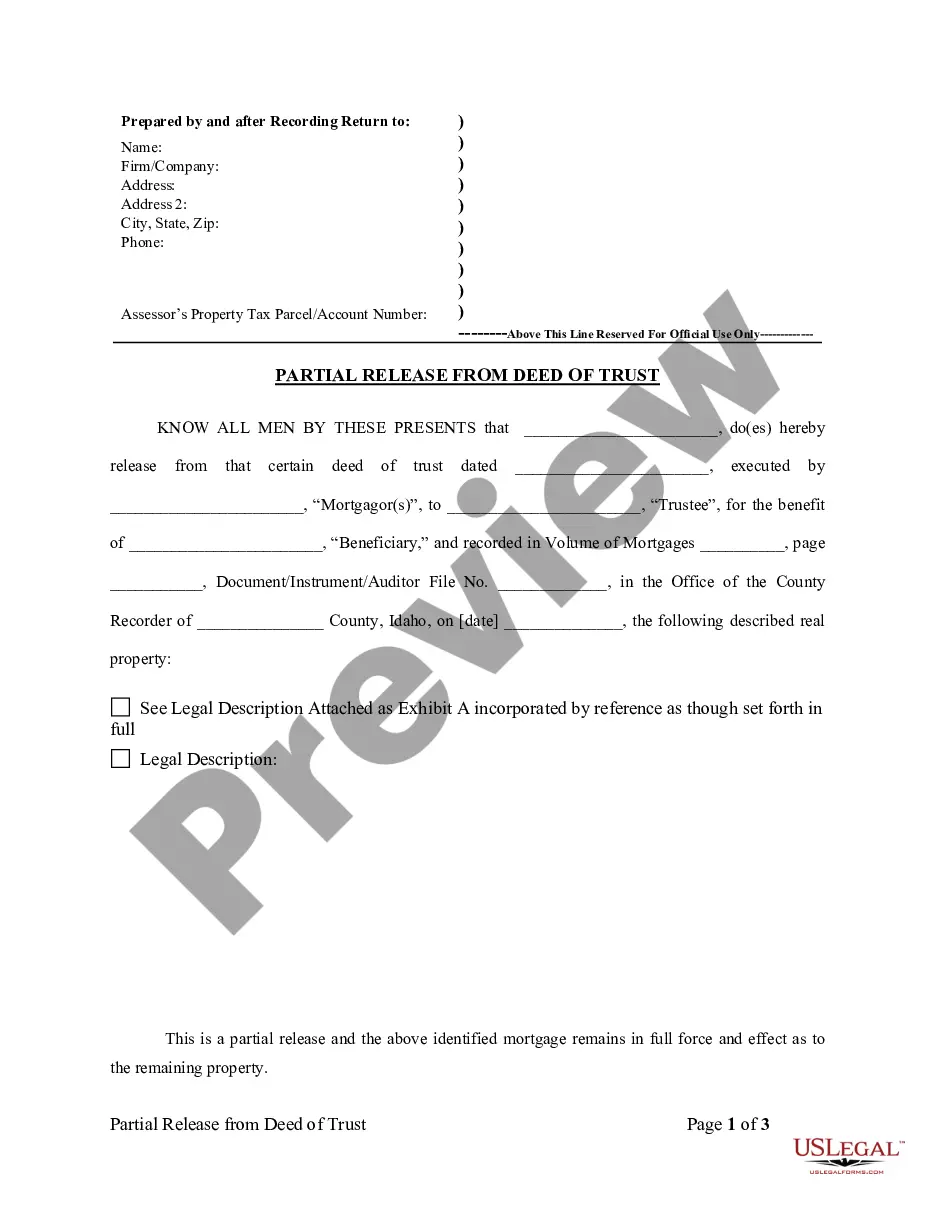

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified an referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Idaho Partial Release of Property From Deed of Trust for Individual

Description

How to fill out Idaho Partial Release Of Property From Deed Of Trust For Individual?

Searching for Idaho Partial Release of Property From Deed of Trust for Individual templates and completing them may pose a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically tailored for your state in just a few clicks.

Our lawyers prepare each document, allowing you to simply fill them out. It is truly that straightforward.

Select your plan on the pricing page and establish your account. Choose how you want to make a payment with a credit card or via PayPal. Download the document in your preferred file format. You can print the Idaho Partial Release of Property From Deed of Trust for Individual template or complete it using any online editor. There’s no need to worry about making mistakes as your template can be utilized and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's webpage to download the document.

- All of your stored samples are kept in My documents and are always available for future use.

- If you haven’t created an account yet, you should register.

- Check our comprehensive instructions on how to acquire your Idaho Partial Release of Property From Deed of Trust for Individual form in a matter of minutes.

- To obtain a valid sample, verify its suitability for your state.

- View the example using the Preview feature (if available).

- If there’s a description, read it to understand the specifics.

- Click Buy Now if you found what you are looking for.

Form popularity

FAQ

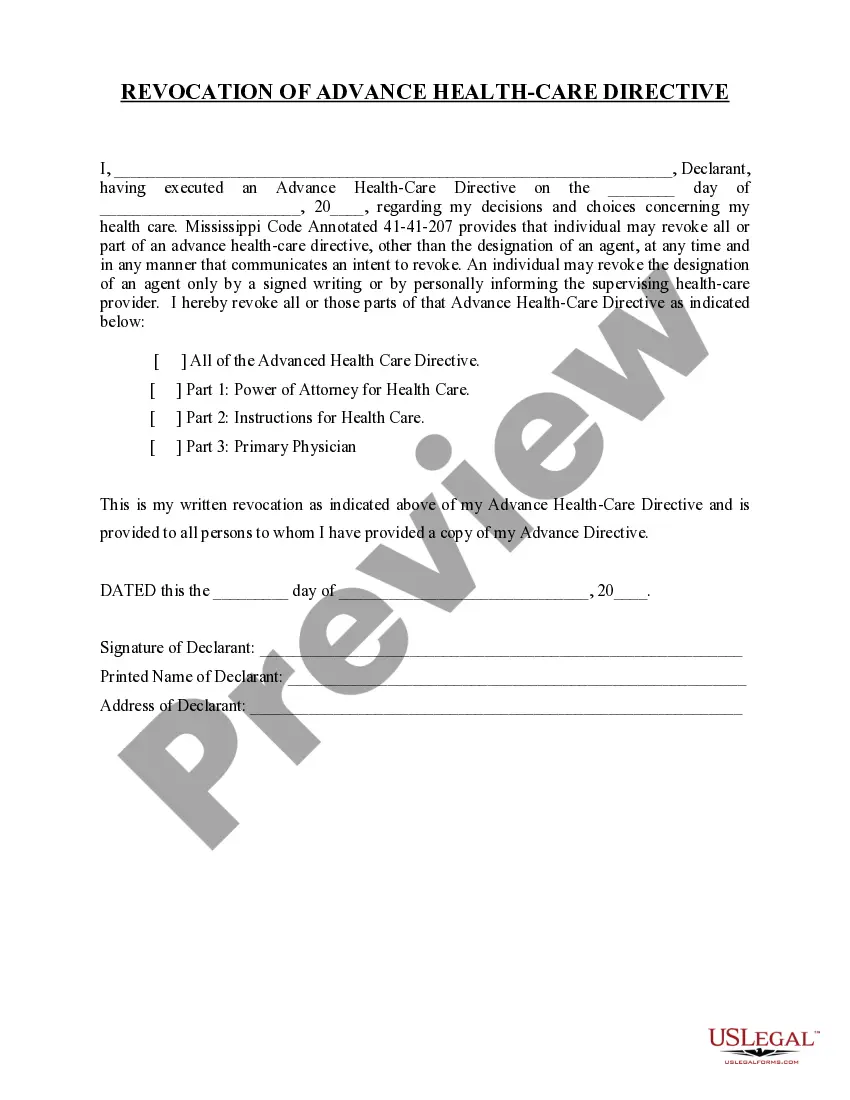

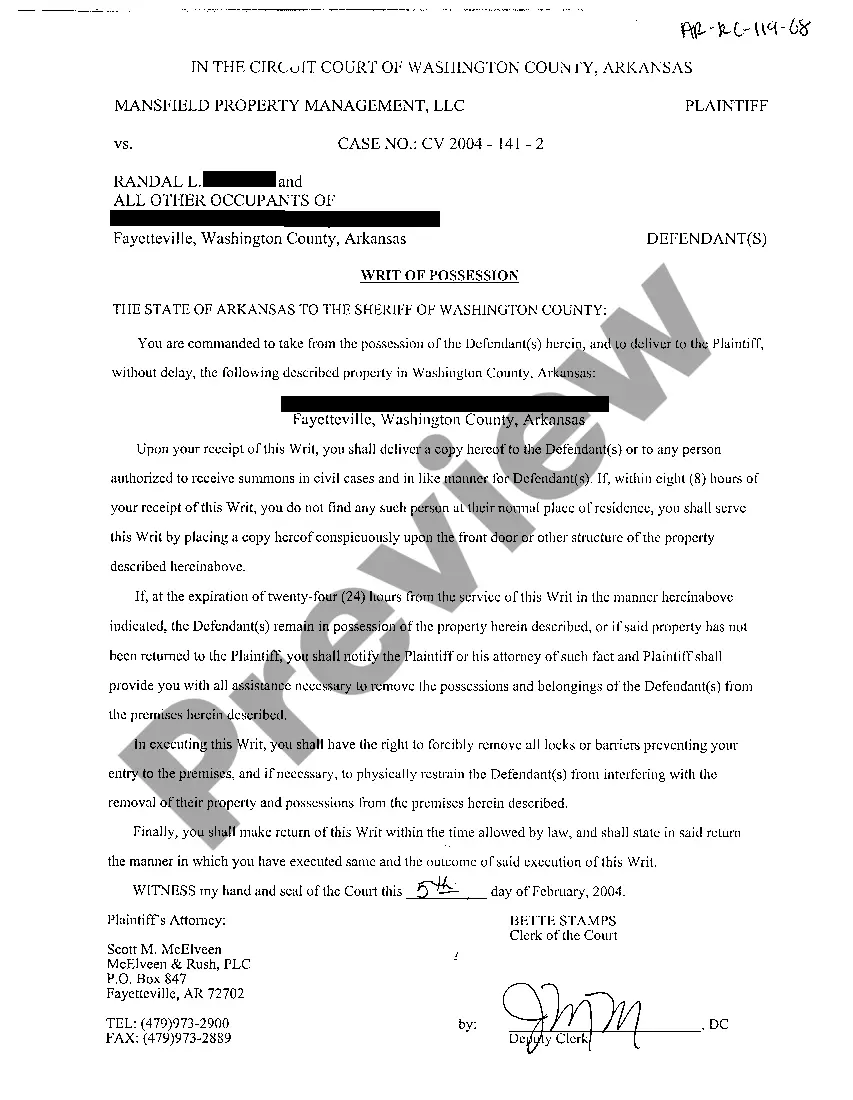

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.

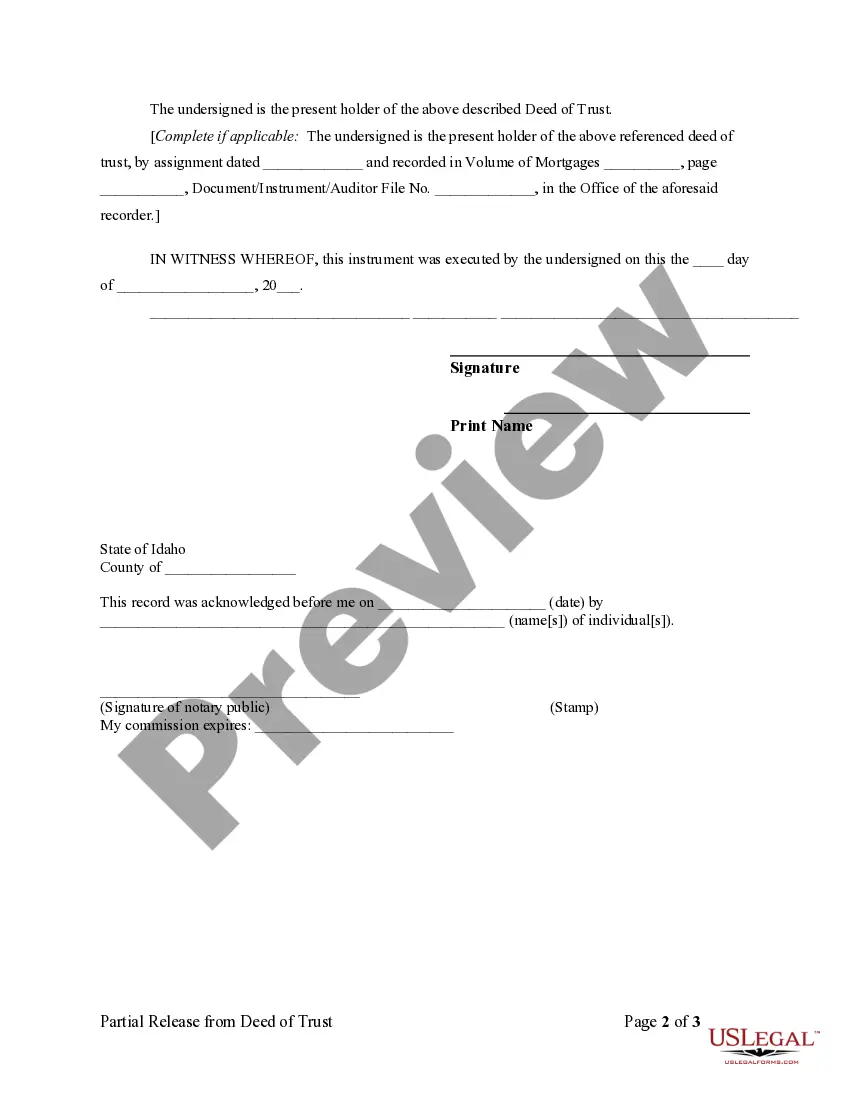

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

Yes, you can challenge the release deed/ relinquishment deed after the death of the person. but to challenge it you need to have solid grounds and proof stating that the deed was made fraudulently. if you dont have any proof then their is no point challenging it as the case may not sustain merit in the court.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.