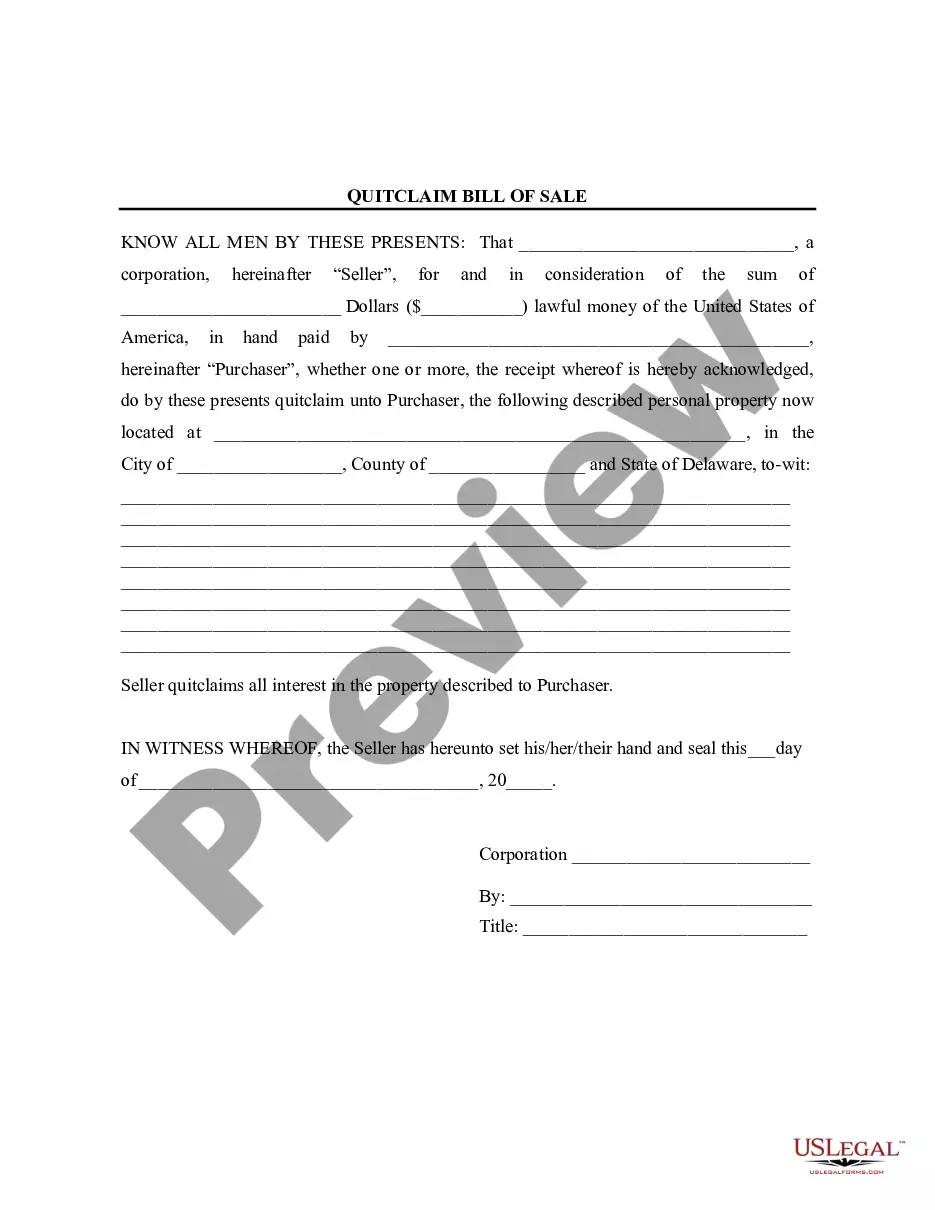

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Idaho Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Looking for Installments Fixed Rate Promissory Note Secured by Commercial Real Estate for Idaho forms and completing them can be quite a challenge. To save lots of time, costs and effort, use US Legal Forms and find the correct template specifically for your state within a few clicks. Our legal professionals draw up each and every document, so you simply need to fill them out. It really is so simple.

Log in to your account and return to the form's web page and download the sample. All your downloaded templates are kept in My Forms and they are accessible at all times for further use later. If you haven’t subscribed yet, you have to register.

Check out our thorough instructions concerning how to get the Installments Fixed Rate Promissory Note Secured by Commercial Real Estate for Idaho form in a couple of minutes:

- To get an eligible sample, check its validity for your state.

- Look at the sample making use of the Preview function (if it’s available).

- If there's a description, go through it to know the specifics.

- Click on Buy Now button if you found what you're seeking.

- Pick your plan on the pricing page and create an account.

- Choose you wish to pay out by way of a card or by PayPal.

- Download the file in the favored format.

Now you can print out the Installments Fixed Rate Promissory Note Secured by Commercial Real Estate for Idaho form or fill it out utilizing any web-based editor. No need to worry about making typos because your sample can be used and sent away, and printed as often as you wish. Try out US Legal Forms and access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

No. California promissory notes do not need to be notarized or witnessed for validity.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

However, it is still smart to contact a lawyer to help you prepare a personal promissory note, even if you already used an online template. A lawyer can prepare and/or review the note to ensure that all state law requirements are included. This will help with enforceability if there are any issues down the road.