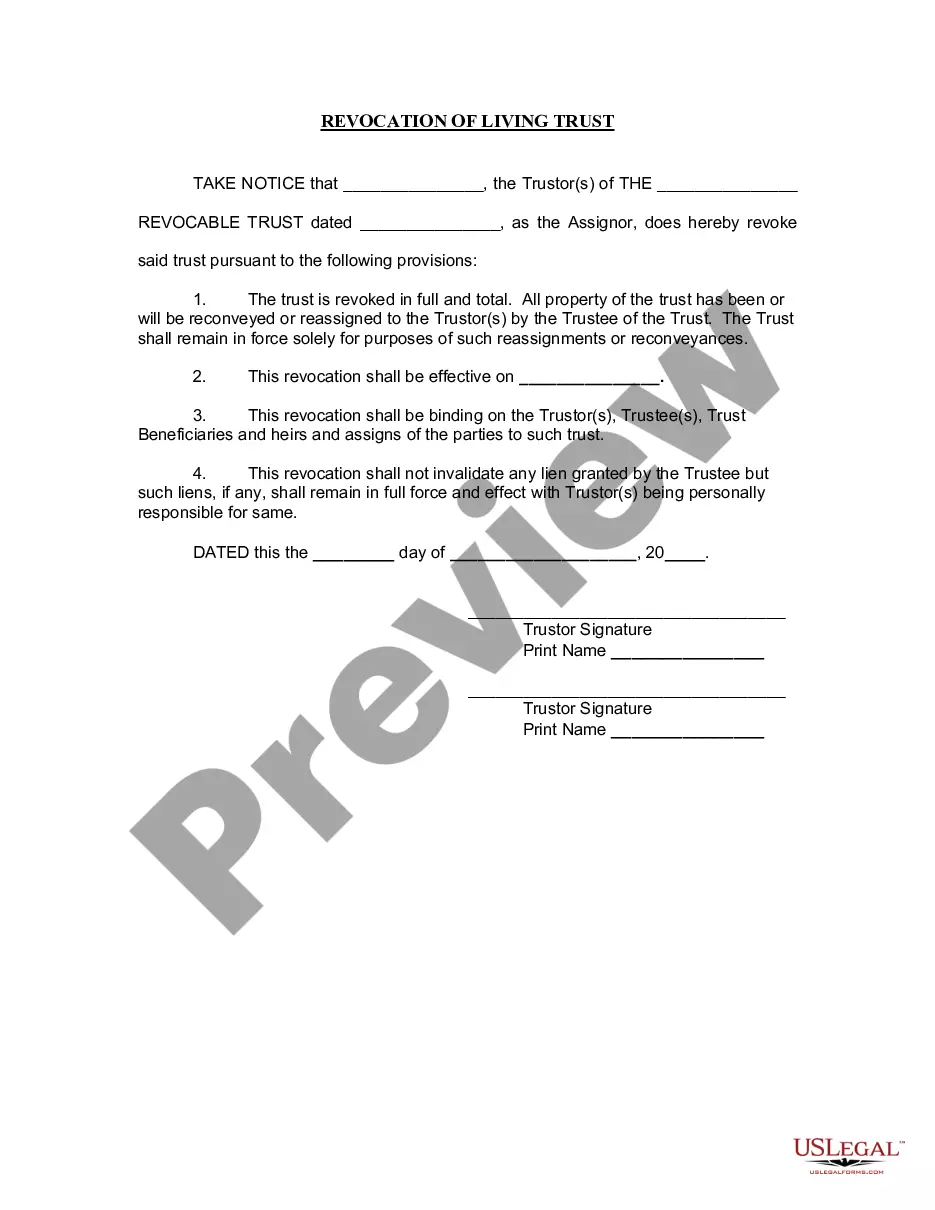

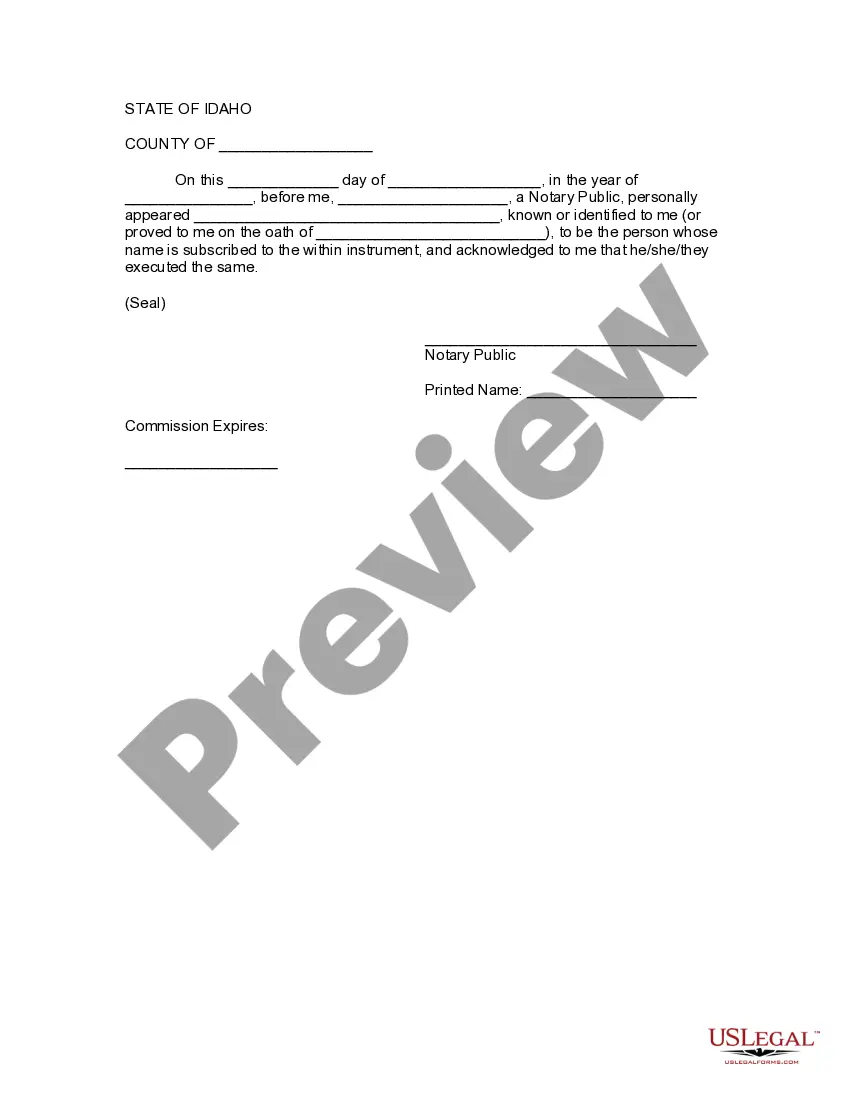

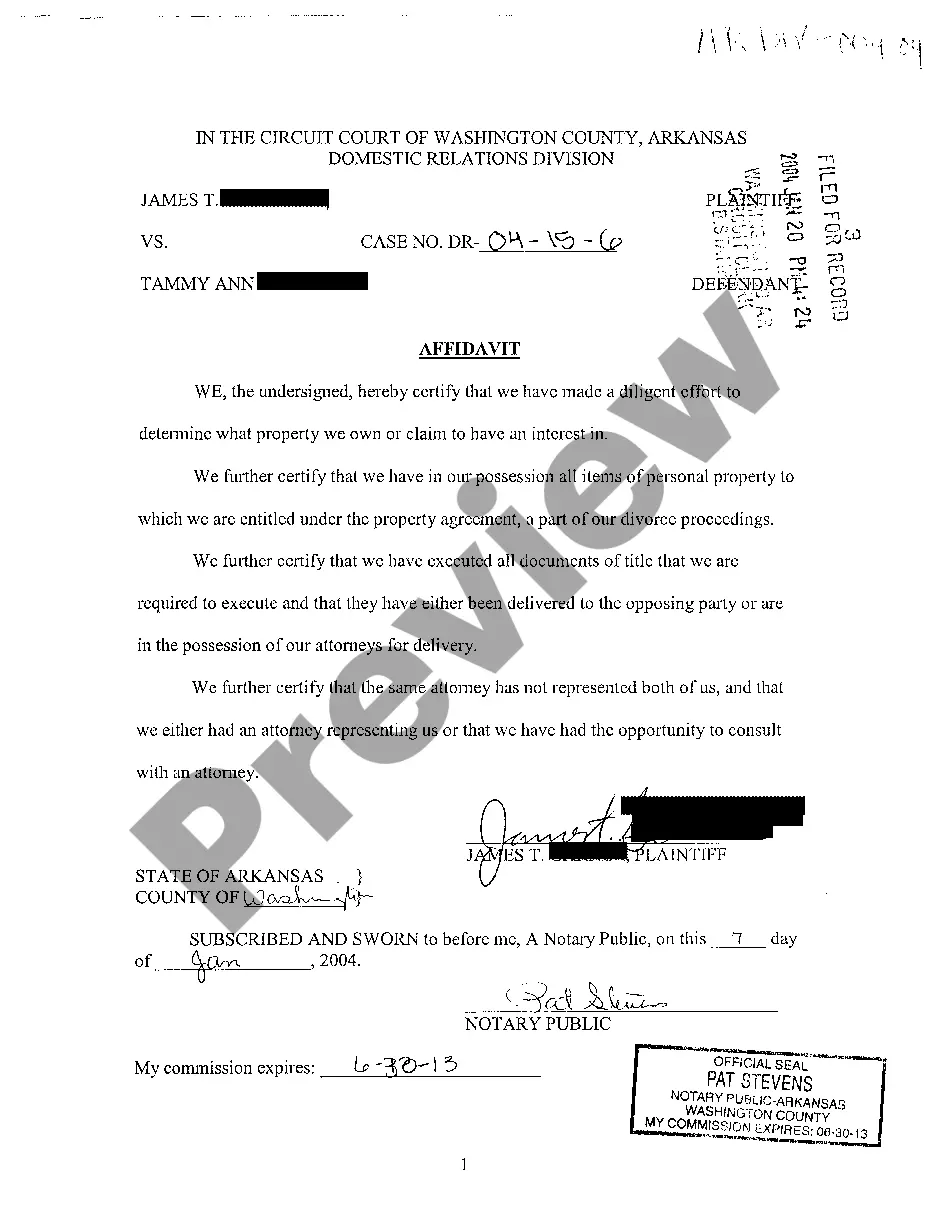

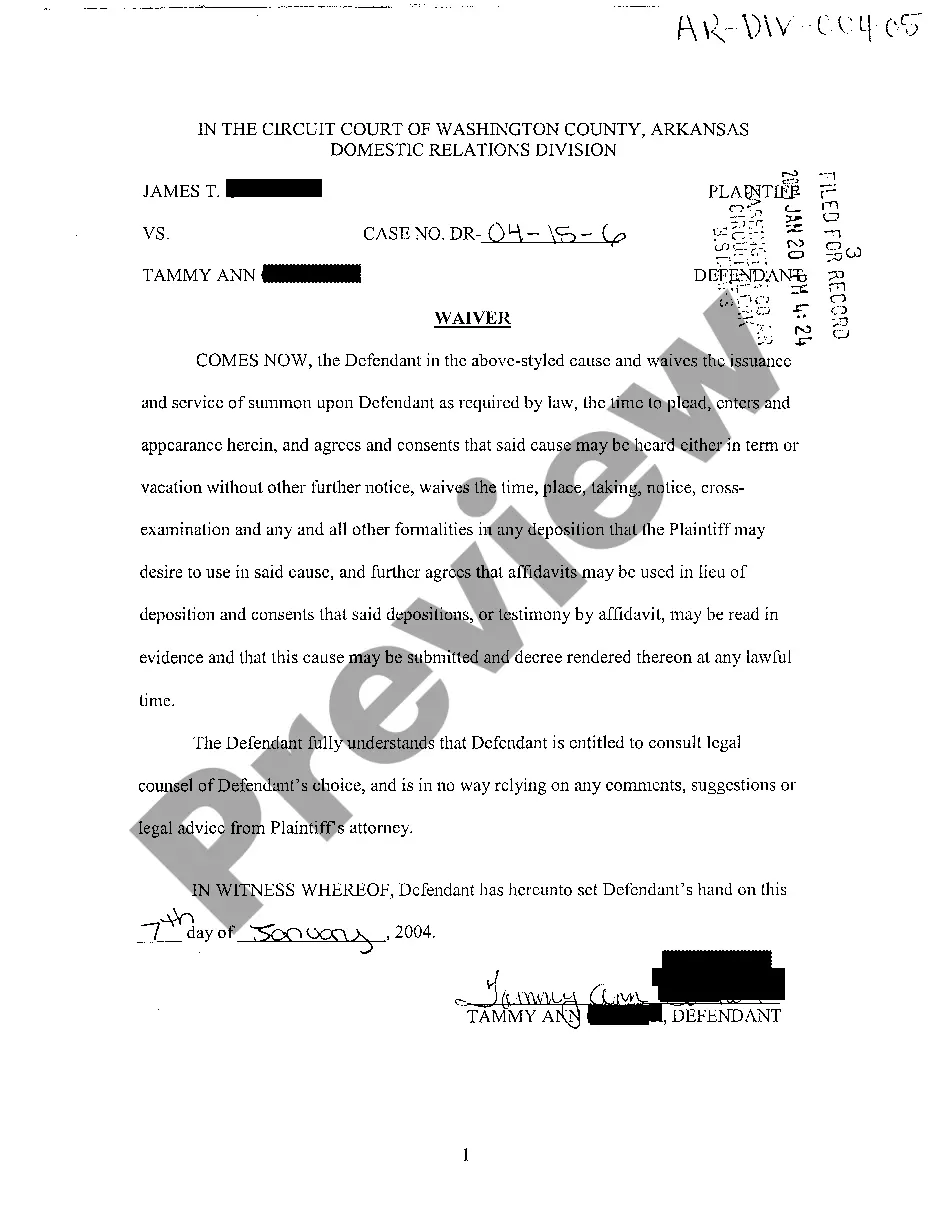

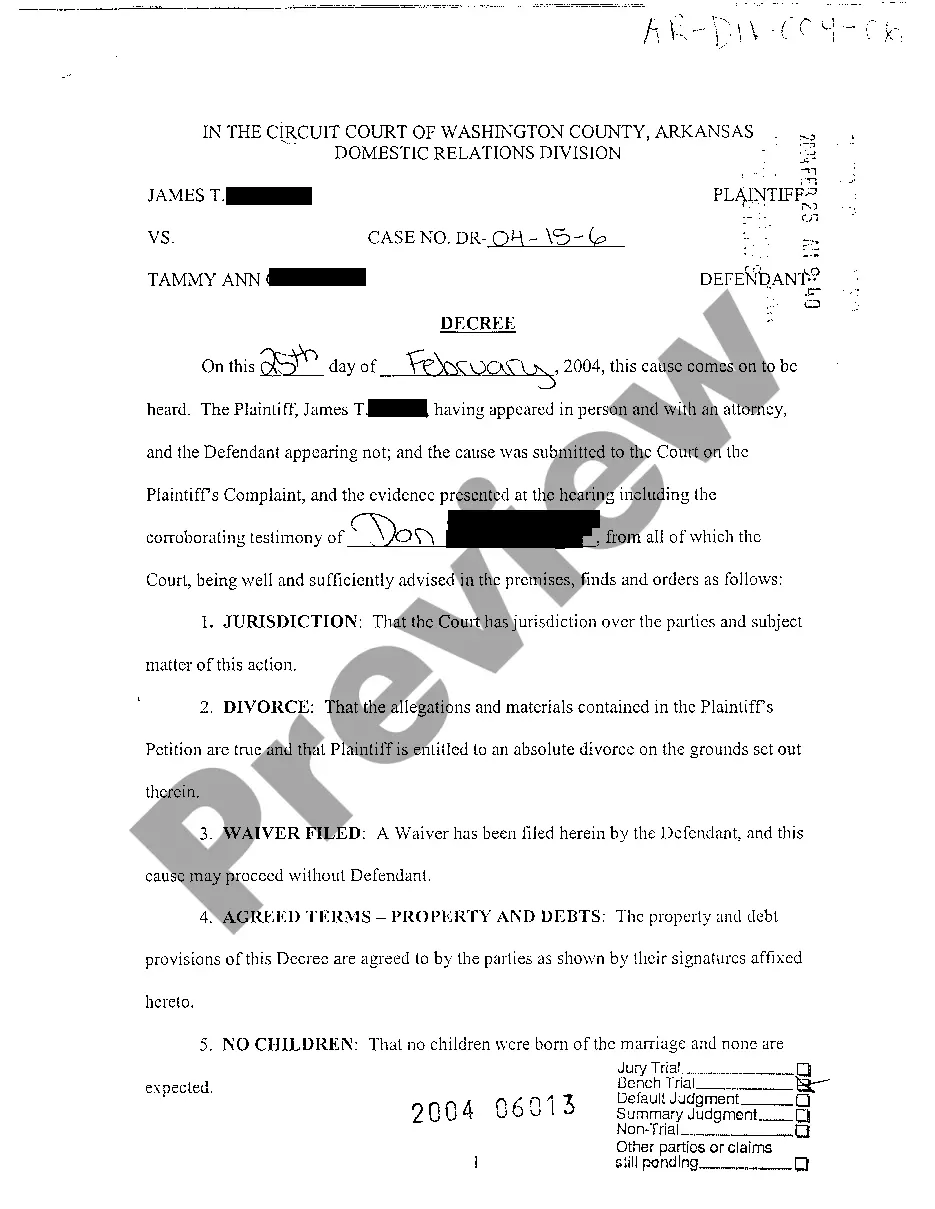

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Idaho Revocation of Living Trust

Description

How to fill out Idaho Revocation Of Living Trust?

In search of Idaho Revocation of Living Trust templates and completing them could be a problem. In order to save time, costs and effort, use US Legal Forms and find the right template specially for your state in a couple of clicks. Our legal professionals draw up each and every document, so you simply need to fill them out. It truly is so simple.

Log in to your account and come back to the form's page and save the sample. Your saved templates are kept in My Forms and they are available at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our comprehensive recommendations on how to get your Idaho Revocation of Living Trust sample in a couple of minutes:

- To get an qualified sample, check its applicability for your state.

- Take a look at the form making use of the Preview function (if it’s accessible).

- If there's a description, go through it to know the specifics.

- Click Buy Now if you identified what you're looking for.

- Pick your plan on the pricing page and make an account.

- Select you would like to pay out with a card or by PayPal.

- Save the file in the favored file format.

You can print out the Idaho Revocation of Living Trust form or fill it out making use of any online editor. Don’t concern yourself with making typos because your form can be employed and sent, and printed out as many times as you wish. Check out US Legal Forms and get access to around 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Irrevocable trusts can remain up and running indefinitely after the trustmaker dies, but most revocable trusts disperse their assets and close up shop. This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer.

A revocable trust may be revoked, certainly. If you have transferred property into that trust, then you'll need to transfer it back to yourself and then into the new trust.You would then keep the old trust name and date of original execution, but the entire document will have changed.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.Such documents, often called a trust revocation declaration or revocation of living trust," can be downloaded from legal websites; local probate courts may also provide copies of them.

In some states, your trustee must submit a formal accounting of the trust's operation to all beneficiaries.Trustees can sometimes waive this requirement if all beneficiaries agree in writing. In either case, after the report is made, the trust's assets can be distributed and the trust can be dissolved.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.