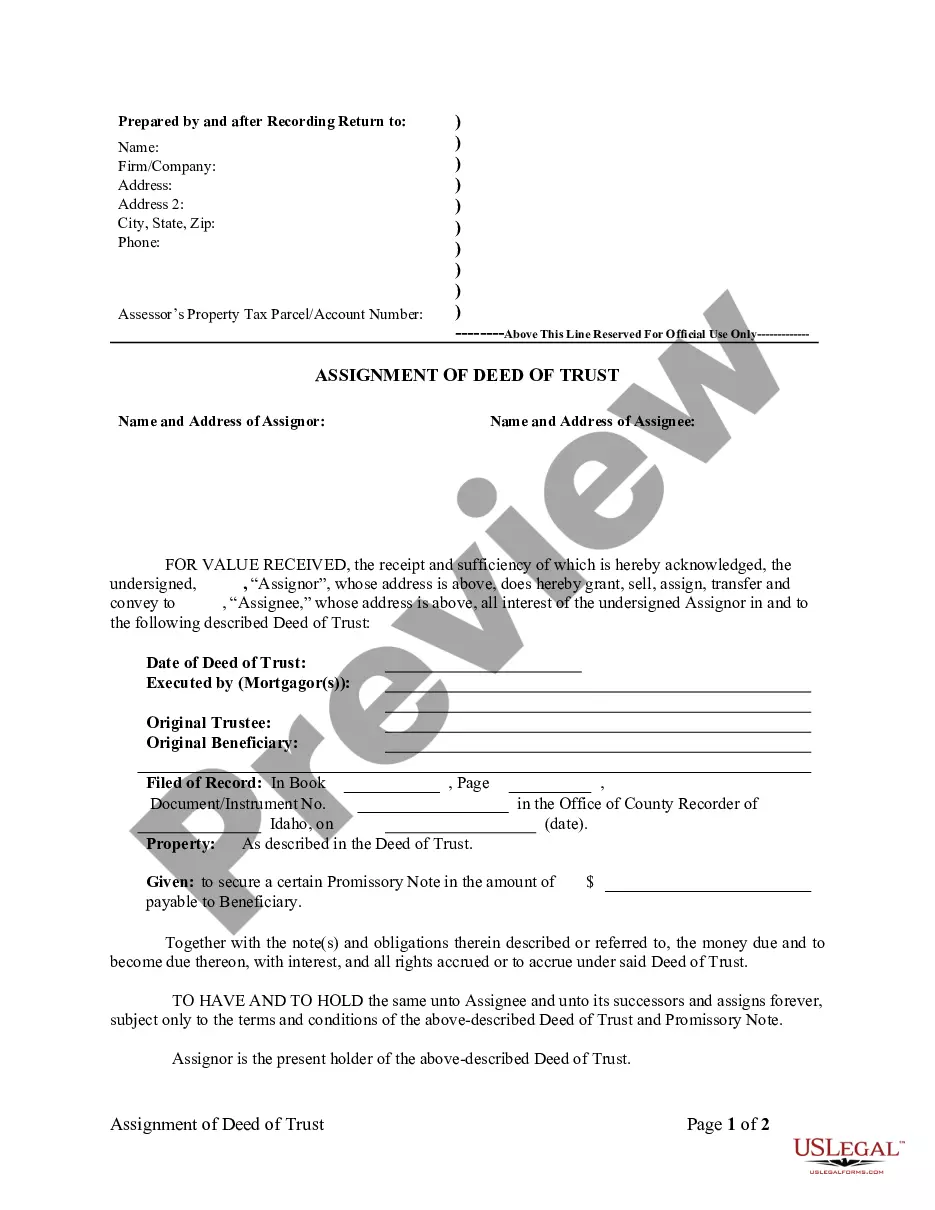

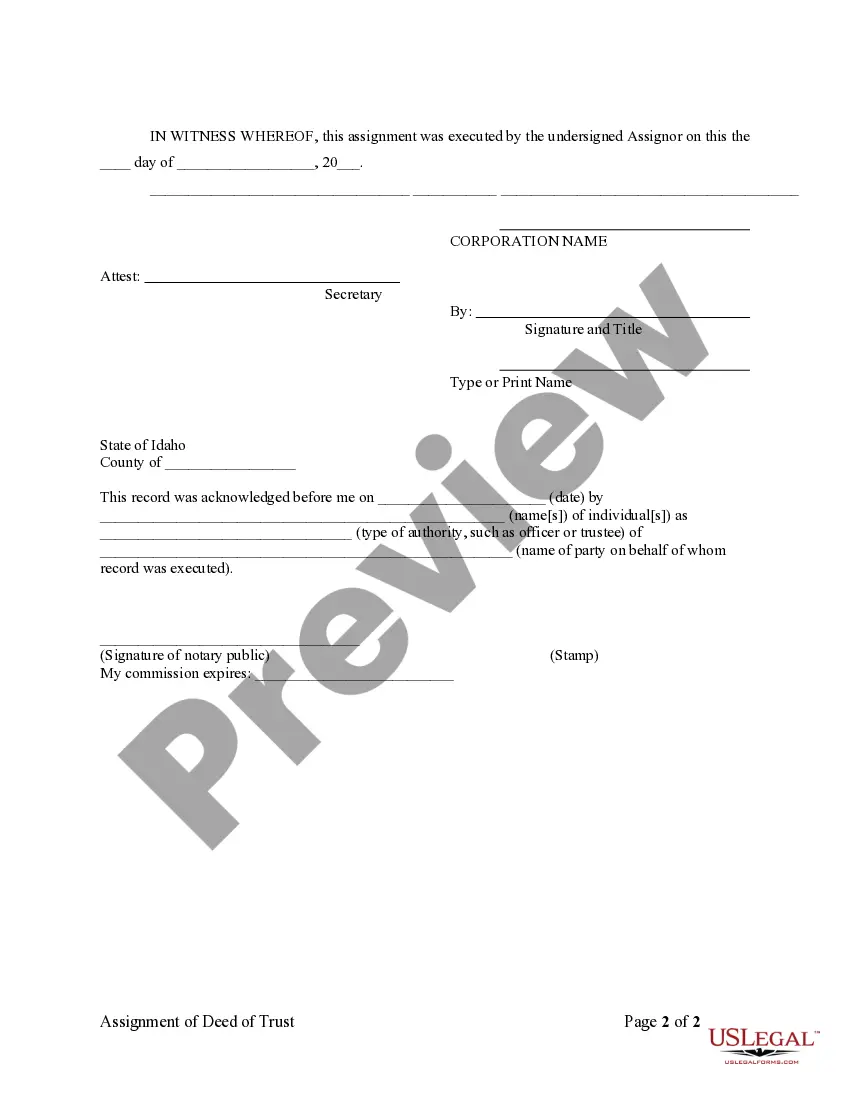

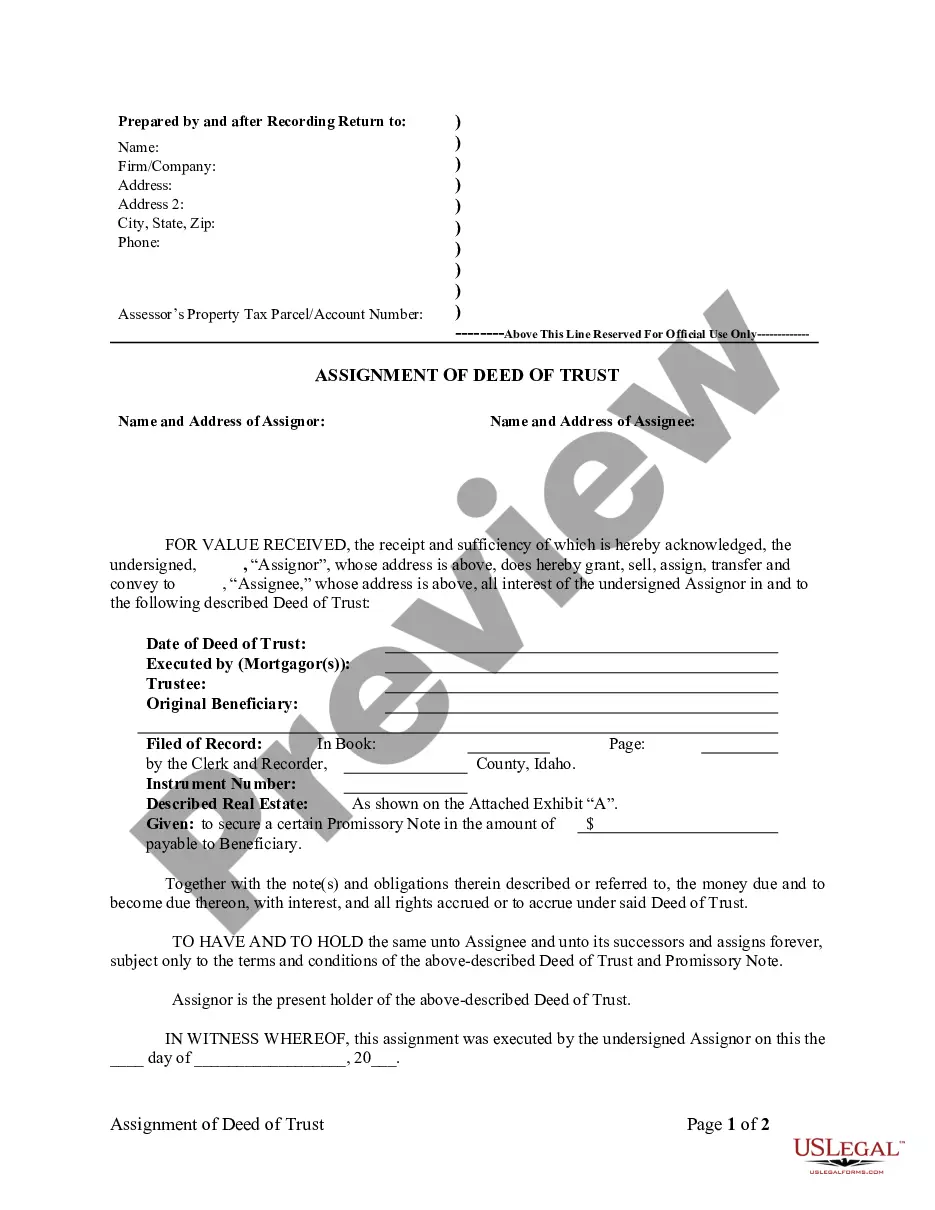

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Idaho Assignment of Deed of Trust by Corporate Mortgage Holder

Description What Is Corporate Assignment Of Deed Of Trust

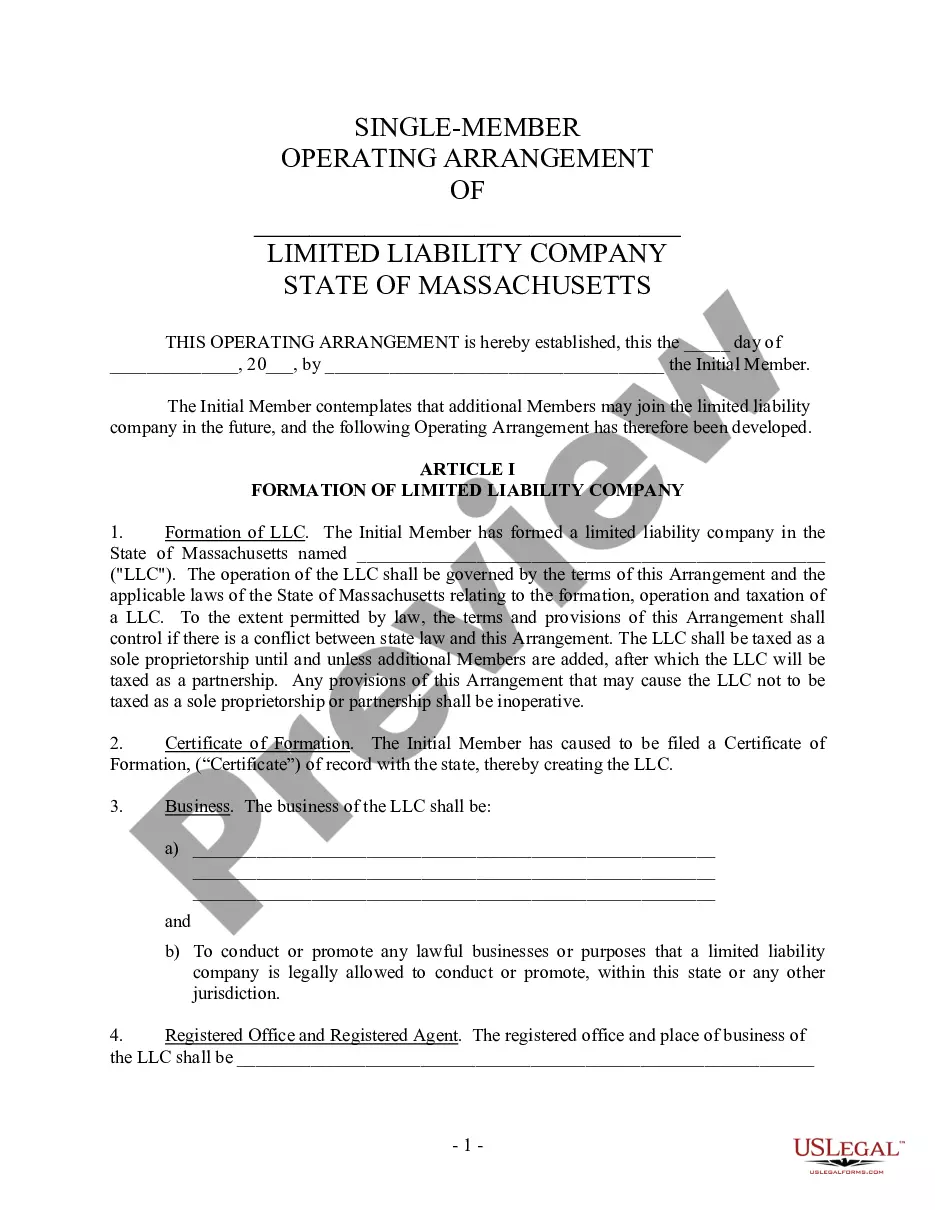

How to fill out Idaho Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Access one of the most extensive library of legal forms. US Legal Forms is really a solution to find any state-specific form in clicks, including Idaho Assignment of Deed of Trust by Corporate Mortgage Holder examples. No need to waste several hours of the time searching for a court-admissible sample. Our qualified specialists make sure that you receive updated examples every time.

To make use of the forms library, pick a subscription, and sign up an account. If you registered it, just log in and click on Download button. The Idaho Assignment of Deed of Trust by Corporate Mortgage Holder template will quickly get saved in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new profile, follow the quick recommendations below:

- If you're having to use a state-specific documents, ensure you indicate the correct state.

- If it’s possible, review the description to understand all the nuances of the document.

- Utilize the Preview option if it’s offered to look for the document's information.

- If everything’s right, click on Buy Now button.

- Right after choosing a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Downoad the document to your device by clicking Download.

That's all! You need to submit the Idaho Assignment of Deed of Trust by Corporate Mortgage Holder template and double-check it. To be sure that all things are accurate, contact your local legal counsel for help. Sign up and simply look through around 85,000 helpful templates.

Form popularity

FAQ

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Essentially, the Deed of Assignment (DOA) is a legal document that transfers the ownership of a property from one party to another.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

When a deed of trust is required by state law, it is just one of many forms the parties sign at the real estate closing. Typically, the deed of trust is prepared by the lender, who is agreeing to put up money to finance the buyer's purchase.

Idaho is one of a handful of states that use deeds of trust as the primary form of financing purchases of real property. A deed of trust, similar to a mortgage, is a security instrument that, along with a promissory note, sets out the terms for repaying the loan used to purchase the property.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)