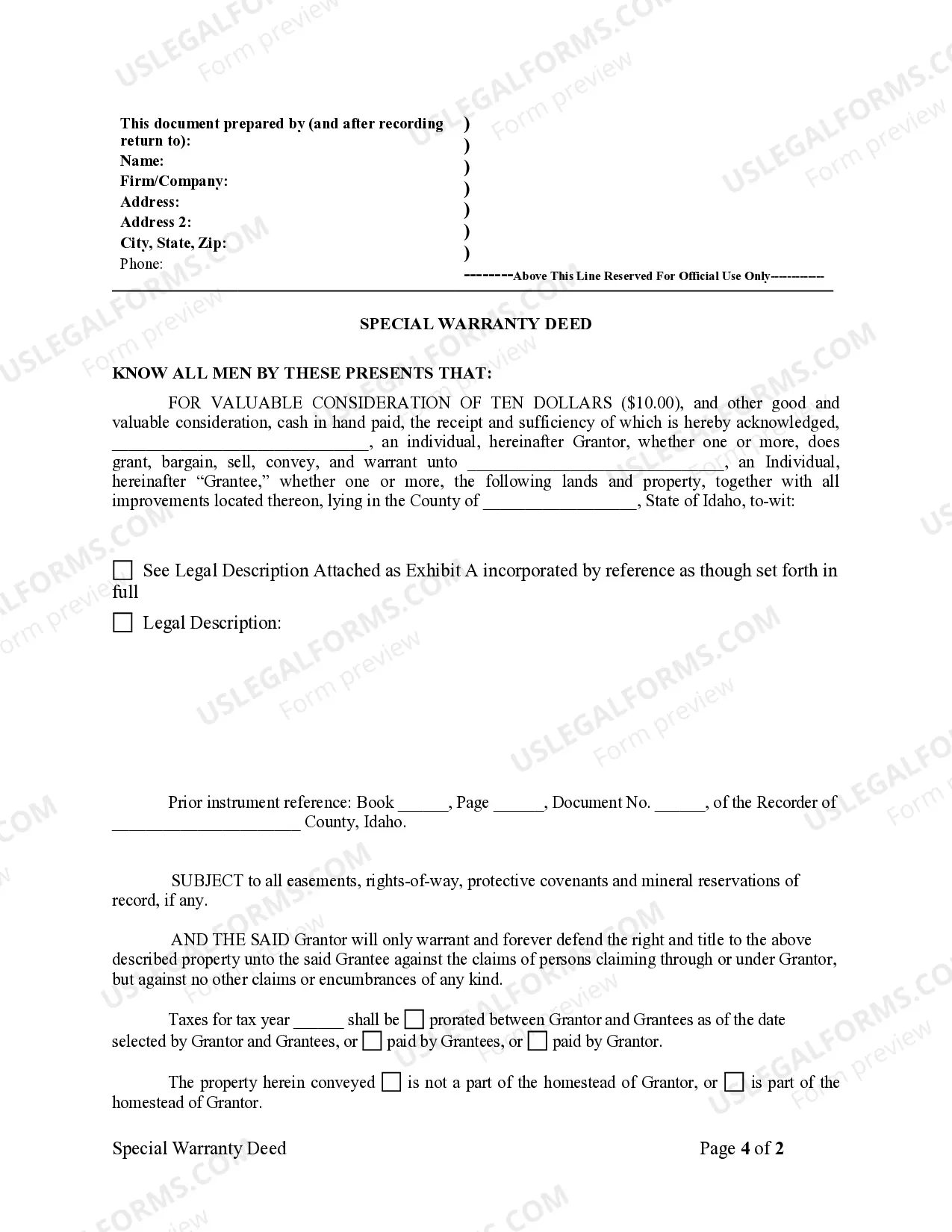

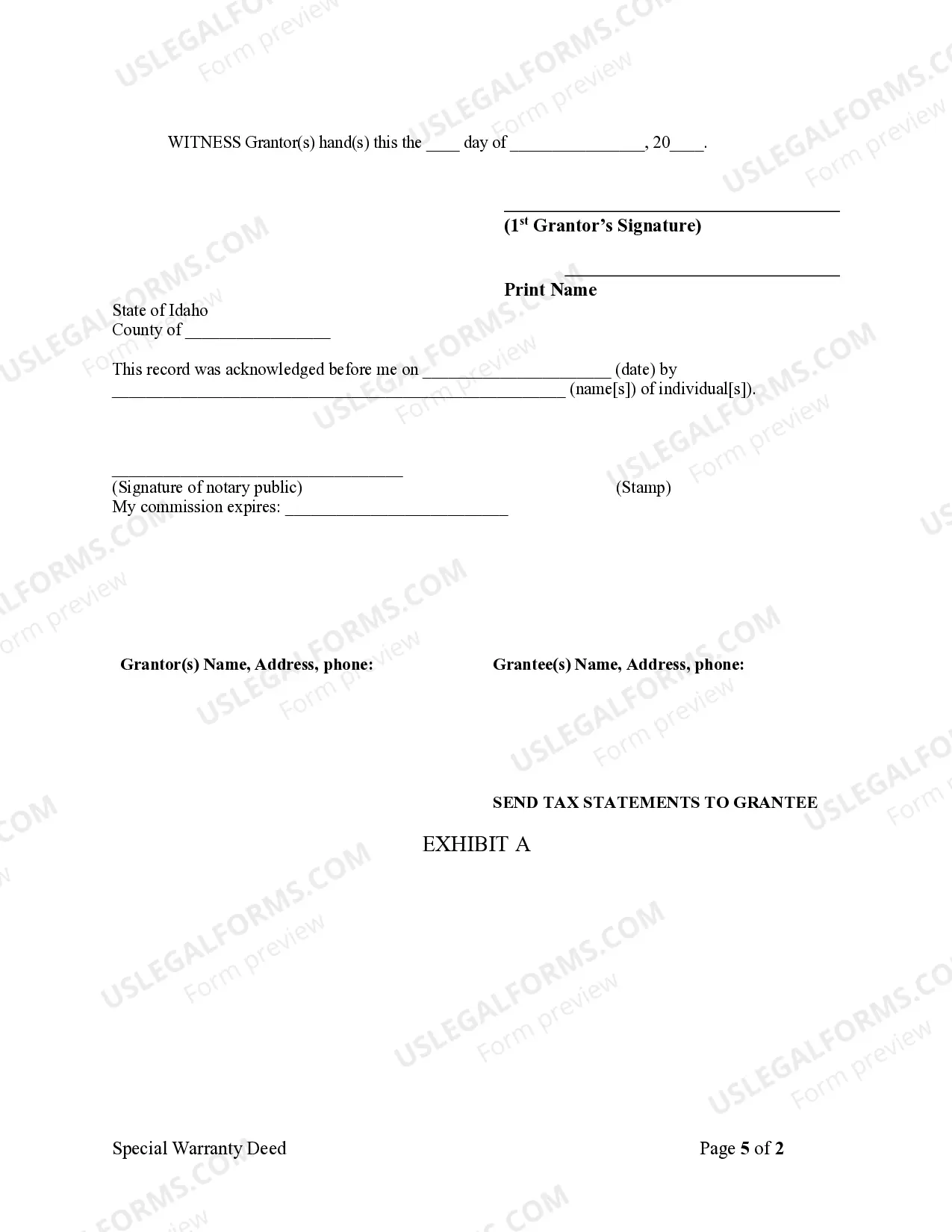

This form is a Special Warranty Deed where the grantor is an individual and the grantee is an individual.

Idaho Special Warranty Deed

Description

How to fill out Idaho Special Warranty Deed?

Among hundreds of paid and free samples that you’re able to get on the internet, you can't be sure about their accuracy. For example, who created them or if they are skilled enough to take care of what you need them to. Always keep calm and utilize US Legal Forms! Discover Idaho Special Warranty Deed samples created by professional attorneys and avoid the costly and time-consuming procedure of looking for an lawyer and then having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access all of your earlier acquired samples in the My Forms menu.

If you are making use of our platform for the first time, follow the guidelines below to get your Idaho Special Warranty Deed quick:

- Ensure that the document you discover is valid in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you’ve signed up and bought your subscription, you can use your Idaho Special Warranty Deed as many times as you need or for as long as it stays valid in your state. Edit it with your preferred editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

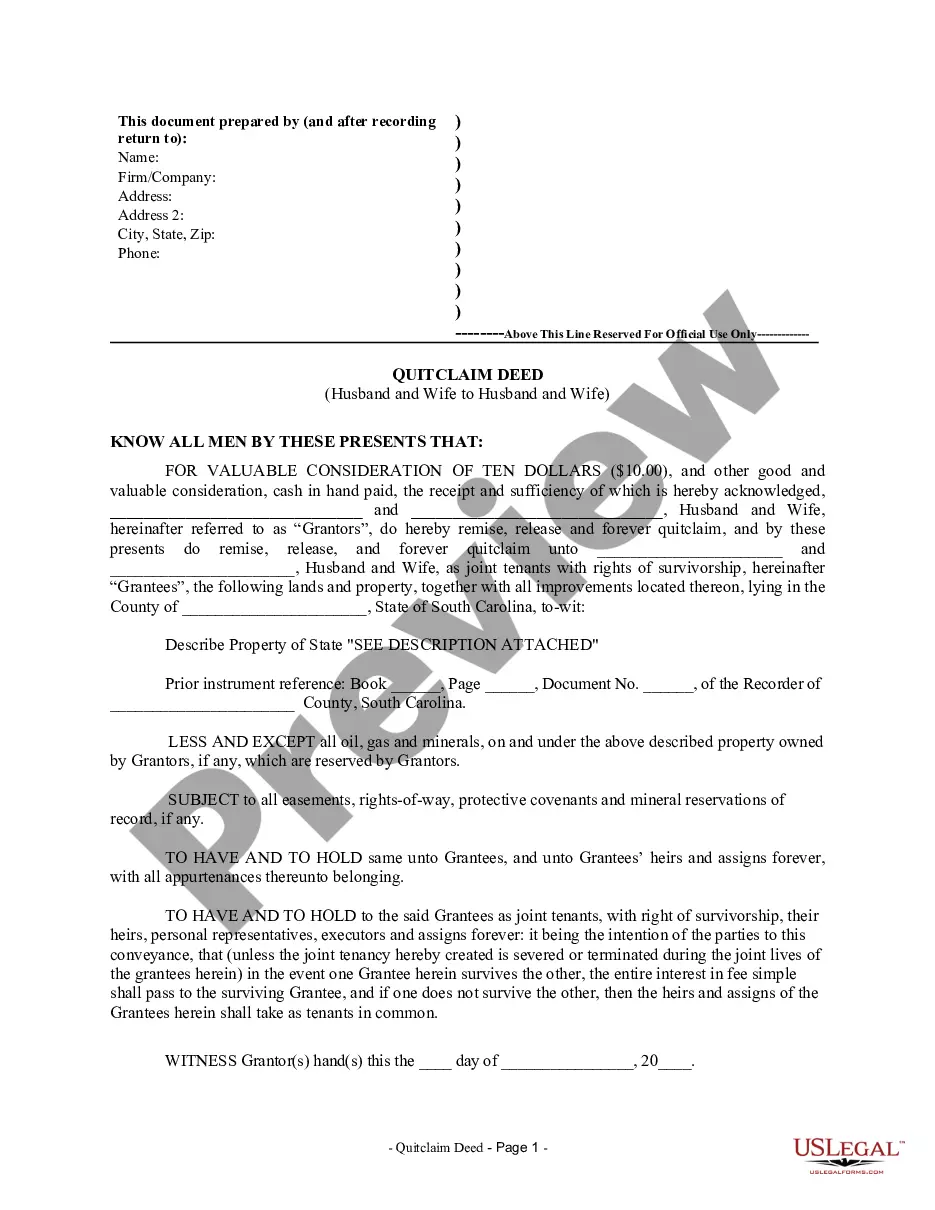

Unlike a warranty deed or special warranty deed, a quitclaim deed makes no assurances whatsoever about the property.For example, in a divorce situation where one spouse deeds the house to the other spouse. Quitclaim deeds are commonly used to transfer real property to an LLC or a living trust.

A special warranty deed is common when a house has been foreclosed on by a bank because the previous owner did not pay their mortgage.The special warranty deed that the bank provides to the new buyer provides no protection for the period of time before the bank took ownership of the property.

It will not protect against title issues that arose prior to the time the seller took occupancy. Consequently, it offers less protection to buyers, and more protection to sellers, than a general warranty deed, which is the most common option for selling or buying a property.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

Special warranty deeds are most commonly used with commercial property transactions. Single-family and other residential property transactions will usually use a general warranty deed. Many mortgage lenders insist upon the use of the general warranty deed.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.

A general warranty deed covers the property's entire history.With a special warranty deed, the guarantee covers only the period when the seller held title to the property. Special warranty deeds do not protect against any mistakes in a free-and-clear title that may exist before the seller's ownership.