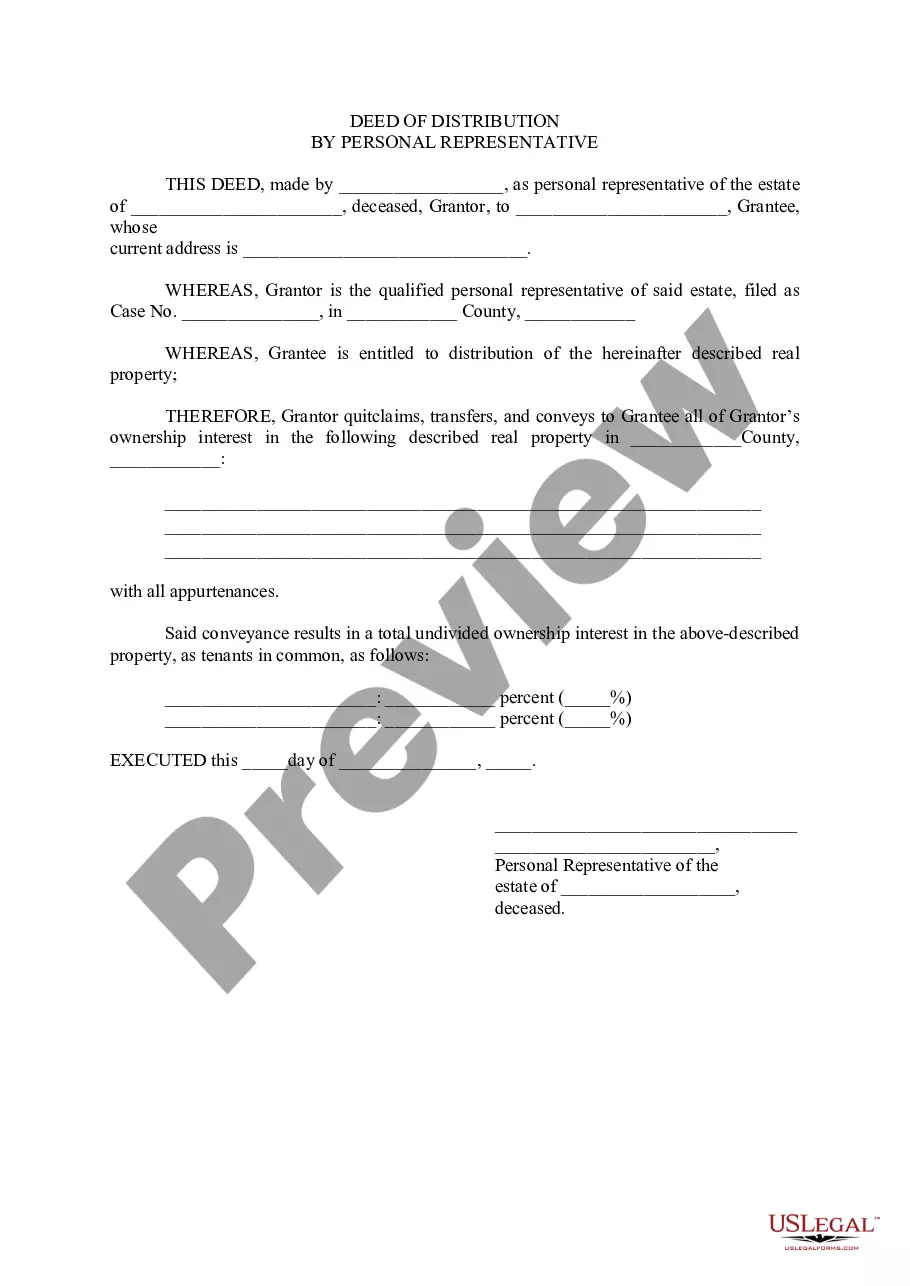

Idaho Deed of Distribution By Personal Representative

Description Deed Of Distribution

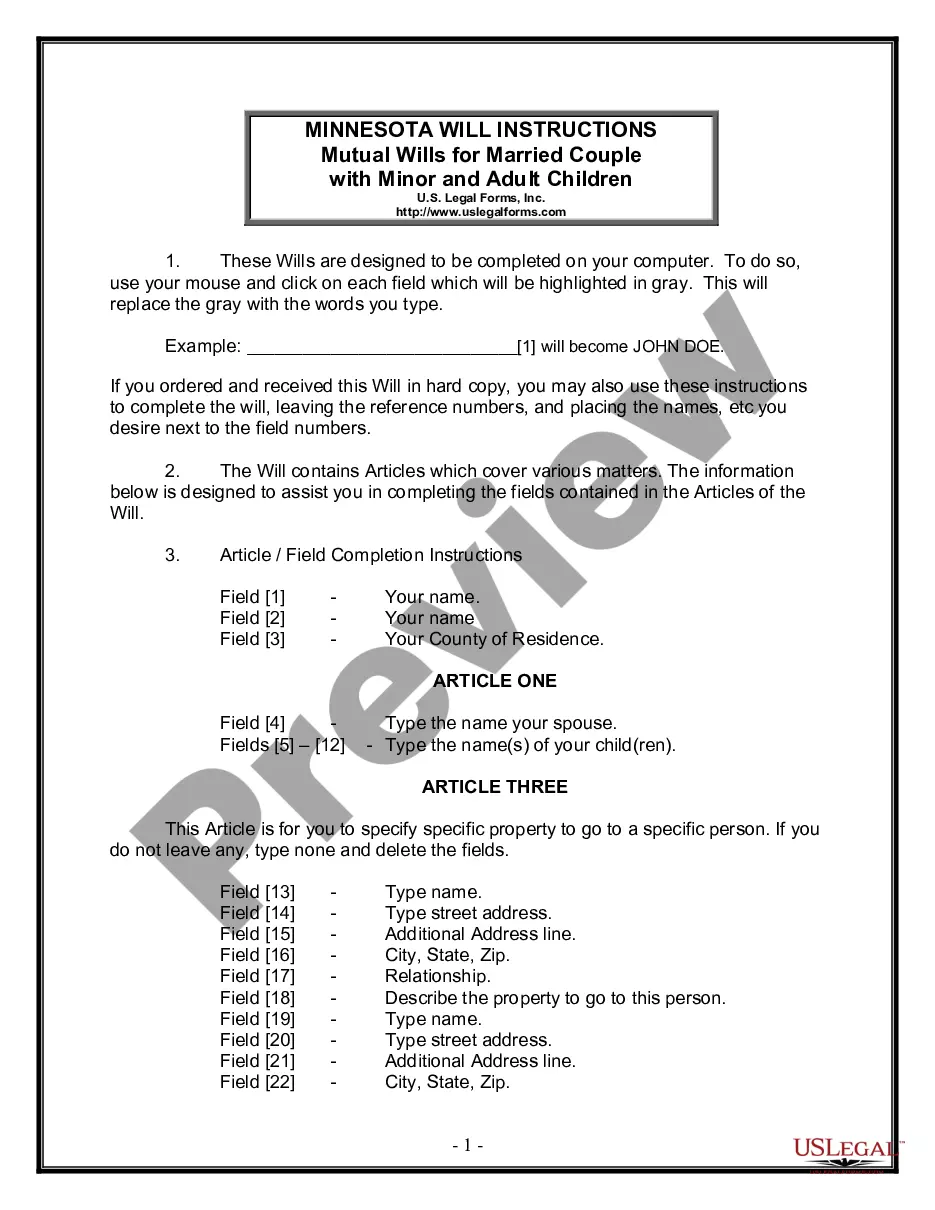

How to fill out Idaho Deed Of Distribution By Personal Representative?

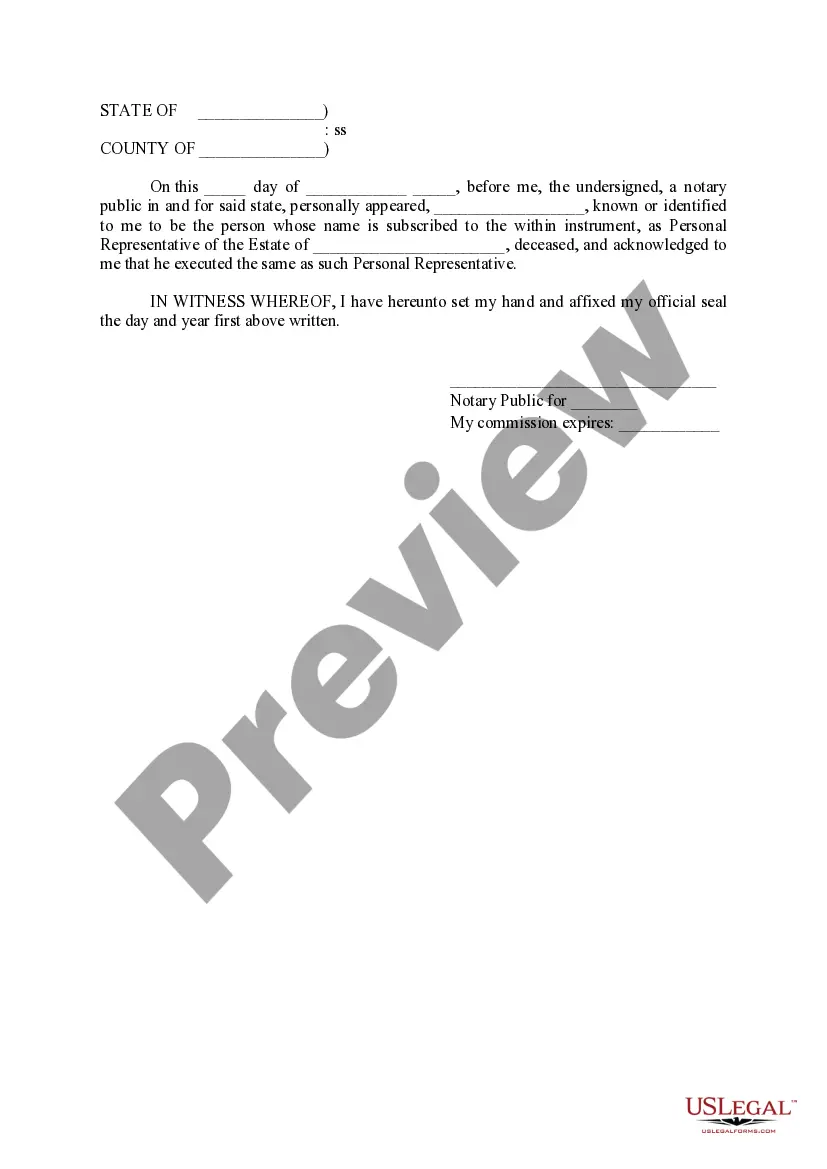

Use US Legal Forms to obtain a printable Idaho Deed of Distribution By Personal Representative. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms library on the internet and offers reasonably priced and accurate templates for customers and lawyers, and SMBs. The documents are categorized into state-based categories and a number of them might be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Idaho Deed of Distribution By Personal Representative:

- Check out to ensure that you have the proper template with regards to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you need to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Idaho Deed of Distribution By Personal Representative. Over three million users have utilized our platform successfully. Select your subscription plan and have high-quality forms within a few clicks.

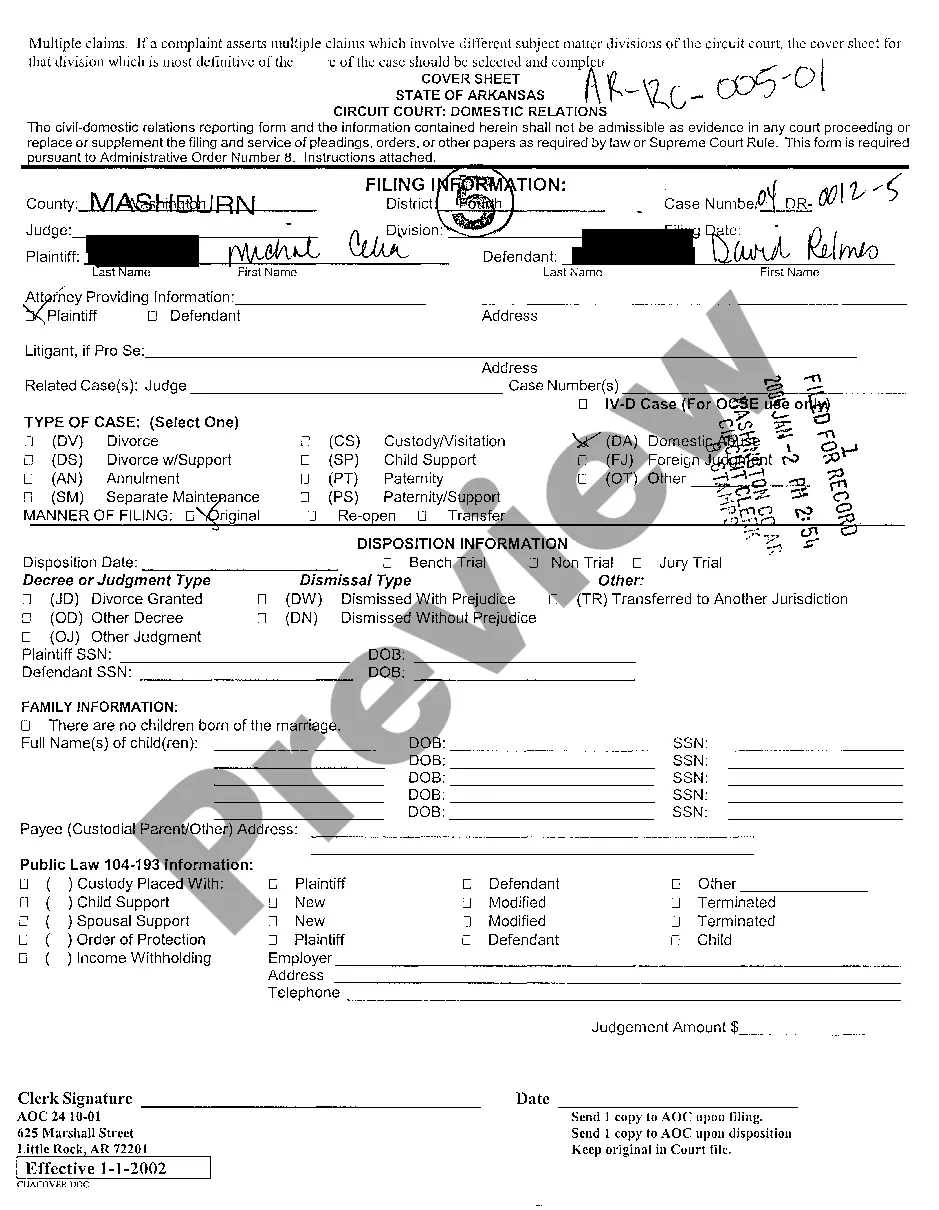

Colorado Pr Deed Drafting Form popularity

Pr Deed Drafting In Colorado Other Form Names

FAQ

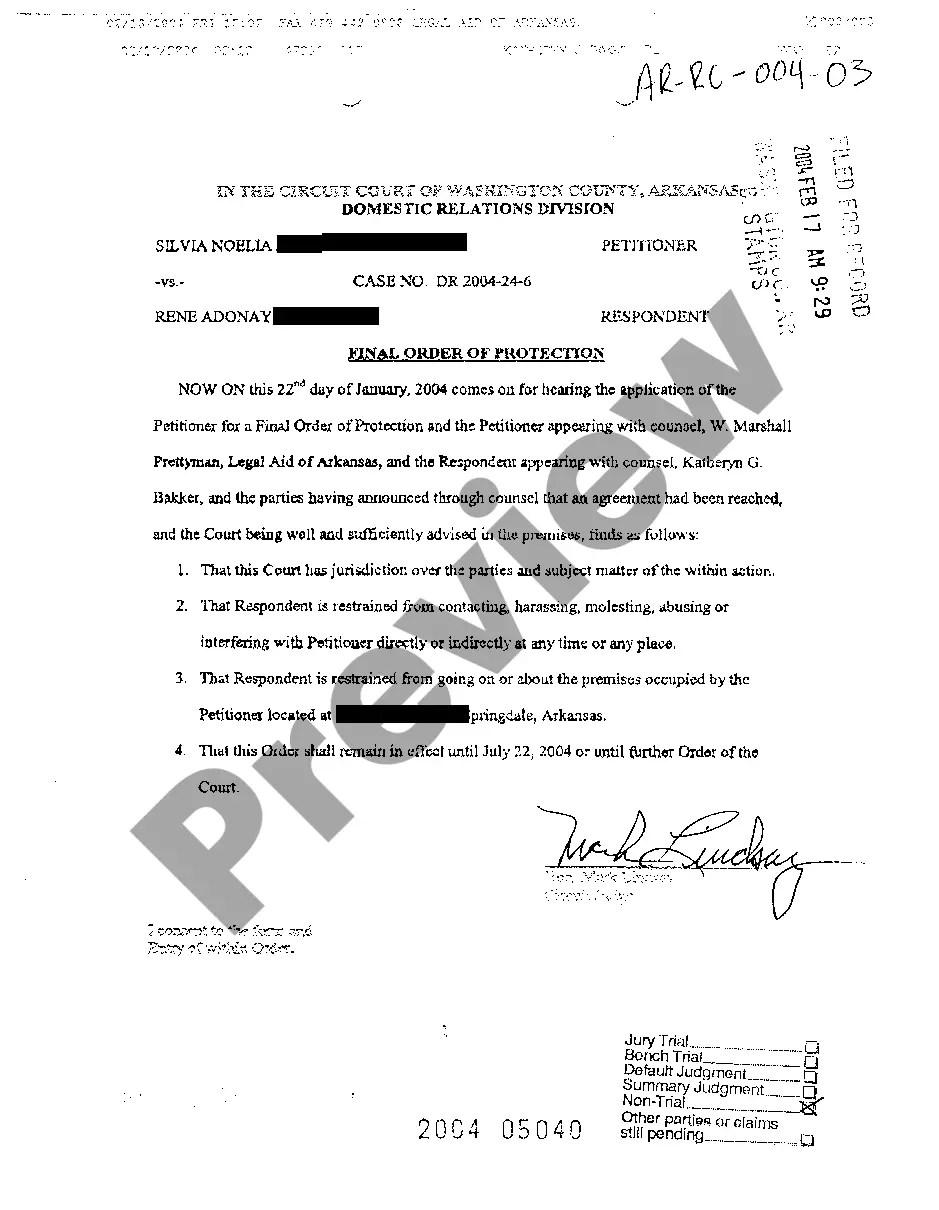

In Colorado, the person approved or appointed by the probate court to administer a decedent's estate is called a personal representative. The personal representative has a fiduciary duty to settle the decedent's estate.Use the personal representative's deed of sale to convey real property to a purchaser.

With Informal probate, an Application (along with the decedent's original will) and Acceptance are typically filed with the court by the person nominated as Personal Representative, and then the court signs and issues (without a formal hearing) a Statement and Letters Testamentary (if the decedent had a will) or

In a Non-Warranty Deed, the seller gives no warranties.In a Non-Warranty or Quitclaim Deed, the seller merely is giving the buyer whatever rights, if any, that the seller has in the property and the seller makes no warranties of any nature about the seller's rights in the property.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

A personal representative deed and warranty deed are the same only in that they both convey ownership of land. The types of title assurance that the different deeds provide to the new owner are very different.

The rate ranges from 1.5% to 4% of the gross (not net) value. So, for a modest estate of $500,000.00, the attorney and executor would each receive $13,000. And this does not include the costs of court filing fees, publication cost, or other actual estate administration expenses.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Used to transfer property rights from a deceased person's estate. Involves Probate Court. Like a Quit Claim deed, there are no warranties. Generally, the Personal Representative is unwilling to warrant or promise anything relating to property that he/she has never personally owned.

In order to provide finality to the termination of a trust or the closing of an estate, the form of deed given by a personal representative or a trustee simply calls for the seller to convey as opposed to convey and warrant the property.Again, all the buyer gets is whatever the trust or estate owned.