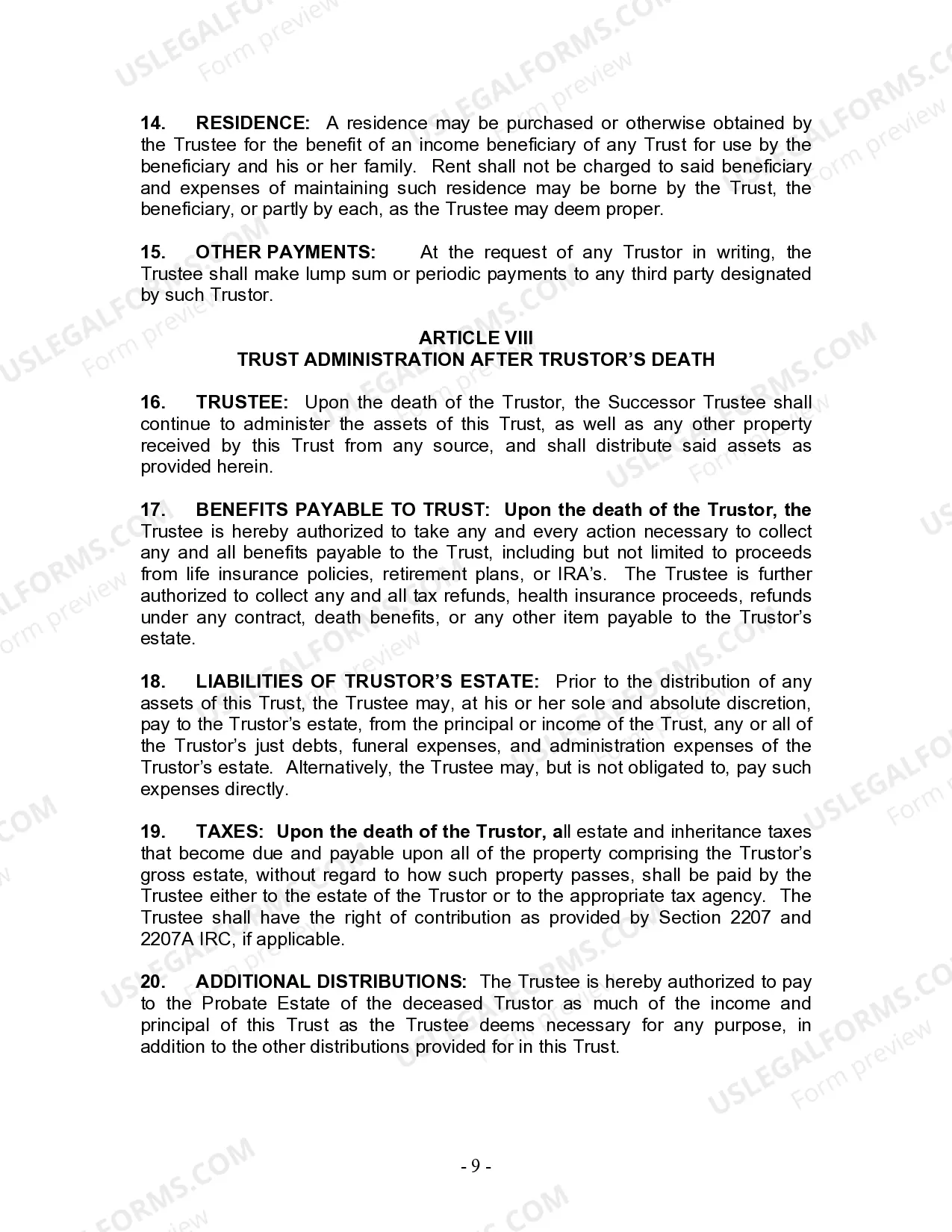

Idaho Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Idaho Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

In search of Idaho Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children forms and filling out them might be a problem. To save lots of time, costs and energy, use US Legal Forms and find the appropriate example specifically for your state in just a couple of clicks. Our lawyers draw up every document, so you just need to fill them out. It truly is that simple.

Log in to your account and come back to the form's page and download the document. All your downloaded samples are stored in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you should sign up.

Take a look at our detailed instructions concerning how to get the Idaho Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children template in a couple of minutes:

- To get an eligible form, check its validity for your state.

- Look at the example utilizing the Preview function (if it’s offered).

- If there's a description, go through it to learn the important points.

- Click on Buy Now button if you identified what you're looking for.

- Choose your plan on the pricing page and create your account.

- Select you want to pay out by a credit card or by PayPal.

- Download the form in the favored format.

Now you can print the Idaho Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children template or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your template may be used and sent, and printed out as often as you wish. Try out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

First, a probate is required in Idaho anytime an estate has a value of $100,000 or more regardless of the property that is contained in the estate.Second, a probate is required in Idaho anytime an estate holds any real property, regardless of the value of the real property. (Idaho Code § 15-3-711.)

If someone dies without a will, the money in his or her bank account will still pass to the named beneficiary or POD for the account.The executor has to use the funds in the account to pay any of the estate's creditors and then distributes the money according to local inheritance laws.

If you die without a will in Idaho, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Idaho must consider them your children, legally.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

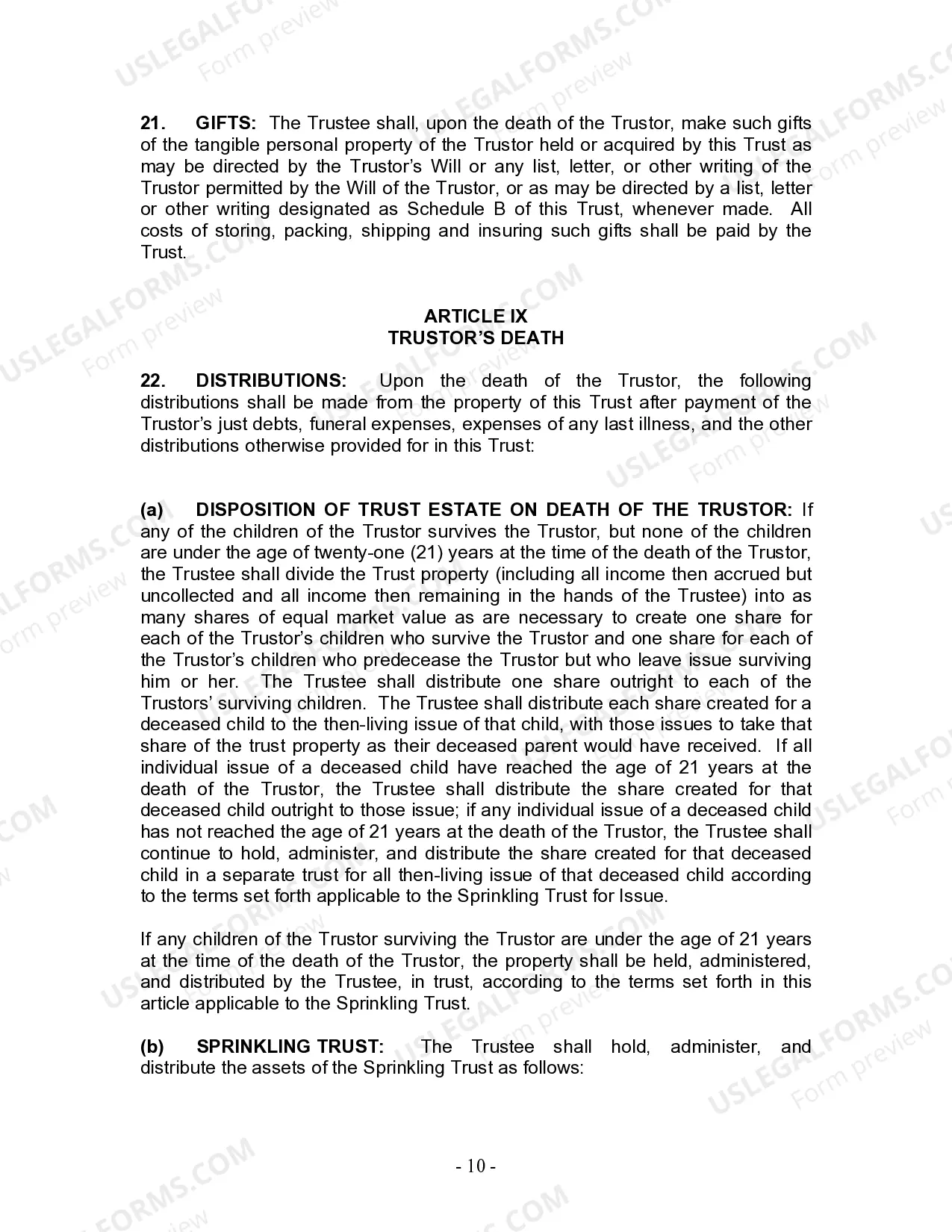

In Idaho, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

The decision to draft your own will should be made hesitantly and only after careful consideration. Idaho law recognizes handwritten wills, referred to as holographic wills. Material provisions of the will and the signature must be in the handwriting of the person making the will.