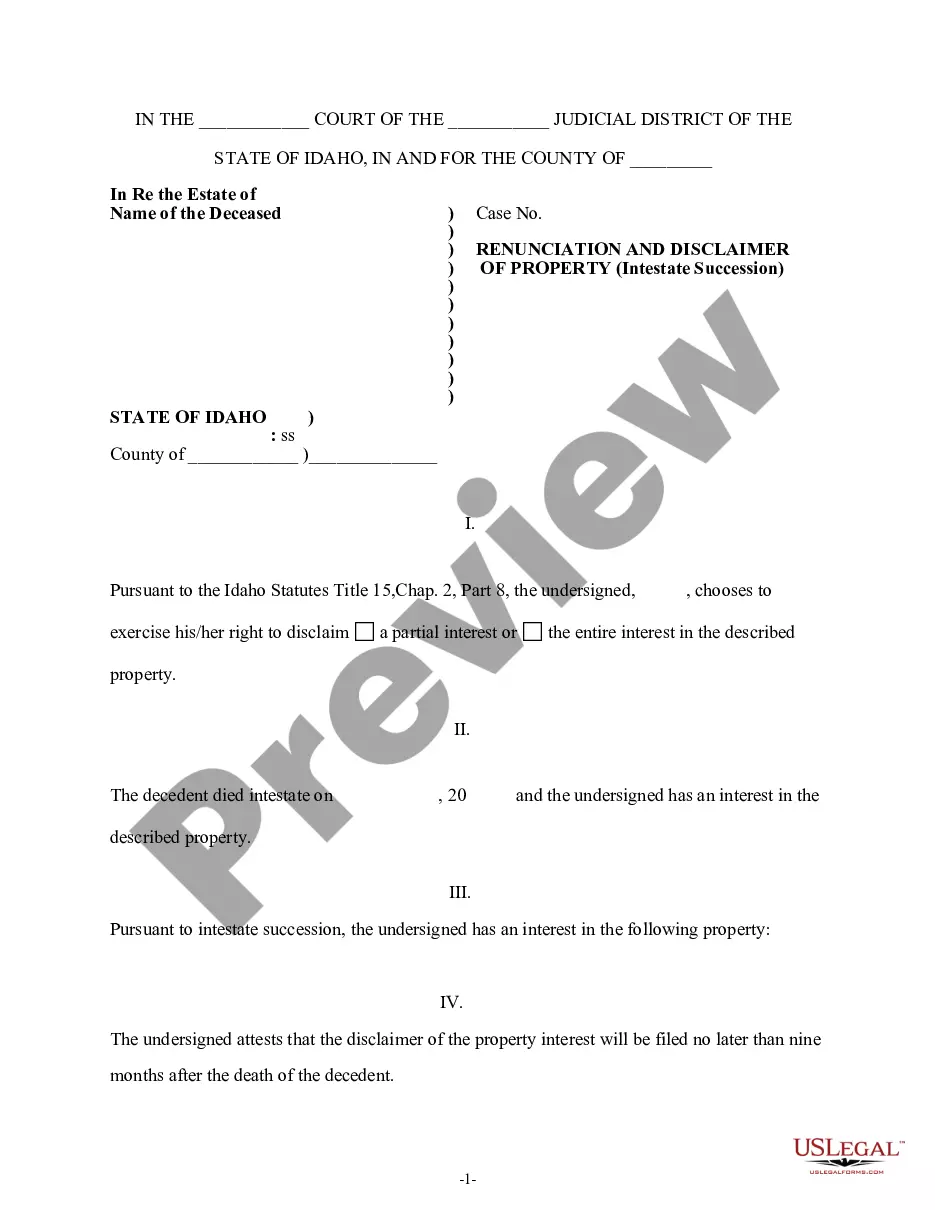

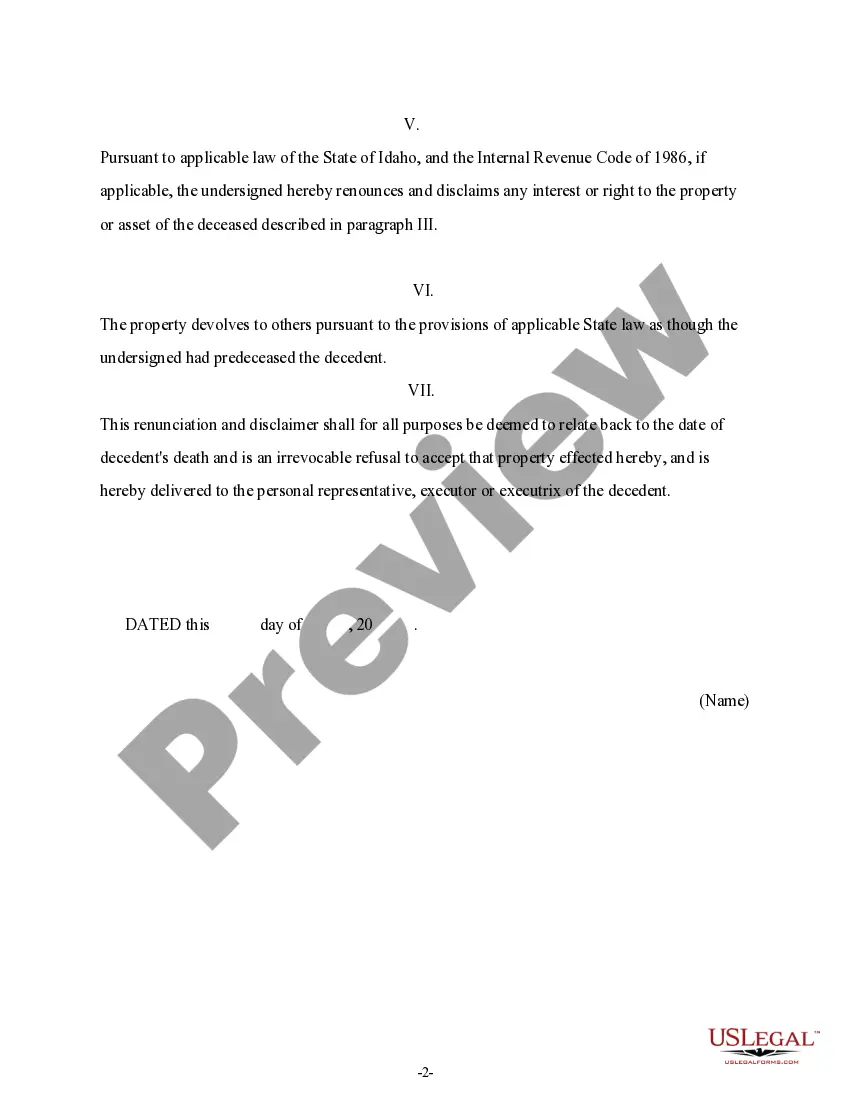

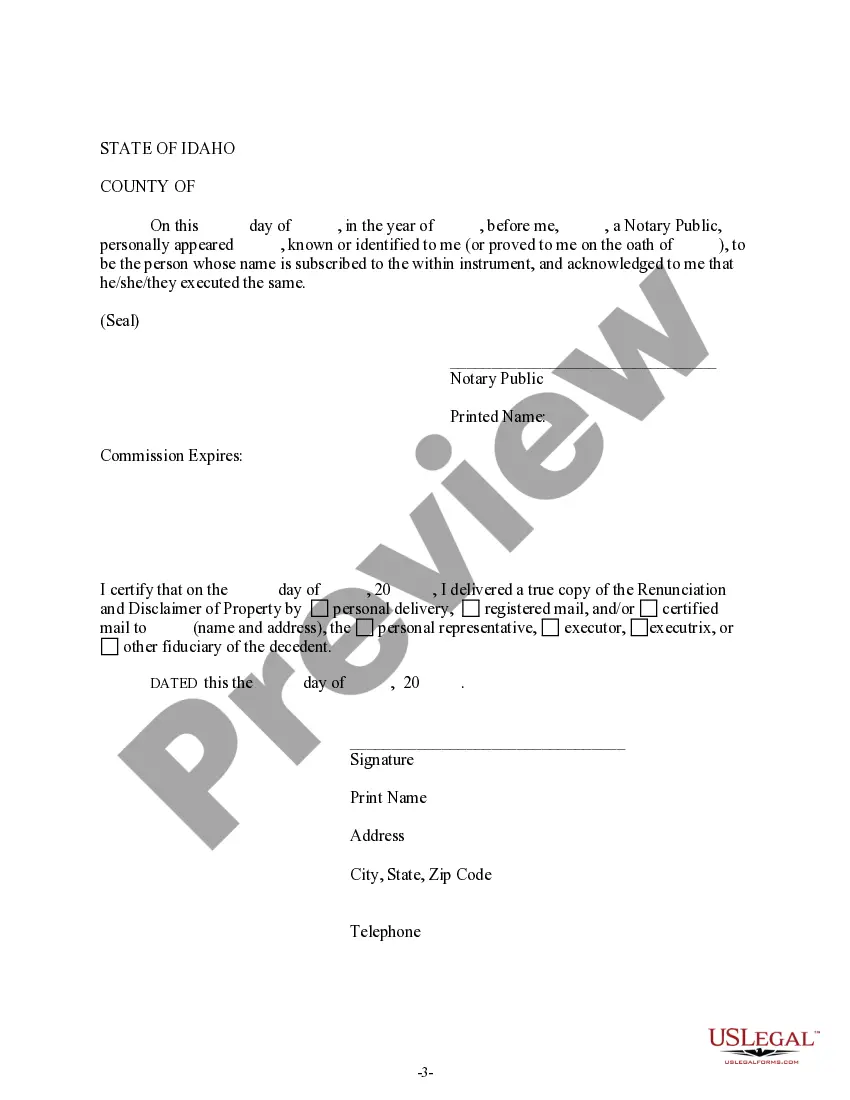

This form is a Renunciation and a Disclaimer of Property acquired by Intestate Succession. The decedent died intestate and the beneficiary gained an interest in the described property. However, pursuant to Idaho Statutes Title 15, Chap. 2, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest he/she has in the property. The disclaimer will relate back to the date of death of the decedent and will serve as an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Idaho Renunciation and Disclaimer of Property received by Intestate Succession

Description Idaho Succession

How to fill out Idaho Renunciation And Disclaimer Of Property Received By Intestate Succession?

Get access to one of the most extensive library of legal forms. US Legal Forms is really a solution where you can find any state-specific document in a few clicks, even Idaho Renunciation and Disclaimer of Property received by Intestate Succession examples. No reason to waste hrs of the time seeking a court-admissible sample. Our accredited pros ensure you get up-to-date examples all the time.

To take advantage of the documents library, pick a subscription, and sign up an account. If you created it, just log in and click on Download button. The Idaho Renunciation and Disclaimer of Property received by Intestate Succession file will instantly get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at simple recommendations listed below:

- If you're having to use a state-specific example, ensure you indicate the appropriate state.

- If it’s possible, go over the description to understand all the nuances of the form.

- Make use of the Preview function if it’s available to look for the document's information.

- If everything’s appropriate, click on Buy Now button.

- Right after picking a pricing plan, make an account.

- Pay by credit card or PayPal.

- Downoad the document to your device by clicking on Download button.

That's all! You should submit the Idaho Renunciation and Disclaimer of Property received by Intestate Succession form and double-check it. To make sure that everything is correct, contact your local legal counsel for help. Register and simply look through over 85,000 beneficial samples.

Form popularity

FAQ

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.