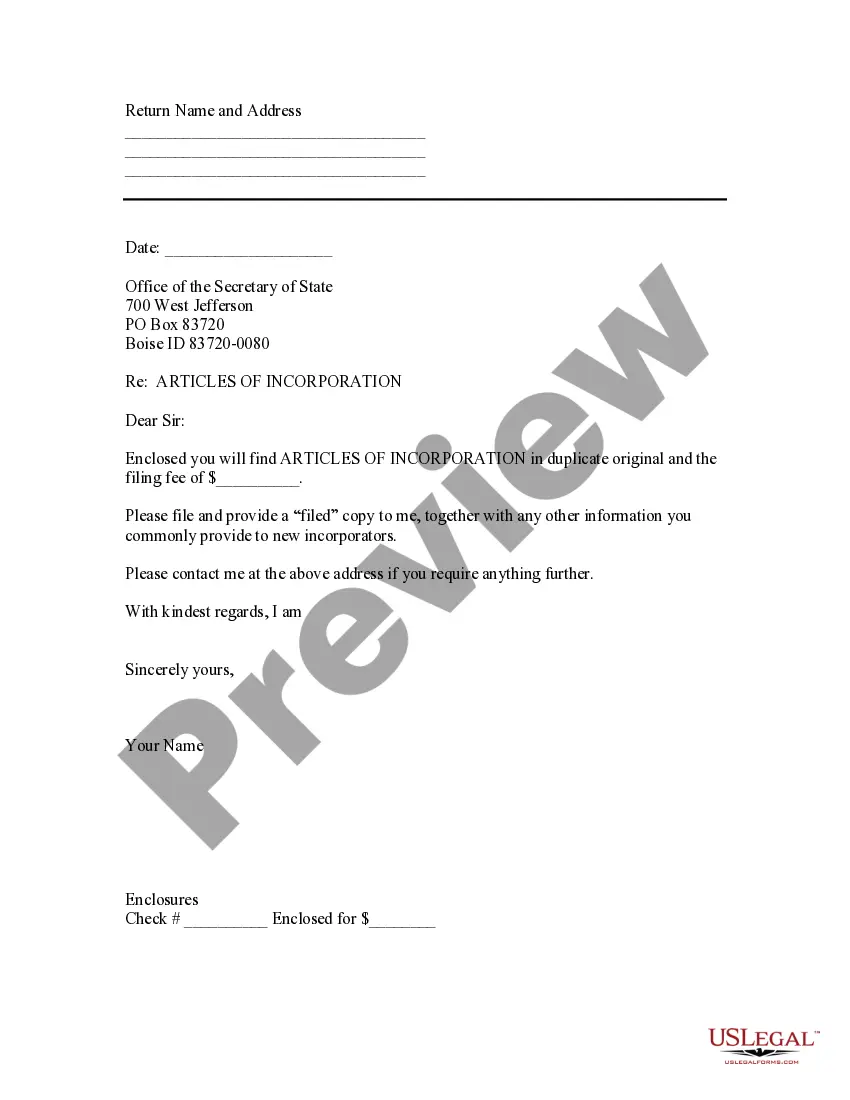

This sample transmittal letter can accompany the Articles of Incorporation when filed with the Secretary of State.

Idaho Sample Transmittal Letter for Articles of Incorporation

Description

How to fill out Idaho Sample Transmittal Letter For Articles Of Incorporation?

Looking for Idaho Sample Transmittal Letter for Articles of Incorporation forms and completing them might be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the correct example specifically for your state in a few clicks. Our attorneys draft all documents, so you just need to fill them out. It is really so easy.

Log in to your account and come back to the form's web page and download the document. Your downloaded samples are kept in My Forms and are accessible at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Have a look at our thorough recommendations regarding how to get the Idaho Sample Transmittal Letter for Articles of Incorporation form in a couple of minutes:

- To get an qualified sample, check out its validity for your state.

- Have a look at the form using the Preview option (if it’s available).

- If there's a description, read it to know the important points.

- Click Buy Now if you identified what you're trying to find.

- Choose your plan on the pricing page and make an account.

- Pick how you want to pay by way of a card or by PayPal.

- Save the sample in the favored format.

Now you can print the Idaho Sample Transmittal Letter for Articles of Incorporation template or fill it out utilizing any web-based editor. Don’t worry about making typos because your form can be employed and sent away, and published as often as you would like. Try out US Legal Forms and access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

Step 1: Name Your Idaho Corporation. Choosing a business name is the first step in starting a corporation. Step 2: Choose an Idaho Registered Agent. Step 3: Hold an Organizational Meeting. Step 4: File the Idaho Articles of Incorporation. Step 5: Get an EIN for Your Idaho Corporation.

Articles of incorporation are public, so it is important to omit any confidential business information. It is also important to keep in mind that each state will have different filing requirements. Checking the local state website can provide you with an updated list of required documents.

Obtaining a copy of a company's Articles of Incorporation is a relatively simple process. In most states, a certified copy can be requested by visiting the office of the Secretary of State in person or by phone, mail, or the state's online system.

File the documents with the Secretary of State's office. Include the fee of incorporation, as well as the names and addresses of the incorporating business partners.

In the U.S., articles of incorporation are filed with the Office of the Secretary of State where the business chooses to incorporate. Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares.

Are articles of incorporation public? The answer is yes. These documents, which are filed with the Secretary of State or similar agency to create a new business entity, are available for public viewing.In some states, including Arizona, the articles of incorporation can be downloaded by anyone for free.

When a corporation is created, each owner is issued shares proportional to the percentage of ownership. A corporation can be private or public. Public corporations (such as IBM, General Electric) trade shares on stock exchanges such as the Toronto Stock Exchange (TSE) or the New York Stock Exchange (NYSE).

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

SEC is mandated by the Corporation Code and the Securities Regulation Code to regulate the corporate sector and the securities markets.Thus, SEC treats the Articles of Incorporation (AOI), By-Laws, and related documents as public records which are available to the public.