Idaho Inventory and Appraisement

Understanding this form

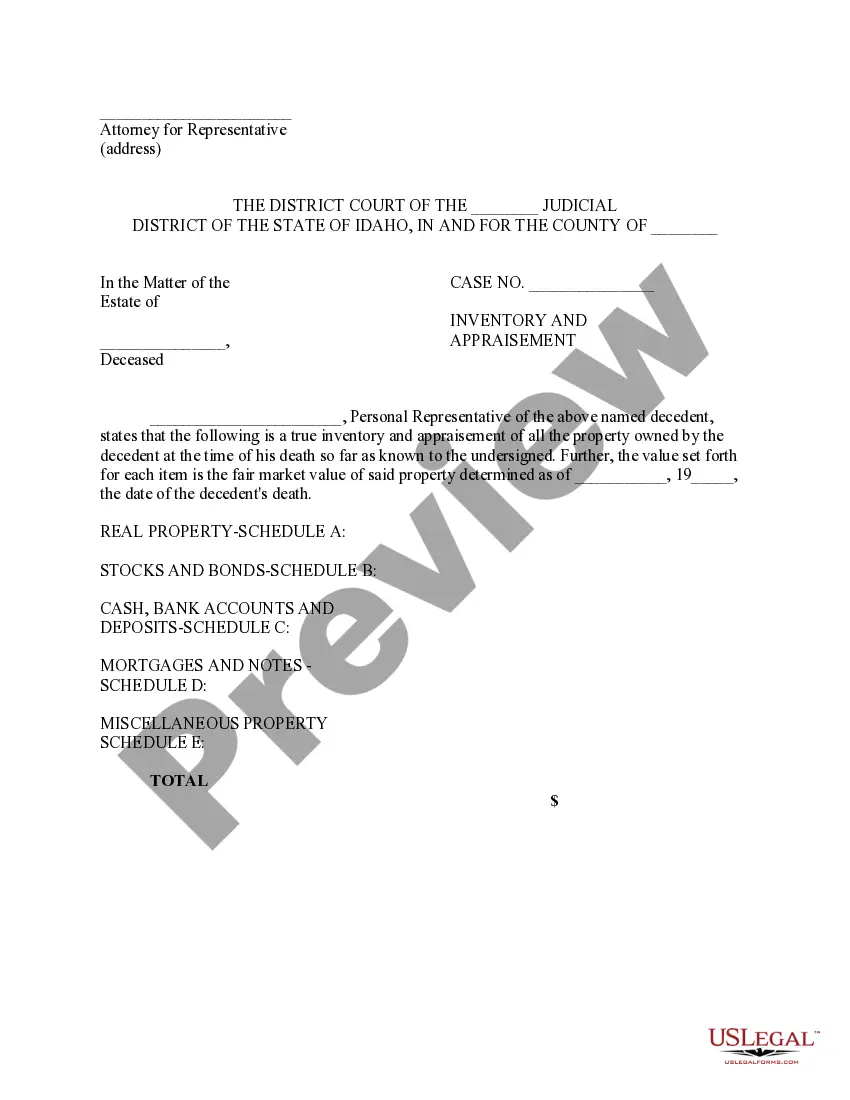

The Inventory and Appraisement is a legal document filed by the Personal Representative of an estate. Its primary purpose is to provide a detailed list of all assets and debts associated with a deceased person's estate. This form is essential for ensuring an accurate account of the estate's financial situation and differs from other estate planning documents by focusing specifically on inventorying assets and appraising their value as of the decedent's death.

What’s included in this form

- Personal Representative information: Details of the representative managing the estate.

- Estate details: Includes case number and court information pertinent to the decedent's estate.

- Real property: Schedule A for listing real estate owned by the decedent.

- Stocks and bonds: Schedule B for any financial investments held at the time of death.

- Cash and deposits: Schedule C for capturing bank accounts and liquid assets.

- Mortgages and notes: Schedule D for listing outstanding debts associated with property.

- Miscellaneous property: Schedule E for other types of personal property owned by the decedent.

When to use this form

This form should be used when settling the estate of a deceased individual. It is typically required when filing with the court shortly after the death, particularly in probate proceedings. Utilizing the Inventory and Appraisement helps facilitate the accurate allocation of assets to heirs and creditors, making it a crucial step in estate administration.

Who needs this form

- Personal Representatives: Individuals designated to manage the estate of the deceased.

- Heirs and beneficiaries: Those entitled to inherit assets may benefit from understanding the estate's administration.

- Attorneys: Legal professionals assisting clients with probate and estate matters.

Instructions for completing this form

- Identify the Personal Representative by entering their name and address at the top of the form.

- Fill in the case number and court details specific to the estate.

- List all real property, including addresses and descriptions, in Schedule A.

- Enumerate stocks and bonds held by the decedent in Schedule B, including quantities and values.

- Document cash, bank accounts, and other deposits in Schedule C, providing account numbers and current balances.

- Record any outstanding mortgages and notes in Schedule D, ensuring to include details of debts owed.

- For miscellaneous property, add any remaining assets in Schedule E, providing descriptions and values.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Typical mistakes to avoid

- Failing to include all assets and debts which can lead to disputes among heirs.

- Underestimating or overestimating asset values which may cause legal complications.

- Not updating the form if new assets are discovered after the initial filing.

- Omitting the required signatures of the Personal Representative.

Advantages of online completion

- Convenience: Downloadable forms are available anytime, accommodating your schedule.

- Editability: Easily fill out the form at your own pace and make changes before finalizing.

- Reliability: Documents provided are drafted by licensed attorneys to ensure legal validity.

Key takeaways

- The Inventory and Appraisement is a crucial document in the estate administration process.

- Accurate and thorough reporting of assets and debts is necessary for effective probate proceedings.

- Understanding the specific requirements of your state can ensure compliance and prevent delays.

Form popularity

FAQ

Real Estate, Bank Accounts, and Vehicles. Stocks and Bonds. Life Insurance and Retirement Plans. Wages and Business Interests. Intellectual Property. Debts and Judgments.

An inventory and appraisement is a list of all real and personal property as well as debts and liabilities claimed by each spouse. This list will include separate property, community property, and debts that you and your spouse have.

In general, an estate inventory checklist will include financial assets that belonged to the deceased.The financial information must also include the deceased's debts, such as credit card bills, student loans, alimony, child support and medical bills.

Life insurance or 401(k) accounts where a beneficiary was named. Assets under a Living Trust. Funds, securities, or US savings bonds that are registered on transfer on death (TOD) or payable on death (POD) forms. Funds held in a pension plan.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

A probate inventory was taken shortly after an individual's death by two or more people, described as 'appraisers'.They also excluded debts owed by the deceased, although sometimes record debts owing to the deceased. Appraisers often identified goods by room, thus providing evidence of both rooms and room use.

An estate is everything comprising the net worth of an individual, including all land and real estate, possessions, financial securities, cash, and other assets that the individual owns or has a controlling interest in.