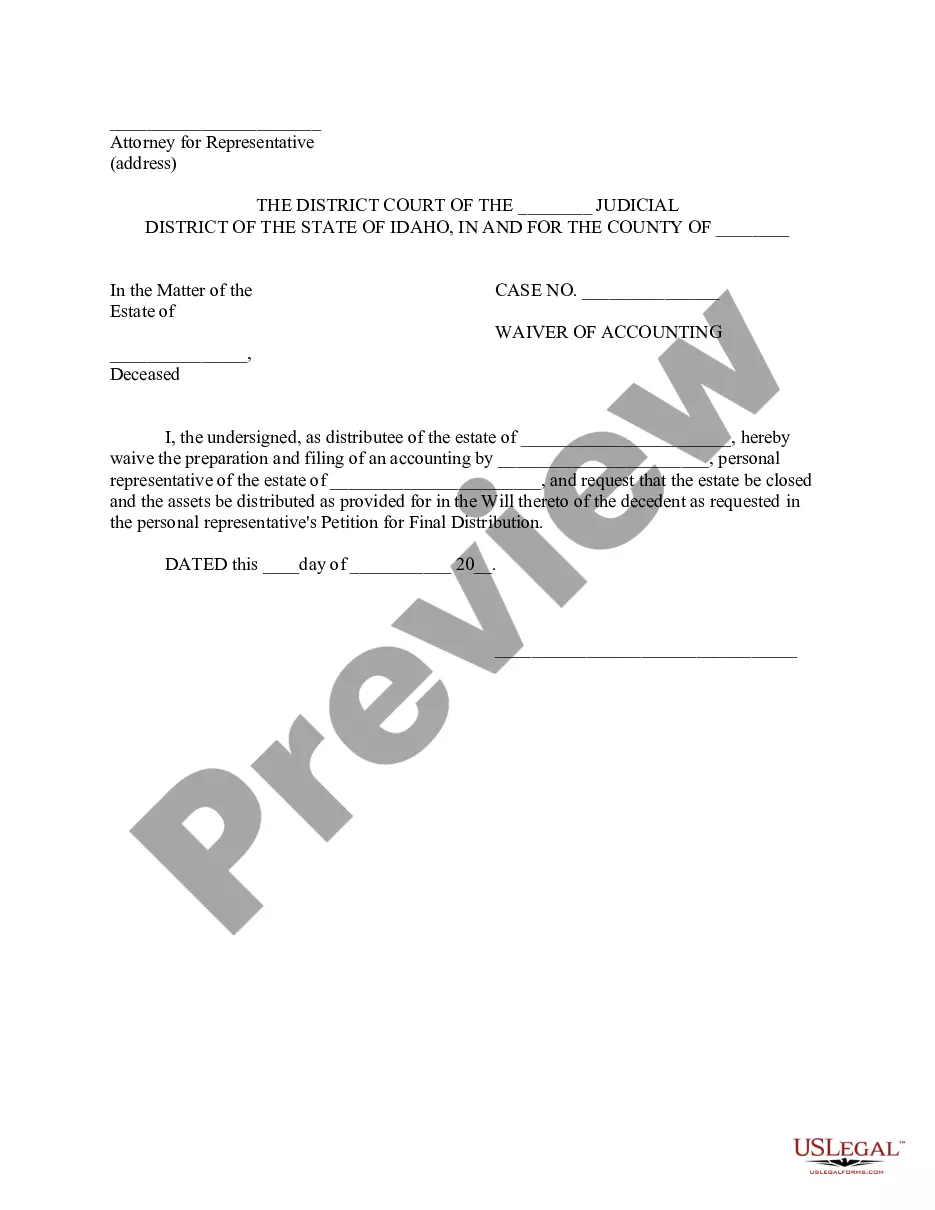

Waiver of Accounting: A Waiver of Accounting is filed by an heir to the estate. It states that he/she waives the right for an accounting of the estate's assets and debts, filed by the Personal Representaive. Instead, he/she states that the distribution of the assets, as provided for in the deceased's will, is acceptable. This form is available in both Word and Rich Text formats.

Idaho Waiver of Accounting

Description

Key Concepts & Definitions

Waiver of Accounting: A legal document in which beneficiaries of a trust or an estate choose to waive their right to a formal accounting of assets by the trustee or executor. This waiver is typically used to simplify and expedite settlements, reduce administrative costs, and minimize potential conflicts among beneficiaries.

Step-by-Step Guide on How to Implement a Waiver of Accounting

- Discuss with Legal Advisor: Consult with an estate lawyer to understand the implications of signing a waiver of accounting.

- Review the Trust or Estate Documents: Examine the documents to ensure understanding of what is included in the estate or trust.

- Communicate with All Beneficiaries: Ensure all beneficiaries are informed and in agreement about the decision to waive the accounting.

- Prepare the Waiver: Have your legal advisor draft the waiver document, clearly stating the relinquishment of the right to the formal accounting.

- Sign the Waiver: All beneficiaries should sign the waiver in the presence of a notary to ensure legality.

- File the Waiver: The signed waiver should be filed with the relevant court or entity overseeing the estate or trust administration.

Risk Analysis of Waiving Accounting

- Potential for Mismanagement: Without a formal accounting, there is less oversight, which could potentially lead to mismanagement or misuse of assets.

- Future Disputes: Beneficiaries might later dispute the distribution of assets due to lack of transparency or perceived unfairness.

- Legal Risks: If improper management is discovered later, beneficiaries might face legal challenges or complications in rectifying the situation.

Key Takeaways

Waiving accounting in the context of trust or estate management can lead to faster settlements and lower administration costs, but it carries risks such as potential for mismanagement and future disputes. Legal consultation is strongly advised.

How to fill out Idaho Waiver Of Accounting?

Access the most extensive catalogue of authorized forms. US Legal Forms is a solution where you can find any state-specific document in a few clicks, even Idaho Waiver of Accounting templates. No reason to spend time of your time seeking a court-admissible example. Our certified specialists make sure that you receive up to date documents all the time.

To leverage the forms library, pick a subscription, and sign up your account. If you already did it, just log in and then click Download. The Idaho Waiver of Accounting file will instantly get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at quick recommendations below:

- If you're having to utilize a state-specific documents, make sure you indicate the appropriate state.

- If it’s possible, look at the description to know all the nuances of the document.

- Use the Preview option if it’s available to look for the document's information.

- If everything’s correct, click on Buy Now button.

- After selecting a pricing plan, make your account.

- Pay out by card or PayPal.

- Downoad the example to your computer by clicking on Download button.

That's all! You need to complete the Idaho Waiver of Accounting template and double-check it. To make sure that all things are correct, contact your local legal counsel for help. Register and simply look through above 85,000 valuable templates.

Form popularity

FAQ

With Informal probate, an Application (along with the decedent's original will) and Acceptance are typically filed with the court by the person nominated as Personal Representative, and then the court signs and issues (without a formal hearing) a Statement and Letters Testamentary (if the decedent had a will) or

To get a contempt finding, you must usually file a court document called a "motion for an order to show cause." That puts the burden on the parent who isn't following the custody or visitation order to explain to the court the reasons why he or she should not be held in contempt.

Formal probate involves a petition , a hearing or trial before a Judge or Court Commissioner who resolves the issues with a final court order . Informal Probate only requires an application, no hearing or trial, and is administered by a court official known as the Probate Registrar .

First, a probate is required in Idaho anytime an estate has a value of $100,000 or more regardless of the property that is contained in the estate.Second, a probate is required in Idaho anytime an estate holds any real property, regardless of the value of the real property. (Idaho Code § 15-3-711.)

The lawyer who represents the Executor typically asks the beneficiaries to waive their right to an accounting to save the estate the cost of paying for an accounting and report by the Executor of what s/he did while in that position.

Contempt proceedings can be initiated either by filing an application or by the court itself suo moto. In both the cases, contempt proceedings must be initiated within one year from the date on which contempt is alleged to have been committed.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Waiver simplifies the closing of the estate.

In Idaho, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).