The Idaho Statement of Dissolution is a document filed with the Idaho Secretary of State to officially dissolve a business entity. Depending on the type of business entity, there are two types of Idaho Statement of Dissolution documents: (1) the Statement of Dissolution for a Corporation, and (2) the Statement of Dissolution for a Limited Liability Company. The Statement of Dissolution for a Corporation must be signed by the corporation's president, secretary, or other authorized officer. The Statement of Dissolution for a Limited Liability Company must be signed by a managing member or other authorized person. Both documents must include the name of the business entity, the date of dissolution, the effective date of the filing, and the signature of the signatory. Once the Statement of Dissolution is filed, the business entity is officially dissolved and is no longer required to file annual reports with the Idaho Secretary of State.

Idaho Statement of Dissolution

Description

How to fill out Idaho Statement Of Dissolution?

How much time and resources do you typically allocate for creating formal documents.

There’s a more efficient solution to obtain such forms than employing legal professionals or spending countless hours searching online for an appropriate template. US Legal Forms stands as the premier online repository that provides expertly drafted and validated state-specific legal documents for any use, such as the Idaho Statement of Dissolution.

Another benefit of our library is that you can access documents you have previously downloaded, which are securely stored in your profile under the My documents tab. Retrieve them at any time and redo your paperwork as often as necessary.

Save both time and effort when completing official documents with US Legal Forms, one of the most reliable online services. Register with us today!

- Review the content of the form to ensure it aligns with your state regulations. You can accomplish this by reading the form description or utilizing the Preview option.

- If your legal template fails to meet your requirements, seek another one using the search feature at the top of the site.

- If you already possess an account with us, Log In and fetch the Idaho Statement of Dissolution. If not, continue to the subsequent steps.

- Click Buy now after identifying the correct document. Select the subscription plan that best fits your needs to access the full range of our library’s offerings.

- Establish an account and proceed with your subscription payment. Transactions can be made via credit card or through PayPal - our service is completely secure.

- Download your Idaho Statement of Dissolution onto your device and fill it out on a printed copy or electronically.

Form popularity

FAQ

Dissolution is a legal process that terminates a business entity's existence. If a corporation or LLC is not properly dissolved, it continues to exist as a legal entity under state law. This means that it still faces corporate or LLC filing requirements, such as annual reports and franchise taxes.

LLC ownership is personal property to its members. Therefore the operating agreement and Idaho state laws declare the necessary steps of membership removal. To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail.

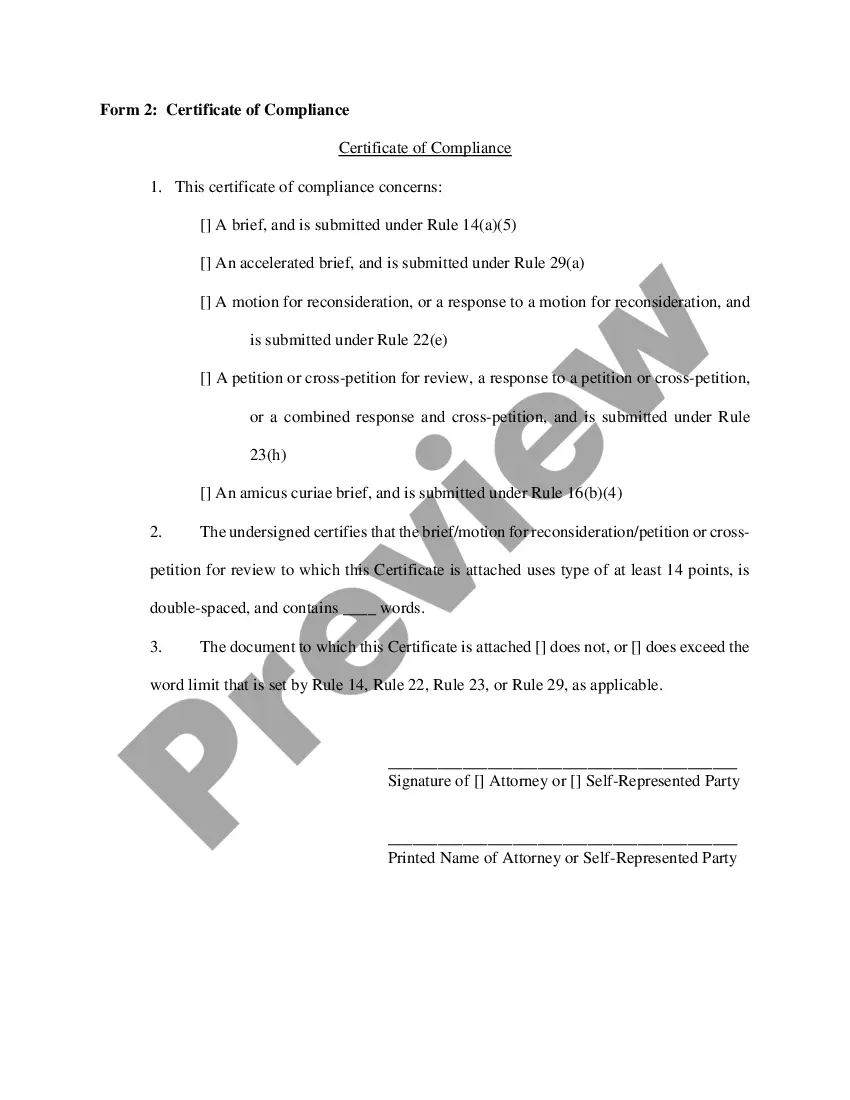

The statement of dissolution must be signed by a manager/member/authorized person of the LLC. Please identify the name of the signer by typing his/her name below the signature. If you have questions or need help, call the Secretary of State's office at (208) 334-2301.

To amend your Certificate of Organization for an Idaho LLC, you must submit an Amendment to Certificate of Organization with the Idaho Secretary of State. You'll also need to pay the $30 online filing fee or the $50 paper filing fee, depending on how you file.

To dissolve your corporation in Idaho, you can sign in to your SOSBiz account and choose ?terminate business.? Or, you can provide the completed Articles of Dissolution form in duplicate to the Secretary of State by mail or in person, along with the filing fee.

30-25-702. WINDING UP. (a) A dissolved limited liability company shall wind up its activities and affairs and, except as otherwise provided in section 30-25-703, Idaho Code, the company continues after dissolution only for the purpose of winding up. (G) Perform other acts necessary or appropriate to the winding up.

To dissolve your corporation in Idaho, you can sign in to your SOSBiz account and choose ?terminate business.? Or, you can provide the completed Articles of Dissolution form in duplicate to the Secretary of State by mail or in person, along with the filing fee.