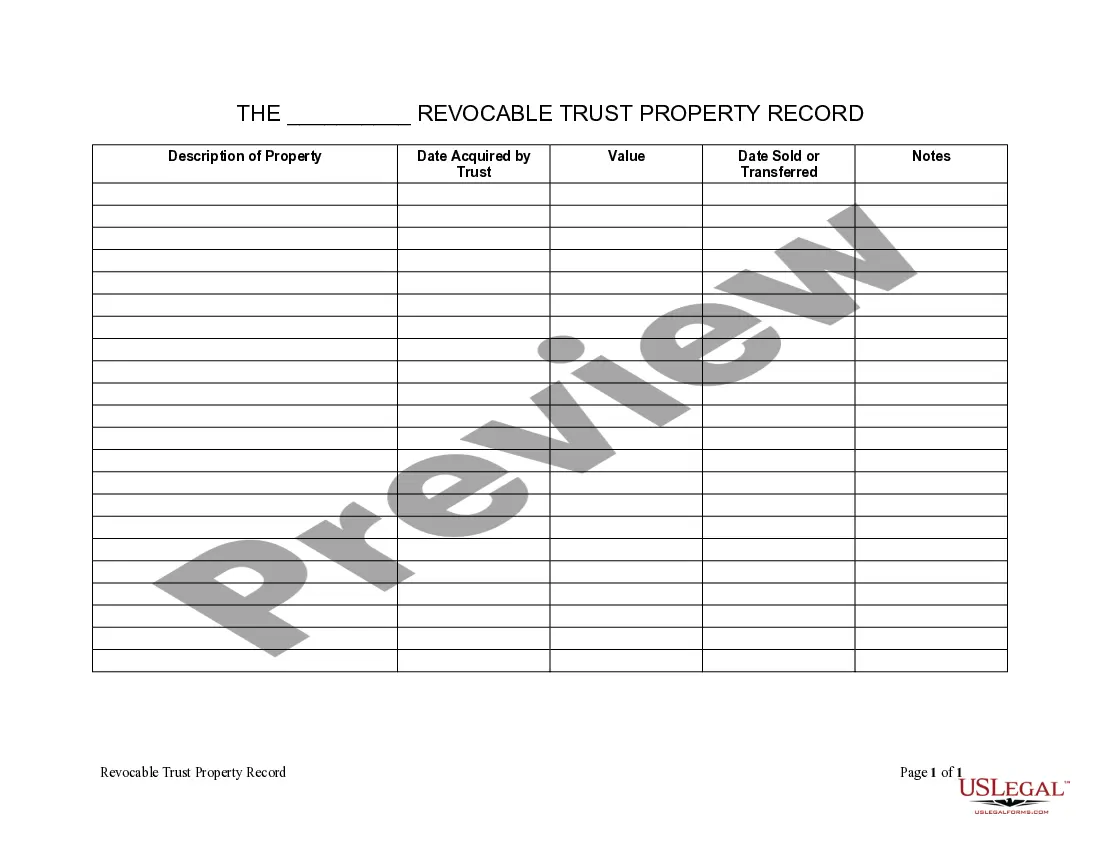

Idaho Living Trust Property Record

Description

How to fill out Idaho Living Trust Property Record?

Locating Idaho Living Trust Property Record forms and completing them can be rather challenging.

To conserve time, money, and effort, utilize US Legal Forms and discover the appropriate template tailored for your state with just a few clicks.

Our lawyers prepare all documents, so you merely need to complete them. It is truly that simple.

Click Buy Now if you have found what you need. Select your chosen plan on the pricing page and create an account. Choose whether to pay via card or PayPal. Download the sample in your preferred format. You can print the Idaho Living Trust Property Record form or complete it using any online editor. There’s no need to worry about typos because your template can be utilized and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the template.

- All of your stored samples are maintained in My documents and they remain accessible at all times for future use.

- If you haven’t registered yet, you must sign up.

- Examine our extensive instructions on how to obtain the Idaho Living Trust Property Record template in a few minutes.

- To acquire a valid form, verify its legality for your state.

- Preview the sample using the Preview option (if it’s offered).

- If there is a description, read it to understand the key points.

Form popularity

FAQ

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Trusts Are Not Public Record.However, trusts aren't recorded. Not having to file the trust with the court is one of the biggest benefits of a trust because it keeps the settlement a private matter between the successor trustees and trust beneficiaries.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.