The Idaho Standard Custody Child Support Worksheet (H&W) is a document used by courts in Idaho to calculate the amount of child support that should be paid in cases involving joint legal and physical custody. This worksheet is used to calculate the combined net income of both parents, the number of children, and the child support obligation of the noncustodial parent. The Idaho Standard Custody Child Support Worksheet (H&W) takes into account the number of overnights each parent has with the child, the income of each parent, and any special expenses for the child. There are two types of Idaho Standard Custody Child Support Worksheet (H&W): the Standard Worksheet and the Simplified Worksheet. The Standard Worksheet is more detailed and includes calculations for any additional expenses related to the custody arrangement, such as daycare costs or medical expenses. The Simplified Worksheet is a basic worksheet that uses standardized amounts for additional expenses and does not take into account any special circumstances.

Idaho Standard Custody Child Support Worksheet (H&W)

Description

How to fill out Idaho Standard Custody Child Support Worksheet (H&W)?

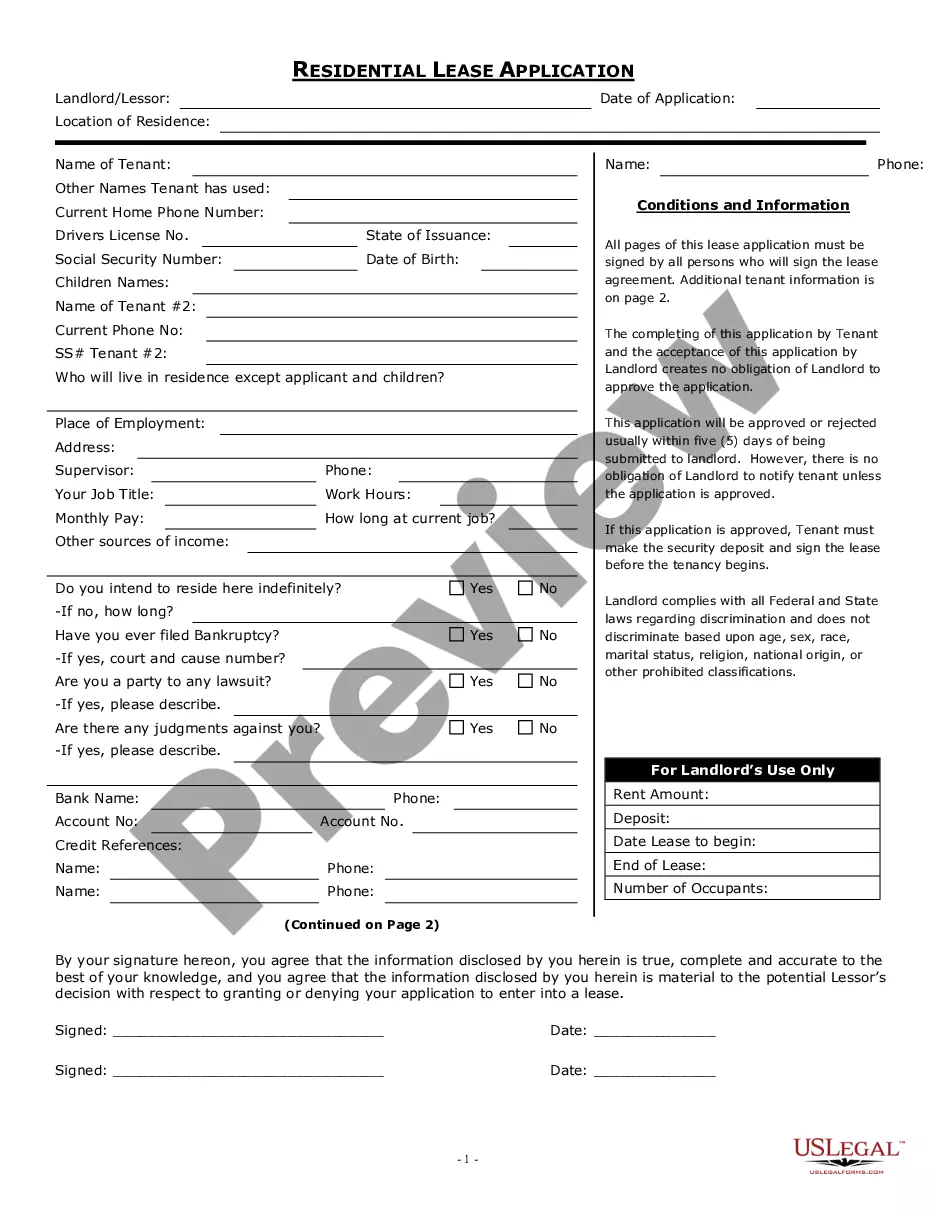

How much time and resources do you usually spend on drafting formal documentation? There’s a greater way to get such forms than hiring legal specialists or spending hours browsing the web for a proper blank. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Idaho Standard Custody Child Support Worksheet (H&W).

To obtain and prepare a suitable Idaho Standard Custody Child Support Worksheet (H&W) blank, adhere to these easy steps:

- Examine the form content to make sure it complies with your state requirements. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Idaho Standard Custody Child Support Worksheet (H&W). If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally reliable for that.

- Download your Idaho Standard Custody Child Support Worksheet (H&W) on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Form popularity

FAQ

California does not have a cap on how much a parent may owe for child support. The amount you can expect to pay is not based on a state average but your own individual income, the income of your co-parent, and the number of children you have to support.

Maximum support The maximum child support payable is also known as the ?cap?. The maximum child support is applied to the combined income of both parents up to 2.5 times the annual equivalent of all Male Total Average Weekly Earnings (MTAWE) and calculated using the Costs of Children Table.

This means that child support payments are based on both parents' income and how much more the higher-earning parent makes, but there is no law that caps child support at any specific dollar amount.

If a parent is voluntarily unemployed or underemployed, child support will be based on gross potential income, except that potential income should not be included for a parent that is physically or mentally incapacitated.

The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent.

So, yes, Texas does have a cap on child support payments ? but exceptions can be made. If you need assistance determining how much you or your ex-spouse should pay in child support, contact our child support lawyers in Houston at Grimes & Fertitta for help.

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six

Child support obligations in Idaho are calculated using the Income Shares Model. The idea is to estimate the amount of support that the children would have received if the marriage hadn't failed. This support amount is then divided between the parents in proportion to their respective incomes.