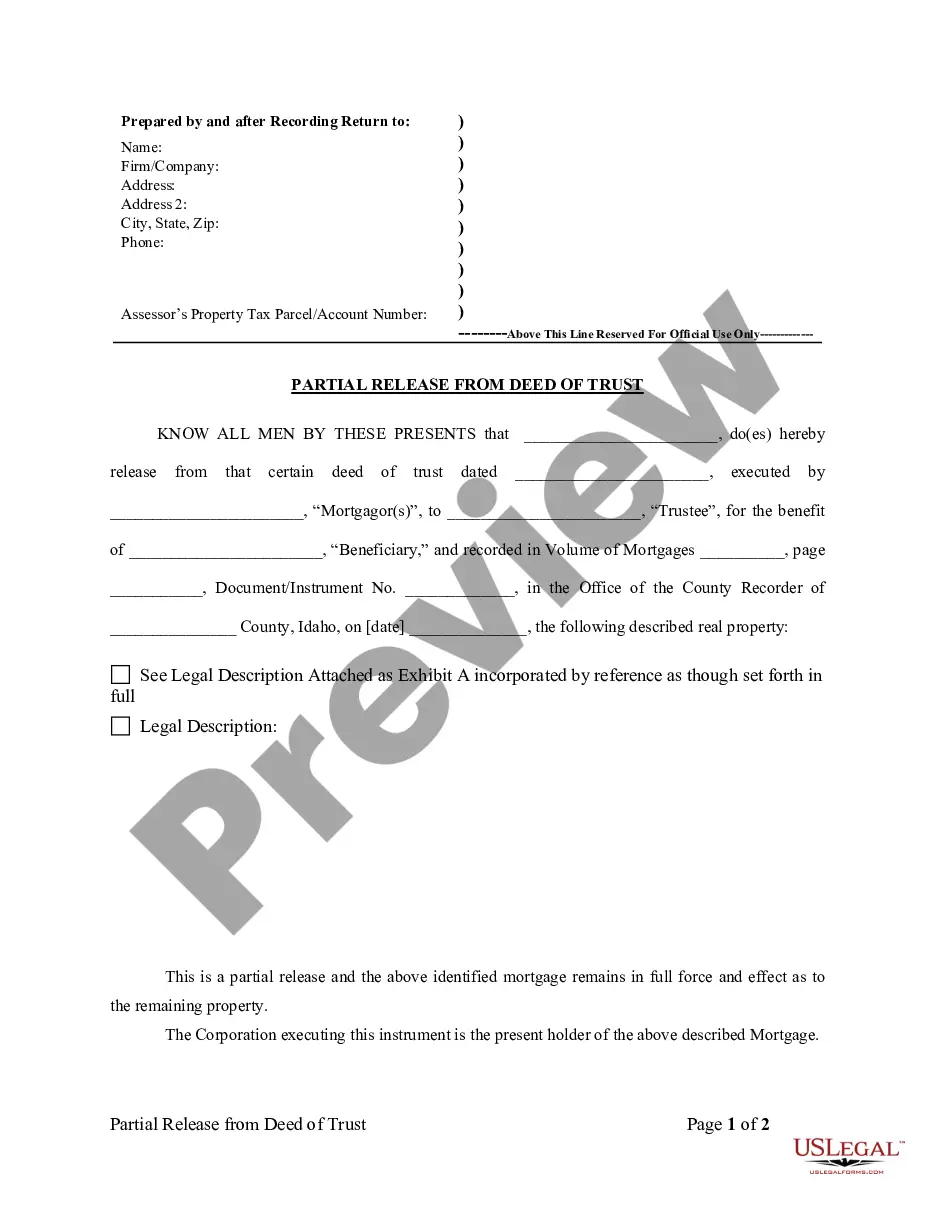

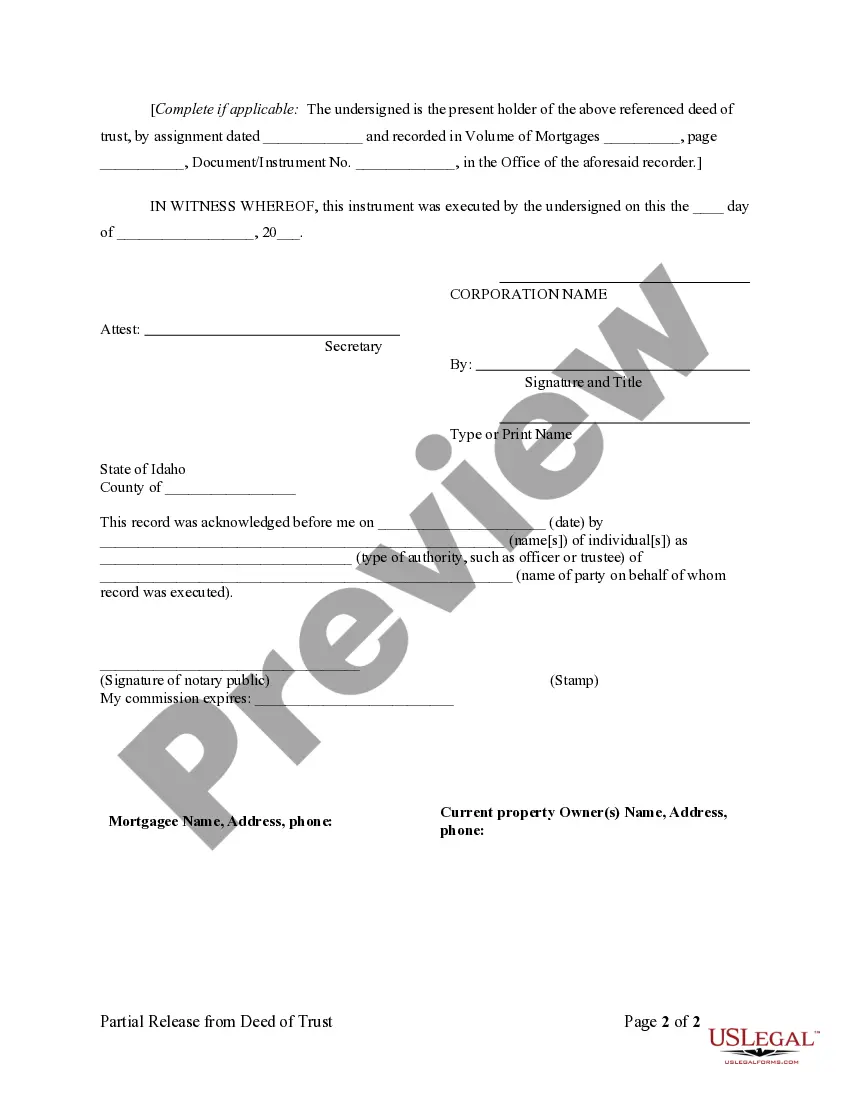

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Partial Release of Property From Deed of Trust - Corporation (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Idaho Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out Idaho Partial Release Of Property From Deed Of Trust For Corporation?

Searching for Idaho Partial Release of Property From Deed of Trust for Corporation templates and completing them can be a challenge. To save time, costs and effort, use US Legal Forms and find the correct template specially for your state in just a couple of clicks. Our attorneys draft every document, so you just have to fill them out. It truly is that easy.

Log in to your account and come back to the form's page and save the sample. All of your downloaded examples are kept in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you should register.

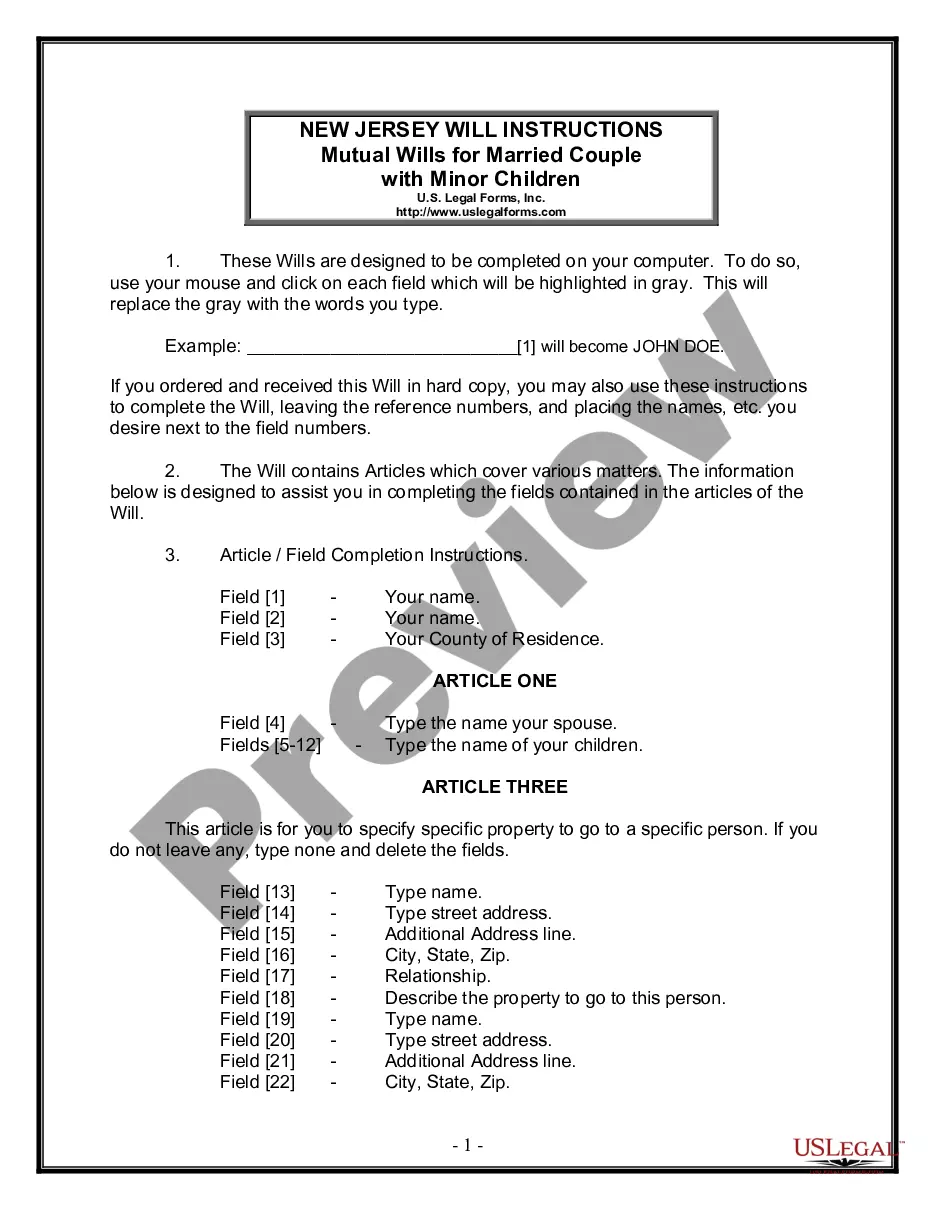

Check out our comprehensive instructions regarding how to get the Idaho Partial Release of Property From Deed of Trust for Corporation sample in a couple of minutes:

- To get an entitled form, check out its applicability for your state.

- Look at the sample utilizing the Preview function (if it’s accessible).

- If there's a description, go through it to know the details.

- Click on Buy Now button if you found what you're seeking.

- Pick your plan on the pricing page and create an account.

- Choose you wish to pay out with a credit card or by PayPal.

- Save the sample in the preferred format.

Now you can print out the Idaho Partial Release of Property From Deed of Trust for Corporation template or fill it out making use of any web-based editor. No need to worry about making typos because your form may be used and sent, and published as often as you want. Check out US Legal Forms and get access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

A Deed of Trust is a three party document prepared, signed and recorded to secure repayment of a loan. The Borrower (property owner) is named as Trustor, the Lender is called the Beneficiary, and a third party is called a Trustee.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

A mortgage only involves two parties the borrower and the lender.A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid. In the event of default on the loan, the trustee is responsible for starting the foreclosure process.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

A deed conveys ownership; a deed of trust secures a loan.

Idaho is one of a handful of states that use deeds of trust as the primary form of financing purchases of real property. A deed of trust, similar to a mortgage, is a security instrument that, along with a promissory note, sets out the terms for repaying the loan used to purchase the property.