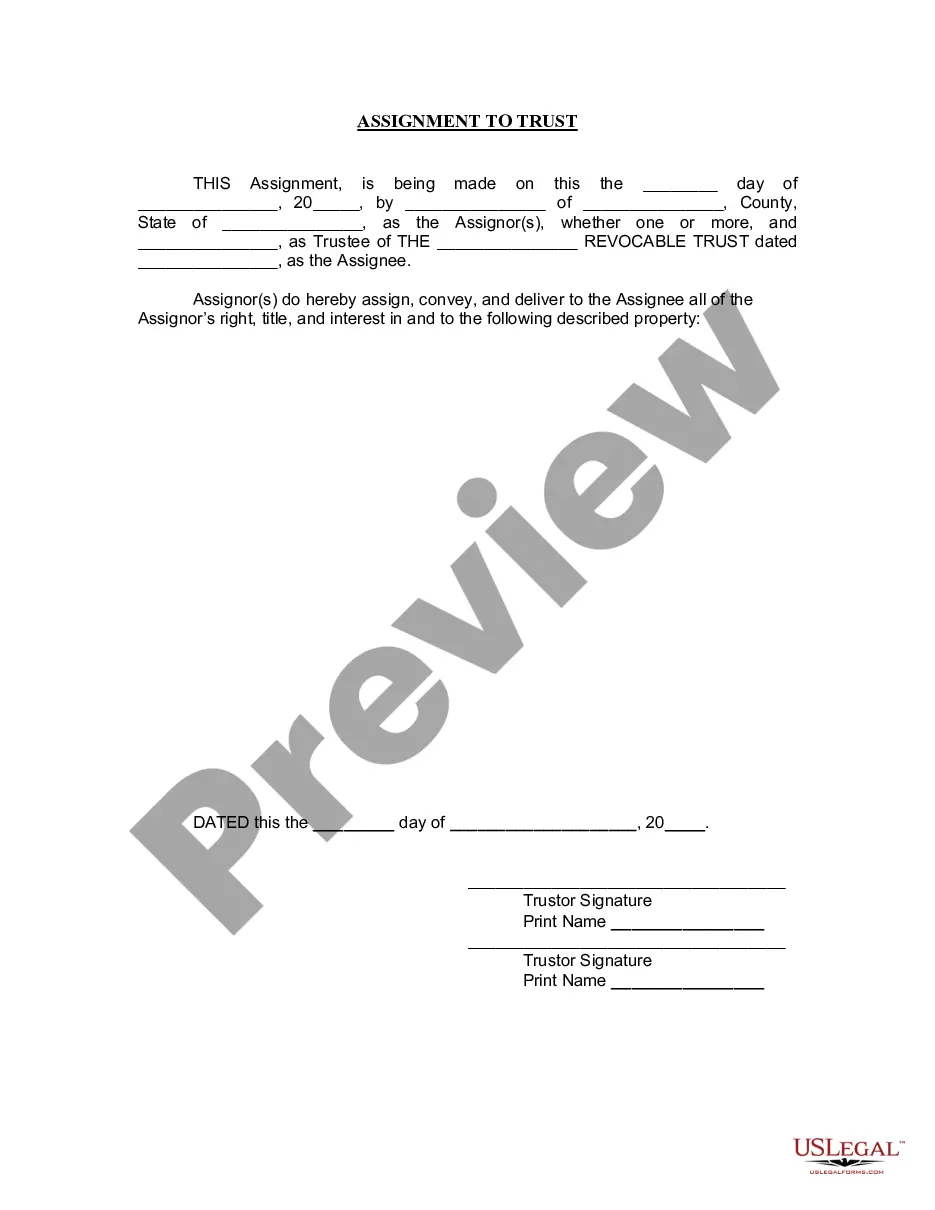

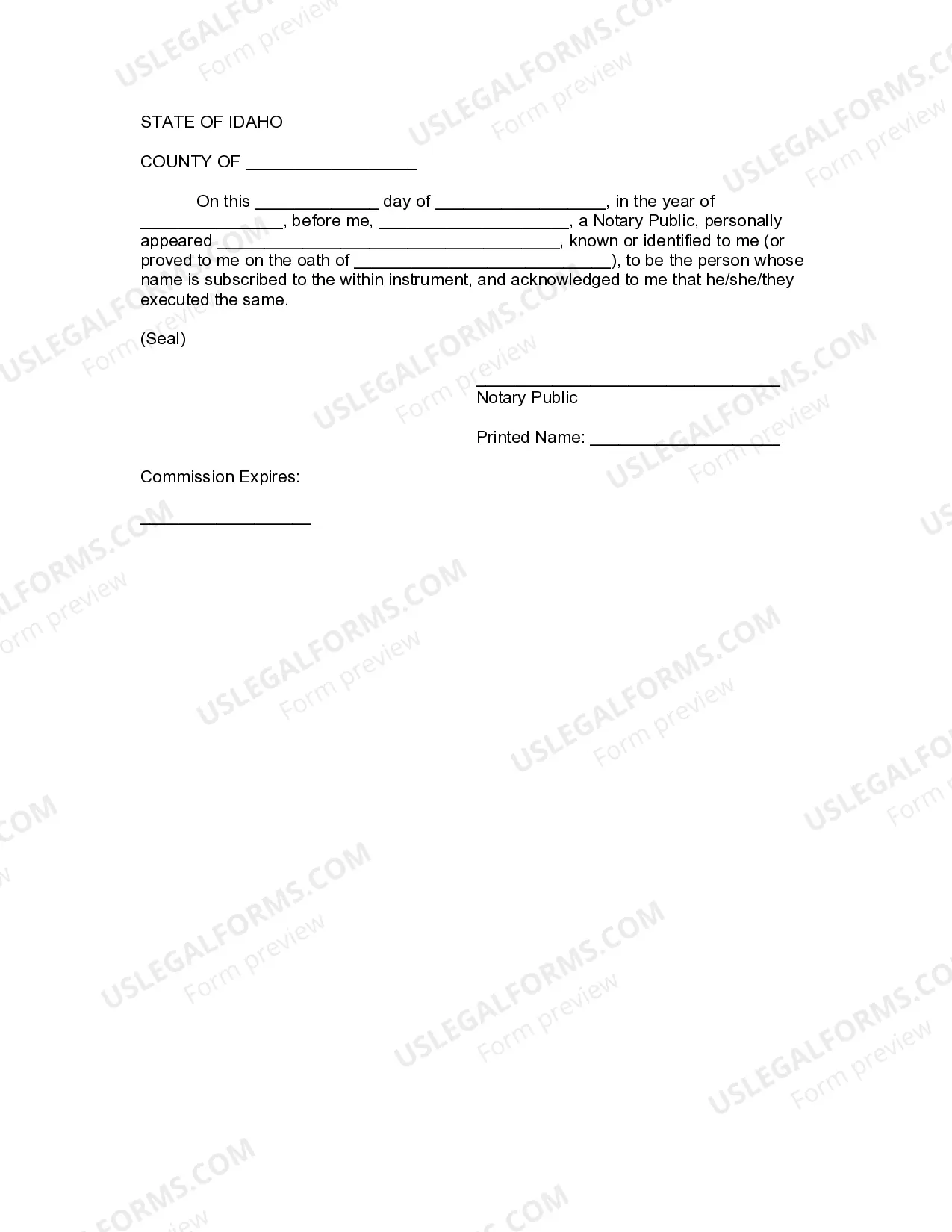

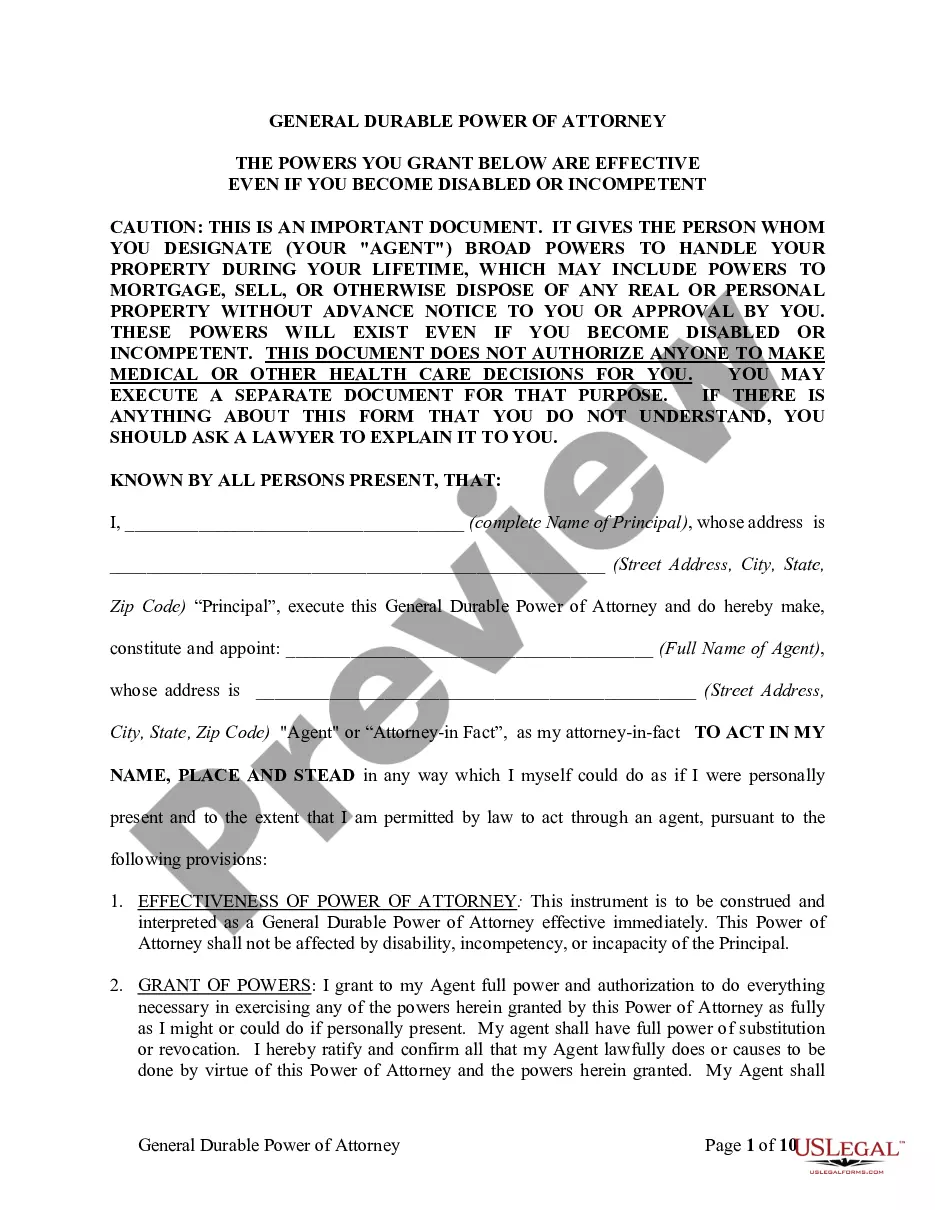

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Idaho Assignment to Living Trust

Description

How to fill out Idaho Assignment To Living Trust?

Trying to find Idaho Assignment to Living Trust forms and completing them can be quite a problem. In order to save time, costs and energy, use US Legal Forms and find the correct sample specially for your state in just a couple of clicks. Our legal professionals draw up each and every document, so you just have to fill them out. It really is that easy.

Log in to your account and return to the form's page and save the document. All of your downloaded templates are kept in My Forms and they are accessible always for further use later. If you haven’t subscribed yet, you have to register.

Take a look at our thorough guidelines on how to get the Idaho Assignment to Living Trust sample in a few minutes:

- To get an eligible example, check out its applicability for your state.

- Look at the form using the Preview option (if it’s accessible).

- If there's a description, read through it to learn the specifics.

- Click Buy Now if you identified what you're seeking.

- Select your plan on the pricing page and create your account.

- Pick how you want to pay out by a card or by PayPal.

- Save the sample in the favored file format.

You can print out the Idaho Assignment to Living Trust template or fill it out using any online editor. No need to concern yourself with making typos because your form may be used and sent away, and published as many times as you wish. Try out US Legal Forms and access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Compared to Simple Will Package, our office charges an additional $800 to upgrade to a Living Trust or Family Trust. In total dollars, the cost of a Family Trust or Living Trust package for an unmarried person would cost $1,895. For a married couple, the total cost would be just $2,295.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.