Idaho Requesting Administrative Waiver or Objection to Intercepted Tax Refund is a process that allows taxpayers to dispute the state’s decision to withhold a portion of their tax refund to collect a debt. This process can be used if the taxpayer believes an error has been made in the withholding of a tax refund or if the taxpayer has a legitimate reason for requesting a waiver or objection. There are two types of Idaho Requesting Administrative Waiver or Objection to Intercepted Tax Refund: 1) Waiver Request and 2) Objection Request. A Waiver Request is an appeal to the Idaho State Tax Commission to cancel or reduce the amount of a debt that is being held from a taxpayer’s refund. The taxpayer must provide evidence of why they believe the debt should be waived or reduced. An Objection Request is an appeal to the Idaho State Tax Commission to stop or reduce the amount of a debt that is being held from a taxpayer’s refund. The taxpayer must provide evidence of why they believe the debt should not be collected. In both cases, taxpayers must submit a written request which must include the amount of the refund being withheld, the name and address of the taxpayer, details of the debt, and any supporting documents. The request will then be reviewed by the Idaho State Tax Commission, and a decision will be made.

Idaho Requesting Administrative Waiver or Objection to Intercepted Tax Refund

Description

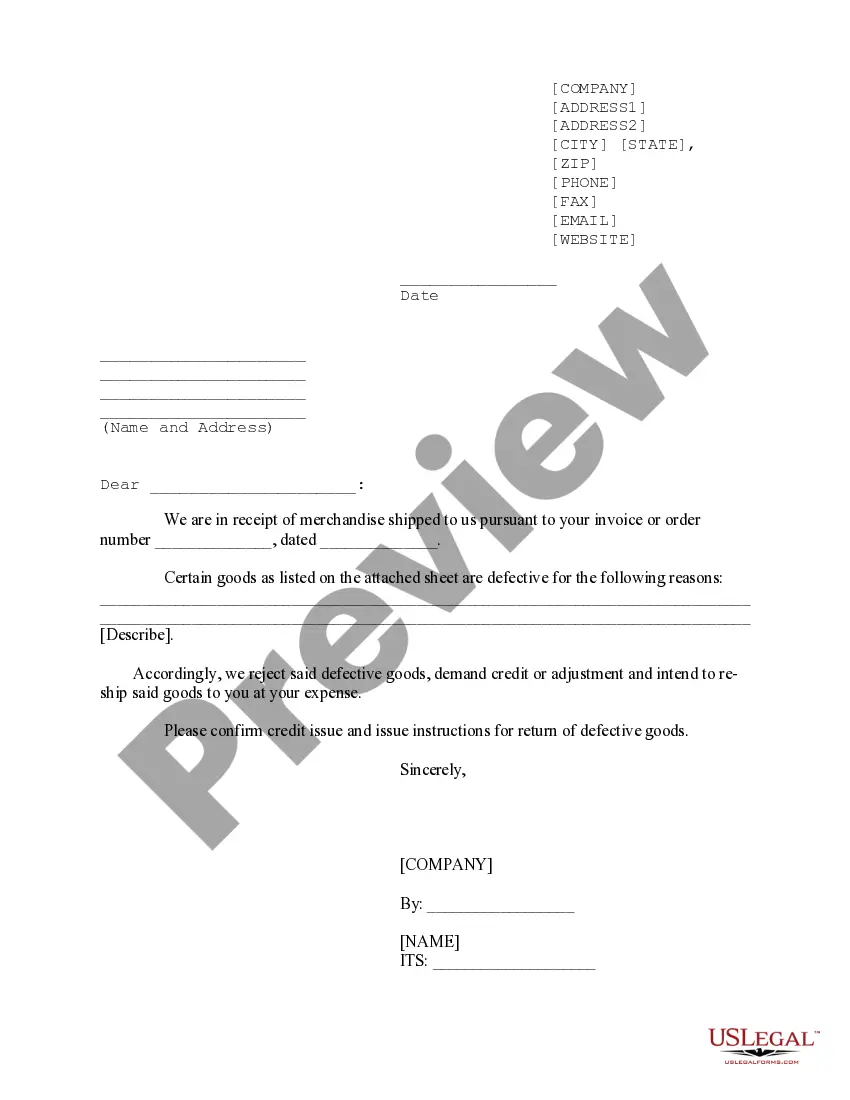

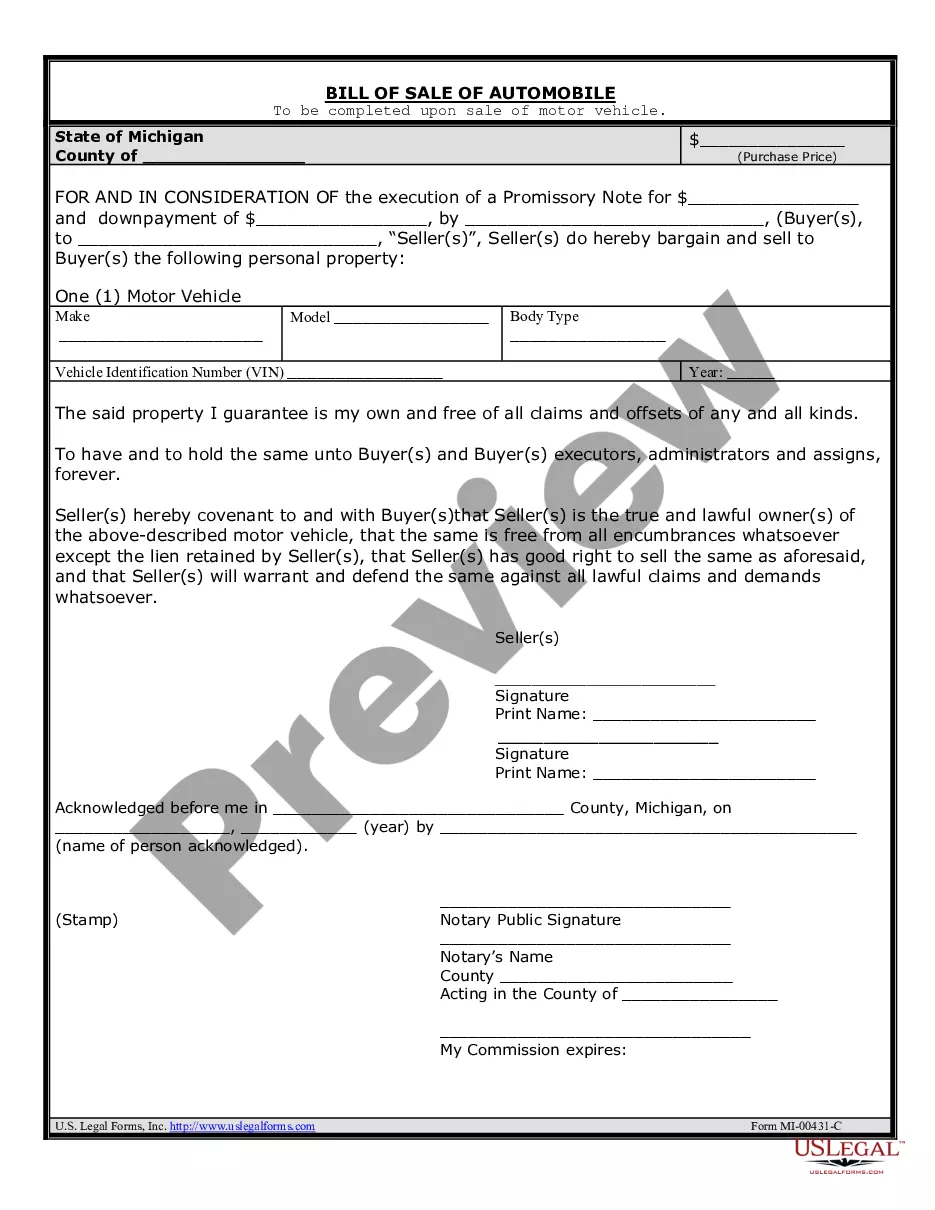

How to fill out Idaho Requesting Administrative Waiver Or Objection To Intercepted Tax Refund?

US Legal Forms is the most simple and affordable way to find suitable formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Idaho Requesting Administrative Waiver or Objection to Intercepted Tax Refund.

Getting your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Idaho Requesting Administrative Waiver or Objection to Intercepted Tax Refund if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one meeting your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Idaho Requesting Administrative Waiver or Objection to Intercepted Tax Refund and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more proficiently.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the corresponding official documentation. Give it a try!

Form popularity

FAQ

Have you noticed a deposit in your bank account from the state this week? Well, good news - it's not a scam. In May, Gov. Brad Little signedhouse bill 380 which created the ?2021 Idaho Tax Rebate Fund.?

Taxpayers need to file the required tax returns by December 31, 2022, to be eligible for the rebate. The rebate amount is $300 for individual filers and $600 for joint filers or 10% of a taxpayer's 2020 income taxes, whichever is greater.

Idaho Code Section 1-1624 authorizes the interception of an Idaho state tax refund to pay for delinquent debts owed by the taxpayer to the courts of Idaho.

The IRS announced on February 10, 2023, that taxpayers who received Idaho's tax rebates won't need to report these payments on their 2022 federal income tax returns. Idahoans also don't need to report the rebates on their state income tax returns.

Have you noticed a deposit in your bank account from the state this week? Well, good news - it's not a scam. In May, Gov. Brad Little signedhouse bill 380 which created the ?2021 Idaho Tax Rebate Fund.?

The Tax Commission might need to verify your identity. This helps safeguard your information and keeps your refund from going to criminals. You could receive one of three letters: A PIN letter that asks you to enter a personal identification number (PIN) we provided to confirm you filed the tax return we received.

Idaho taxpayers are set to receive a payment of up to $600 in the first quarter of 2023. The Gem State is giving the rebate to anyone who was a state resident for the full year of 2020 and 2021 and has filed their taxes for the same tax years.

Idaho is giving eligible taxpayers two rebates in 2022: 2022 Special Session rebate: On September 1, 2022, a Special Session of the Idaho Legislature passed and Governor Brad Little signed House Bill 1 authorizing a tax rebate to full-year residents of Idaho.