Idaho Chapter 13 Plan

Description

How to fill out Idaho Chapter 13 Plan?

Trying to find Idaho Chapter 13 Plan forms and filling out them can be quite a challenge. In order to save time, costs and effort, use US Legal Forms and find the correct example specifically for your state in a couple of clicks. Our legal professionals draw up every document, so you simply need to fill them out. It is really that easy.

Log in to your account and come back to the form's page and download the document. All of your downloaded templates are kept in My Forms and they are available always for further use later. If you haven’t subscribed yet, you need to sign up.

Have a look at our detailed recommendations on how to get your Idaho Chapter 13 Plan form in a few minutes:

- To get an eligible example, check out its validity for your state.

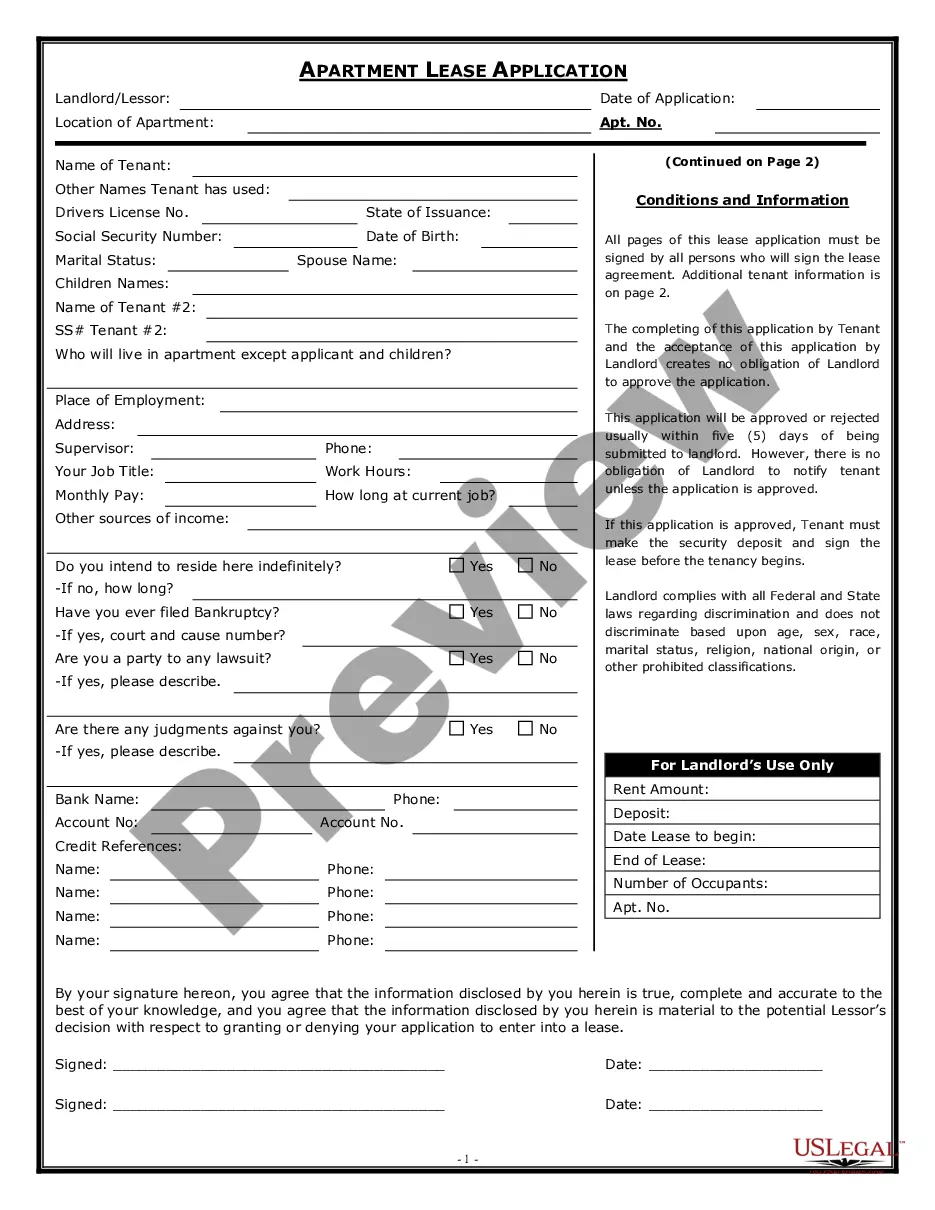

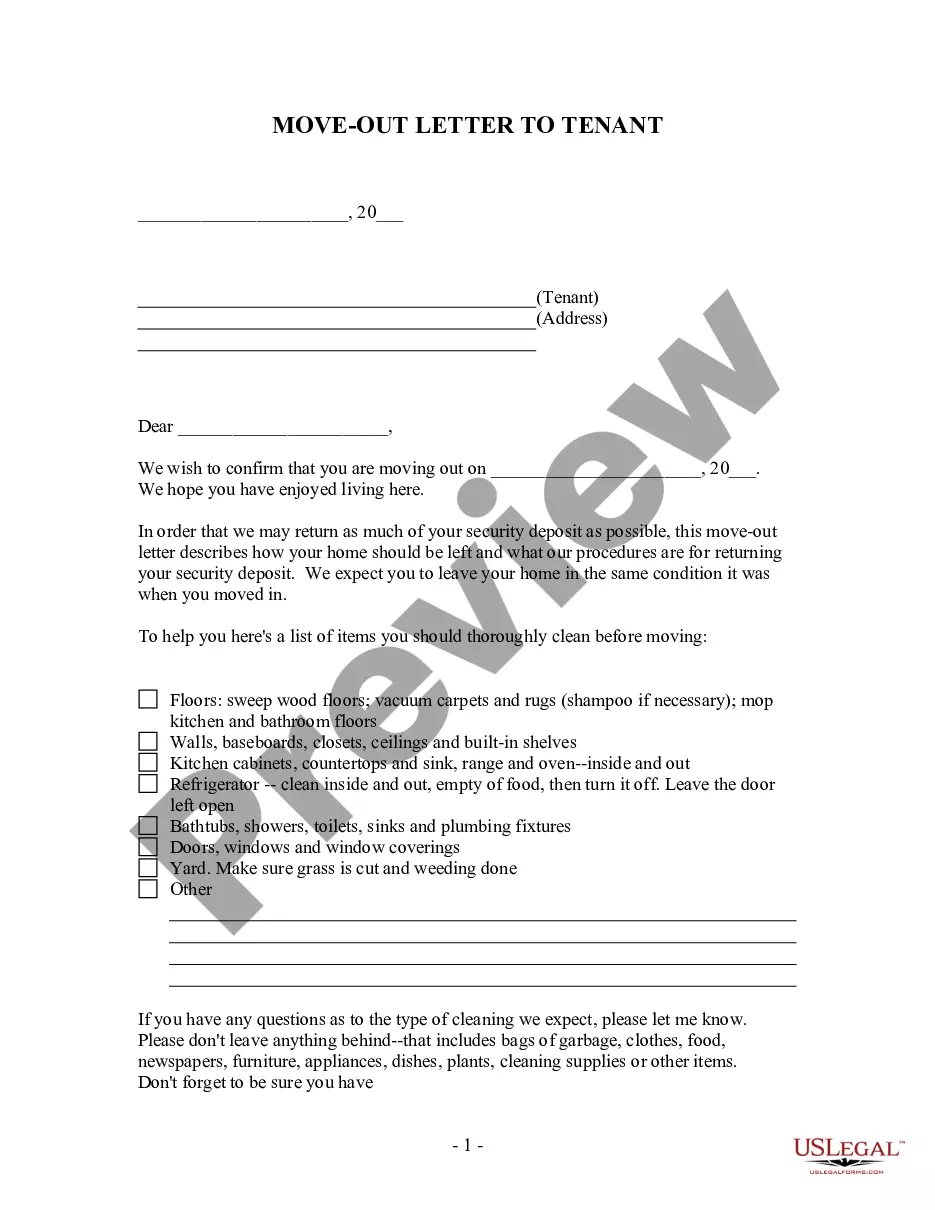

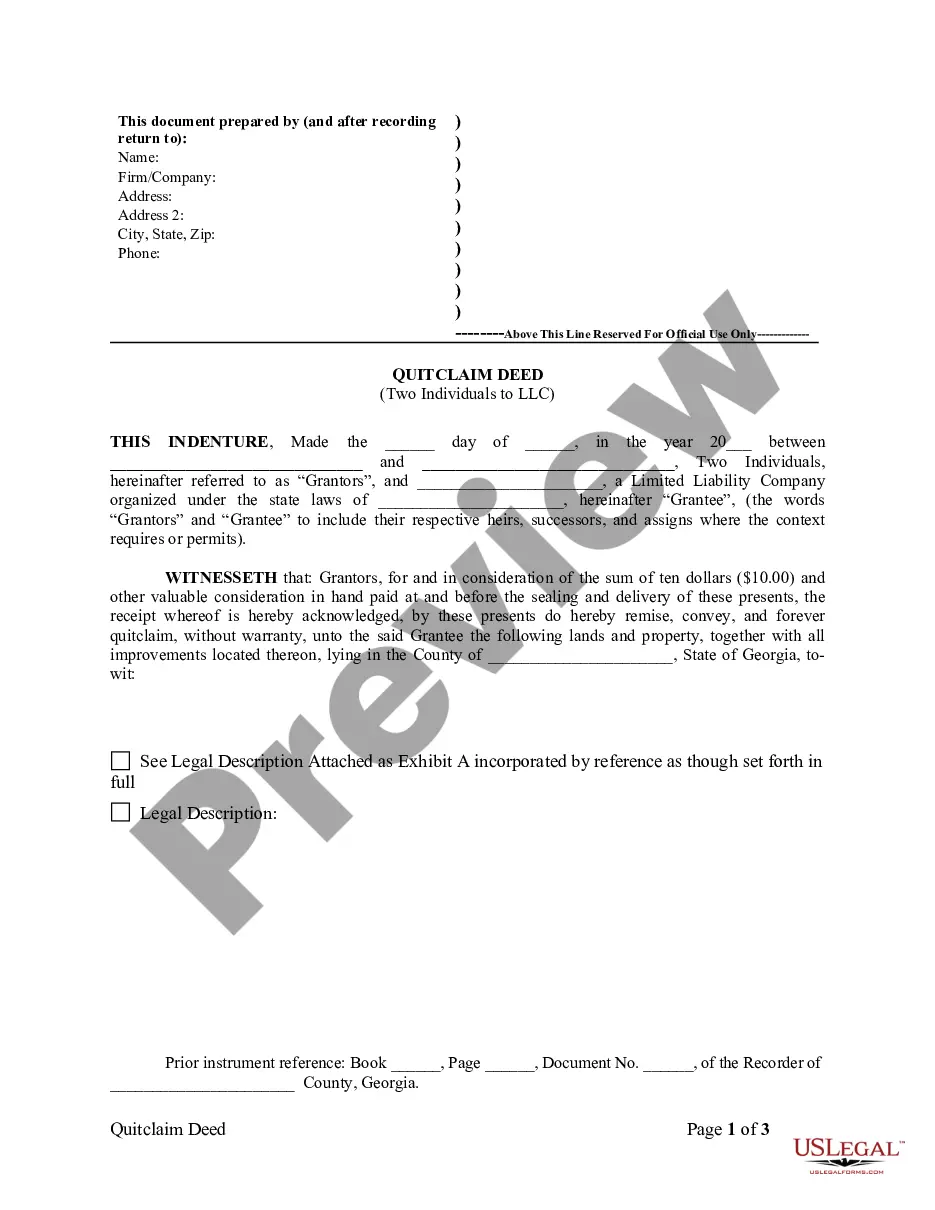

- Look at the sample making use of the Preview option (if it’s offered).

- If there's a description, read through it to know the important points.

- Click on Buy Now button if you found what you're trying to find.

- Choose your plan on the pricing page and make an account.

- Pick how you wish to pay out by way of a credit card or by PayPal.

- Save the form in the favored file format.

You can print the Idaho Chapter 13 Plan template or fill it out using any web-based editor. No need to concern yourself with making typos because your sample can be employed and sent, and printed out as many times as you would like. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Chapter 13 typically lasts for 3 to 5 years and involves a repayment plan, where you pay some or all of the money owed to your creditors over the length of the plan. Written by Attorney Eva Bacevice. A Chapter 13 bankruptcy case will typically take between three and five years to complete.

You should disclose any payments to insiders on your Statement of Financial Affairs (Official Form 107). Bankruptcy trustees will also look through your bank statements to see your cash deposits and withdrawals. Any large deposits in your account should be accounted for.

To qualify for Chapter 13 bankruptcy: You must have regular income. Your unsecured debt cannot exceed $394,725, and your secured debt cannot exceed $1,184,200. You must be current on tax filings.

You take and complete a credit counseling course. You'll prepare the bankruptcy petition and the proposed Chapter 13 plan. You file your bankruptcy petition, proposed plan, and other required documents. The court appoints a bankruptcy trustee to administer your case. The automatic stay takes effect.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

Debts You Must Pay in Full Through Your Plan. Add up the following debts and divide by the number of months your plan will last. Secured Debt Payments on Property You Want to Keep. Unsecured Debts. Length of Your Repayment Plan.

Chapter 13 allows you to keep all of your assets, even if you have $1 million in cash in the bank. In return, the court asks you to pay at least some of your debt back over the next three or five years.

Generally speaking, the funds you have in your bank accounts are safe when you file for Chapter 13 bankruptcy.Chapter 13 also allows debtors to keep bank account funds in excess of the allowable exemption amount provided the excess amounts are worked into the Chapter 13 plan and paid back over the life of the plan.