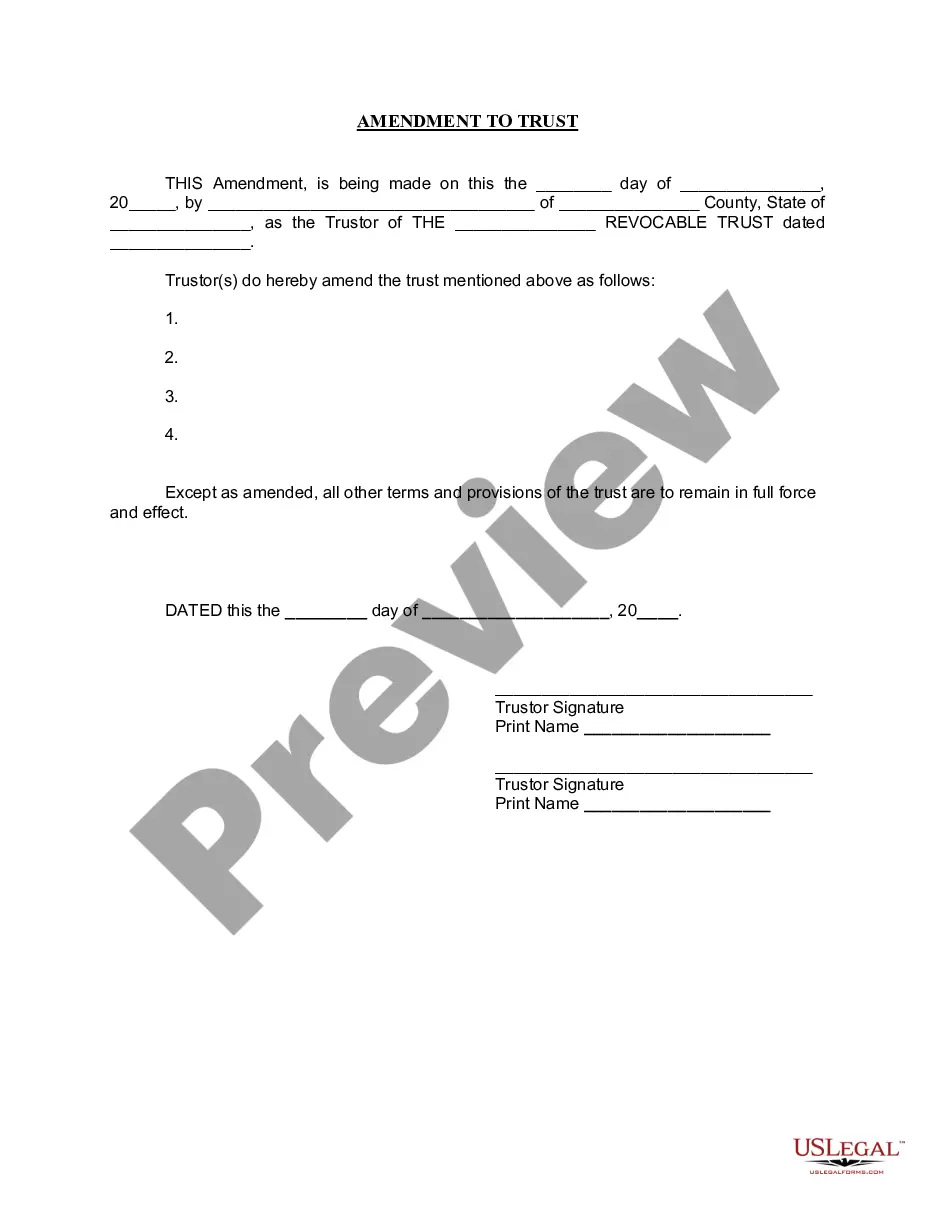

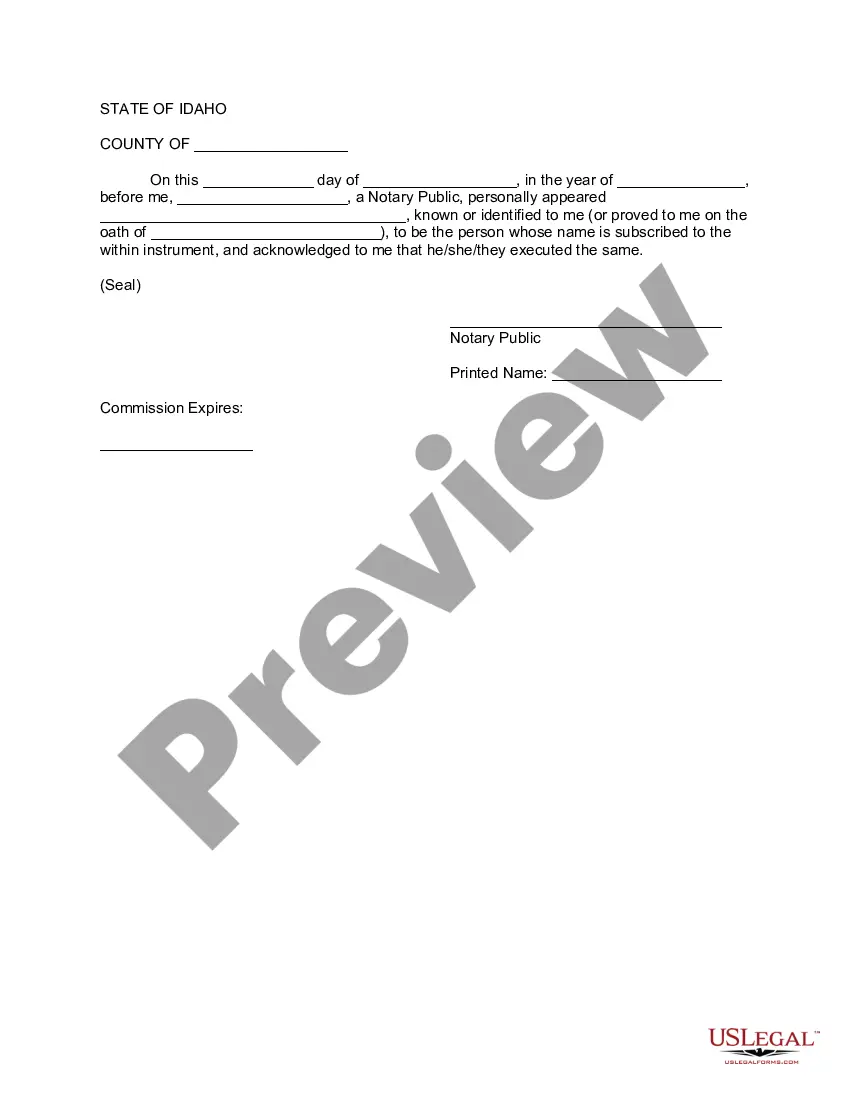

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Idaho Amendment to Living Trust

Description Id Living Trust

How to fill out Idaho Amendment To Living Trust?

Looking for Idaho Amendment to Living Trust templates and filling out them could be a challenge. To save lots of time, costs and effort, use US Legal Forms and choose the right example specially for your state in just a couple of clicks. Our attorneys draft all documents, so you just need to fill them out. It is really so simple.

Log in to your account and return to the form's web page and save the document. All of your saved samples are kept in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you should register.

Take a look at our thorough instructions on how to get the Idaho Amendment to Living Trust sample in a few minutes:

- To get an qualified sample, check its validity for your state.

- Take a look at the example using the Preview option (if it’s accessible).

- If there's a description, read through it to understand the specifics.

- Click on Buy Now button if you found what you're looking for.

- Select your plan on the pricing page and create your account.

- Pick how you want to pay out with a card or by PayPal.

- Save the sample in the favored format.

You can print the Idaho Amendment to Living Trust template or fill it out using any online editor. Don’t concern yourself with making typos because your sample may be utilized and sent, and published as many times as you wish. Check out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Trust Amendment Form Form popularity

Idaho Living Trust Forms Other Form Names

FAQ

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.