Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund is a type of legal action taken by an injured worker or their representative against the Industrial Special Indemnity Fund (ISAF). This complaint is filed when an injured worker is denied workers compensation benefits or if the benefits are not enough to cover the costs of their medical treatment or lost wages. The complaint involves filing a petition for damages with the State Industrial Commission, which will be reviewed by a hearing examiner. The complaint may also be filed in court. The main types of Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund include: 1. Denial of Benefits: This complaint is filed when an injured worker is denied workers compensation benefits for any reason. 2. Unreasonable Delay: This complaint is filed when an injured worker is not receiving workers compensation benefits in a timely manner. 3. Insufficient Benefits: This complaint is filed when the workers compensation benefits are insufficient to cover the costs of medical treatment or lost wages. 4. Unfair Practices: This complaint is filed when an employer or the ISAF has unfairly denied benefits or otherwise acted in bad faith.

Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund

Description

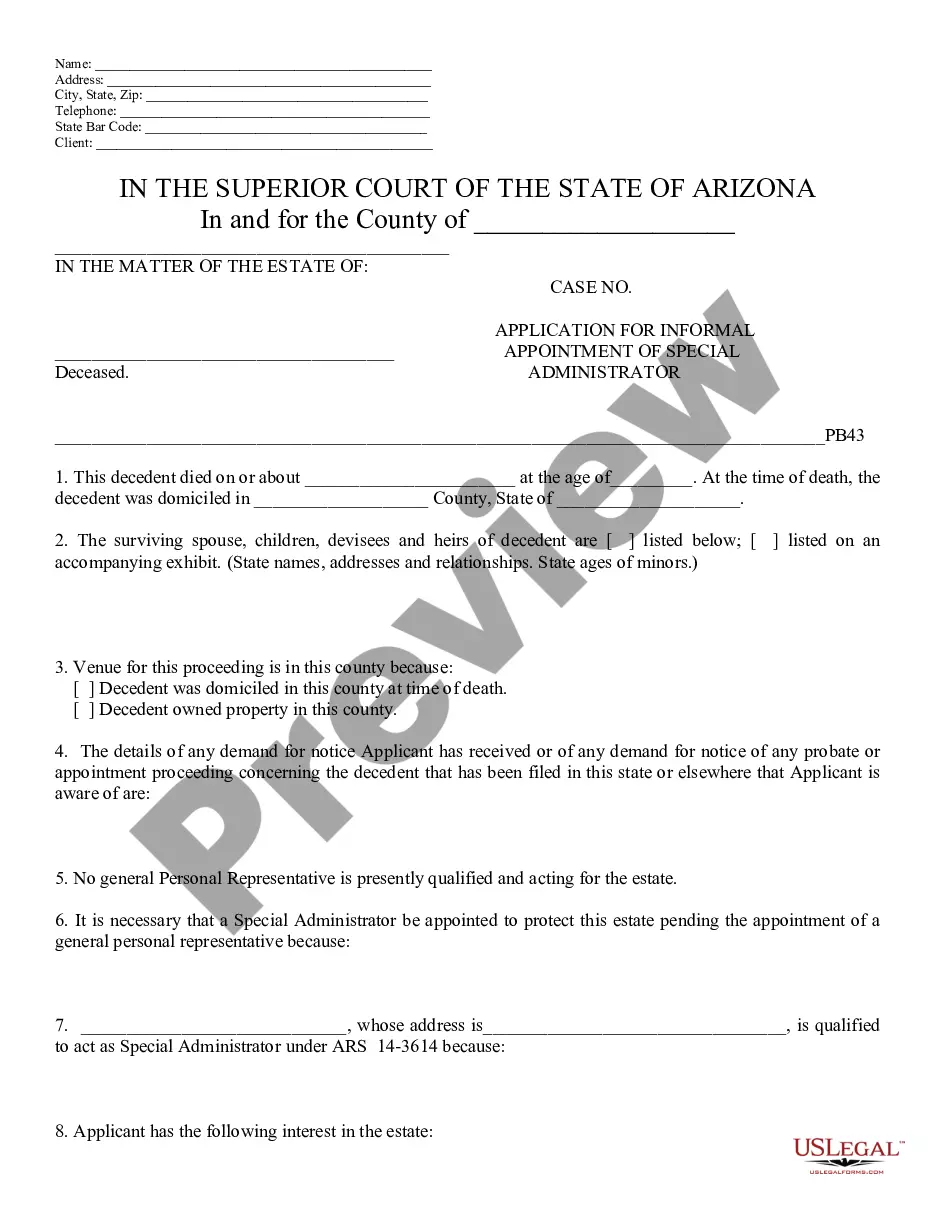

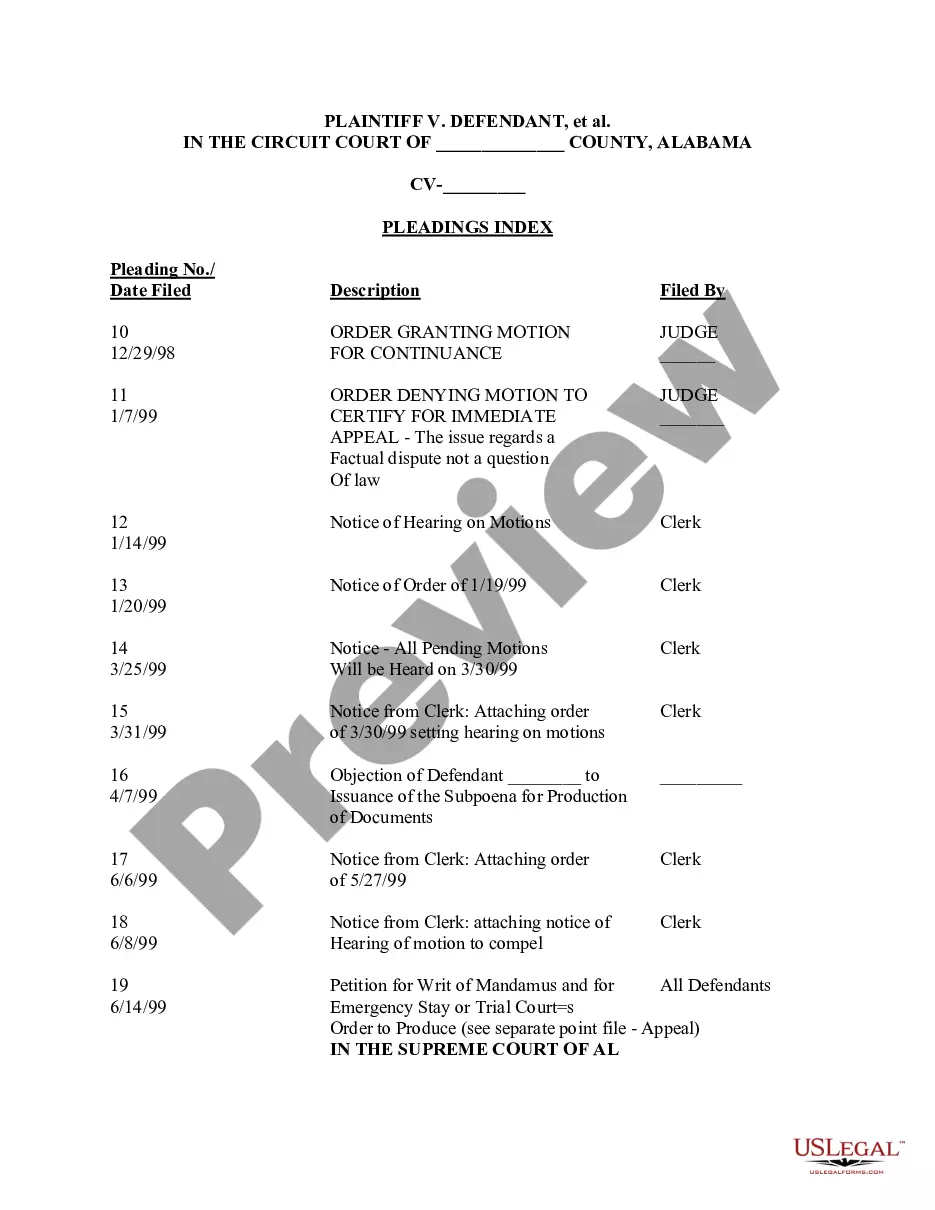

How to fill out Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund?

Coping with legal paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund template from our library, you can be certain it complies with federal and state regulations.

Dealing with our service is straightforward and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund within minutes:

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund in the format you prefer. If it’s your first experience with our website, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

To qualify for workers' compensation benefits, you must report your job-related injury or disease to your employer IMMEDIATELY. You could lose all benefits if you wait longer than 60 days to report your injury. Tell your employer about your injury or disease.

Workers' compensation is no-fault insurance. It provides compensation for missed work, permanent injuries, and rehabilitation in the event an employee is injured on the job. Employers are protected from paying costly medical bills and defending against lawsuits no matter who is at fault in an accident.

The basic benefit is sixty-seven percent (67%) of your average weekly wage, subject to the minimums and maximum of 90% of the average state wage provided in Idaho Code (I.C.) 72-408 and 72-409. After 52 weeks, the basic benefit is 67% of the average state wage subject to maximums and minimums in I.C. 72-409.

72-319. Penalty for failure to secure compensation.

422. 72-311. NOTICE OF SECURITY -- CANCELLATION OF SURETY CONTRACT. (1) The employer shall forthwith file with the commission in form prescribed by it, a notice of his security.

Resigning While on Disability It is not necessary to resign to qualify for disability. However, if you do resign, it is necessary to prove that the decision to resign was solely based on the disability. Resigning while on short-term disability is possible, but it could jeopardize future benefits.

Exemptions from workers' compensation requirements in Idaho include: Sole proprietors and independent contractors. Family members employed by a sole proprietor and living in the same household. Some family members of sole proprietors who don't live in the same household may file for an exemption.

Job status does not affect medical benefits. If you have already left your job and your employer has stopped paying your workers' comp medical benefits ? or has threatened to ? you need to speak to an experienced workers' compensation attorney right away.